Gold did very well lately. Gold performed so well that it entered the top of an 18-month rising channel. While this is a sign of overbought conditions, the question is whether gold can go parabolic with the outbreak of war.

Related – Will Gold Continue To Rise In 2024 Or Is The Gold Price Rally Over?

On April 13th, 2024, the war between Israel and Iran started heating up. The situation in the Middle East is escalating quickly now:

- Iranian navy seizes Israel-linked container ship amid escalating tensions in Middle East (CNN)

- Iran missile and drone attack on Israel (The Guardian)

- Israel on alert after unprecedented Iranian attack (BBC)

It is clear – escalations will become center stage the coming months. Risk assets will come under pressure. Safe havens will become attractive. This might be a bumpy process, with ups and downs, but the bottom line is that safe havens will become a mandatory part of portfolios.

Safe havens attractive during war

Traditionally, there have been a few safe havens:

- The US Dollar.

- Gold.

- Treasuries.

Let’s face it – central banks messed up the case for holding Treasuries with their aggressive monetary interventions. IF anything, we don’t know how to analyze Treasuries with their distorted chart structures.

Gold and the USD are different, though. They have clear patterns.

The USD, if anything, looks increasingly bullish.

Below is the USD chart – it’s a bullish reversal with breakout level 107.7 points. We believe that 107.7 will provide resistance. We also believe that the bullish pattern is not bullish until 107.7 is cleared, to the upside.

For now, we believe that investors have been moving out of risk assets (stocks) into the USD and gold, with rising tensions in the Middle East. This process might accelerate, going forward.

Gold as a safe haven

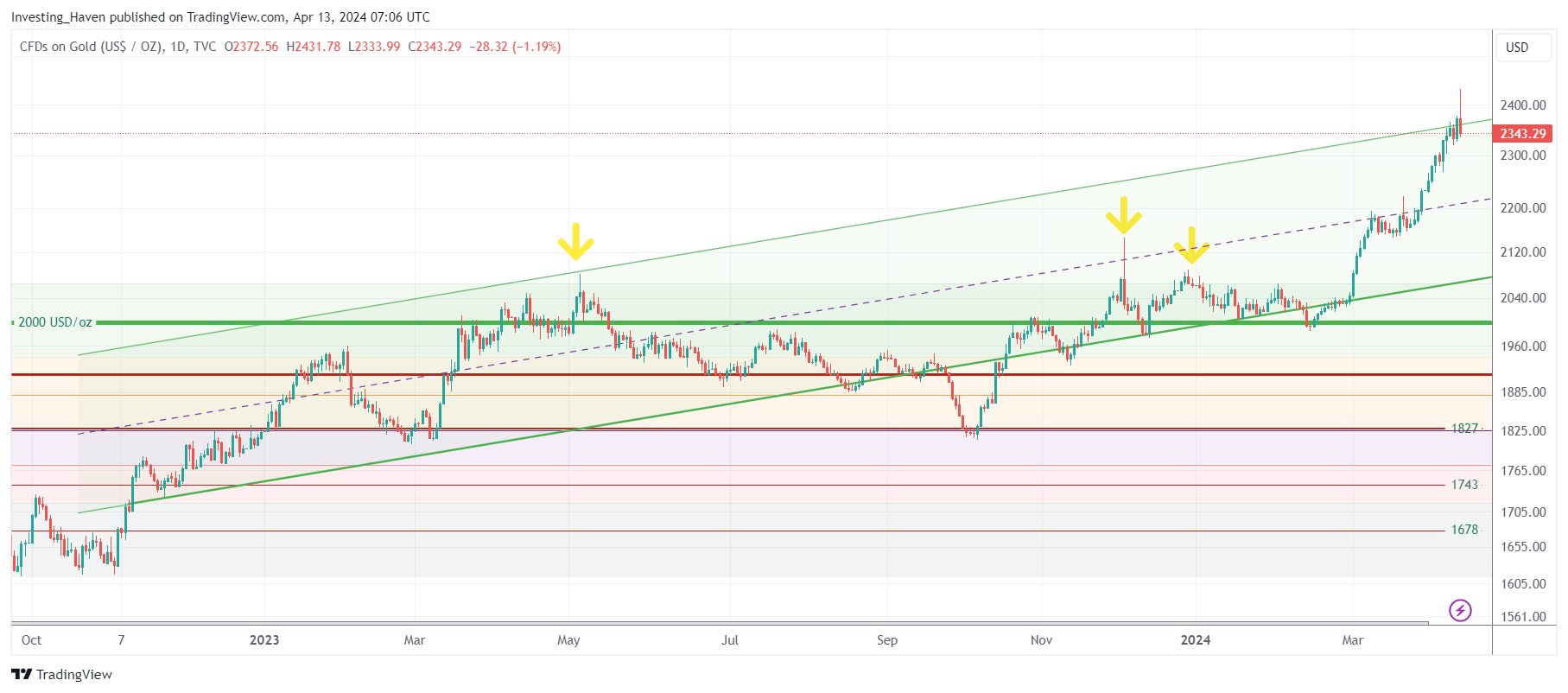

Gold is in an uptrend since February of 2024.

We will never know whether the gold price catalyst has been related to Middle East tensions. All we know is that gold staged a bullish trend in February of 2024.

What we also know is that gold touched the top of its 18-month rising channel. This implies that gold is overbought, short term.

While gold can continue to rise, the top of the channel will be a serious hurdle to overcome. From experience, we know that markets (including gold) have the ability to continue to rise near the top of a channel, certainly if a trend is powerful (like the gold’s trend currently).

Can the price of gold go parabolic?

The question is whether gold can continue to rise given short term overbought conditions.

On the one hand, gold is touching the top of its channel.

On the other hand, the USD is set to ‘benefit’ from uncertainty related to war.

Both are potentially preventing gold from moving higher.

However, gold is the most obvious beneficiary of a war.

Here is the outcome of these inherently conflicting dynamics:

Gold has the potential to stage a parabolic rise, with a price target of $3,000, in case it continues to rise above its long term channel, driven by fear of war.

While this may not happen short term, there is certainly the possibility of this to happen over the course of the next weeks.

Read our latest detailed gold & silver price analysis >>