Leading indicators in the precious metals universe suggest that silver will outperform in 2025 and 2026. Gold acting as the bull market driver, silver the outperformer.

RELATED – Gold prediction 2025 through 2030

As we approach 2025, the precious metals universe is set for a shift.

While gold has traditionally been the go-to metal for investors seeking portfolio stability and long-term growth, silver is set to become the outperform in 2025.

This article outlines thoughts about which precious metal to buy for 2025. We explain the 3 reasons why silver is set to outperform the other precious metals:

- Speculators are giving up which is a bullish indicator – more details below.

- Secular silver chart dynamics are solid, very solid, suggesting silver is the precious metal to buy for 2025.

- Bull market dynamics: Silver tends to react with a delay compared to gold – historic evidence below.

This is why silver should be a consideration for investors in 2025.

Precious metals outlook for 2025

The precious metals market is influenced by a complex set of economic data, market sentiment, and other leading indicators.

Recent trends suggest that silver is preparing a major upswing, it may not start in the short term but it looks like an acceleration phase is likely to occur in 2025.

Silver is expected to be driven by historical patterns, chart dynamics, and market dynamics.

Silver’s unique attributes and current indicators suggest it is not only a valuable addition to an investment portfolio. Potentially, silver could become the most ‘juicy’ opportunity in the precious metals sector in 2025, we’ll explain in this article why we think so.

If we want to understand which precious metal to buy for 2025, we need reliable leading indicator data. That’s what we’ll focus on in this article.

That’s why we suggest to stay way from the news. This is why (updated on November 24th):

- Oct 25th – Gold strong because of mideast woes and election uncertainty (source).

- Nov 15th – Gold biggest weekly fall in 3 years as Fed rate-cut bets ease (source).

- Nov 22nd – Gold rallies on safe-haven demand (source).

Nobody on earth can make sense out of this sequence of news events. That’s why we offer gold price analysis based on leading indicators and gold chart analysis.

1. Speculators are giving up – A bullish indicator

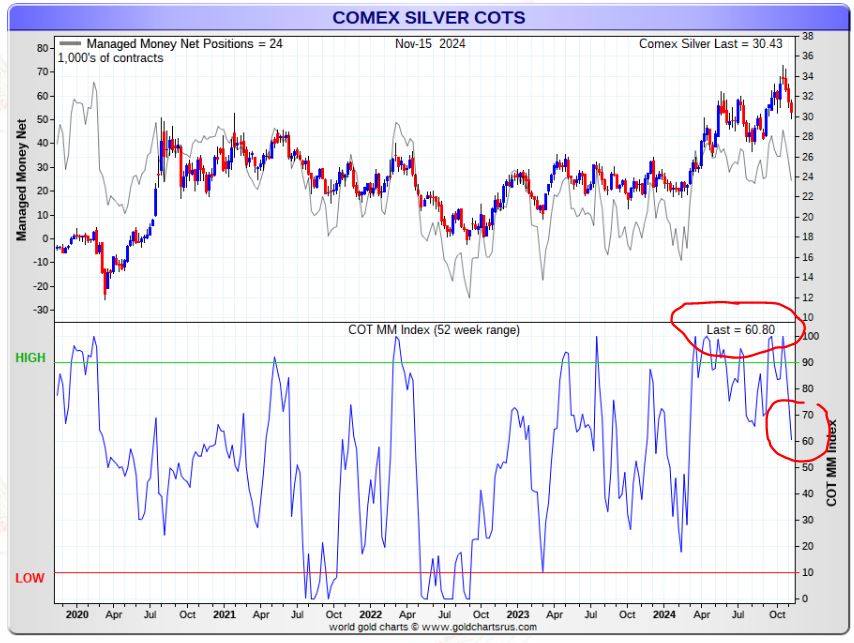

One of the most compelling reasons to consider silver for 2025 is the current state of speculator positions in the silver futures market.

Managed money traders, who are typically considered speculators in the market, have been significantly reducing their long positions.

This trend is particularly noteworthy because it aligns with historical patterns that have preceded major rallies in silver prices.

November 24th – The number of managed money traders (speculators, dumb money) on the long side is coming down significantly in recent weeks.

In the past, substantial rallies in silver have often been preceded by a reduction in speculative positions. The historic silver rally of 2010/2011 serves as a prime example. During that period, a similar decrease in speculator long positions was observed, which was followed by a dramatic increase in silver prices. The current decrease in speculator activity suggests that silver could be on the verge of a similar breakout.

