In this coffee price forecast, we present coffee price prediction for 2025 based on its leading indicators. The price of coffee hit our predicted target ahead of schedule, particularly in December 2024.

Mid-2024, we wrote this:

This coffee price forecast suggests that the price of coffee is set to double by 2025. This is based on favorable supply/demand trends in the global coffee market, combined with favorable leading indicators Brazilian Real and Coffee CoT’s.

Coffee was trading at 2.00 per pound back then.

As 2025 kicks off, our predicted coffee price target for 2025 got hit.

This implies that our coffee price prediction for 2025 turns neutral to bearish.

We apply our regular forecasting method to this coffee price prediction. We look at the leading indicators that apply to predicting the price of coffee. From this, we derive an understanding of the directional trend. We then analyze the trend(s) on the long term coffee price chart.

- 1. Coffee Price Prediction 2025: Methodology

- 2. Leading Indicator: Global Supply Demand 2024

- 3. Leading Indicator: Coffee’s COT Report

- 4. Coffee Price Charts & Price Target 2025

- 5. Summary: Coffee Price Forecast for 2025 and 2026

Coffee price prediction 2025: methodology

Every InvestingHaven forecast is based on the same structural approach:

- We identify and analyze the relevant leading indicators of a market. This gives us insights about the longer term trend: directionally higher, lower, or unclear.

- We analyze the price charts to identify trends and turning points. We typically look at the monthly, weekly, daily charts, in a top-down approach.

When it comes to coffee we look at leading indicators which tend to determine the future price of coffee. The leading indicators for coffee’s future price are:

- Global supply/demand conditions.

- Coffee’s COT report (futures market positioning), acting as a long term ‘stretch indicator’ as it relates to overbought or oversold conditions for price.

- Coffee price chart.

We apply this structured method to predict a reasonable coffee target (area) for 2025.

Enjoying an expensive cup of coffee?

We will focus on the price of coffee, set in global markets and COMEX futures markets.

However, there is of course a relationship with the cup of coffee that all of us are drinking, as consumers.

Coffee prices in the grocery stores went up significantly, as evidenced by our own experience and consumer stories like this one:

@Morrisons When people are struggling & you and other supermarkets are busy patting yourselves on the back for finally reducing basic items by a couple of pence, how on earth do you justify a price rise of 3 quid within a couple of weeks on a jar of coffee? Shameful! pic.twitter.com/ZdD26CmyU0

— @helen_spirit1 May 17, 2023

One would expect that the underlying commodity went up as well.

Commodity price changes over the last year…

Sugar: +9%

US CPI: +6.0%

Gold: +2%

Silver: -7%

Soybeans: -12%

Corn: -14%

Copper: -14%

Gasoline: -16%

Coffee: -19%

Heating Oil: -23%

Zinc: -27%

Brent Crude: -28%

WTI Crude: -31%

Wheat: -33%

Cotton: -41%

Lumber: -56%

Natural Gas: -61%— Charlie Bilello (@charliebilello) March 29, 2023

Nothing is further from the truth: the price of coffee in global commodity markets came slightly down in recent years.

Morale of the story: don’t mix up coffee price forecasting with your own experience as a consumer. Financial markets and real life markets may be decoupled. That’s why we need a methodology to forecast prices in financial markets. It is imperative to have a solid methodology to forecast the price of coffee.

Leading indicator: Global supply demand 2024

First, the global supply vs. demand conditions in the global coffee market has proven to be a reliable indicator over the years. The correlation between global supply/demand and the price of coffee, directionally, has a reliable correlation.

In other words we look at major changes in global shortage vs. deficit, to understand, directionally, to forecast the direction of the price of coffee.

As per this report Coffee World Markets and Trade published in June of 2023, the world coffee production forecast for 2024 is set to rise:

World coffee production for 2023/24 is forecast 4.3 million bags (60 kilograms) higher than the previous year to 174.3 million. Higher output in Brazil and Vietnam is expected to more than offset reduced production in Indonesia. With additional supplies, global exports are expected up 5.8 million bags to a

record 122.2 million primarily on strong shipments from Brazil. With global consumption forecast at a record 170.2 million bags, ending inventories are expected to remain tight at 31.8 million bags.

