ur bullish coffee price forecast is driven by 3 leading indicators: global supply/demand conditions, Brazilian Real, coffee futures market positioning (CoT).

This coffee price forecast suggests that the price of coffee is set to double by 2025. This is based on favorable supply/demand trends in the global coffee market, combined with favorable leading indicators Brazilian Real and Coffee CoT’s.

We apply our regular forecasting method to this coffee price prediction. We look at the leading indicators that apply to predicting the price of coffee. From this, we derive an understanding of the directional trend, long term: up or down or unclear. We then analyze the trend(s) on the long term coffee price chart.

- 1. Our Coffee Price Prediction 2024 and 2025 methodology

- 2. Leading Indicator: Global Supply Demand 2024

- 3. Leading Indicator: The Brazilian Real

- 4. Leading Indicator: Coffee’s COT Report

- 5. Coffee Price Charts & Price Targets 2024 & 2025

- 6. Summary: Coffee Price Forecast 2024, 2025 and 2026

Coffee price prediction 2024 and 2025: methodology

Each and every of our forecasts is based on the same structural approach:

- We identify and analyze the relevant leading indicators of a market. This gives us insights about the longer term trend: directionally higher, lower, or unclear.

- We analyze the price charts to identify trends and turning points. We typically look at the monthly, weekly, daily charts, in a top-down approach.

When it comes to coffee we look at 3 leading indicators which tend to determine the future price of coffee. The 3 leading indicators for coffee’s future price are:

- Global supply/demand conditions.

- The positive correlation between the coffee price and the Brazilian real against the US Dollar.

- Coffee’s COT report (futures market positioning), acting as a long term ‘stretch indicator’ as it relates to overbought or oversold conditions for price.

We apply this structured method to predict a reasonable coffee target (area) for 2024 and 2025.

Enjoying an expensive cup of coffee?

We will focus on the price of coffee, set in global markets and COMEX futures markets.

However, there is of course a relationship with the cup of coffee that all of us are drinking, as consumers.

Coffee prices in the grocery stores went up significantly, as evidenced by our own experience and consumer stories like this one:

@Morrisons When people are struggling & you and other supermarkets are busy patting yourselves on the back for finally reducing basic items by a couple of pence, how on earth do you justify a price rise of 3 quid within a couple of weeks on a jar of coffee? Shameful! pic.twitter.com/ZdD26CmyU0

— Spirited1 (@helen_spirit1) May 17, 2023

One would expect that the underlying commodity went up as well.

Commodity price changes over the last year…

Sugar: +9%

US CPI: +6.0%

Gold: +2%

Silver: -7%

Soybeans: -12%

Corn: -14%

Copper: -14%

Gasoline: -16%

Coffee: -19%

Heating Oil: -23%

Zinc: -27%

Brent Crude: -28%

WTI Crude: -31%

Wheat: -33%

Cotton: -41%

Lumber: -56%

Natural Gas: -61%— Charlie Bilello (@charliebilello) March 29, 2023

Nothing is further from the truth: the price of coffee in global commodity markets came slightly down in recent years.

Morale of the story: don’t mix up coffee price forecasting with your own experience as a consumer. Financial markets and real life markets may be decoupled. That’s why we need a methodology to forecast prices in financial markets. It is imperative to have a solid methodology to forecast the price of coffee.

Leading indicator: Global supply demand 2024

First, the global supply vs. demand conditions in the global coffee market has proven to be a reliable indicator over the years. The correlation between global supply/demand and the price of coffee, directionally, has a reliable correlation.

In other words we look at major changes in global shortage vs. deficit, to understand, directionally, to forecast the direction of the price of coffee.

As per this report Coffee World Markets and Trade published in June of 2023, the world coffee production forecast for 2023 & 2024 is set to rise:

World coffee production for 2023/24 is forecast 4.3 million bags (60 kilograms) higher than the previous year to 174.3 million. Higher output in Brazil and Vietnam is expected to more than offset reduced production in Indonesia. With additional supplies, global exports are expected up 5.8 million bags to a

record 122.2 million primarily on strong shipments from Brazil. With global consumption forecast at a record 170.2 million bags, ending inventories are expected to remain tight at 31.8 million bags.

