How to identify the best stocks with strong bullish outlook? How to define realistic price targets? How to not get shaken out of your positions in volatile periods? These are the most important questions for any investor. The only answer: apply a a solid method that has stood the test of time. At InvestingHaven we continuously improve our method. We are pleased to present our 5 top stocks for 2019 which were identified based on ‘InvestingHaven’s 1/99 rule’ combined with our ‘COF method’. Moreover, we add our 2019 forecast to the top 5 stocks. Here is our top 5 stocks forecasts for 2019.

As an introductory note let’s point out what our own 1/99 Investing Principles and our ‘COF method’ are.

The 1/99 rule is a set of rules that avoid making wrong decisions which are mostly the result of emotions combined with impulses. In a world of information overload you must be aware that you should not make decisions to buy or sell based on news articles as they are designed to sell advertising, not to be relevant data points for investors. Hence, only 1% of news articles is relevant. In a world of chart overload you must go back to the core, and realize that only 1% of price points on a chart do matter, they also make up for great patterns (if any at all).

Top 5 stocks forecasts for 2019: method

As there are 50,000 stocks and assets to trade you must realize only 1% is worth following, and another 1% is worth trading and/or holding. That’s indeed 500 stocks and assets to follow, and some 5 (maximum 10) to hold. There may be thousands of hedge funds but scientific research has proven that only 1% of them are outperformers, so you better ignore all news and results from all 99% of hedge funds, traders and other gurus. Identify only the 1% successful guys, and only use their activity and viewpoints as relevant.

The 1/99 rule is a set of rules that are meant to be applied diligently. It’s your mental power to resist this world of overload. It’s your set of rules to create discipline. Because that’s the basis of success!

On the other hand the COF method is designed to assess any market, commodity, currency, stock, cryptocurrency, in a structured way, in order to increase the probability that it will be a winner in your portfolio. There are 3 components to the COF:

- Chart: Start with the chart, always. If the chart does not show a constructive setup it is an absolute no-go to continue. Once the chart shows a juicy opportunity there must be a confirmation from the 3 timeframes: monthly, weekly, daily, in that order, as that’s the only top down approach that really works. Moreover, chart structures must be constructive, it does not make any sense to try to force any structure. It must be a natural structure that categorizes in one of the following patterns: a momentum setup, a clear breakout, a rounding bottom or a bullish triangle pattern.

- Options: As a second step, the options market structure must confirm a bullish setup. Open interest in call options in the medium term must be bullish.

- Fundamentals (inc financials for stocks): The fundamentals of any asset, market, commodity, stock, must be strong. This might be the outlook of a company, top level revenue trends for stocks, futures market structures for a commodity like gold or silver, real life usage of a cryptocurrency, and the likes.

Only if all of the above rules are respected, and criteria are assessed, is it worth considering to trade or invest in a stock.

As we apply all this we derive 5 top stocks for 2019. Here is the top 5 stocks with their forecast for 2019 and beyond.

