Bitcoin moved 12% higher in the last 7 days. It is a very long time ago that Bitcoin did went up more than 10% in a single week. While this is encouraging, there are multiple considerations that we shared in our latest crypto research note to premium members on January 7th “30 cryptocurrencies reviewed, must-see charts, clear conclusions”. The short version is that we continue to think that altcoins are the place to be, as per our crypto predictions 2023, but only a minority is worth your time and capital.

A few months ago we wrote Bitcoin: Why January 1st, 2023 Will Be A Crucial Date.

No surprise, the 72h window around January 1st pushed the price of Bitcoin higher. It appeared to be a crucial date. While the entire world expected Bitcoin to move lower, driven by extreme pessimism around a pending Grayscale bankruptcy, spillover effects from the FTX & SBF drama, and so many more depressing events in the crypto space.

But, as usual, peak fear and peak pessimism tend to coincide with turning points.

Bitcoin decided to move higher, not lower, around January 1st, which was a decisive date which we derived from our charts.

Bitcoin went up this week which may ‘feel’ good. But it’s important to stay grounded, always, which is only possible by staying focused on the charts.

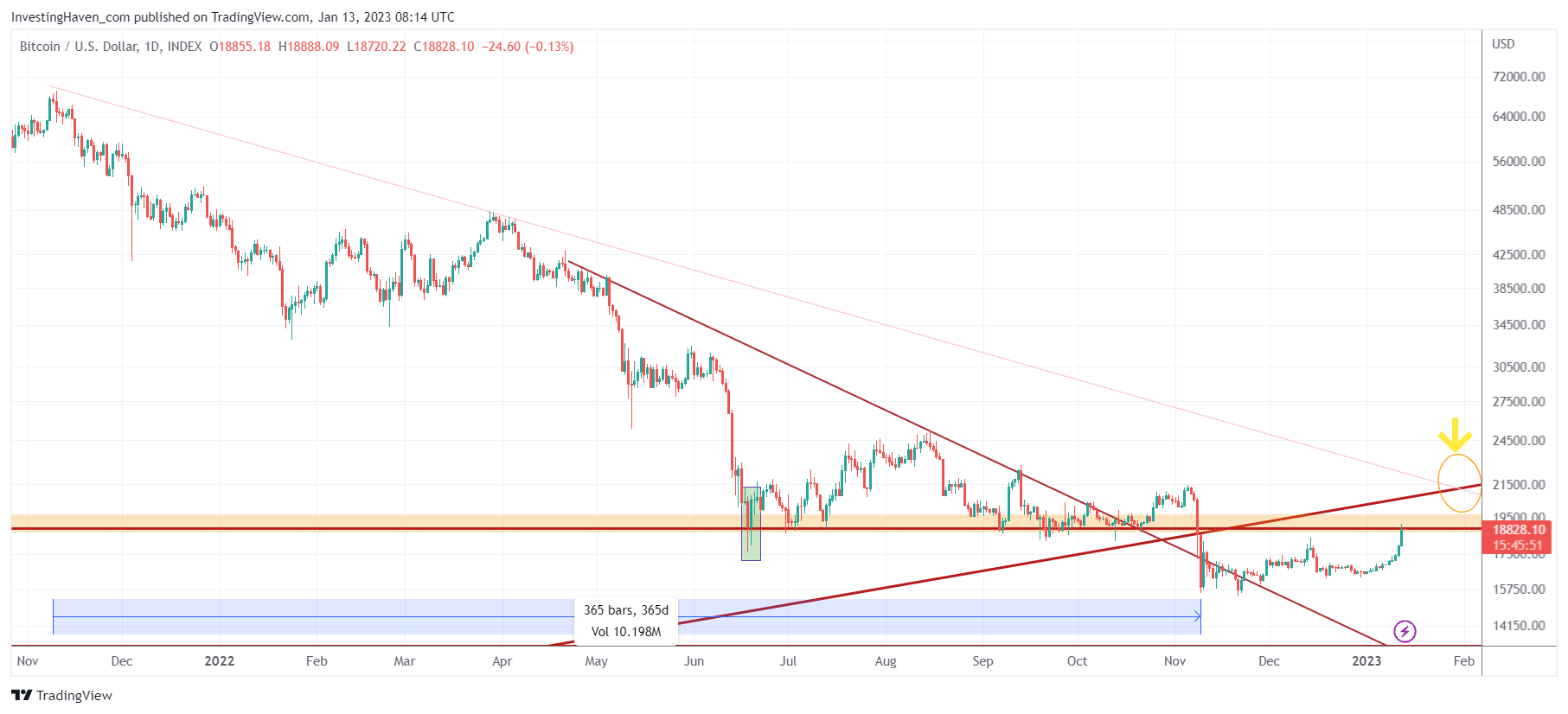

Below is the daily BTC chart. It shows this nice rounded reversal that is in the making in the last 4 to 6 weeks.

While this setup looks good there is triple resistance to overcome:

- Horizontal: The June lows around 19k (see orange shaded area on the chart).

- Rising: a long term trendline (see red line on the chart).

- Falling: the 2022 bearish trendline (see fine purple line on the chart).

Triple resistance equals a lot of resistance.

Moreover, February 1st is the next decisive date we retrieve from our charts.

Here are 2 considerations from our latest research note shared with members on January 7th (available in the restricted area for all our members):

On the longest term timeframe, BTC fell outside of its channel on November 9th (SBF drama). It must trade above 19622 in order to be in an uptrend, right now the long term chart looks concerning.

Bitcoin must decisively clear 19622, on a 7 day closing basis, in order to be in an uptrend. With triple resistance we believe it’s too early for Bitcoin to be ‘up and away’.

More importantly, however, is this point:

We start sensing that our vision might be underway: real life adoption will start dominating the crypto world, because BTC has no utility it will start moving to the background. This might be the conclusion of BTC falling outside of its longest term channel. We will know by the end of this year, it’s our thesis as this point in time.

The latter comes with important implications for crypto investors. It is imperative to look at the crypto space in terms of segments, or clusters, in order to find the segments that are gaining traction in terms of adoption.

As an illustration, we tipped the Big Data & AI space, one week ago, as a crypto sector that is gaining adoption. Since then, those tokens are up strongly, presumably only the beginning of a long term upward journey.