Frequently Asked Questions

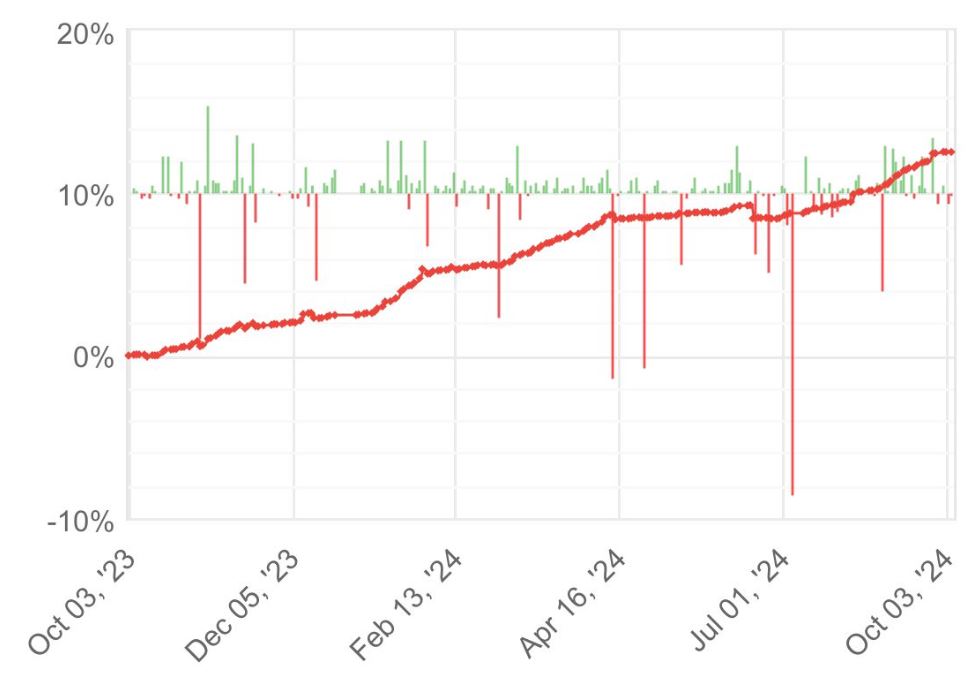

Question: Are the results shown on this page based on a real-life trading account?

Our answer: Yes.

Question: What are the risks associated with auto-trading?

Our answer: We have undertaken more than the average auto-trading service to maximize risk management and have controls in place to protect capital. However, market cycles can change and black swan events can hit the market in a way that it will adversely affect our trading results, even with the great track record we have. Our trading strategies are back-tested against 20 years of market data. Even with all these measures in place, we do know that past performance does not guarantee future results in financial markets.

Question: What are the differentiators of this service compared to similar auto-trading services in the market?

Our answer: We designed this service, leveraging a trading strategy and at technology platform of a reliable broker, in such a way to grow your money steadily, with great care to keep risks low. Most importantly, it’s super easy for you. You only need to set up your account with the broker and subscribe to InvestingHaven’s Co-Trader strategy in the PAMM environment.

- Maximum convenience: truly only the initial setup of the account at the broker is the only action required from members, there is even no paperwork, everything is taken care of.

- Maximum risk management: we minimize the drawdowns and lower risk when it seems appropriate. We are happy if we accumulate small profits in 90-95% of trading days in a year.

- Maximum profits: after maximum risk management comes profit optimization.

- Minimum costs & fees: the only fee is a % as a success fee on realized profits.

Question: Do you have a welcome offer for loyal members?

Our answer: The only fee we will apply to our loyal members, also our currently auto-trading members, is a success fee (performance fee) which is 20% on realized profits. Moreover, we apply the “highwater mark”. This fee might go up over time as we book consistent success, but members signing up in 2023 will lock this fee in perpetuity even if we are going to increase it to 25% further down the road. Moreover, we will never charge the following:

- No set up fee. This might change over time, especially if we can prove our consistent success in some 6 to 9 months, we might charge a set-up fee to members that will sign up in the future. Our current and loyal members will not be charged a set-up fee.

No management fee. This might change over time, to members signing up in the future.

Question: Why is the choice of the broker important? Why can’t I choose my own broker??

Our answer:

The trading strategy and the choice of a broker are closely linked. This is primarily because our strategy has some unique features. To put it simply, most brokers can’t support our strategy due to its strict demands. We had additional criteria beyond trading too, such as having a global audience (including US and CA citizens) and being a regulated broker with at least 7 years of experience. After thorough research, we found only one broker that met all these requirements.

I understand that switching brokers may not be the most convenient option. However, we’ve set incredibly high standards: only 1 in 10,000 trading strategies can achieve our long-term compound goals without causing significant losses. The more specific our requirements are – concerning trading strategy, trading conditions, audience reach, and trustworthiness – the fewer brokers can meet them. In the end, changing brokers boils down to two transactions: one withdrawal and one deposit. Our micro-trading strategy is designed for maximum convenience; these two steps are all that’s really needed, and everything else will be taken care of for many years.

