We said last week that silver would be the next play field for the Reddit WallStreetBets crowd even though they didn’t admit to be behind the 3-day silver surge. We did warn our followers to stay away because you have the inevitable dump (after the pump) which is extremely hard to get right in terms of timing it perfectly. And the dump that started after the huge pump on Monday pre-market says it all. Good luck getting this right. For now, this pump-and-dump in silver did not affect our silver forecast, but we’ll continue to watch the spectacle in the next few weeks. For now, our best guess prediction is to take it slowly when it comes to silver, as the 2021 opportunity is there in silver but not when the silver market pumps-and-dumps.

From our article last week Silver Market Welcomes Reddit Crowd

We want to give one, and only one advice to our followers: don’t mix up trading activity with investing activity. If you are an investor, know what you are doing in a market dominated by traders!

Whatever happens, the silver price chart is now completing a beautiful cup-and-handle formation. A make-or-break level, and the question is if the Reddit crowd will indeed succeed in creating an epic breakout.

We believe we have to be very prudent betting on the silver market. If anything, there are a few silver miners that we really like.

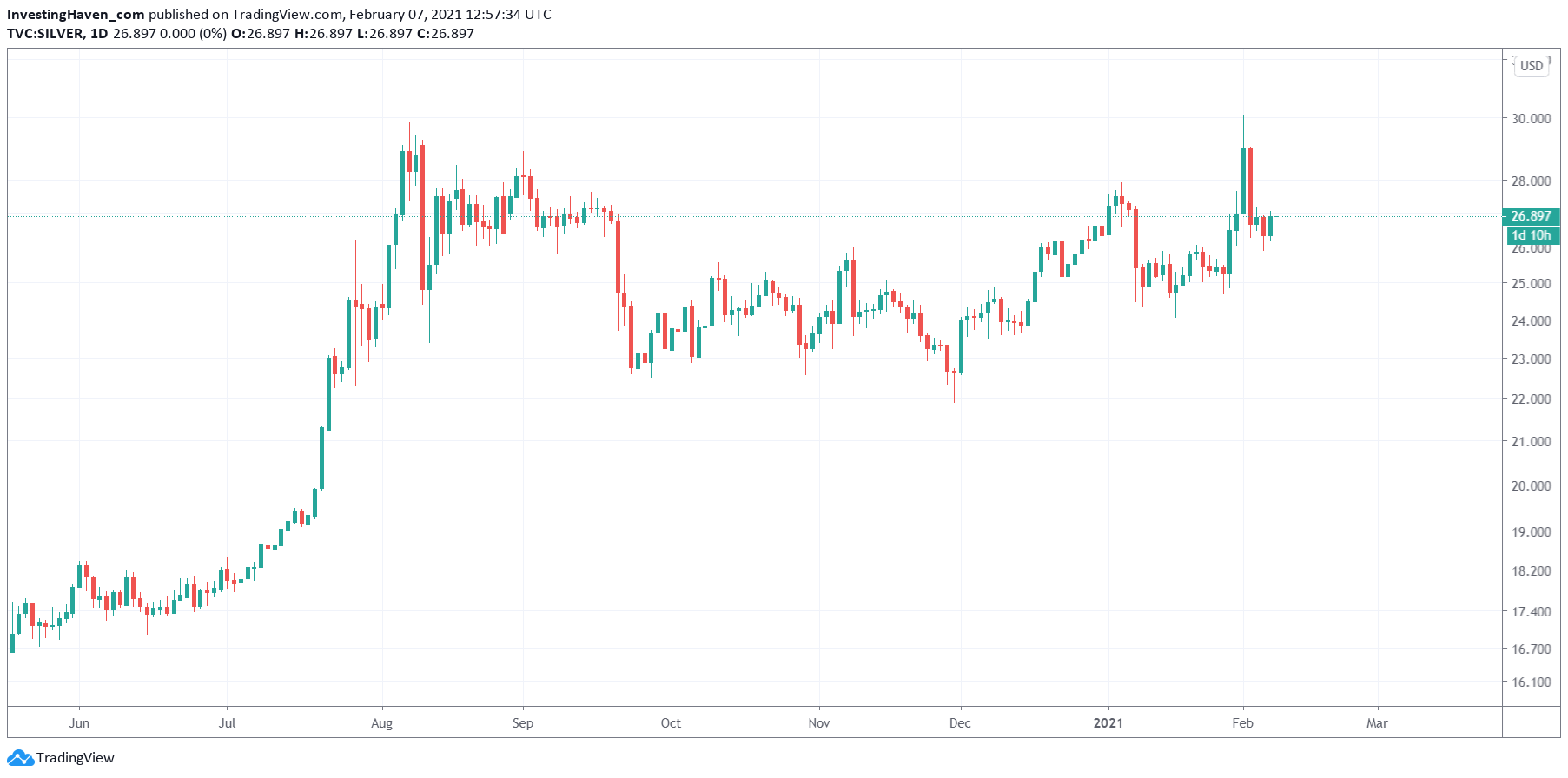

This was the silver price chart before the pump on Monday, from the same article we posted last weekend.

And this is the silver chart one week later.

Pump-and-dump is the one thing that sticks out on this chart, with a huge green candle that had an even larger red candle the next day. A rejection scenario, is how we call it.

