Many investors are anxious that a cataclysmic stock market crash is underway. Here is our prediction: there is no stock market crash in 2024 because there is no secular turning point in 2024. Worst case, leading stock indexes will exceed all-time highs, create a lot of excitement in doing so, which will open the door for a stiff pullback late summer of 2024. In sum, we do not see stock market crash in 2024 but rather a pullback when bullish sentiment will be near extremes.

As it relates to the topic of the long-expected stock market crash, one that many investors were expecting to occur in 2023 and now in 2024, inspired by narratives created by financial mainstream media and perma-bears, there is no secular turning point in the making. This means that cycle analysis does not suggest a big (bearish) turnaround to start anytime soon, which does not mean there will not be volatile periods.

Note that in our top market trends 2024 we did not talk about a market crash in 2024, on the contrary.

It really means that no stock market crash is likely to occur in 2024, only a pullback, especially if bullish sentiment starts rising towards ‘overly bullish levels’ read: extremes).

In this article, we neutralize emotions and fear around a stock market crash in 2024. We cover the following data points and topics:

- A history of stock market crashes

- 1. No secular bearish turning point anytime soon = no market crash in 2024

- 2. Volatility broken down, structurally = no market crash in sight

- 3. Inflation decelerates in 2024

- 4. Inflation expectations bottoming

- 5. The S&P 500 chart: a bullish reversal, no market crash

- 6. Epic stock market rotation in 2024

- 7. Market breadth improving, rejecting the stock market crash idea

- 8. Contrarian readings in the bull vs. bear ratio

- 9. The market is contrarian, be careful with consensus viewpoints

- 10. Anecdotal evidence & financial media

- 11. Consumer sentiment bad, consumer spending good

- 12. No stress in credit markets = no stock market crash

- 13. Broker/dealers are bullish

- 14. EPS Estimates for S&P 500 companies now flat

- 15. Productivity jump & low unemployment in 2024

- 16. Conclusion: no market crash in 2024

- 17. Conclusion: a stock market crash in 2024?

Let’s dive into each of the topics outlined above so we can come to a factual viewpoint on the question “will there be a stock market crash in 2024?”

A history of stock market crashes

It is so easy nowadays to use the word ‘stock market crash’. Twitter, social media, financial media is full of ‘crash’ predictions and the likes.

If you look deeper into the number of real stock market crashes you will find out the likelihood of one to occur is extremely low. Wikipedia says that there are only 4 crashes since 1900:

- Panic of 1907.

- Wall Street Crash of 1929.

- October 19, 1987 (aka, Black Monday).

- Crash of 2008–2009.

Note that the 2000 dotcom crash does not qualify as a stock market crash. Why? Because it was only the NASDAQ really crashing. The other broad indexes corrected significantly but they did not crash!

1. No secular bearish turning point anytime soon = no market crash in 2024

The fear for another historic stock market crash is justified. However, it should be rationalized.

The first thing to do, when analyzing the possibility of an historic stock market crash, one that is able to wipe out 90% of portfolio values, is to look for evidence of a bearish turning point. That’s not a regular bearish turning point but a secular turning point.

Stated differently, if we are afraid that 2024 will bring a market crash, we need to find a very strong bearish turning point, of secular strength, to validate the market crash idea.

Here is the good news for the bulls, bad news for the bears. Based on 5 distinct data points, we did not find evidence of a secular turning point in markets, not in 2023 nor in 2024. We looked primarily at data points like the inverted yield curve, the US Dollar chart, and, timeline readings.

We forecasted no secular bearish turning point in 2023, we strongly recommend to read the details of this article. We copy a few quotes and charts from our thesis, outlined in great detail in the aforementioned article.

In conclusion, this article “no secular bearish turning point in 2023” has delved into the specifics of forecasting the next secular bearish turning point in 2023. By adopting a structured methodology, analyzing leading indicators, and charting the market’s trajectory, we have arrived at a logical and data-driven forecast.

Note that everything we wrote about the absence of a secular bearish turning point in 2023 also applies to 2024. Moreover, timeline analysis does not suggest a secular turning point is in the making in the short to medium term.

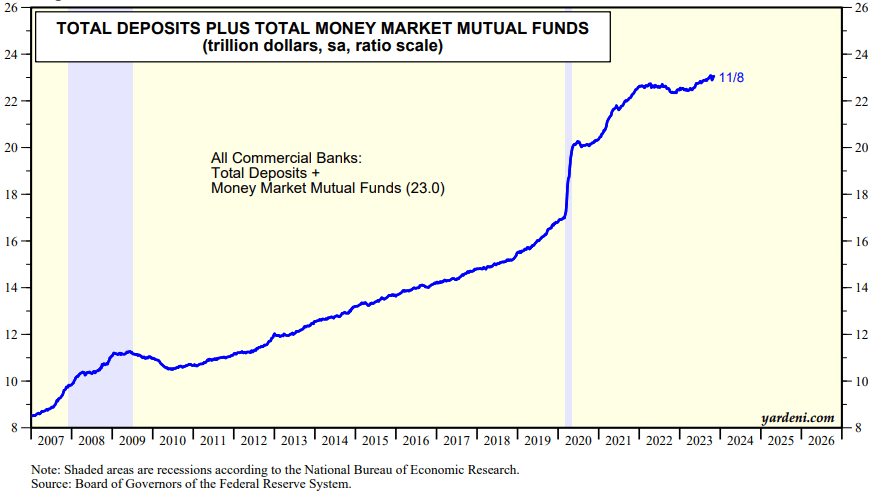

Perhaps, the most interesting chart to share from our turning point analysis is the total deposits which suggests there is plenty of liquidity in the market (chart: courtesy of Ed Yardeni).