The next chart (source) says it all: the global coffee market is expected to grow with a CAGR of 6.2% per year.

This first leading indicator suggests that the global coffee market is growing, directionally, in 2025.

This is supportive of higher coffee prices, certainly ahead of the coffee price rise from $2.00 to $3.30 per pound.

We need the other 2 coffee price leading indicators to complement the above statement though, especially as the coffee price has risen significantly in the last quarter of 2024.

Leading Indicator: Coffee’s COT Report

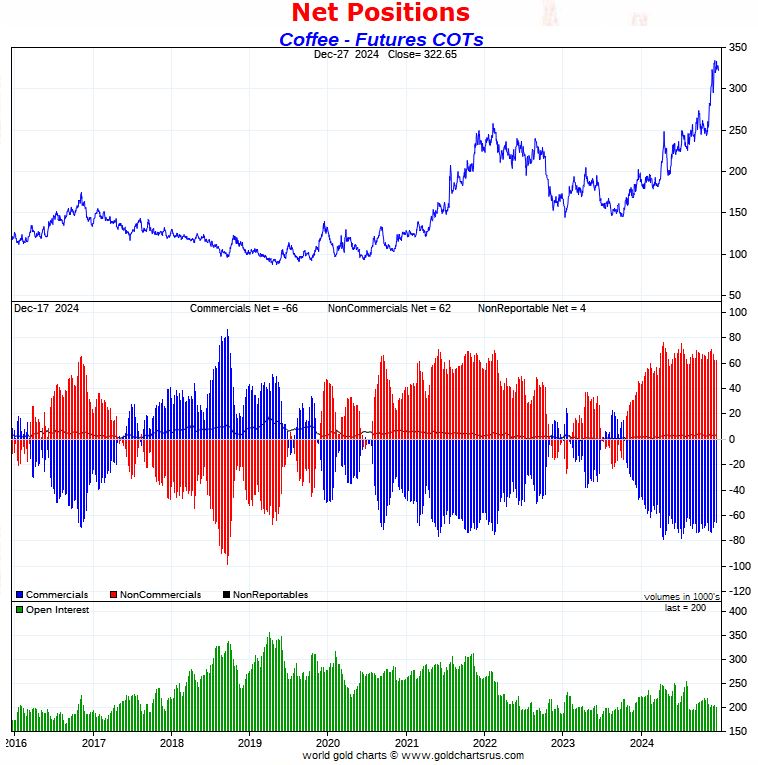

The trend in speculator positions (‘Commitment of Traders’) has a strong impact on the price of coffee. The way to leverage the CoT report is more like a ‘stretch indicator’. What does this mean?

- It’s all about the net positions of commercial and non-commercial traders.

- The blue bars and red bars, on the center pane, on the chart below, is what to look for.

- Whenever the net positions of commercial traders is extremely low (blue bars very small), there is a lot of upside potential with limited downside potential in terms of price.

- The opposite is true as well.

- Note that the CoT report is not a timing indicator, it does not tell you when prices might move higher. It only says that the downside vs. upside is limited, a stretch indicator of price.

We look at 9 year of CoT data, at the time of updating this article (December 2024). What stands out is that the bars have grown significantly. More importantly, it seems that the pattern of the bars shows a top. It looks like this leading indicator was able to predict a big rise, and is now suggesting that a local top has been set.

In sum, this leading indicator was supportive of higher coffee prices mid-2024. However, it now suggests that a top is set, at least a local top (not necessarily a lasting top).

