Trading and investing is made easy since the advent of the internet. Brokerage firms which we call broker-dealers have reduced commission fees significantly. Nowadays literally everyone is able to trade through a mobile phone with the trading apps. No coincidence broker-dealers have seen a huge inflow in recent years. But what to think of investing in broker-dealer stocks? This article features 5 top U.S. broker-dealer stocks which have significant upside potential in 2018 and beyond.

U.S. broker-dealer stock ETF

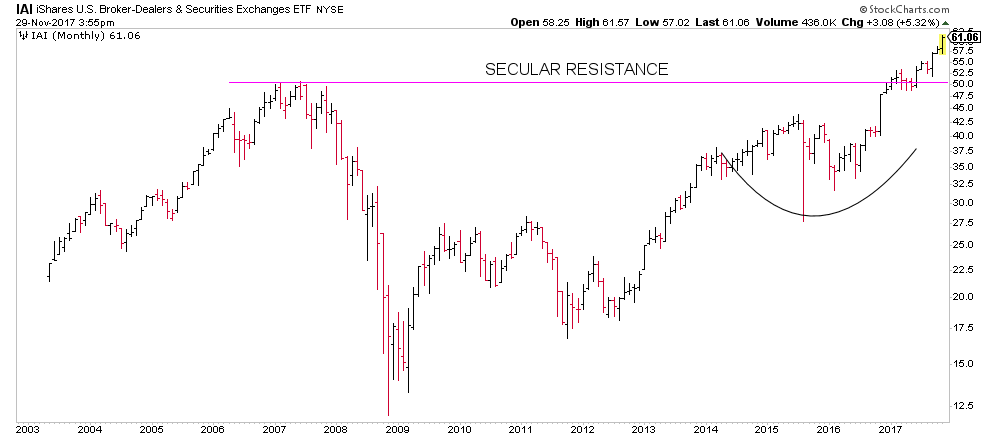

There is just one ETF that tracks the performance of this sector: iShares US Broker-Dealers ETF (Ticker IAI). We screen the profitable stocks in this ETF, and pick out the top 5 stocks with their charts in this article.

The monthly chart of IAI shows that after completing a pseudo U shape bottom, price finally broke out above resistance. And this signals that it could be time to allocate some funds though only in selected stocks.

5 U.S. broker-dealer stocks

Charles Schwab (SCHW) – one of the famous investment and brokerage firms is set to test its all-time high at 51.25 (monthly chart). From there, either it consolidates before a convincing break or it can simply break out it straight away with a move towards 60-65 by the end of 2018. The downside risk is a swift retracement to ~39.

Next, we have TD Ameritrade (AMTD) which mimics the monthly chart of Charles Schwab. From the monthly chart price has 61.4 in sight before making an attempt to break out. Keep a close eye on the downside risk of ~37-46

At the time of writing, Lazard (LAZ) is trading at 48.19, ~57.25 is definitely the next target before a subsequent upside move. The very same price of 48 could be the first support should price reverse.

Of course, there are certainly stocks that are lagging behind. E Trade Financial Corp (ETFC) is one of them. It is safe to say that the monthly chart still looks like a downtrend with price definitely approaching the resistance area at 54-57. From there it is likely to consolidate and make one more attempt to break the downtrend line. Looking at the way price collapsed during the 2008 global financial crisis, E Trade almost didn’t make it. In case it fails to break the downtrend line, the next support will be ~25.

Lastly, BGC Partners Inc (BGCP) is also making a serious attempt to reach ~28 which we suspect will need a little consolidation as the next and most bullish upside target is 85 (do not expect a swift rise though).

We are not suggesting investors should buy into the story of all these stocks. We rather recommend investors to work out which of the 5 stocks suit their balanced portfolio.