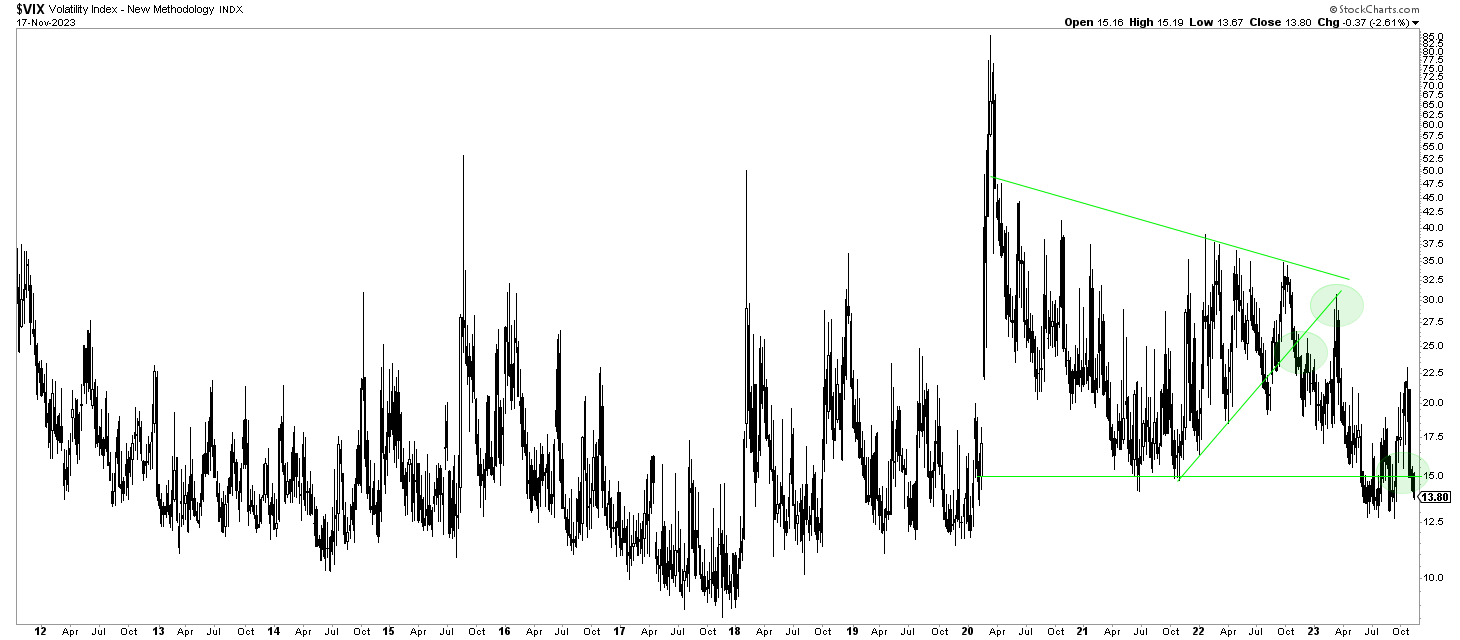

2. Volatility broken down, structurally = no market crash in sight

As we head into 2024, we can see how the volatility index VIX is setting a series of lower highs. It is also setting a series of higher lows.

We believe that the former is more important and the dominant force in this market.

The market could have had its stock market crash moment, particularly in 2022, with so many opportunities to push VIX way above 40 points, in the 50ies and 60ies, which is the real stock market crash area. It didn’t happen.

The persistently elevated volatility levels, though not extremely high to trigger a stock market crash, is what is causing investors to be very afraid and uncertain. This results in irrational thoughts, simply because emotions are taking over control of the mind. That was the dynamic of markets in 2023, and it created deep fear, expecting a market crash in 2023 which did not occur.

Given the volatility index long term structure, we do not see a stock market crash occurring any time soon.

3. Inflation decelerates in 2024

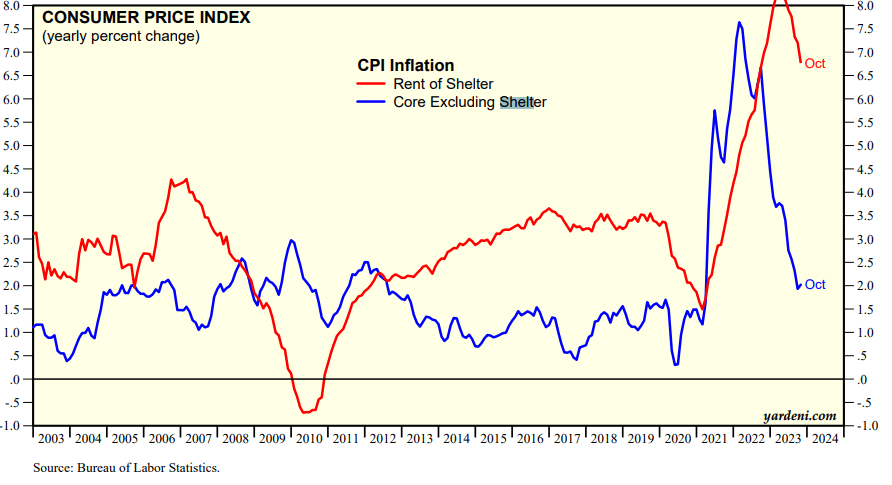

Inflation readings continue to moderate, as evidenced by the y-o-y inflation readings and CPI/PCED/PPI reports.

