Markets are fickle, we explained why and how in great detail to members of our premium service Momentum Investing. For anyone who wants to see our proprietary charts feel free to sign up and study the alert sent on Tue February 4th titled “you can run but you cannot hide.” One sector that is going crazy is the biotech stock sector. One thing we do know about markets that go bananas: if it’s unclear what their intention is you better stay at the sidelines, regardless whether we hold a bullish biotech forecast for 2020.

Biotech was hot in the last months of 2019.

Biotech may become, and presumably will become, a very sector in 2020. Not so at this point in time.

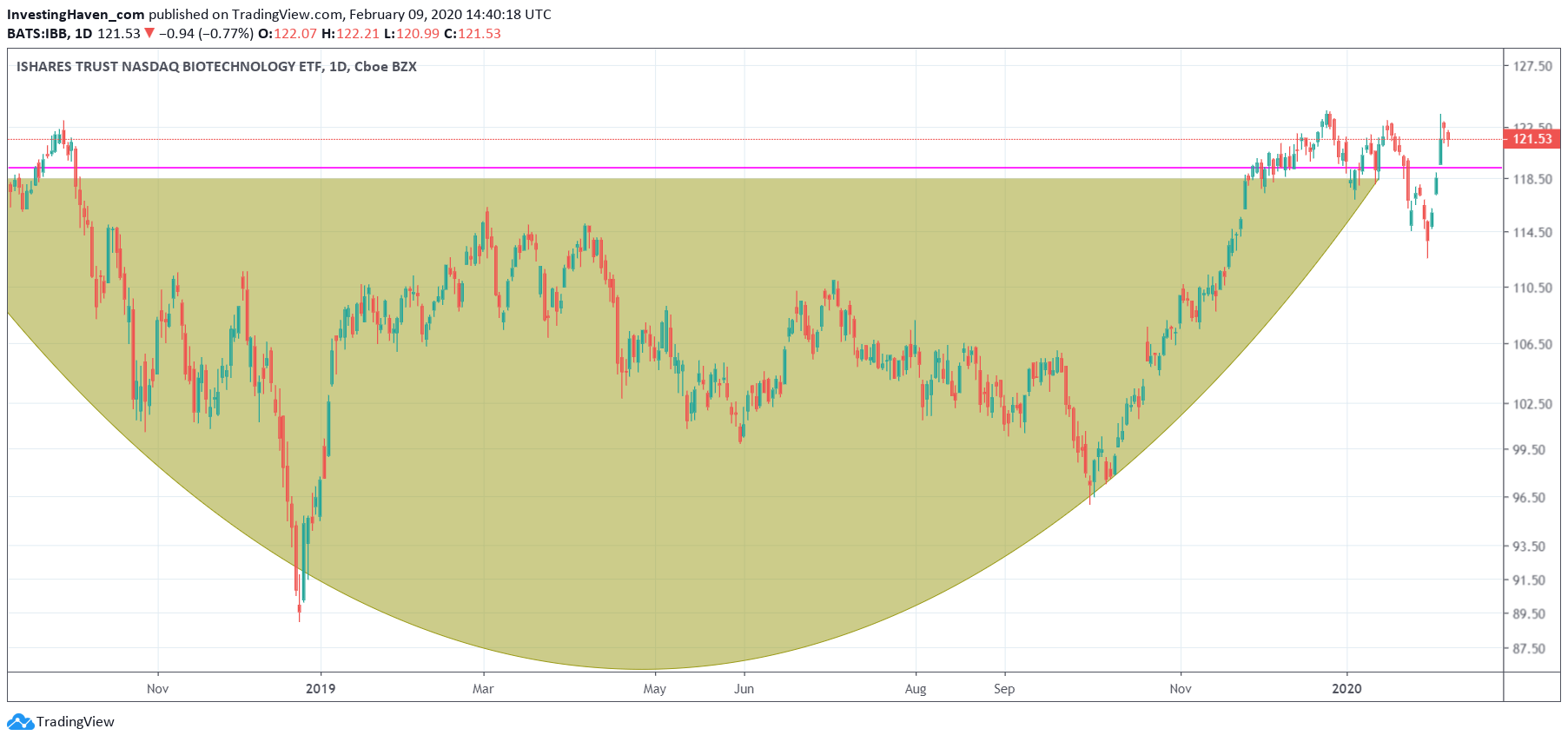

The biotech daily chart of the last 15 months makes the point.

We see a 14 month reversal in the form of a rounding formation. Pretty accurate how the biotech index IBB ETF has moved within the confines of this pattern.

Presumably the end of a reversal means the start of a new trend: bullish or bearish.

That’s not really the case with biotech right now: it moves from bullish to bearish to bullish in some 3 weeks time. Go figure.

We prefer to give this sector the time it needs to decide which direction it wants to go, acknowledging that trendless is also a direction. Between now and then we watch this sector closely.

For those that want to get into this sector we recommend to sign up to our Momentum Investing methodology, as the biotech space is one of the many sectors we closely track until we find a great entry point. It is probably later in 2020 that we will take a position in this sector.