Coffee Price Chart 2025

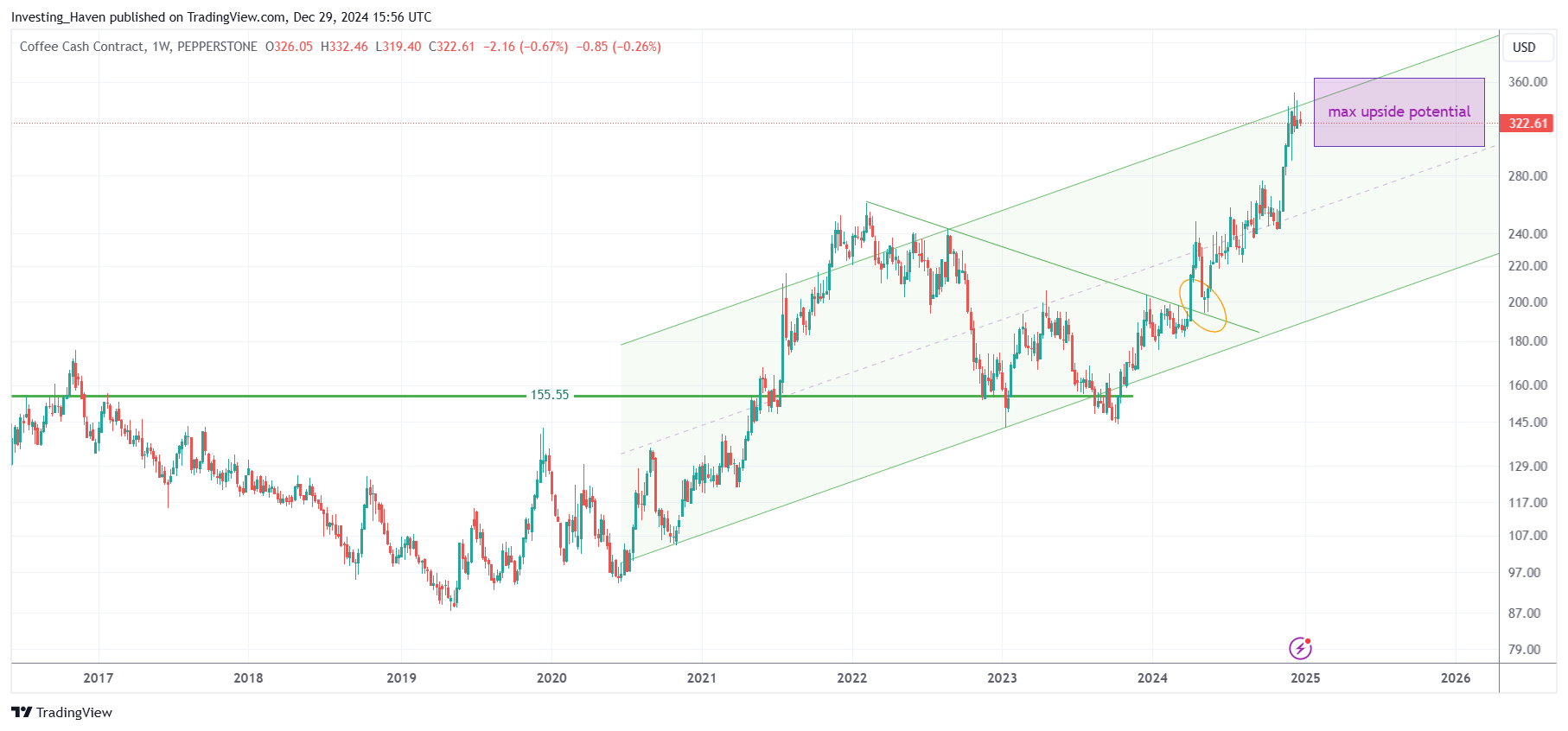

Interestingly, the long term coffee chart supports all the findings in our 3 leading indicators.

On the one hand, we see an enticing long term setup for the price of coffee. On the other hand, we also observe the probability of coffee to return to its previous ATH.

We believe that it might be a choppy road, certainly not a straight uptrend, between 2024 and 2026, for the price of coffee. We have seen violent moves to the upside of coffee in the past. The price of coffee tends to move aggressively higher every 2 to 3 years.

The odds favor an upside move, as a final outcome.