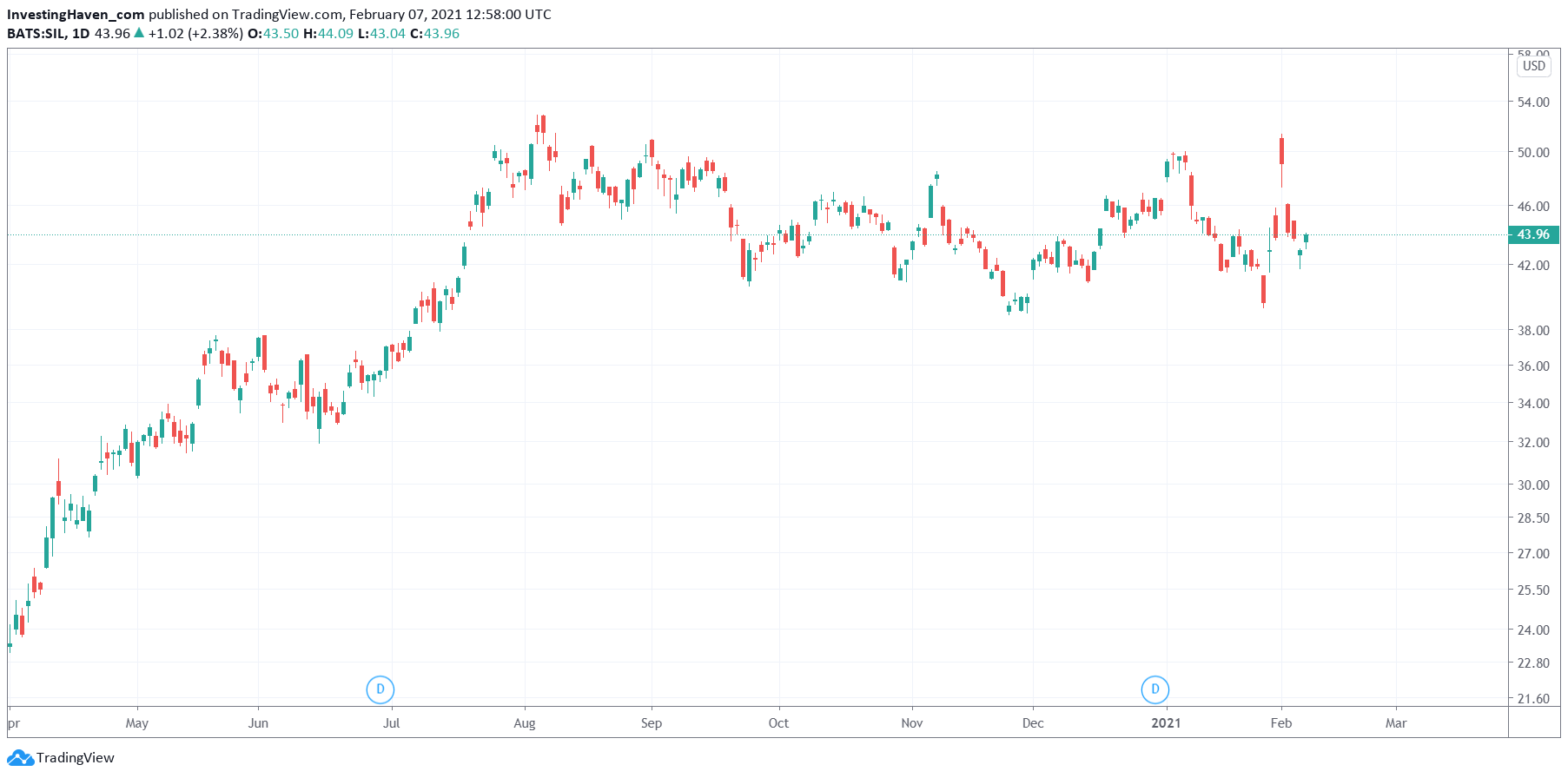

By far, the worst thing is the silver mining stocks chart. We vividly remember pre-market prices in silver stocks on Monday morning: from +10% to +35%. That’s pre-market.

The big red candle that was printed on Monday, followed by a much lower red candle (gap down) the day after is the drama we are talking about.

How many investors got caught up into the noise?

Many, far too many.

It was a drama last week for many investors or traders. Whether their silver investment/trade will get back to their entry levels, at the market open of Monday February 1st, remains to be seen. But those pre-market traders on Monday were selling their silver stuff to many innocent investors on Monday morning, that are now stuck … and may sell right at the wrong moment in time. That’s what we call a drama.

Certainly not InvestingHaven members, they were safe as we did not flash any buy on silver and only cautioned for this frenziness.

We want a calm market for a perfect entry point. And we might be lonely voices in 2021, as the entire world is trading stock markets to pass time at home during epic global lockdowns …. all from their mobile apps.

We will resist the trading opportunity, and will avoid the trading drama as well.

We’ll stick to disciplined investing and trading, in our 2 premium services.

We believe we have to be very prudent betting on the silver market. If anything, there are a few silver miners that we really like. But not during trading frenziness, we want to get in either at the start of a bull run or when the market is quiet. We track silver closely in our 2 premium services: silver miners in our Momentum Investing service, and from time to time we take a silver trade in our Trade Alerts portfolio. But we do so while respecting high risk management levels, no reckless trading and certainly no follow-the-crowd type of trades nor investments over here at InvestingHaven.