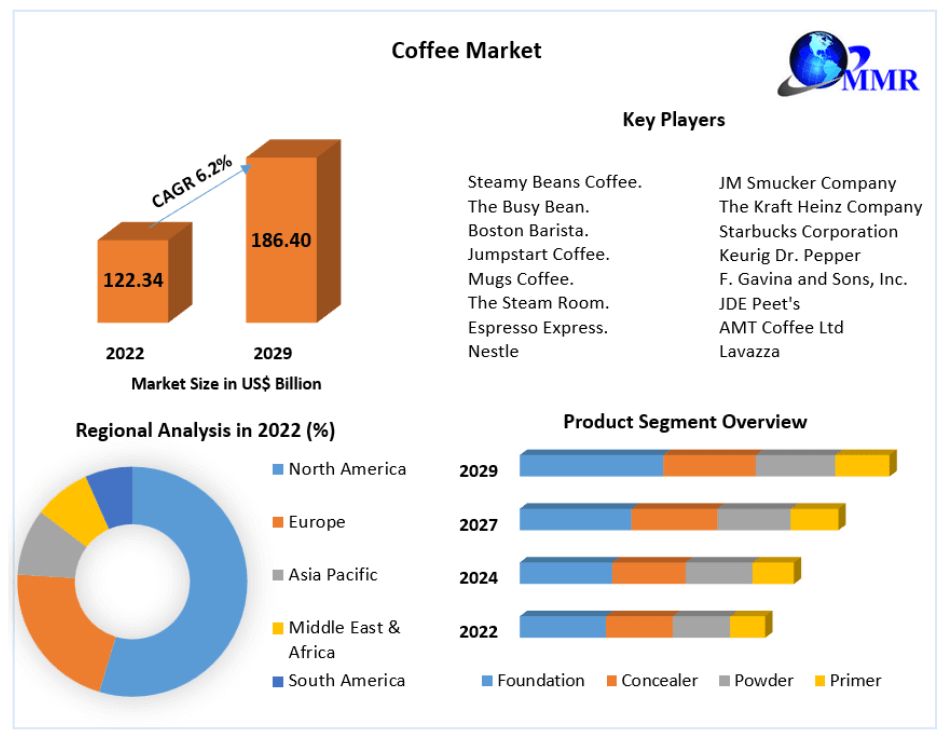

The next chart (source) says it all: the global coffee market is expected to grow with a CAGR of 6.2% per year.

So what we conclude from our first leading indicator is that the global coffee market is growing, directionally, in 2024 and 2025.

This is supportive of higher coffee prices, making us conclude that a mildly bullish coffee price forecast for 2024, 2025 and 2026 is justified.

We need the other 2 coffee price leading indicators to complement the above statement though.