The m-o-m readings confirm that the inflation trend is coming down.

Mid-2023, we wrote this:

The market, as a forward looking mechanism, continues to react to this new reality. The naysayers and doomsday people got it really wrong!

What’s really interesting, as we head into 2024, is the following chart, courtesy of Yardeni: CPI excluding shelter is already at the Fed’s 2% annual target. Whenever shelter, a lagging market, reacts to the moderating inflation trend, CPI headline data will be ‘in no time’ near 2%.

4. Inflation expectations bottoming

Inflation expectations came down a lot in 2022. That’s because of the tightening by the Fed and other monetary policy makers around the world.

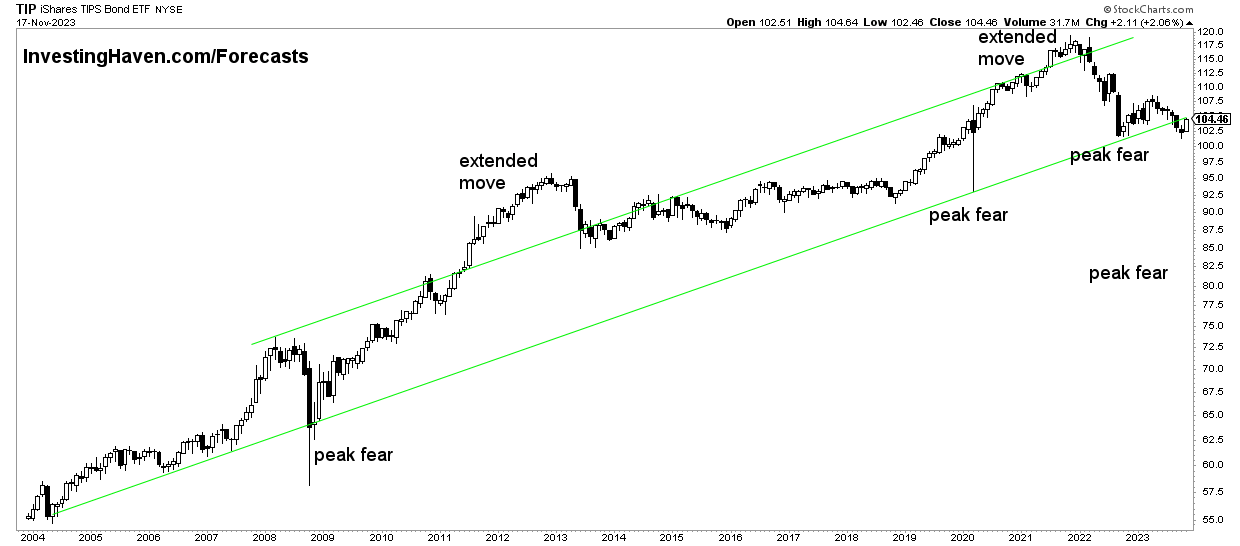

The Inflation expectations chart, TIP ETF, says it all. Inflation expectations expressed by TIP ETF came down in a dramatic fashion. As we head into 2024, we see TIP ETF establish a double bottom pattern, one that took a year to complete. In a way, this means that 2023 was a remarkable transition year. This data point, in and on itself, suggests there will be no stock market crash in 2024.

Indeed, it is reasonable to expect that inflation expectations are in a bottoming process, one that might take a few months to complete. Similar to 2008, 2018, 2020, this should coincide with a bottom in markets.

No stock market crash in 2024 unless TIP ETF is going to close for more than 3 consecutive months below 102 points which no seems very unlikely with m-o-m inflation falling back to zero.

