Ethereum is trading at the exact same level where it was mid-March. Not only has Ethereum (ETH) barely moved in 4 months time, its volatility level has come down to historically low levels. Being invested in Ethereum may feel very boring. When we look at Ethereum top-down we observe the longest ‘trendless period’ in its history. We focused on the shorter timeframe in one of our recent writing Ethereum Consolidating For 6 Months: Good Or Bad but will put those findings in perspective in this blog post.

Note that XRP may have written history a few weeks ago but it was one of the few exceptions in the crypto universe. It was a very eventful month for XRP. As said, we remain very bullish long term with an XRP forecast of 10 USD because XRP’s beautiful long term crypto chart.

XRP cannot be compared to Ethereum, both have gone through very different cycles. We are not here to compare both, but we want to emphasize that XRP’s recent price action is not reflecting ongoing dynamics in the crypto market. In fact, Ethereum is much more reflecting crypto market trends nowadays.

This brings up the question when crypto will experience its ‘golden weeks‘.

Let’s verify the charts, in a top-down approach, in order to understand if the charts can answer the question(s) outlined above.

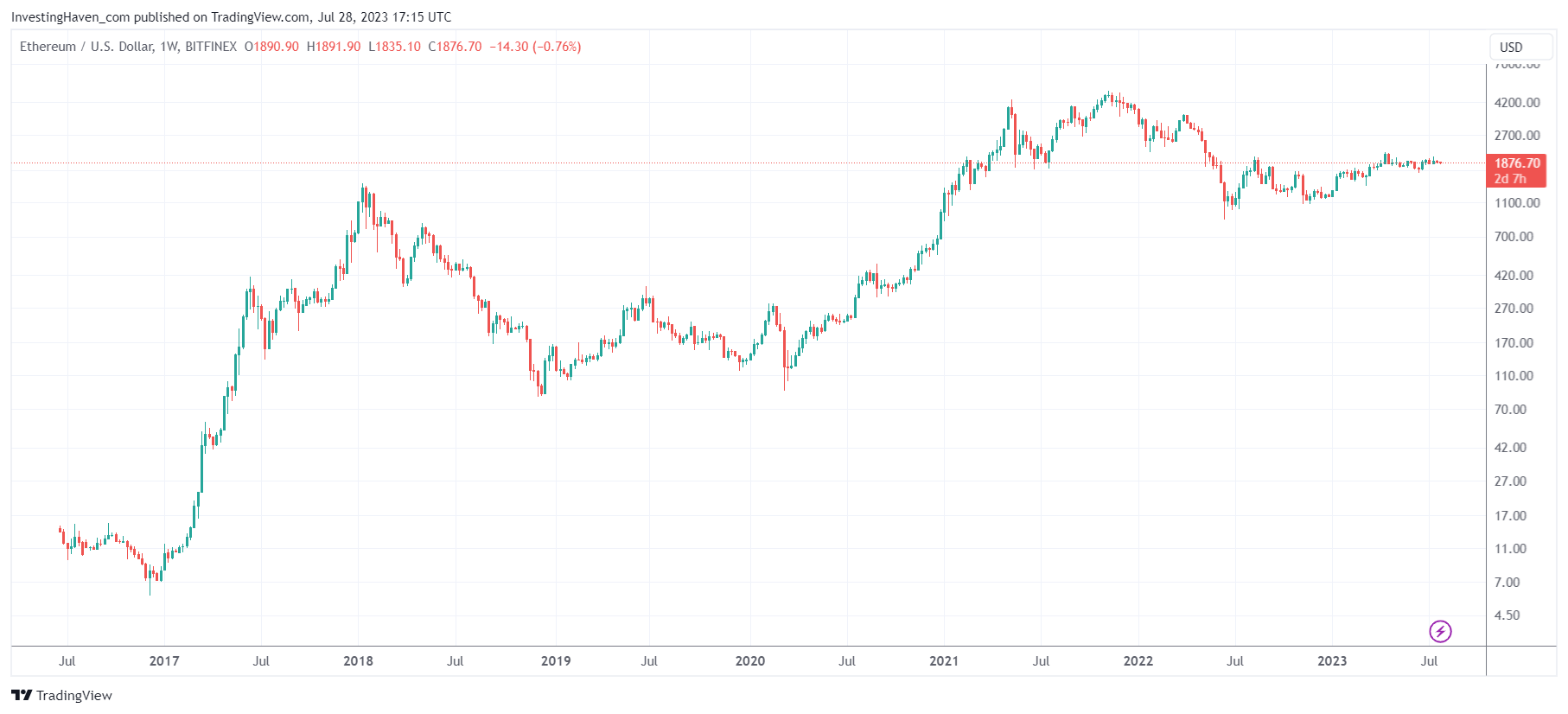

First of all, if we look at the weekly chart, since 2016, we can see how trendless ETH is. In fact, since April 14th, ETH turned completely trendless, as if it discontinued trading. Never before have we seen ETH, completely paralyzed, for 3 full months.

