Gold is visibly hitting a strong resistance level. InvestingHaven’s research team noted last week why the $1220 gold price is so important, and right now the market seems to be doing exactly what was forecasted.

The daily gold price chart shows the support area from the March to November timeframe with the thick red line. As it usually goes in a bear market, former support becomes resistance when prices go down. That is exactly what is happening in the gold market right now. That is also why the $1220 level was identified as a strong barrier, both on the daily and weekly chart.

In line with previous articles, it seems clear that gold is now preparing its move towards $1000, if not a bit lower, which is exactly in line with InvestingHaven’s 2017 gold price forecast.

Why the coming gold bottom will offer a must-buy opportunity

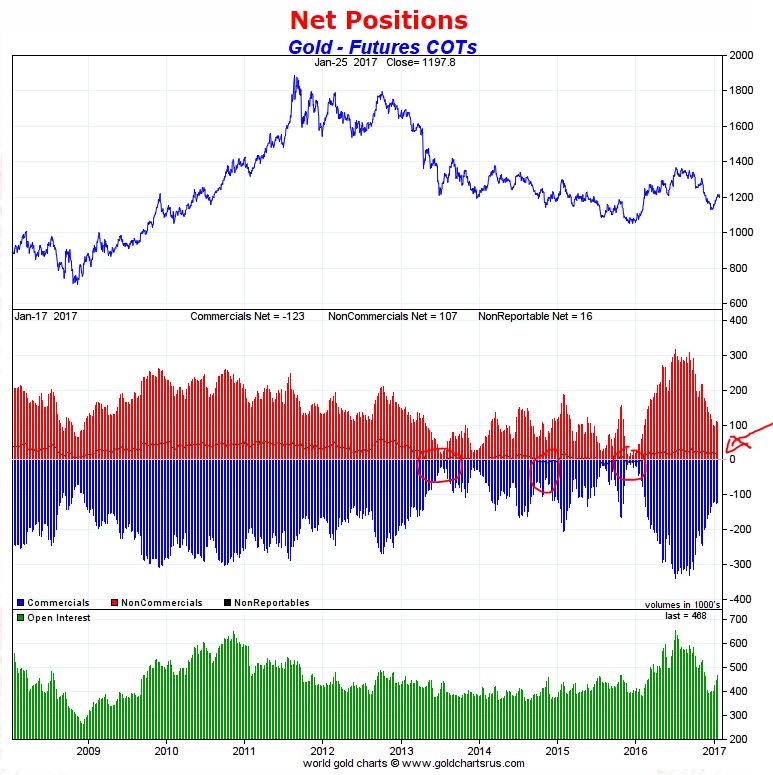

As gold’s price is moving lower, probably towards the $950 area, the trends in the futures markets are moving a similar path. The short positions of commercial traders in the futures market, as reported by the Commitment of Traders (COT) report, is also gravitating to a very low position, as annotated on the latest COT report below.

Why is a buy opportunity in the making? Because the coming bottom in short positions of commercial traders in the futures market will also be a bottom in the gold price. Their short positions provide stopping power, but once they reach a level close to zero there is a bottom. The big difference with previous bottoms which are indicated with the red arrows on below chart is that gold gave a first signal of life last year after a 5-year bear market, as evidenced by the strong buying interesting. Moreover, the $950 area on the chart will likely mark a secular bottom.

That is why there is a very high probability of gold making a big and final bottom later this year. Gold bulls should be extremely glad at this point if gold would move below $1000 as it will offer a once-in-a-decade opportunity to buy the yellow metal at discounted prices. As the current ‘risk on’ trade could be ending later this year, there is a high probability that gold prices will move much higher during the next ‘risk off’ cycle.