Leading Indicator: The Brazilian Real

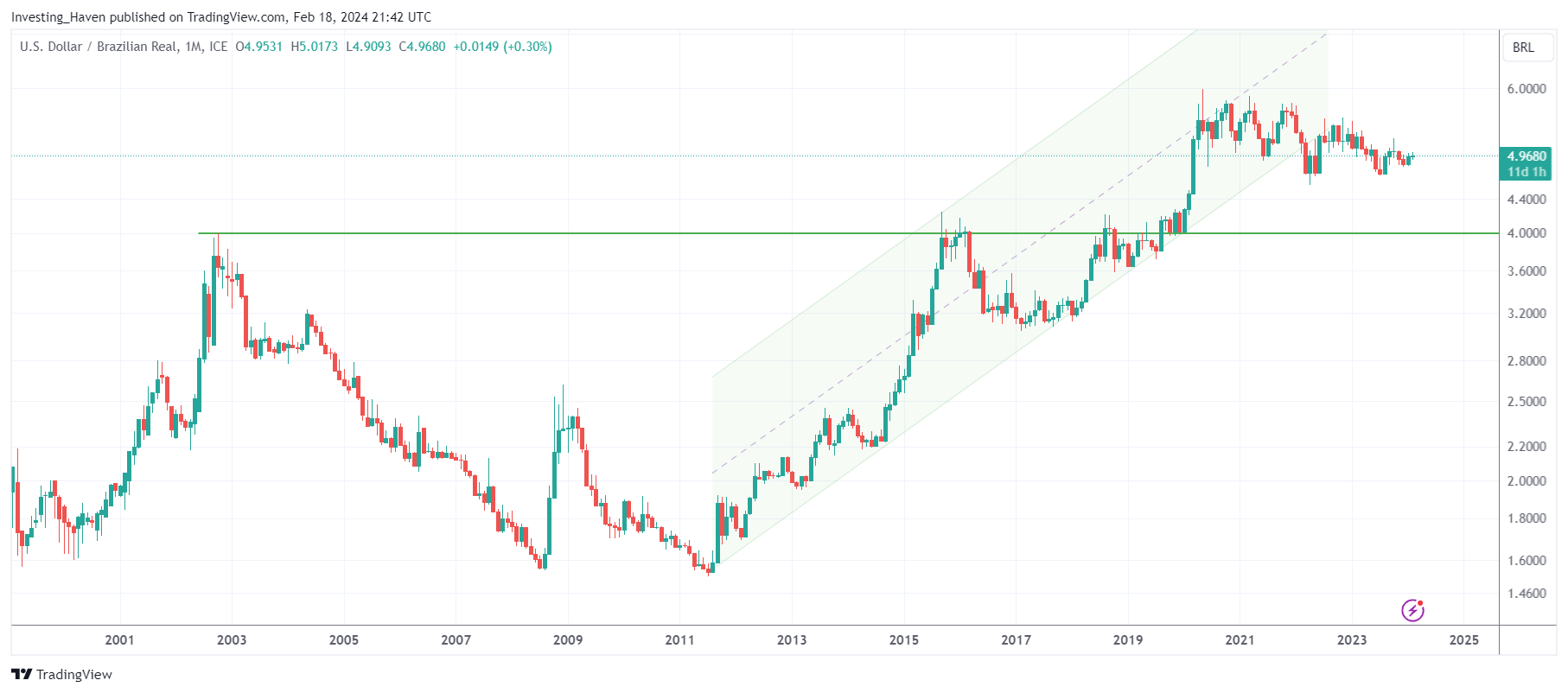

The second leading indicator for the future price of coffee is the Brazilian Real against the US Dollar. Both are positive correlated.

Here as well we look at the direction, not the details. In other words if the Brazilian Real moves in a long term rising channel against the Dollar the price of coffee tends to rise (as the Dollar tends to weaken relative to the Real). However, if the Brazilian Real is in a falling channel against the Dollar it is not supportive for the coffee price.

We explained the underlying dynamic in the past. In particular, it was explained in detail in a paper from ABN Amro:

The coffee price will rise due to the stronger Real as coffee is largely traded in dollars on international markets. The stronger Real makes coffee less valuable, and that gives traders in Brazil an incentive to sell less in international markets in anticipation of higher prices. As a result, the availability of coffee in external markets decreases and this will have an upward effect on prices.

The Dollar to Brazilian Real, inversely correlated to the price of coffee, is shown below.