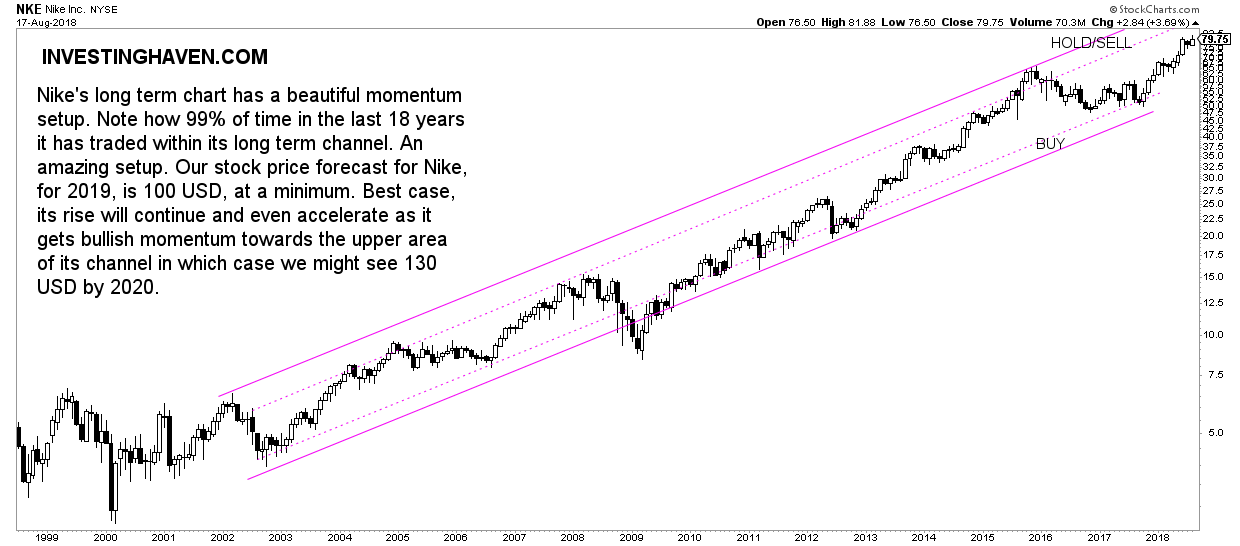

#1 Top stock and price forecast 2019: Nike (NKE)

Nike has a gorgeous long term chart setup. We only include the monthly chart, as the weekly and daily are in confirmation with the monthly.

Note a clear channel, with subchannels that suggest buy (enter) and hold/sell (exit and/or profit taking) areas. Also, the majority of time Nike has traded in the center subchannel. Realistically this center channel will be the one leading the way higher in 2019 and beyond.

Options market structure is very constructive.

Financials are great, and rising, as explained in … The outlook of the company is absolutely fantastic!

Our 2019 forecast for top stock Nike is 100 USD.

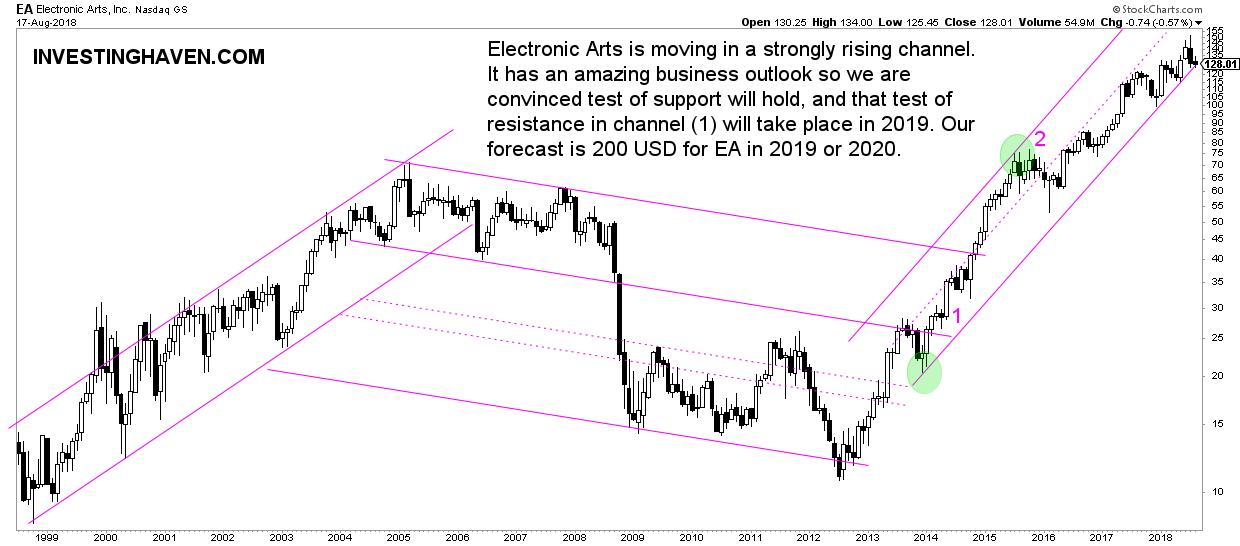

#2 Top stock and price forecast 2019: Electronic Arts

Electronic Arts has a much more volatile chart setup on its monthly. Note how a huge rounding bottom between 2007 and 2014 disrupted the previous rising channel. Note as well how the current rising channel is beautiful and outspoken.