In terms of chart structure, we can see how this trendless period is starting to morph into a long basing pattern. Remember, the longer the stronger, is what applies to base building structures on any chart.

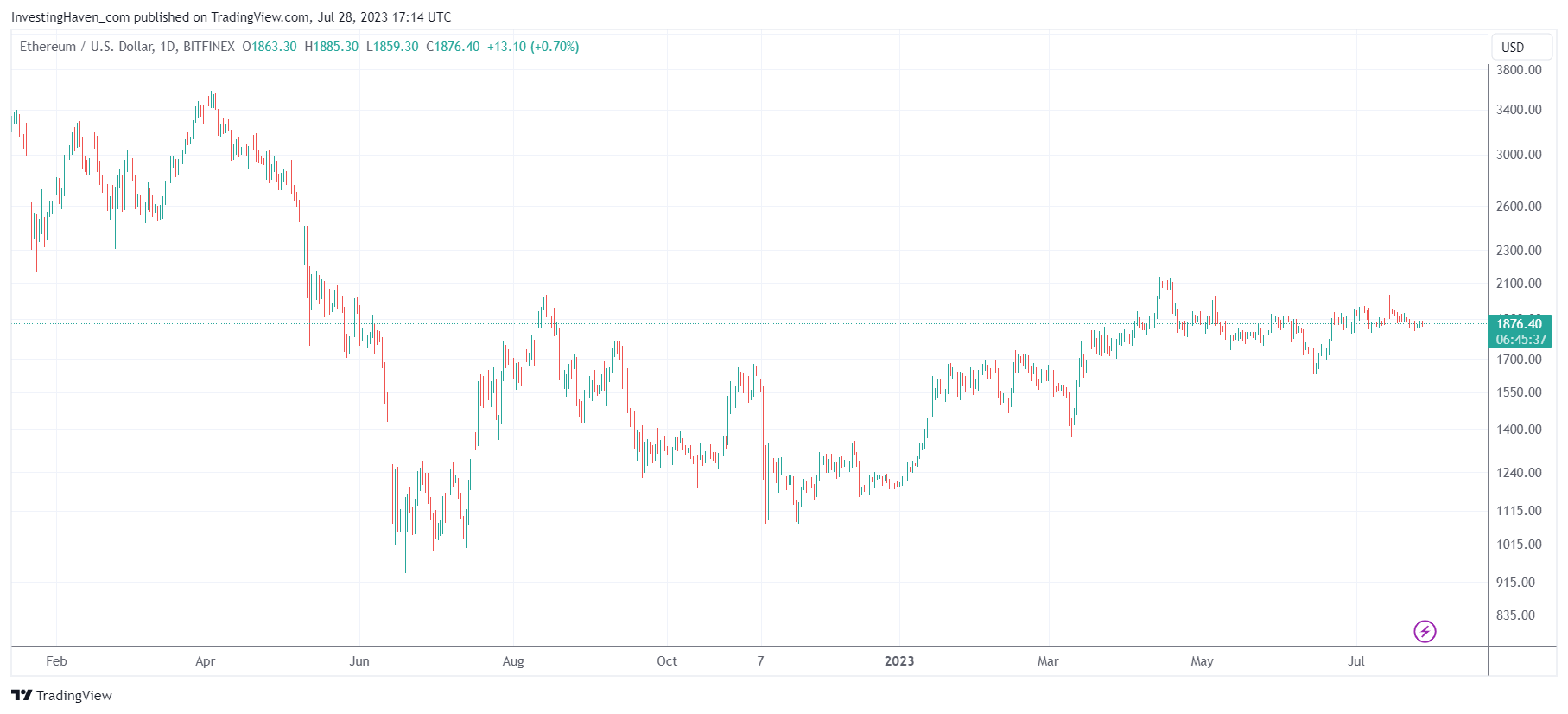

This is what ETH looks like if we zoom in. Needless to say, a chart without annotations is what anyone can create, what’s so special about these charts? Well, it pays off, from time to time, to look at a chart without annotations. The point is to figure WHEN exactly it makes sense to look at a ‘vanilla chart’, we believe it is now.

The daily ETH chart shows large moves, wild swings, a year ago. The reversals became milder and softer, in 2023. This should be a good thing for the long term.