This phenomenon can be attributed to the fact that speculators tend to enter and exit positions based on short-term trends and market sentiment. When they reduce their positions, it can create a more favorable environment for sustained price increases, as the market becomes less susceptible to speculative volatility and more driven by fundamental factors.

For investors, this reduction in speculative activity is a strong indicator that silver might be setting up for a significant and sustained rally.

2. Secular silver chart dynamics suggest silver is the precious metal to buy

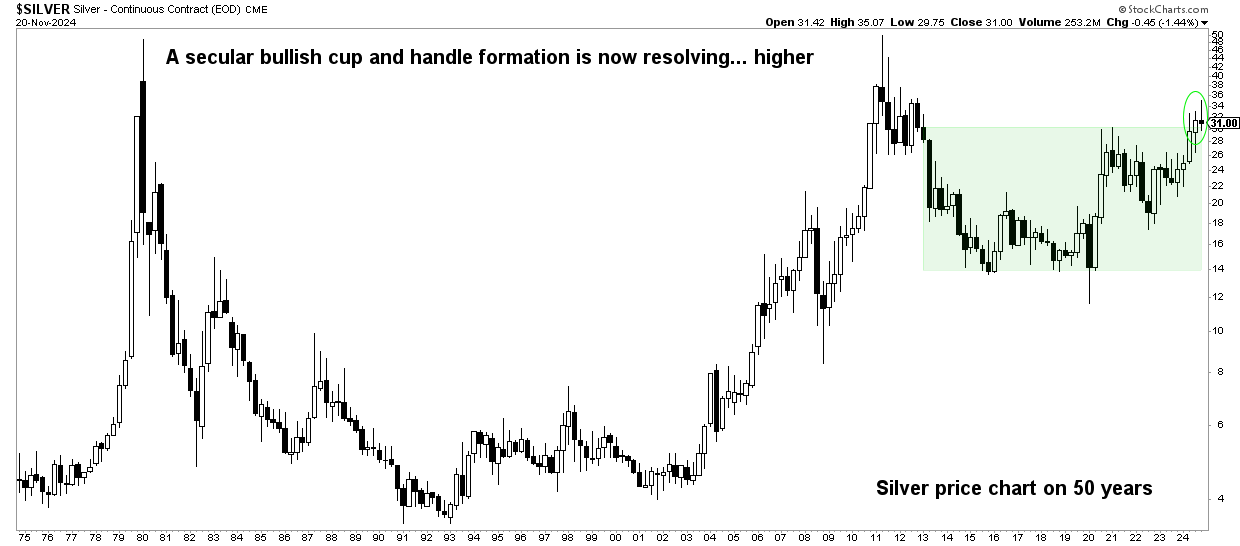

Silver’s charts are displaying exceptionally bullish signals. They make the case for a bullish move in 2025, as explained in great detail in our 2025 silver prediction. Two key patterns stand out: the 50-year cup and handle pattern and the 14-year bullish triangle.

Silver’s 50-year bullish cup and handle pattern

The cup and handle pattern is a classic technical analysis formation that signals a potential upward breakout. In silver’s case, this pattern has developed over an impressive 50-year period.

Source: 50-Year Silver Price Chart

The “cup” part of the pattern represents a period of consolidation and price decline, followed by a gradual upward movement. The “handle” is a shorter consolidation period that typically precedes a breakout to new highs.

This long-term cup and handle pattern indicates that silver has been consolidating and preparing for a significant upward move. The fact that this pattern spans 50 years adds weight to its potential significance.

November 24th – The longest term silver price chart confirms the long awaited breakout. On October 18th, 2024, silver broke out. Since then, it back tested its breakout point which is 32.70 USD/oz. This is our viewpoint – as long as silver remains above the green shaded area, it has a strong bullish bias with a near-confirmed secular breakout. This, in turn, increases our confidence in our call: silver is the precious metal to buy for 2025.

In all fairness, just this one chart shown above is more than enough evidence that silver is the precious metal to buy for 2025, even without all other compelling data points.