Question: With a PAMM account, do I have full control over my account? Can I withdraw at any time, pause at any time?

Our answer: Yes, absolutely, you are in control. The withdrawal process is quite straightforward. You initiate the withdrawal request, and I will approve it. After approval, you can proceed to withdraw your desired amount. However, I will double-check to ensure that there are no open trades that could potentially affect your results. If there is an open trade that represents a significant portion of your portfolio, I may need to wait to approve the withdrawal until that position is closed. When dealing with small positions, I will approve withdrawals immediately. But as the account grows over the years, we want to make sure that withdrawals are managed in a way that doesn’t impact open trades. Rest assured, you have full control over the process, and we take care to avoid any disruption to your ongoing trades during withdrawals.

Question: Do you have long track record?

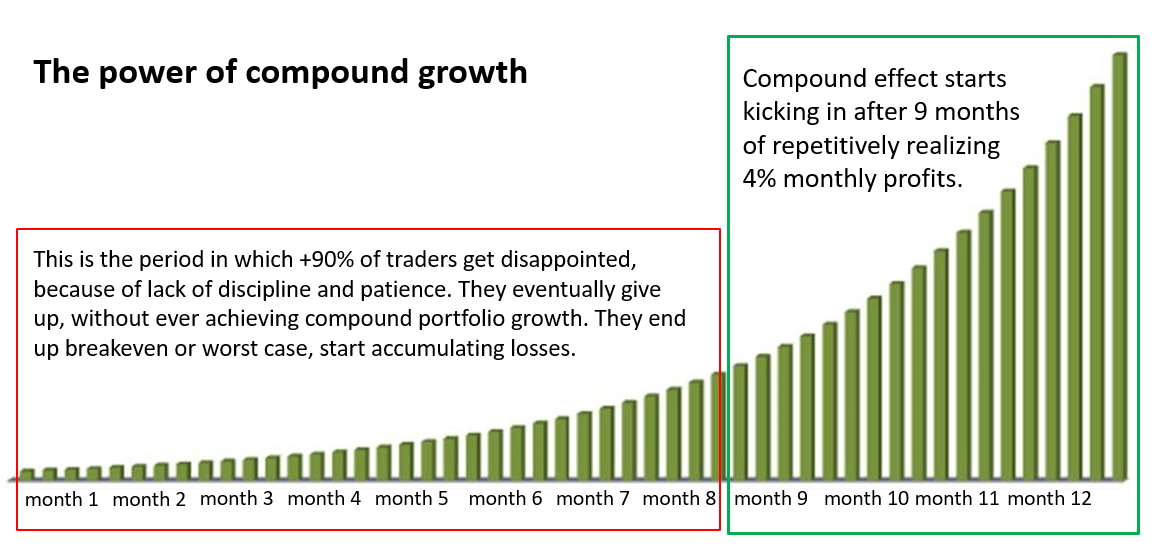

Our answer: Absolutely, we do have a long track record with this trading strategy. One of our fundamental requirements, derived from extensive research, is that 99.9% of automated trading strategies fail to generate compound effects over a 5-year period. Additionally, most strategies don’t survive structural market changes, which tend to occur every 18 to 24 months. Therefore, a key prerequisite for our micro-trading strategy is a track record of at least 3 years.

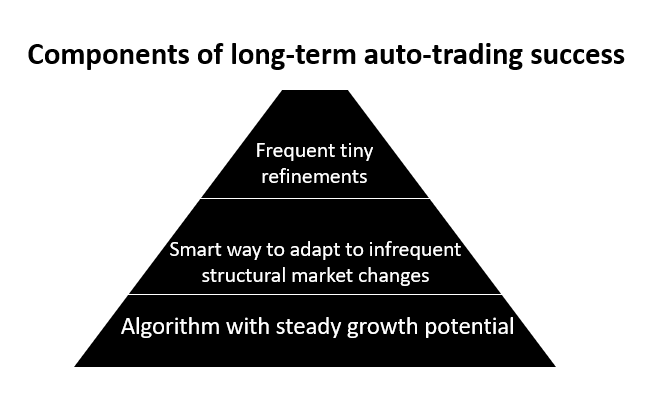

The uniqueness of our micro-trading strategy lies in its combination of (a) multiple expert advisors, (b) risk management, and (c) profit optimization.

The expert advisors that underpin our strategy have demonstrated their effectiveness over time. For instance, one of them, named “Eve,” has been successful for more than 3 years, as shown in the chart below. Another expert advisor, “Tree of Life,” has also shown significant success over a similar timeframe, although it has been officially tracked for just a year. We have two additional expert advisors that haven’t been officially tracked for over a year.

