It should be clear by now that we have a wildly bearish short term bias. Moreover, we believe some markets segments will be hit hard, while others will be hardly impacted, as explained in Volatility A Pressure Cooker, Is A Flash Crash Underway? But the other point probably is that eventually selling will hit its ultimate target. Here is what we know from history: the more aggressive the selling, the more aggressive the bounce. In other words, if markets are preparing themselves for a quick drop we believe that V-shaped type reversal (strong bounce) might be underway. Buy the dip? Be sure that you know what you are doing. This market is merciless, you need pro trading skills currently to be successful in these markets. Or you stick to long term setups that look constructive.

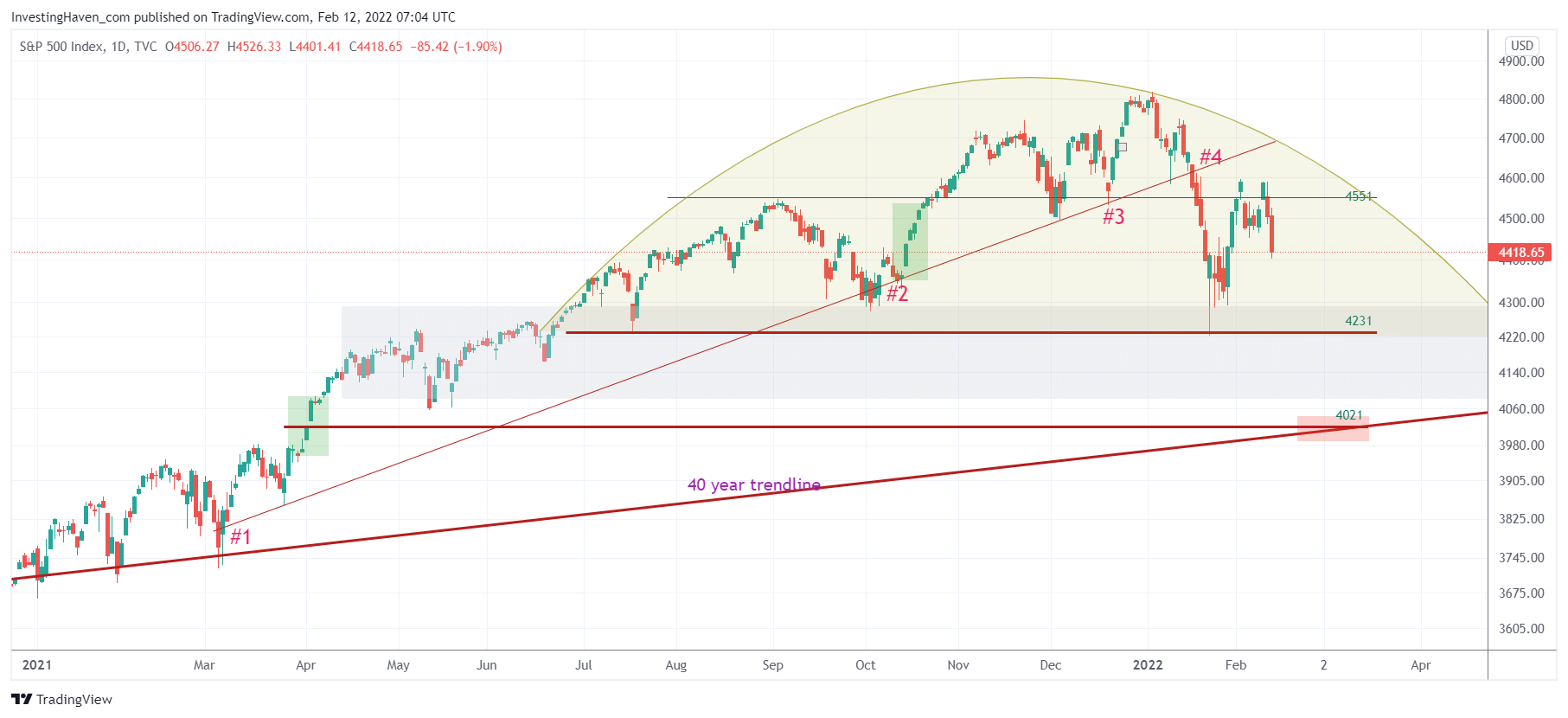

The S&P 500 has a few really interesting insights:

- Selling is not over. The reversal of the last 6 weeks is incomplete, everyone can see it.

- The downside targets are pretty clear: the soft target is 4231, January’s lows. We don’t think it will hold. The next target is probably the area 4021-4231.

- Most interestingly, if the S&P 500 is going to hit 4021, and refuse to move lower, it might be the ultimate bearish target that will bring an end to selling. Why is 4021 so important? Because that’s where the 40 year rising trendline comes in, the one that started with the big secular bull market in stocks that started in 1982.

Yes, short term wildly bearish, but provided 4021 in the S&P 500 holds it might be a long term bullish setup. Sort of a bullish backtest of a very long term bullish trend.

The one question that comes up, in thinking all this through: if this is a bullish backtest then why the hell is so much selling and volatility going to precede it?

What really is going on in this market is huge rotation. And we know that rotation comes with volatility. The bigger and the more dramatic the rotation, the bigger and more dramatic volatility.

In a way, volatility is rotation in disguise.

Rotation to what?

We explained this in the article mentioned in our intro: tech and meme are moving to peak selling (long term maybe an interesting entry), and the capital coming out of those segments are moving into segments that have tangible characteristics.

Simple, in theory, not so easy to get positions / position sizes / entries / exits right.

Above all, participating in financial markets is all about controlling emotions and having deep insights into trends (which is really important when dramatic rotation is going on). But we explained all this in 7 Secrets of Successful Investing.