The price of Bitcoin (BTC) is pretty volatile lately. From a major top around $14k followed by a violent sell-off to $9k, it may feel brutal but it is the volatile nature of crypto. This week, BTC violated the uptrend that started on April 2nd when we said Crypto: Bear Market Officially Ends Today, Bull Market Officially Starts Today. Should crypto investors be concerned now? No, is the answer, as the fundamentals outlined in our Bitcoin Price Forecast 2019 as well as the 5 Cryptocurrency Predictions 2019 did not change whatsoever! There is a totally different take-away from Bitcoin violating its medium term uptrend.

One of the typical pitfalls with which we want to start off this article is an intuitive reaction from investors.

When the price of an asset falls they start looking for news around the web to understand ‘why’ this happened.

It doesn’t make sense in 99% of the cases.

We strongly believe as per Tsaklanos his 1/99 Investing Principles that only in 1% of the cases there is a direction correlation between news and price.

However, stopping with this ineffective and inefficient ‘habbit’, or at least using it in a much more selective way, appears to be a very challenging task for investors. We talked about this extensively, and have much more tips to share in this respect, in our timely insights published in 100 Investing Tips For Long Term Investors as well as 10 Tips To Master Investing Without Emotions.

What Caused The Bitcoin Drop?

We really do not care whether it was the Facebook Libra concerns which became apparent during the hearing by the Senate Banking Committee as explained in this tweet.

All we know is that the correlation between news and price as illustrated in this article does not exist in reality.

News writers look to correlate news and price because they have to write news.

Pretty simple, right?

Good luck applying this day-to-day!

Again, there may be some impact from the potential Libra Coin ‘disaster’ but it is absolutely pointless to spend time in reflecting on this!

So what caused the Bitcoin drop then, is what crypto investors continue to ask, even though we made our point above?

The only answer is: the market! The rest is useless and largely delusion and myth.

All that Matters Is This Bitcoin Price Trend

The trend is your friend, is what smart investors say.

There must be a reason for this! You better take it seriously.

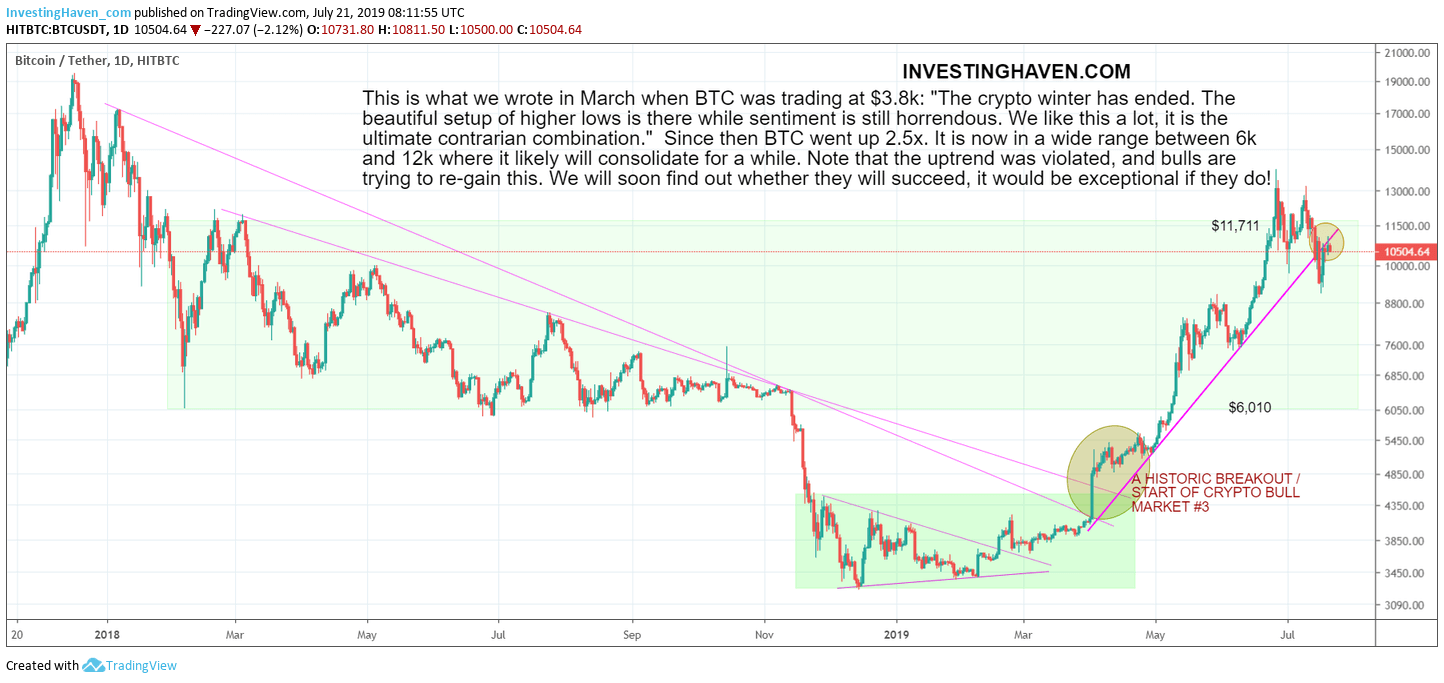

If we look at the trend in Bitcoin, and because Bitcoin is our leading indicator it also sets direction for the trend in the whole crypto market, we see a very interesting data point on the chart.

Note that the Bitcoin uptrend (indicated with the purple rising line starting in April of this year) was violated.

Right now bulls are trying to re-gain this uptrend. They might succeed because we have seen exactly 3 daily closes below the uptrend, so technically it’s not a confirmed breakdown (yet).

Here is the trick: ‘Breakdown’ sounds very bearish, which it is. However, a breakdown from an almost parabolic rise only 3 months into a new bull market is not concerning at all. It is healthy. Crypto bulls should pray to see a slower rising Bitcoin price at this stage of the bull market.

Our viewpoint is that a temporary trading range between $8k and $11.7k would be very healthy, and that there is a high probability of this to materialize. It is the highest probability according to us.

The coming days will be telling so crypto investors should pay higher than average attention to the Bitcoin chart, especially the pattern(s) we have annotated on our chart below. If our viewpoint appears to be accurate crypto investors must look for secondary entry points which we identified two months ago, and published in a premium crypto alert (see next paragraph).

InvestingHaven has a premium crypto investing research service. Its members are notified of important forecasts way before followers in the public domain. They also get very actionable tips with (on average) 2 premium crypto alerts per week. Subscribe here to become a premium crypto member >>