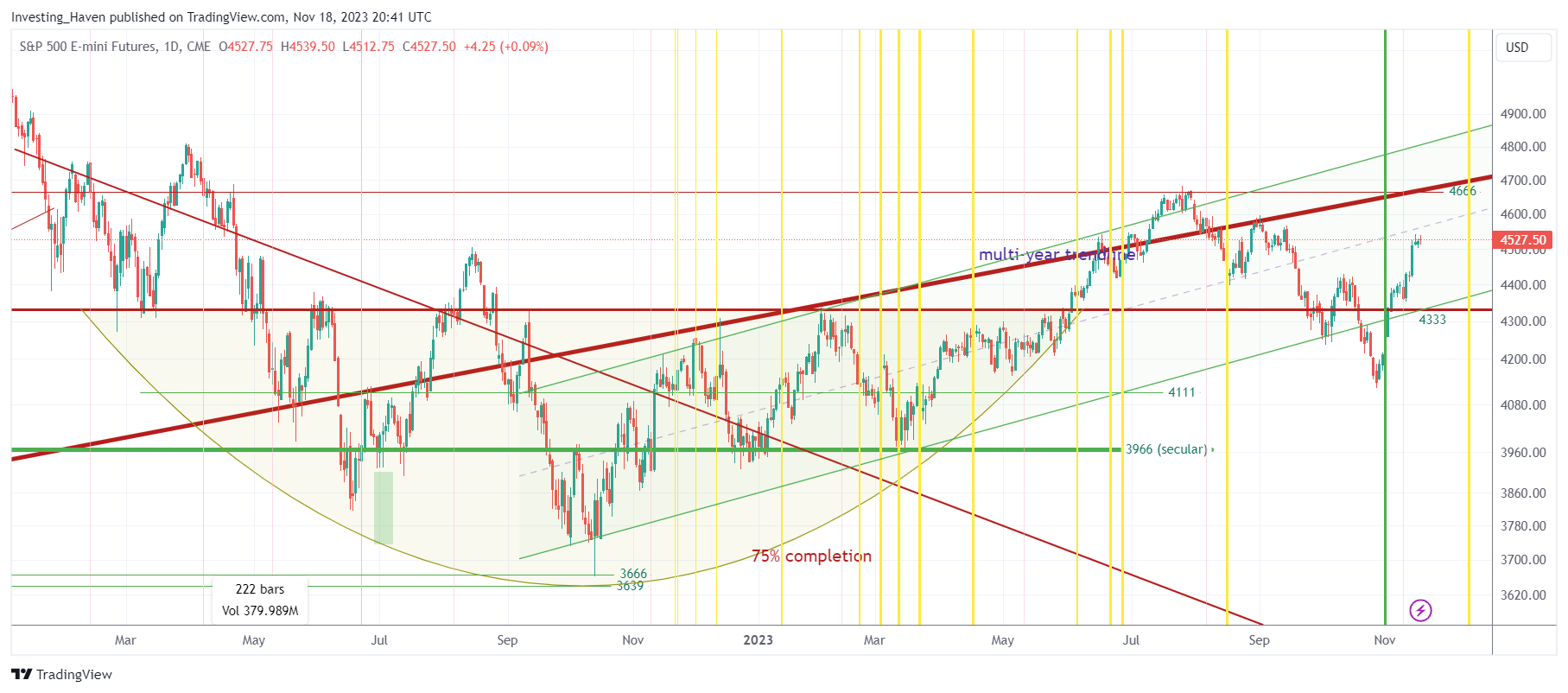

5. The S&P 500 chart: a bullish reversal, no market crash

If we look at the topic of a potential stock market crash from the chart’s perspective we see the opposite: a double bottom setup.

This looks like a really strong bullish reversal, not a setup for a stock market crash.

The S&P 500 is moving in a rising channel, it will touch the multi-year rising trendline (red thick line) in 2024. We expect the S&P 500 to move back above this multi-year rising trendline.

One scenario is that the S&P 500 rises to new all-time highs, say above 5,000 points, and falls back to 4666 points by summer of 2024, the highs of August 2nd, 2023, to shrug off the expected inflow of new bulls.

6. Epic stock market rotation in 2024

If we go back to the S&P 500 chart there is one more finding worth sharing: rotation.

What made 2022 so unusual and confusing was epic rotation between sectors.

What made 2023 so unusual and confusing was epic rotation between sectors.

We can realistically expect rotation to continue to dominate markets in 2024, although not to the same degree as in 2022 & 2023.

