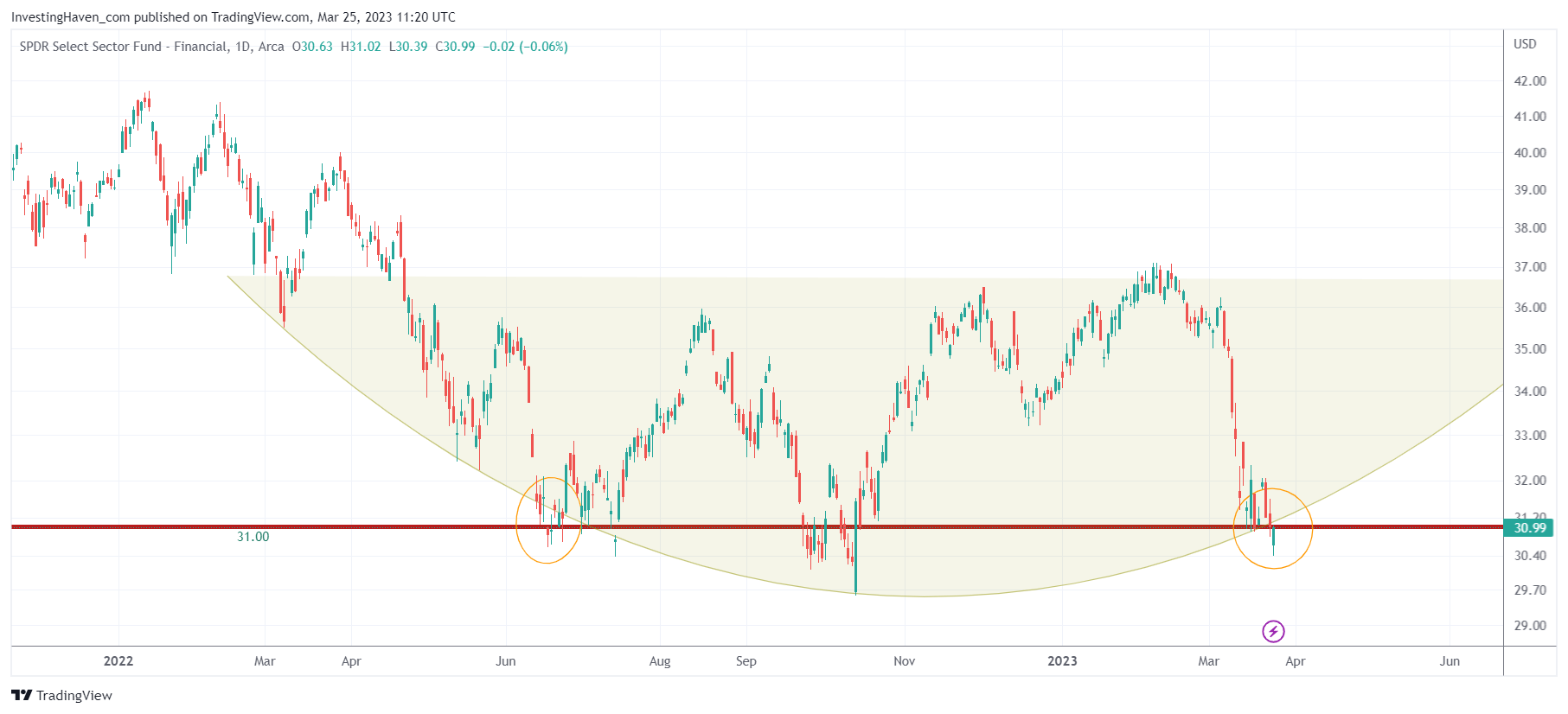

In recent weeks, we outlined which indicator we identified to understand whether this market is facing systemic risk. It was XLF ETF, financial stocks, the heart of the financial system. We had an obvious ‘line in the sand’ level of 31 points which is currently being tested, thoroughly. The market to crash or not to crash, is what’s at stake.

How To Know Whether There Is Systemic Risk In This Market?

We track a limited set of leading indicators. All of them are shared every weekend with members in our premium research service Momentum Investing (another must-read alert is shared this weekend). There is one additional chart we’ll be watching closely: XLF ETF. That’s not because we are interested to take a position in XLF ETF, or any stock in that ETF. We’ll consider XLF ETF one of our indicators to understand contagion risk of SVB Bank.

Our Systemic Crisis Condition Is Being Tested, Thoroughly

For now, XLF ETF is still holding. It will certainly continue to thoroughly test the 31 level, similar to what it did in June of 2022 and Sept/Oct of 2022.