Fundamentally, this is a great company with a great outlook. The move to digital subscriptions paid off, and it offers lots of revenue but also profit potential for the company. That’s the fundmantals we are focused on.

Our 2019 forecast for top stock Electonic Arts is 200 USD.

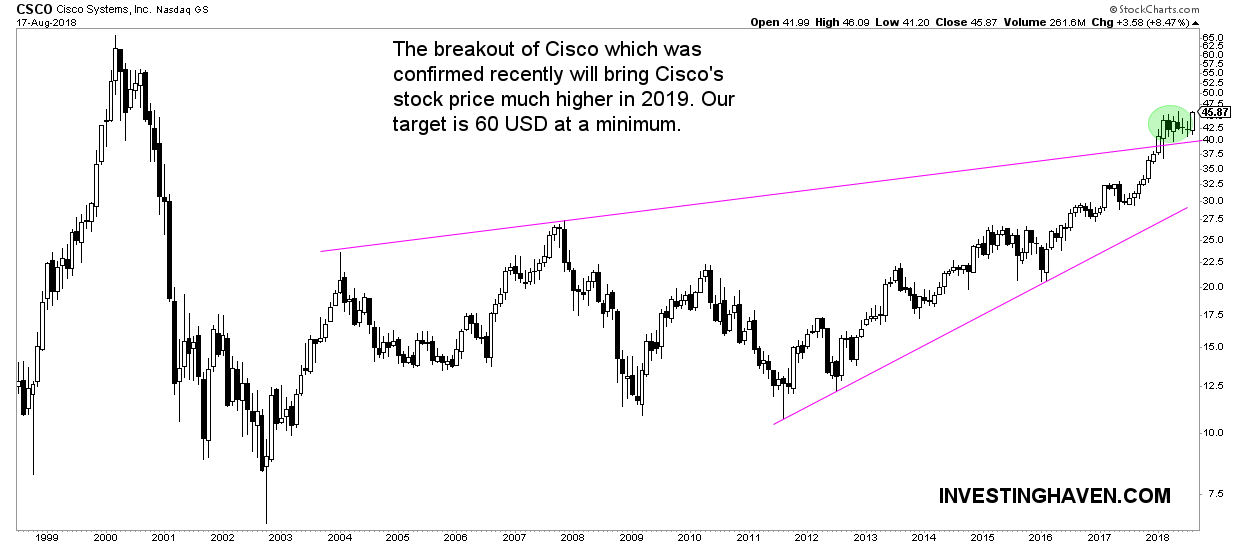

#3 Top stock and price forecast 2019: Cisco

Cisco has this classic triangle pattern breakout on its monthly. Moreover, from a chart perspective, the 2018 breakout got confirmed (successful test in technical terms).

Financials of Cisco support the bullish breakout, and the outlook of this company is positive.

Options market structure underpin a bullish outcome.

Our 2019 forecast for top stock Cisco is 60 USD.