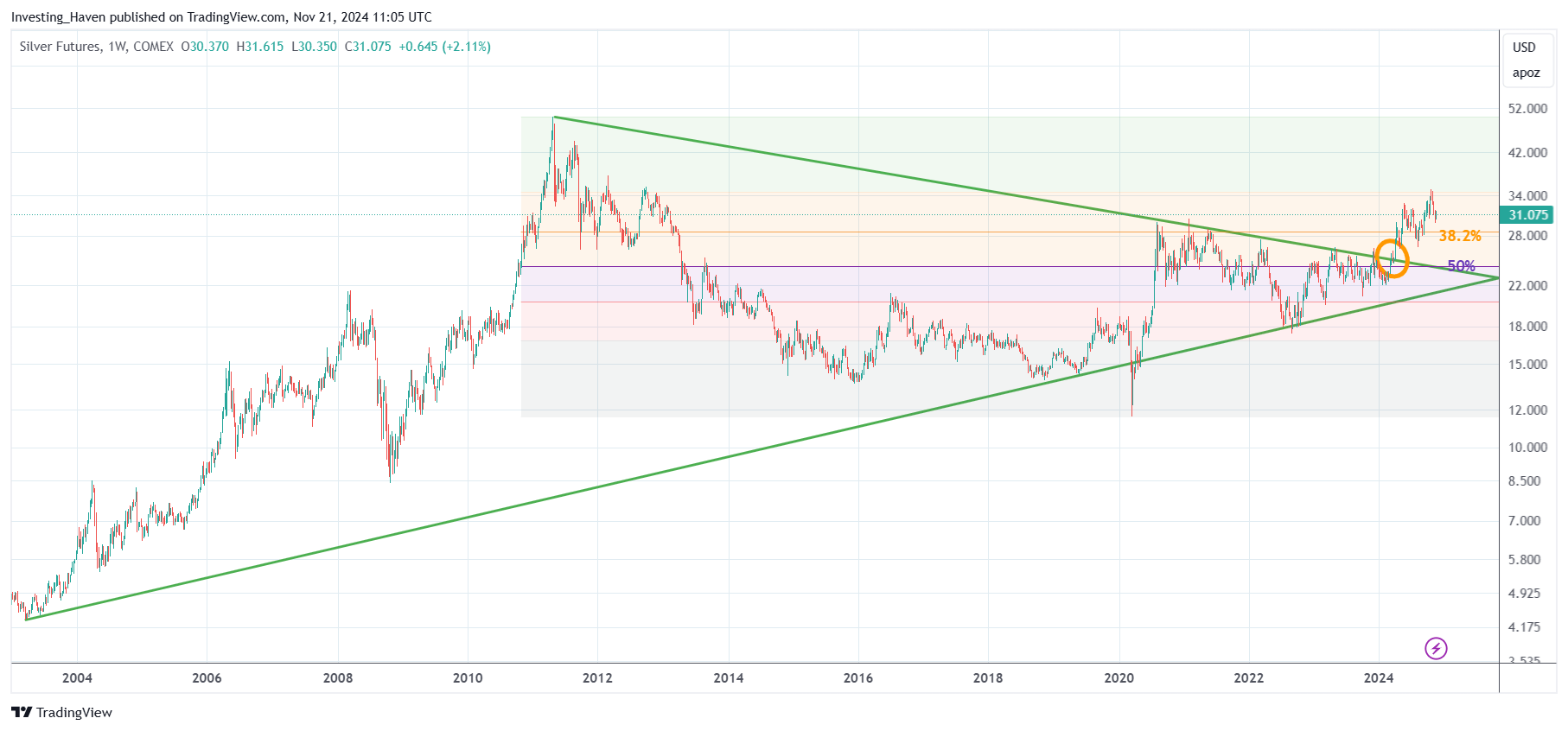

Silver’s 14-year bullish triangle

In addition to the cup and handle pattern, silver’s price chart also shows a 14-year bullish triangle formation. A bullish triangle is characterized by converging trend lines that form a triangle shape on the chart. This pattern typically signifies that the market is in a period of consolidation before a breakout.

SOURCE – Silver Touched $30 an Ounce in 2024. How Much Higher Can Silver Go in 2025?

The 14-year duration of this bullish triangle adds further confidence to its potential impact. As the pattern has recently broken out, it suggests that silver is likely to experience a significant upward movement. This technical analysis supports the notion that silver is well-positioned for substantial growth in the coming year.

November 24th – The silver chart, weekly timeframe, over 20 years, is shown below. Silver broke out of its bullish triangle visible in April 2024, see yellow circle. The ‘horizontal breakout’ which occurred on October 18th, 2024, when silver took out its May 2024 highs. It is fair to say that silver experienced a ‘double breakout’ in 2024. This increases confidence to our call: ‘silver is the precious metal to buy for 2025.’