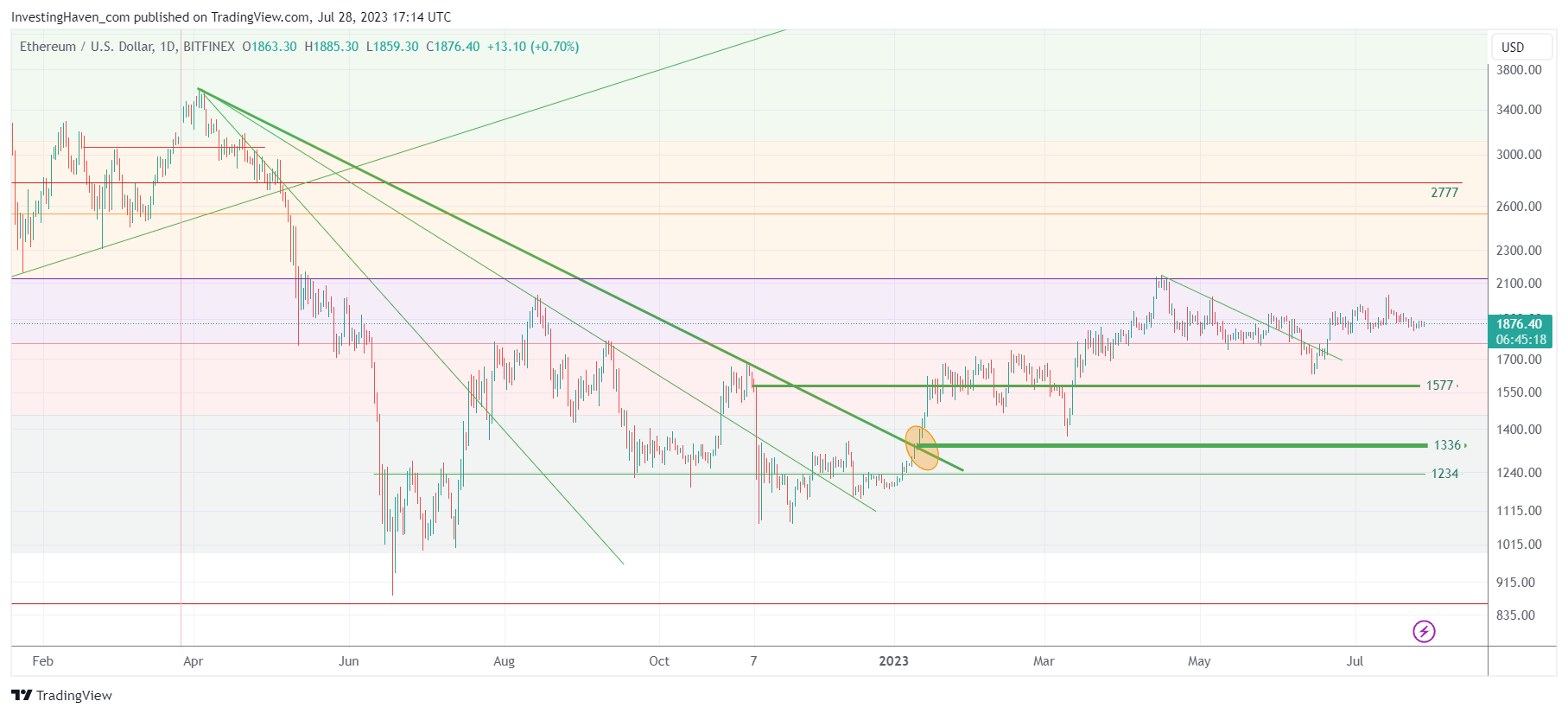

Short to medium term, though, we stick to the findings we discussed recently. The long consolidation is occurring right below the 50% retracement level since ETH hit its ATH. This is what we wrote recently:

In terms of resistance, it is blatantly clear how powerful resistance is right at the 50% retracement level (between its ATH and June 2022 lows), see the fine purple line on the chart. In August of 2022 as well as April of 2023, the 50% retracement level was tested. In the former situation, it resulted in a big drop. In the latter situation, we got a much softer drop.

When we overlay our annotations to the ETH chart, we see the 50% retracement level coinciding with the fine purple line.

In sum, it remains clear that (a) a long consolidation is a good thing (b) ETH won’t be able to create bullish momentum as long as it continues to trade below 2k USD (c) a trendless state may help the long term chart structure even though it is really boring as an experience for investors in the short to medium term.

Also, if a market cannot move higher, it will likely move lower first. ETH might drop to 1555 USD, in September, unless it is able to clear 2k USD in August. In relative terms, it would still be a tiny drop if it were to occur.

In the meantime, crypto enthusiasts can check out the crypto segment that is set up for outperformance whenever bullish momentum hits the crypto sector. Read our latest in-depth crypto report 30 cryptocurrencies in 7 segments: which tokens are ready for a move?