Furthermore, the blended strategy lines depicted below illustrate the multi-year expertise in combining these expert advisors. They also demonstrate that it’s possible to strategize expert advisors in various ways, depending on risk management and profit optimization objectives.

The charts discussed above, along with detailed results, are made available on the newly created InvestingHaven page on myFXbook which features the long run EA’s and trading strategy: https://www.myfxbook.com/members/InvestingHaven

Question: Which funding options are provided by the broker?

- US specific: domestic bank wire + SWIFT

- CA specific: bank transfer in CAD or GBP

- Singapore specific: bank transfer in SGD

- EU specific: bank transfer in EUR

- AU specific: bank transfer in AUD

- Card funding,

- Instant crypto funding

- Neteller, Skrill, Awepay, Union Pay, AdvCash, Dragonpay, local payment MYR

Question: Is it possible to lose more than 100%, i.e. the invested capital + profit = the account goes to 0?

Our answer: Rest assured, our trading strategy is designed with a primary focus on protecting your principal investment. The worst-case scenarios involve (a) potentially slower growth than anticipated, (b) temporary drawdowns, or (c) the occasional month with a small loss (during which no profit-sharing fee applies).

What sets our strategy apart is its commitment to safeguarding your capital as its foremost objective, with profit optimization as a secondary goal. With multiple expert advisors that have demonstrated their reliability over time, there’s always at least one advisor performing well. Furthermore, the broker we’ve chosen is regulated and equipped with “negative balance protection,” ensuring your account can never go below zero. Your principal investment is a top priority.

Last but not least, there is a ‘negative balance protection’ clause in the client agreement that you will sign with the broker. That’s because the broker is regulated.

Question: What happens in a month when your results are negative, for instance a realized loss of 1%?

Our answer: We operate this service based on the “highwater mark” principle: in case of a realized loss in a given month, no success fee is withdrawn. Any previous loss must be recovered before further success fees can be withdrawn. The trade leader is incentivized to keep losses as small as possible, this is built-into the PAMM service capability of the broker.

Illustration: In February of a given year we realize a profit, also in March and April. A success fee applies in those 3 months. In May, we realize a loss of 1% but in June we realize a profit of 1%. There is no success fee charge in the months of May and June. As of July, the count is reset.

Question: What permissions does this grant the professional trader other than trading with the funds?

Our answer: The only permissions from the trader are (a) executing the trades (b) profit sharing / success fee at the end of the month in case of realized profits (in case of a realized loss, the success fee charge rolls over until the previous loss is recovered).

Question: How do I know that you won’t create damage in my auto-trading portfolio?

Our answer: We work with a stop loss, for each and every trade, without any exception. The maximum loss we can allow to an individual trade is defined upfront, in the settings in our trading account.

As seen on the charts, above, the probability of losing 10% of the portfolio is unusually low.

Question: How do I know that these results are legit?

Our answer: All results are verified by a neutral 3d party.

Question: I am not in control but have to trust the auto-trading service?

Our answer: You are in control of your account. The signals execute on your own trading account. You can discontinue auto-trading at any given point in time in the unlikely event you don’t like seeing how your portfolio grows.

Question: Do I need to sign up to VPS?

Our answer: No, it’s all built in to the service, members do not need to take a separate VPS plan.

Question: What is the required level of trading knowledge?

Our answer: None. This auto-trading service is a passive income concept, irrespective of the market which we are trading and without your intervention. You don’t need to trade. You only set up the account, initially, with our support, to enable auto-trading.

Question: Is this service meant for investors, for traders or both?

Our answer: For anyone that has been looking to realize the passive income dream!

Question: Are you trading futures?

Our answer: No certainly not. Currency pairs are risky, but we keep risk under control by setting leverage at the lowest possible level at installation. We only recommend scaling up leverage, very slowly, after a few months, as the portfolio has shown steady growth.

Question: I am based outside of the U.S., can I participate to the trades?

Our answer: Yes, great news, anyone in any part of the world can follow our micro-trading!

Question: What is my minimum required capital for manual execution of the trades?

Our answer: We recommend, at a bare minimum, $4000 as a principal.

Question: Auto-trading looks too good to be true, I don’t believe you guys.

Our answer: No worries, you don’t have to. We are not here to convince anyone. The results have been verified by a neutral, 3d party that is able to track portfolios. You can drop us a message for further due diligence if you desire. It’s all legit!

Question: What happens if the profit potential of your algorithm diminishes in the future?

Our answer: In the unlikely event that we see our algorithm underperform compared to the great results from recent years we will be the first to signal this. Obviously, we will finetune our algorithm to adjust to new or abnormal market conditions.

Question: Do you have another question, one that is not listed on this page nor in the FAQs?

You can ask your question in our , we will get back to you by email within 24 to 48 hours.