3. Bull Market Dynamics: Silver’s Reaction to Gold

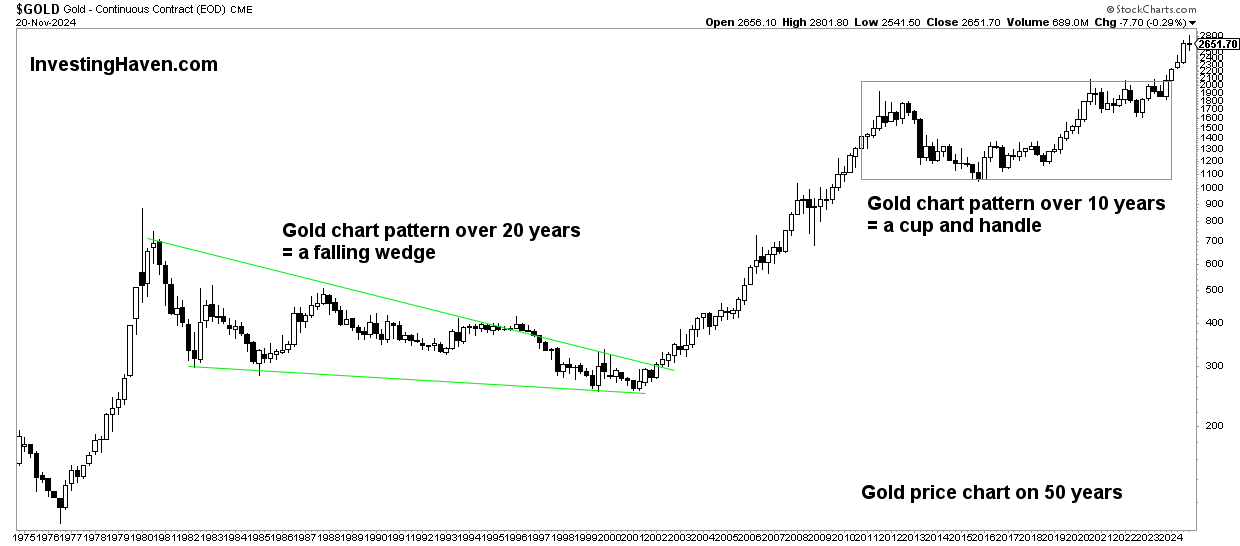

Another critical factor in silver’s potential for 2025 is its historical relationship with gold. Gold has long been the leading indicator in the precious metals market, often initiating long-term bull markets.

Silver, on the other hand, tends to follow gold’s lead but with a delayed reaction that can result in even more pronounced gains.

The gold bull market started on March 4th, 2024, as explained in Is Gold Expected To Set New All-Time Highs. The bull market just got started, we are in an early stage of the gold bull market.

November 24th – The gold bull market started on March 4th, 2024. It was confirmed in September with +3 candlesticks above former ATH. Gold’s new bull market just got started. That’s because of the 10-year gold price consolidation, with a bullish reversal pattern. As long as gold’s bull market remains in tact, silver will accelerate its move up (sooner rather than later).

During a gold bull market, silver often lags behind initially but eventually catches up with a vengeance.

This dynamic is rooted in the nature of both metals’ market behavior. Gold typically experiences early gains that attract attention and drive investor interest, while silver’s gains come as a secondary effect, often resulting in more substantial price increases.

As gold’s bull market matures, silver tends to follow with stronger momentum, capitalizing on the positive market sentiment generated by gold’s performance.

This delayed reaction has historically resulted in silver outperforming gold in the later stages of a bull market.

For 2025, as gold continues to perform well, silver is likely to experience a powerful resurgence, making it an attractive investment opportunity.