This is the up to date XLF ETF chart. This indicator fell outside of its rounded structure, one that is in the making for 12 months now. It did so back in June, but recovered in a 3 to 5 day timeframe.

The message of XLF ETF is very simple: next week is a make-or-break week in markets. If XLF closes back in its rounded pattern, great, we got sort of a replay of last June. However, if XLF continues to edge lower, it won’t be pretty in markets in April.

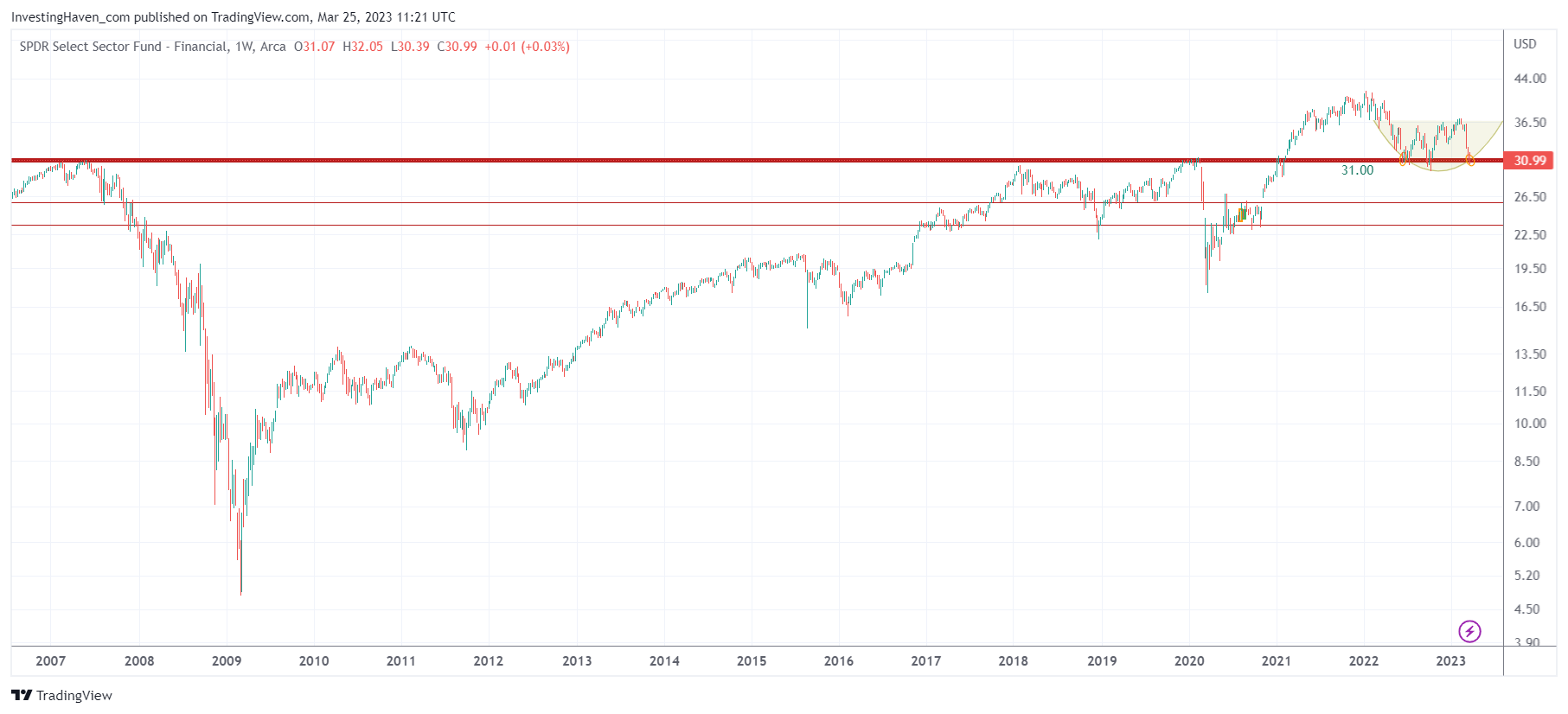

In case it’s not sufficiently clear how crucially important the 31 points level is for XLF you might find it easier to understand if you look at the weekly chart over 15 years. A drop below 31 will open the door for a quick 30% drop. That’s not what the bulls want to see.

In the meantime, our Momentum Investing portfolio is starting to enjoy the positions we selected in the broader AI space. We are also preparing a silver position for members. Obviously, we’ll have tight stop losses in case XLF will continue to lose ground, and we’ll happily become more aggressive in case XLF respects key support next week.