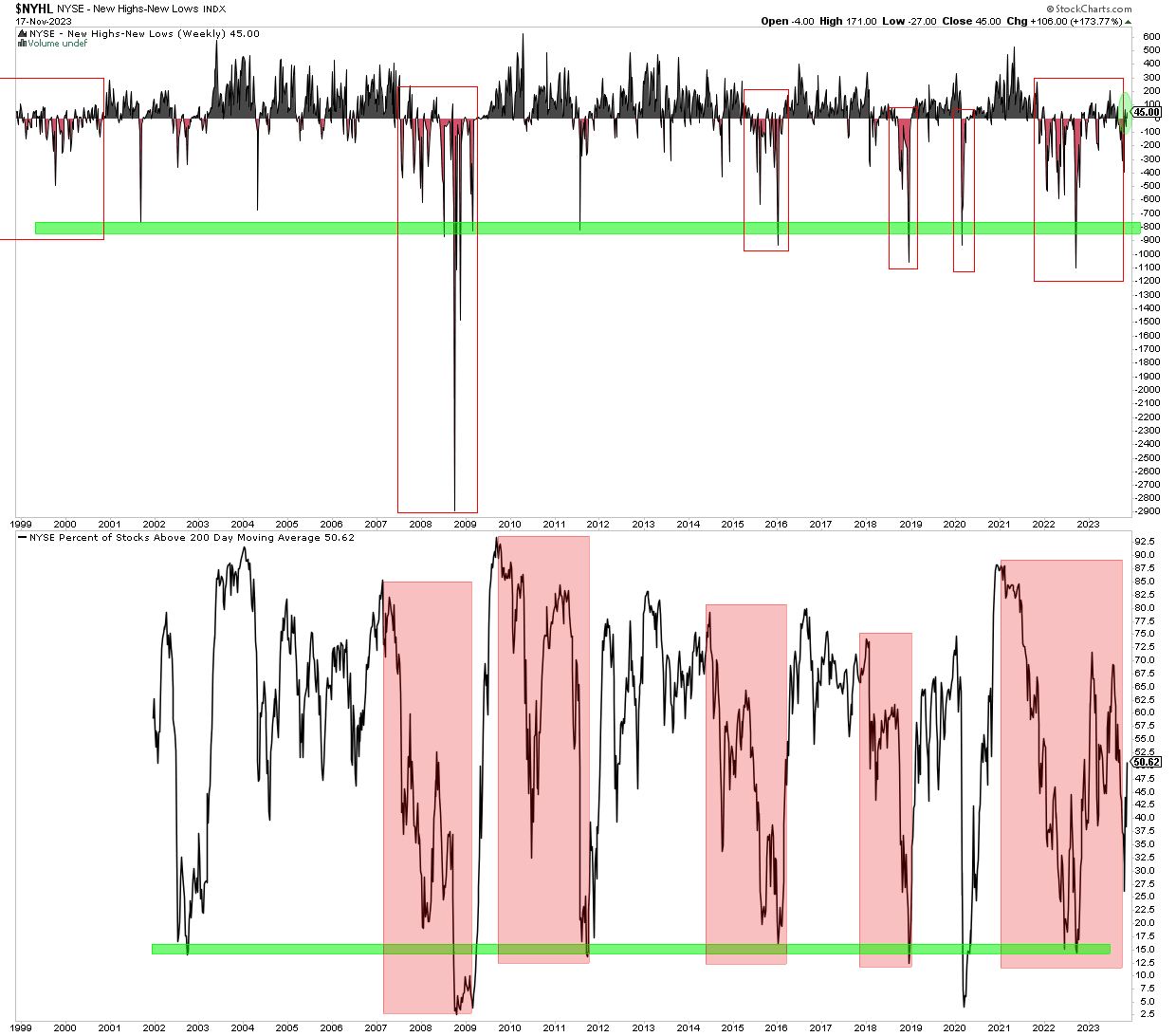

7. Market breadth improving, rejecting the stock market crash idea

Market breadth can never be read as a stand-alone data point.

Also, market breadth is not a timing indicator.

That said, the 25 year chart featuring new highs minus new lows on the NYSE Composite Index shows the persistence and intensity of the new lows that were printed in 2022. In October of 2022, the market also touched a key level which 7 out of 8 times marked the end of a stock market decline, the green bar on the first pane of the next chart.

Furthermore, the time duration of stocks below their 200 DMA in the NYSE Index is long, in historic terms, to qualify as a ‘sufficiently retraced pullback in markets’. This suggests that the pullback is about to run its course and no stock market crash should be expected.

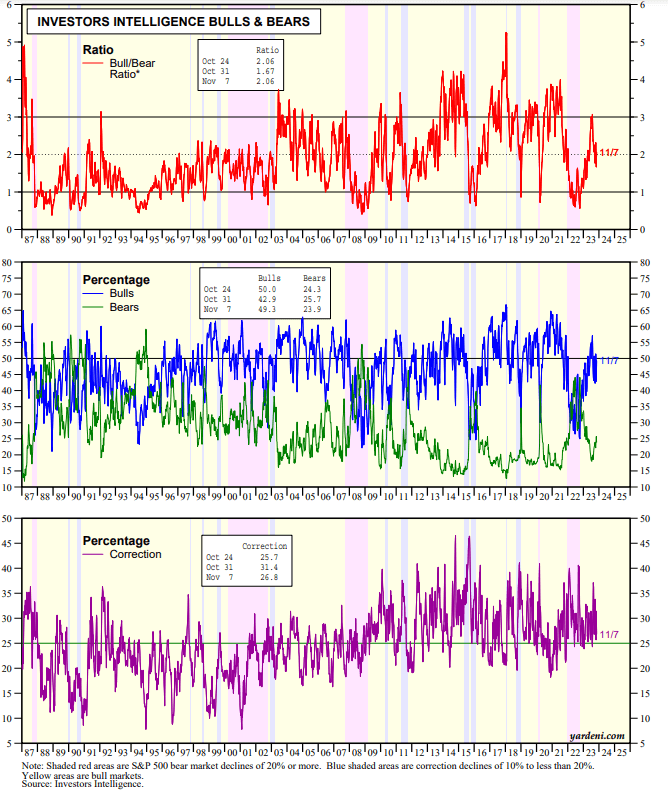

8. Contrarian readings in the bull vs. bear ratio

From a contrarian perspective, the bull vs. bear ratio around 2, right before 2024 kicks off, is a great place to be. , certainly when combined with bulls nowhere near extremes.

9. The market is contrarian, be careful with consensus viewpoints

The market will hardly ever behave in line with what the consensus thinks.

At this very point in time, a recession and hard landing is widely and wildly accepted as the only outcome.

There is too much consensus about this outcome.

Not only is the world already faced with a recession, a rotating one, as said before, but also is the market likely pricing in the recession effect.

This is consistent with the viewpoint that 2022 is a ‘reset year’ for markets which implies that a stock market crash will not hit the market in 2023. There was plenty of opportunity for this to happen prior to 2023.

Moreover, there was a consensus view in 2023, say the “2023 narrative”, that markets would crash. The fear for a market crash in 2023 was unusually high, specifically in January and Sept/Oct of 2023.

We continue to emphasize the contrarian characteristic of narratives.

In other words, the time to be really, really concerned of a stock market crash will be when nobody is concerned about it nor talking about it. There is plenty of upside potential until the narrative is consistently bullish for markets. Until then, the probability of a stock market crash, from a contrarian perspective, is unusually low.

10. Anecdotal evidence & financial media

In closing, we look at a potential stock market crash from an anecdotal perspective. This is what we observe:

- Among our readers and members, elevated levels of fear.