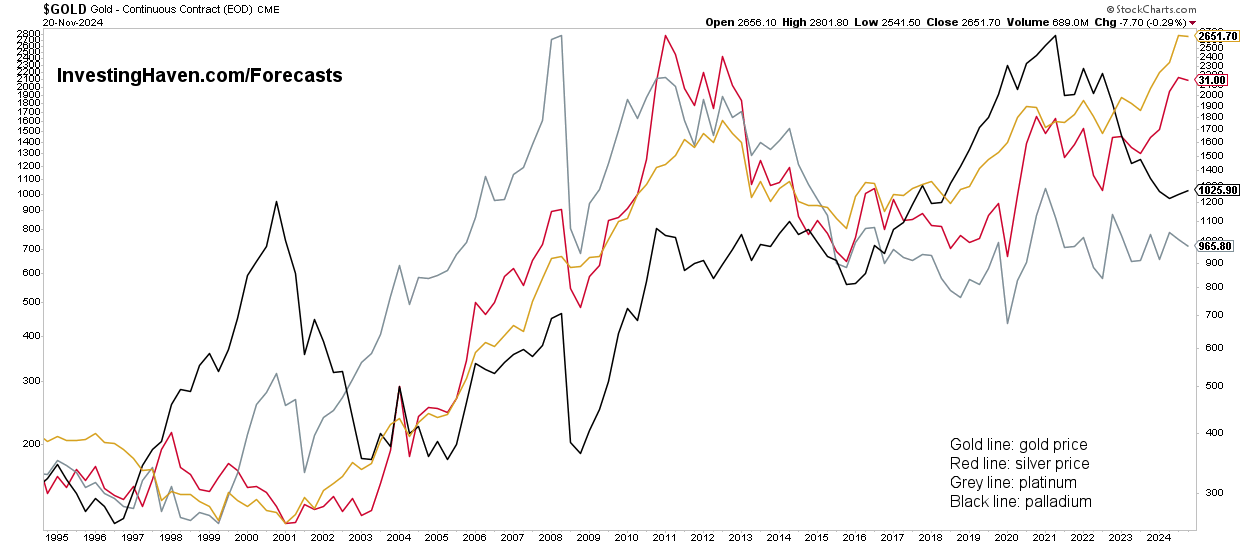

Four precious metals, long term picture

To fully grasp why silver is emerging as the top precious metal to buy in 2025, it’s essential to consider the long-term evolution of all four major precious metals:

- Gold.

- Silver.

- Platinum.

- Palladium.

Understanding how these metals have performed over an extended period provides context for assessing their current and future potential.

Long-term precious metals performance chart

The chart below illustrates the historical price movements of gold, silver, platinum, and palladium over several decades. This comprehensive view highlights each metal’s unique market dynamics and performance trends.

November 24th – Visibly, all four precious metals have either a strong bullish bias (gold and silver) or early signs of a bullish bias (platinum and palladium). This correlation chart suggests that silver is going to rise faster than gold, sooner or later, at a certain point in time. When combined with the above data points, there is a high probability that silver will move faster than gold at some point in 2025.

Gold: Historically, gold has been the leader among precious metals. Over the long term, gold has shown a consistent rise, driven by its role as a hedge against inflation and geopolitical turmoil.

Silver: Silver’s performance has been more volatile compared to gold. While silver often follows gold’s lead, its price movements can be more pronounced due to its dual role as both an investment asset and an industrial metal. Recent trends indicate that silver is pretty resilient.

Platinum: Platinum has experienced fluctuations largely due to its industrial applications, particularly in the automotive industry where it is used in catalytic converters. Over the long term, platinum’s price has been impacted by changes in industrial demand and supply dynamics. Recent years have seen platinum’s performance lag behind gold and silver.

Palladium: Palladium has seen dramatic price increases over the past decade, driven by its critical role in automotive emissions control and supply constraints. However, like platinum, its performance is closely tied to industrial demand.

Which precious metals for 2025?

In November 2024, the current standing of each metal reflects their respective market conditions:

- Gold remains a dominant force, with its price reflecting ongoing economic uncertainties and its role as a financial safe haven.

- Silver is showing promising signs of a secular breakout, though not visible on the last chart but on silver’s secular chart, driven by favorable chart dynamics and a reduction in speculative positions.

- Platinum and Palladium have seen mixed performance, with platinum lagging behind and palladium trying to stabilize after having printed huge swings in both directions in recent years.

In this context, silver’s potential for significant growth becomes even more apparent. While gold continues to lead the market, silver is set for a substantial upswing sooner or later.

Why silver is the precious metal to buy for 2025

Which precious metal to buy for 2025? The answer we explored in this article is silver for 3 reasons:

- The reduced speculator positions.

- Silver bullish chart dynamics.

- Silver’s historical reaction to gold bull markets.

Those 3 reasons present a compelling case for silver as the top precious metal to invest in for 2025. These factors suggest that silver is well-positioned for significant growth and could provide investors with substantial returns.

Understanding these indicators can help predict future trends, acknowledging forward looking thinking may not play out as expected (there is always a risk with future state thinking).

As always, it’s essential to consider all relevant factors in the context of your overall investment strategy and consult with financial advisors to align your investments with your financial goals.