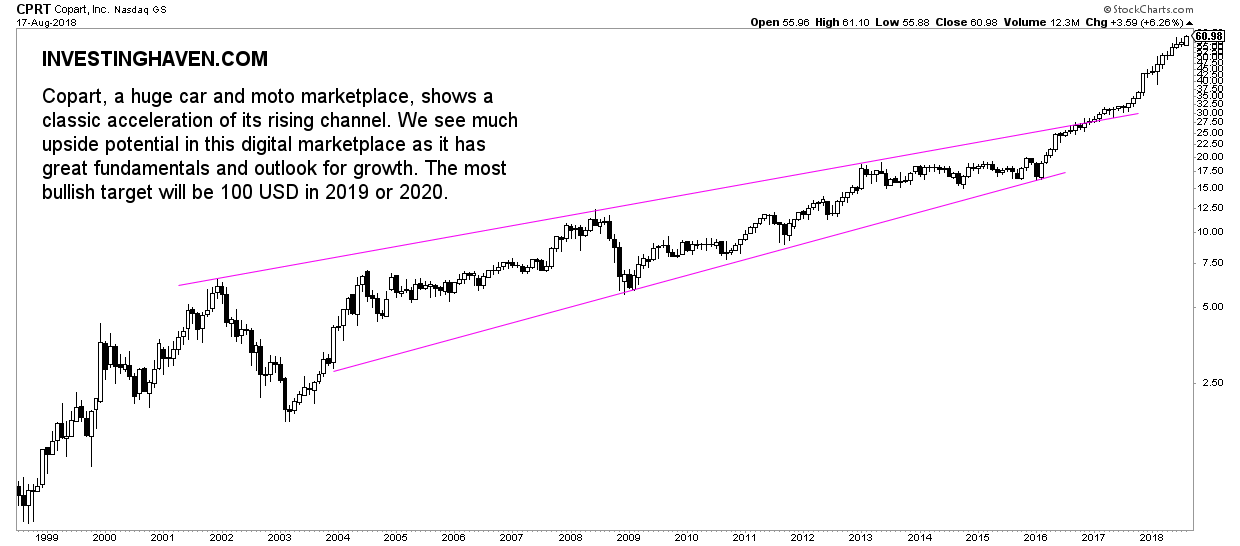

#4 Top stock and price forecast 2019: Copart

Copart has a somehow similar chart setup as the previous stock we identified: a classic triangle pattern with a breakout that took place in the second part of last year. This year has seen a strong rise.

Is this the end of the rise?

There is plenty of upside potential for 3 reasons. First, the chart suggests so. Second, options market structure is bullish. Third, the outlook and financials of this company are great as seen here.

Our 2019 forecast for top stock Copart is 100 USD.

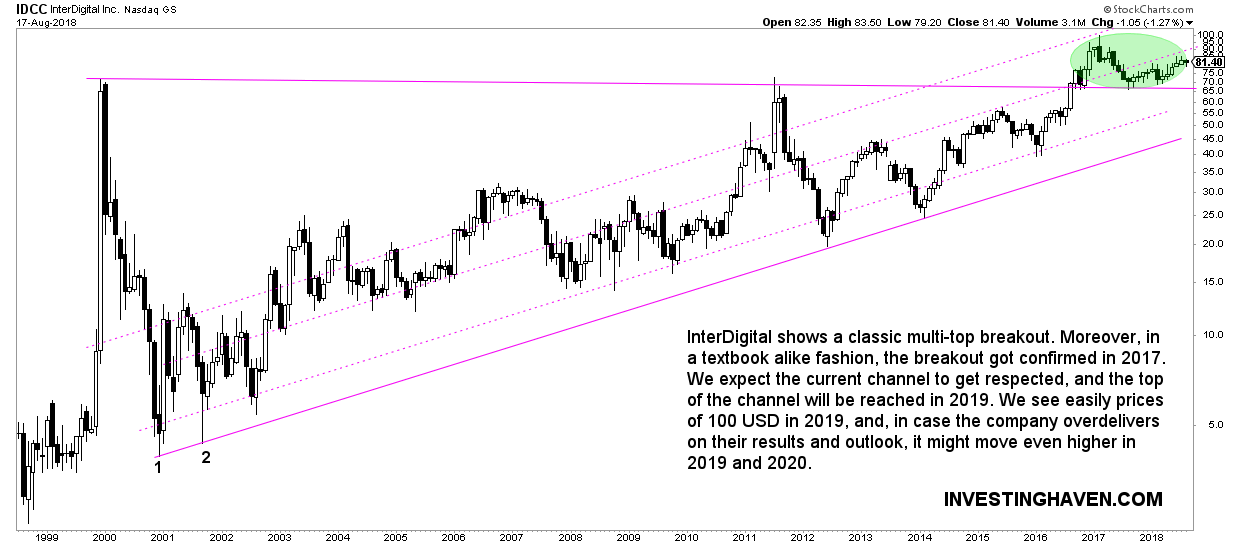

#5 Top stock and price forecast 2019: InterDigital

Last but not least, InterDigital has seduced us after a deep-dive research.

Note how a beautiful breakout took palce in 2016, and got confirmed in the last months of 2017. This suggests much more upside potential in 2019 and beyond.

We see this current rising channel as a base case, with the higher subchannel as the bullish case.

Options market structure favors a bullish outcome.

Outlook and financials support a bullish outcome, see the last investor presentation(s) here.

Our 2019 forecast for top stock InterDigital is 100 USD.