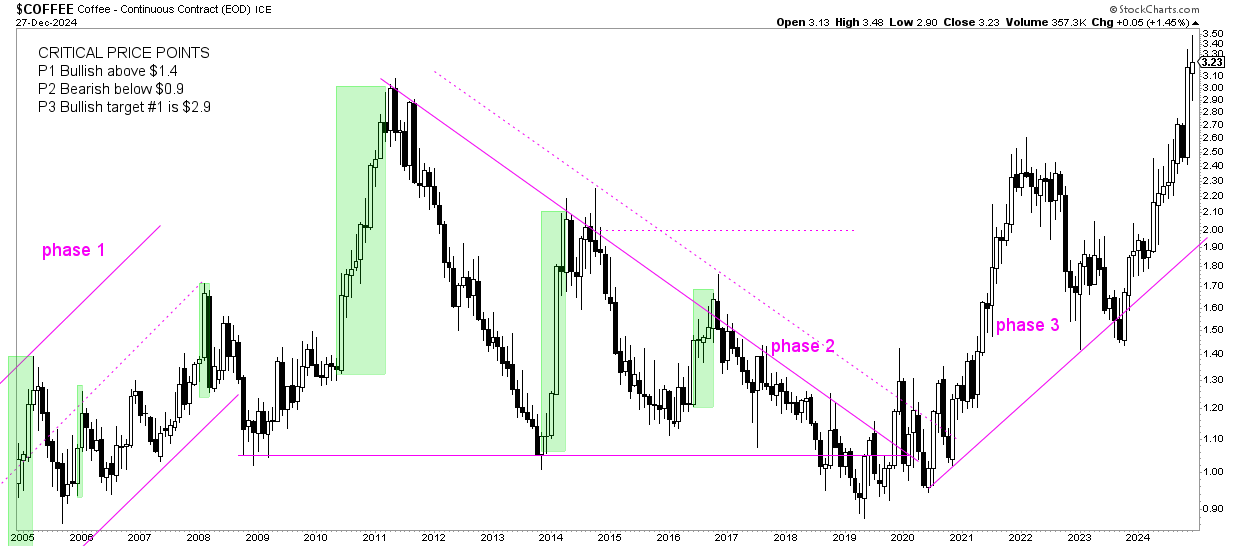

The critical price points we have identified on the secular coffee price chart (we’ve identified these price points many years ago):

- P1 Bullish above $1.40

- P2 Bearish below $0.90

- P3 Bullish target at $2.90

Now, the really important insight that we can derive from our longest coffee price chart is the rising trendline that originates in 2020. We don’t want to see a violation of that trend, below this trendline the coffee chart requires to build up a new structure, presumably at 1.40.

December 29th – The secular coffee price chart touched our most bullish price point. Our coffee price target was $3.30 per pound, published early to mid 2024. This target was hit a few weeks before 2025. Consequently, we believe the upside potential is limited in 2025.

Coffee Price Chart

Interestingly, the 1.40 price point (above) can be spotted, as a crucial level, on the daily futures price chart, below. It coincides with the 2023 lows.