- Financial media has arguably reached ‘peak fear’ when just looking at headlines. More about this in our recent post Rising Rates – How Concerning Is It For Investors In 2024 & Beyond?

Anecdotal evidence, when it reaches extreme levels, is often a good contrarian indicator if it is combined with other data points. The narrative throughout 2023 was for rates to continue to rise, the exact opposite is happening as we head into 2024.

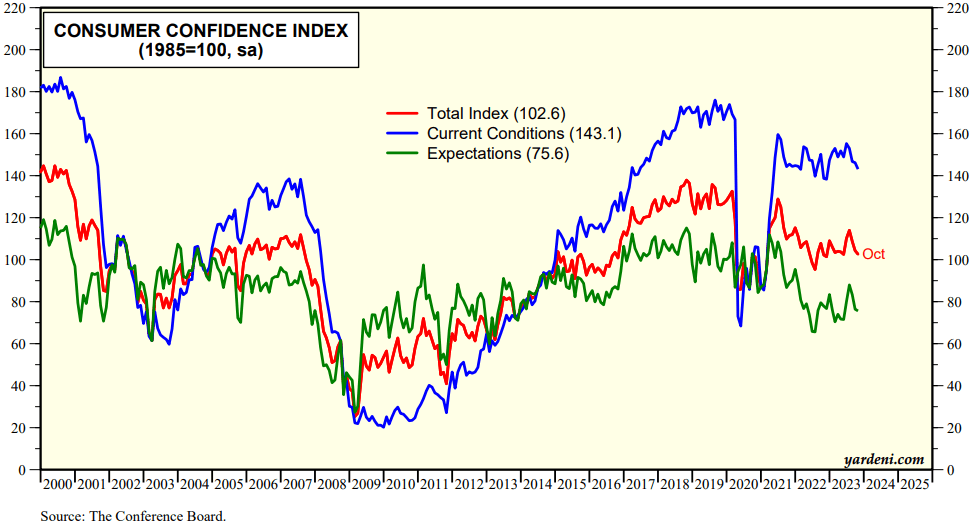

11. Consumer sentiment bad, consumer spending good

Consumer Sentiment is low, for sure. It ‘feels’ like a market crash might be underway.

However, even if consumers remain depressed, emotionally, it does not translate into their shopping behavior. It’s quite the opposite in fact, consumers continue shopping as evidenced by the retail sales chart.

A stock market crash in the last 2 decades came with falling consumer spending, not rising spending.

Consumer confidence came down a bit in October of 2023, which was right during the drop of gasoline prices. With falling inflation, and expectedly less tightening monetary policies underway, historically low unemployment rates, we would expect consumer confidence to at a rock solid bottom.

12. No stress in credit markets = no stock market crash

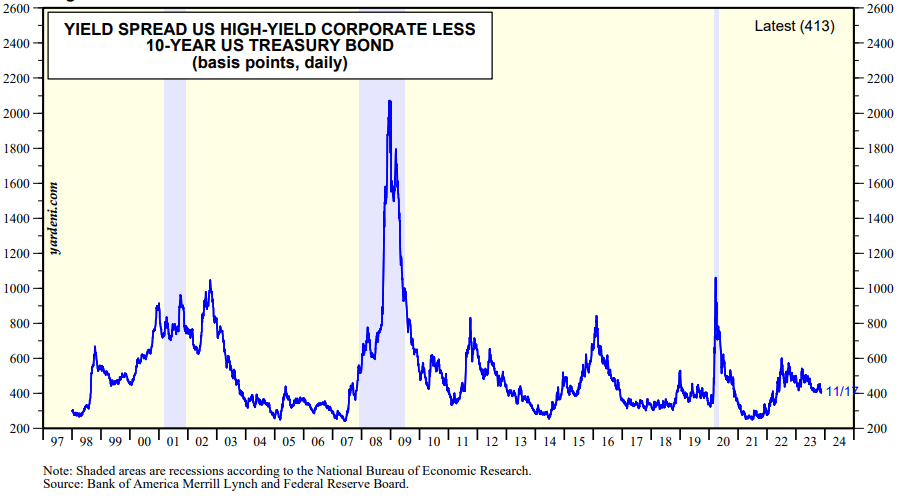

When a bear market is about to pick up in speed, it will be visible in the credit market. A yield spread is the ultimate proof of more pain ahead.

At present day, the spread between the high-yield corporate bond composite and the 10-year US Treasury has widened but it is not spiking the way it did during previous credit crunches.

13. Broker/dealers are bullish

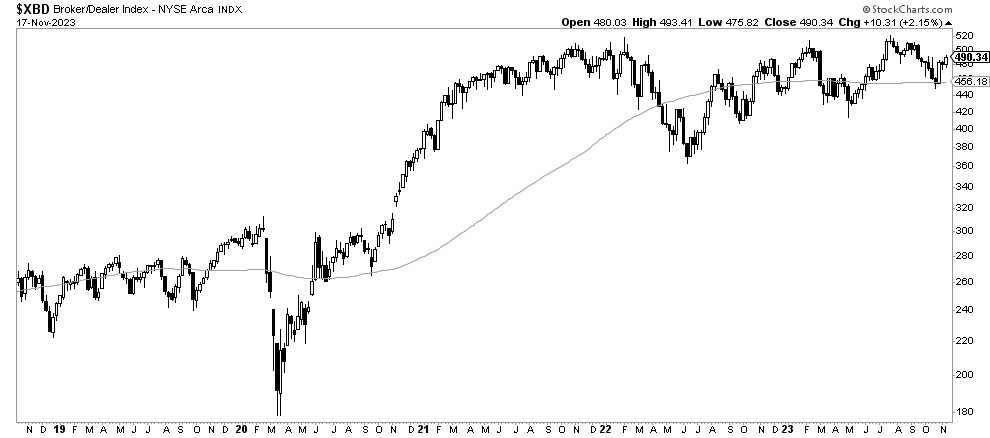

Broker/dealer stocks and investment services are completing a bullish reversal, going into 2024.