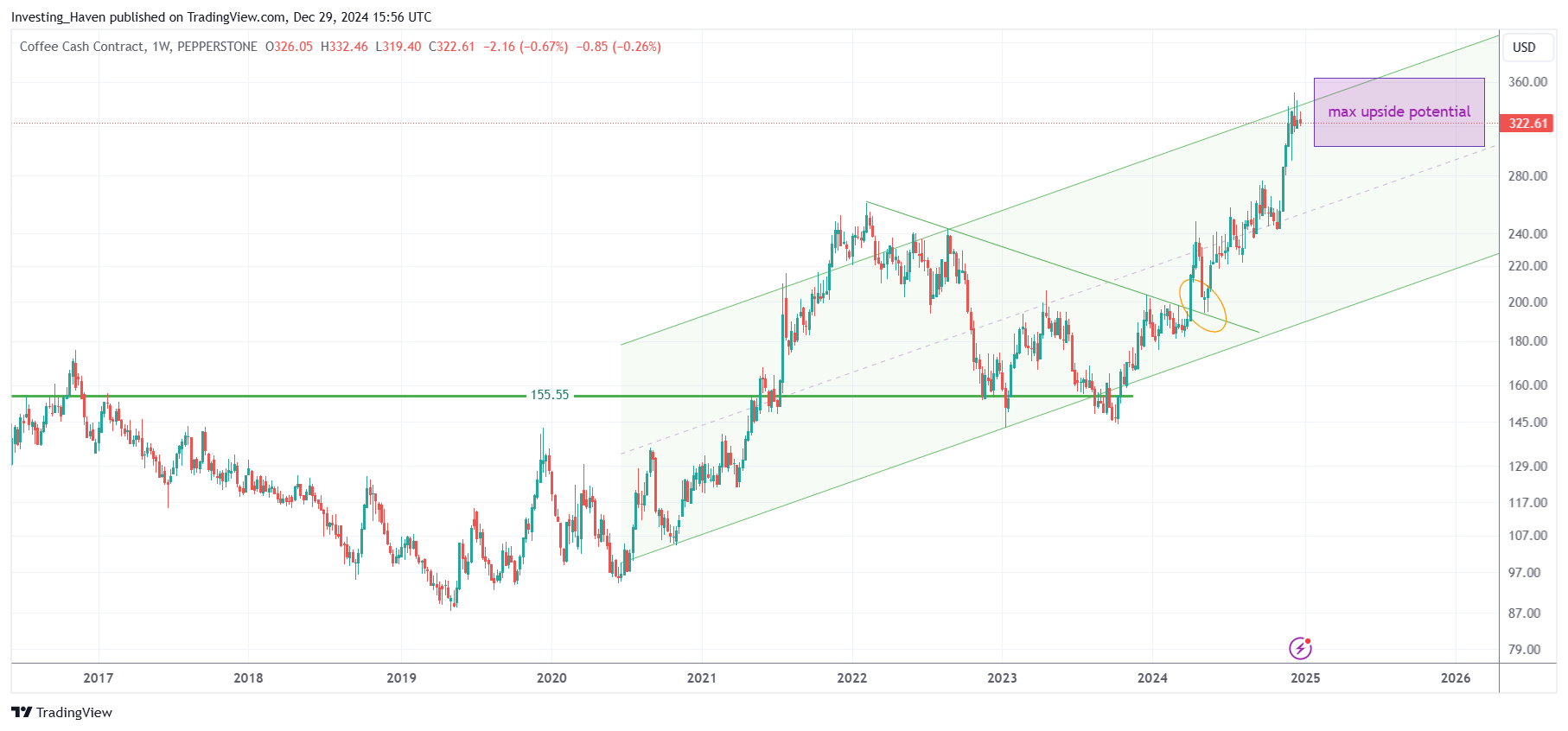

June 15th, 2024 – The price of coffee broke out in 2024, got back down to test and confirm its breakout level (the falling trendline) only to continue rising. This bodes well for the price of coffee, we believe this is a bullish development on the coffee price chart! See yellow circle on the up to date chart shown below.

September 21st, 2024 – The price of coffee found resistance, this week, at its 2022 highs. This suggests a pullback might occur the coming months which would be a great set up for a breakout in 2025 to hit our most bullish 2025 coffee price prediction target.

December 29th, 2024 – The top of the channel got hit. Exact the predicted coffee price target got hit. In terms of time, however, the predicted price got hit 3 to 6 months sooner than expected.

Conclusion from the coffee price charts:

- We believe that coffee is a buy-and-hold investment in 2024 and 2025, on a pullback.

- The pre-requisite: the 2023 lows will need to hold on a 3 to 5-week closing basis.

Our coffee price forecast 2025 was directionally bullish. Now that the top of the rising channel on its chart is hit, we need to become defensive (neutral to slightly bearish) for 2025.

Summary: Coffee Price Forecast 2025 and 2026

The coffee price leading indicators are supportive for higher coffee prices in 2024 and 2025, is what we wrote mid-2024:

- Global supply/demand factors are favorable, directionally.

- The coffee CoT is rather bearish.

The coffee price chart suggests that the rising channel is dominant. However, the bullish target got hit in December 2024.

That’s why we strongly feel that the next chart is decisive.

Our coffee price forecast 2025 of $3.3 per pound got hit (purple box). We now become neutral for 2025.