If a stock market crash in 2024 was underway, both sectors would be bearish, not bullish, going into 2024.

While this broker/dealer index is not trending at this very point in time, it certainly does not have a bearish look, on the contrary.

14. EPS Estimates for S&P 500 companies now flat

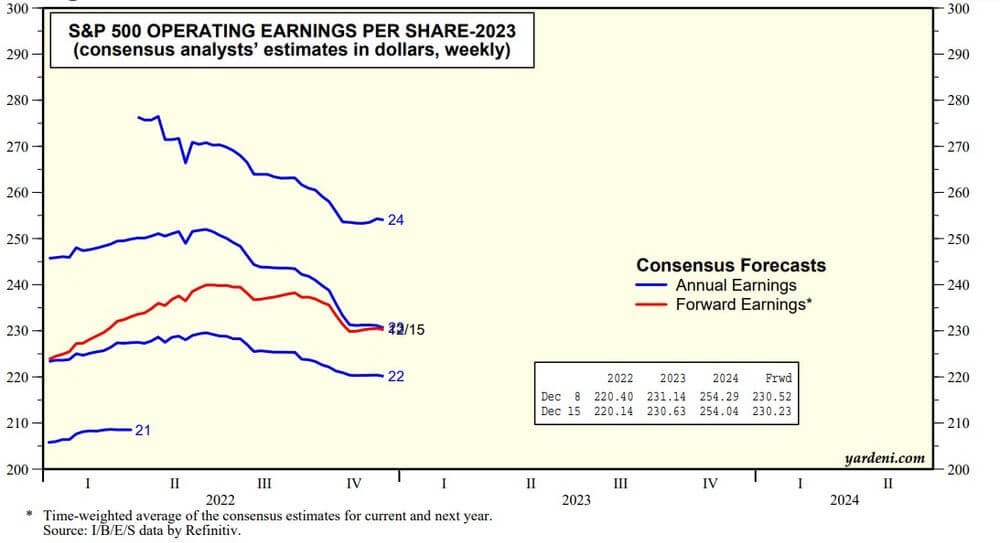

[Ed. note: this point was added on Dec 24th]

One of the most fascinating charts that provides sufficient evidence that 2023 will not kick off with a stock market crash is EPS estimates. As seen on below chart, analysts revised down their 2023 earnings estimates over the course of the year, particularly as of the second quarter of 2022. Interestingly, at the start of 2023, the earnings estimates, both annual earnings and forward earnings, are now flat.

The way we interpret this data point is that analysts believe that the economic impact on earnings (think of inflation, recession fears, etc) did run its course.

If analysts were expecting a stock market crash in 2023, then this downtrend in annual and forward earnings would continue to decline.

15. Productivity jump & low unemployment in 2024

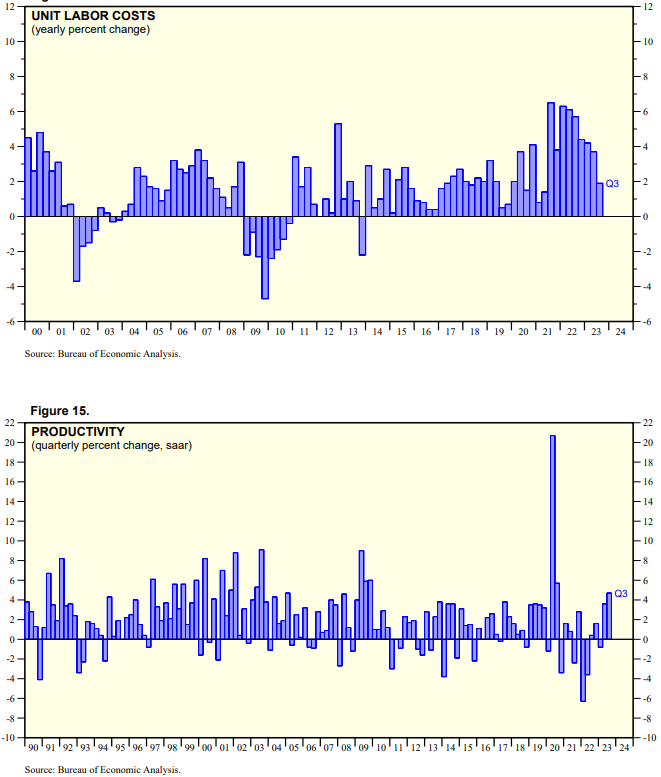

The latest productivity and unit labor cost data as we head into 2023 are outstanding! Productivity is getting a boost, exactly what’s needed to keep the economy going. Moreover, the unit labor cost is falling which offsets the hourly compensation increase.

These data points are of crucial importance to the the U.S. Fed. Remember, the market is a forward-looking entity. It is reacting now on what is expected to happen in 6 months from now. Moreover, the market is trying to anticipate what the Fed is likely to do next. With the data at hand, shown, below, the U.S. Fed, is likely going to end its rate hike cycle. Read: no market crash in 2024.

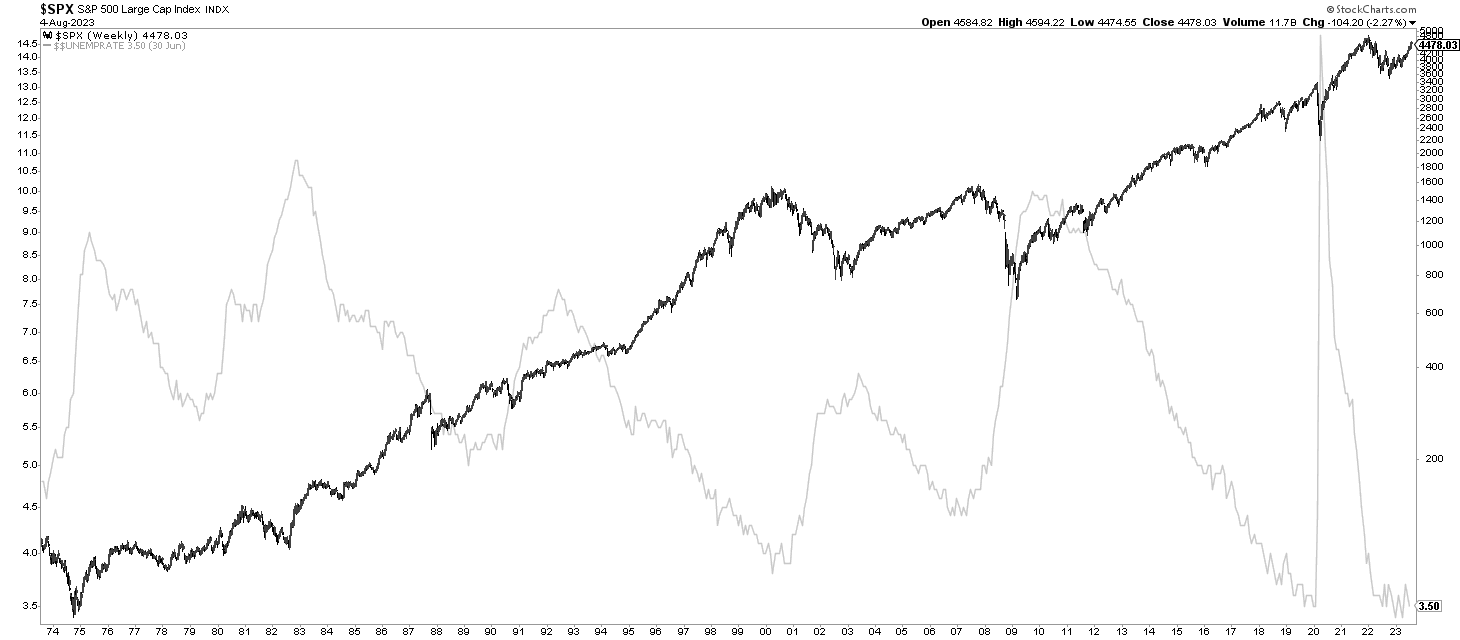

Equally important is the long term correlation between the stock market and unemployment. Both are shown below, inversely correlated. It goes without saying that the historically low unemployment rate is not resulting in an epic market crash, certainly not in 2023, likely also not in 2024.

16. Conclusion: no market crash in 2024

Considering all the data points shown above, most of the leading indicators, some of them supporting data points, we do not see any evidence whatsoever that as stock market crash will hit in 2023.

The most influential data points from our research, with 15 points and 19 charts, are:

- No secular turning point identified.

- No stress in credit markets, plenty of liquidity in the system.

- Inflation expectations are bottoming.

- Consumer sentiment supports economic growth.

- Unemployment, a leading indicator for stocks, remains historically low.

We continue to expect sector rotation, maybe even to an epic degree, which confirms our viewpoint of a selective stance when it comes to picking stocks and sectors.

17. Conclusion: A stock market crash in 2024?

The ‘naysayers’ may continue to push on the idea of the stock market crash, that continues to be a no-show.

Here is a question that will come up: if there is no market crash in 2023, there ‘must’ be one in 2024.

What is our thought about the possibility and probability of a stock market crash in 2024?

While it is a little early to tell, we believe that we can share a few things with a high level of confidence:

- The underlying trends in productivity, unemployment, stock market volatility, all suggest that there will not be a stock market crash in 2024.

- The long term stock market trends are intact, no market crash in 2024.

- In terms of timeline, there are 3 crucial months in 2024 that we will use as additional inputs to understand the intention of the market in the period mid-February to mid-April, to be extended to mid-May. Stated differently, we will be looking at stock market prices and chart patterns, in those months, to get additional insights on the probability of a market crash in 2024.

The last point is important. While 99.99% of analysts only work with price, we include time in our analysis. The chart has 2 axes, price and time. Sometimes, it may be fine to only analyze price movements. Sometimes, it is key to stick to timeline analysis. From time to time, though, it is key to identify decision windows (in terms of time) and look for the message of the market in those time periods (in terms of price).