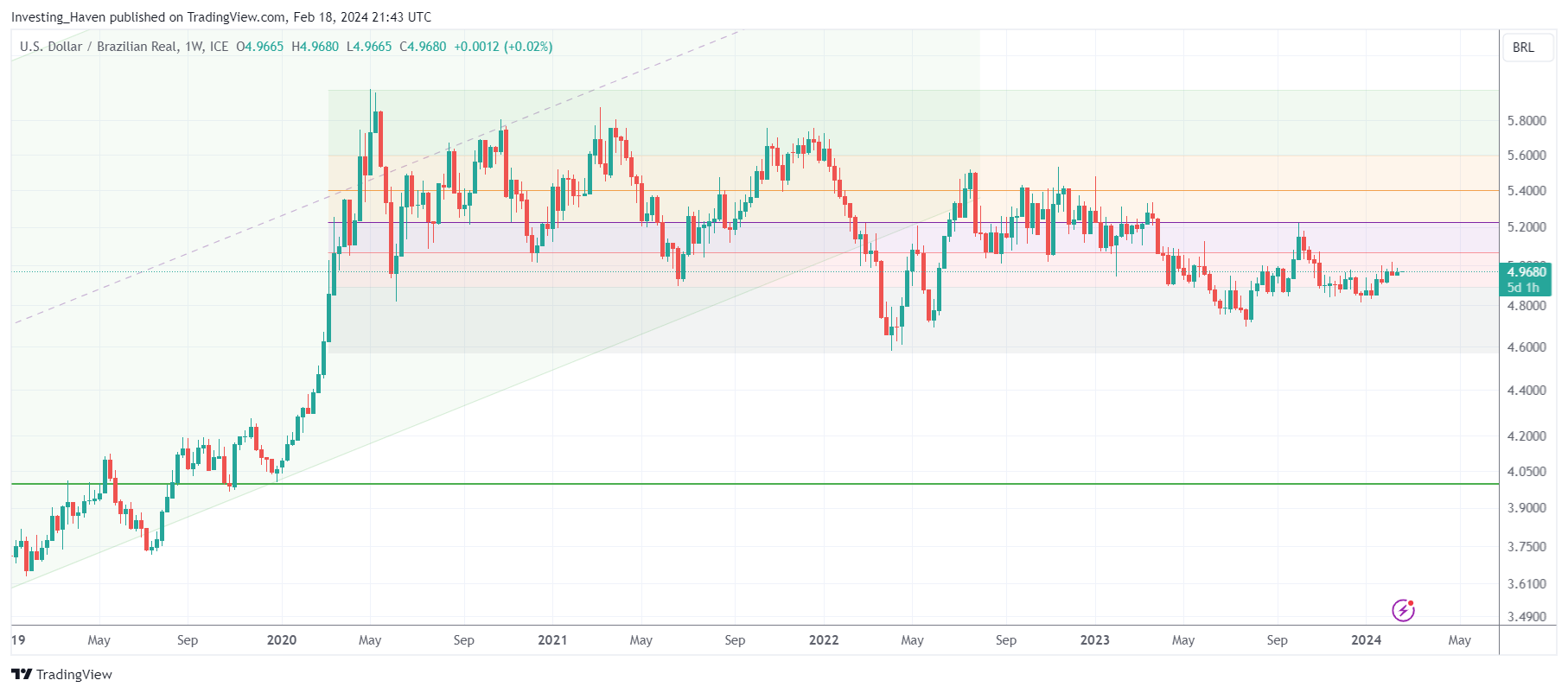

The long term trend channel gave up early 2023. The may imply that the USD/Real is hitting too much resistance which is seen as positive for the price of coffee.

The weekly chart makes the same point, although with more detail.

One thing is crystal clear: if the 4.6 level on the USD/Real chart breaks down, it will positively influence the future price of coffee.

IF the USD/Real declines and stages a falling trend on its chart, it will positively impact the price of coffee. A neutral USD/Real will be neutral to mildly bullish/bearish for the coffee price, in our view, long term.

Leading Indicator: Coffee’s COT Report

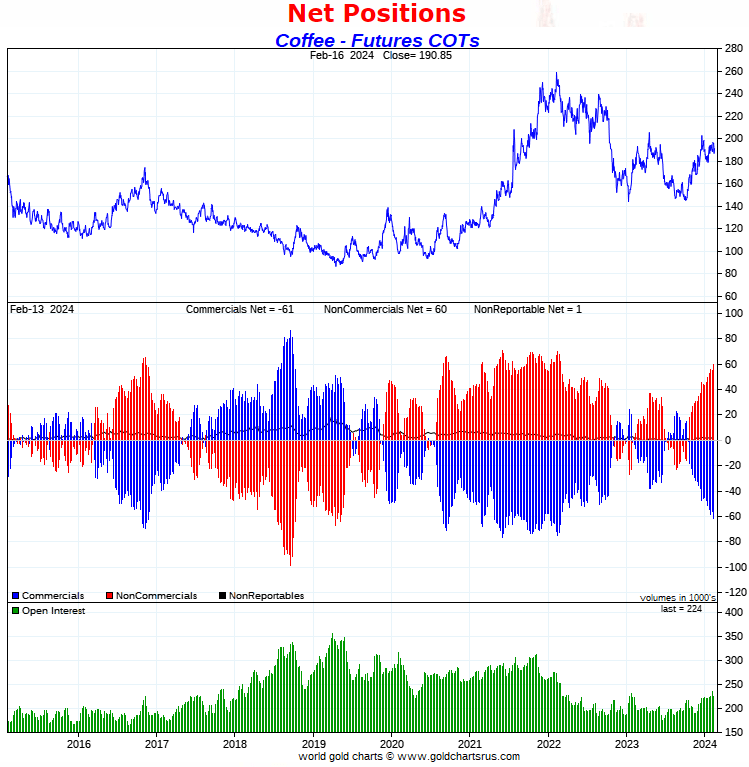

The trend in speculator positions (‘Commitment of Traders’) has a strong impact on coffee prices. The way to leverage the CoT report is more like a ‘stretch indicator’. What does this mean?

- It’s all about the net positions of commercial and non-commercial traders.

- The blue bars and red bars, on the center pane, on the chart below, is what to look for.

- Whenever the net positions of commercial traders is extremely low (blue bars very small), there is a lot of upside potential with limited downside potential in terms of price.

- The opposite is true as well.

- Note that the CoT report is not a timing indicator, it does not tell you when prices might move higher. It only says that the downside vs. upside is limited, a stretch indicator of price.

We look at 9 year of CoT data, at the time of updating this article (mid-February 2024). What stands out is that the bars are growing significantly. Either the coffee market is going through a replay of 2021 (rising futures market positioning on rising coffee prices) or this leading indicator will provide resistance in 2024).

We derive 2 potential outcomes from this CoT report as it relates to our longer term coffee price forecast for 2024 & 2025.

In sum, this leading indicator is either supportive of higher coffee prices in 2024 or will put a cap on the coffee price slightly above current levels. We need other leading indicators because the coffee CoT report is not helpful.

Coffee Price Chart 2024 & 2025

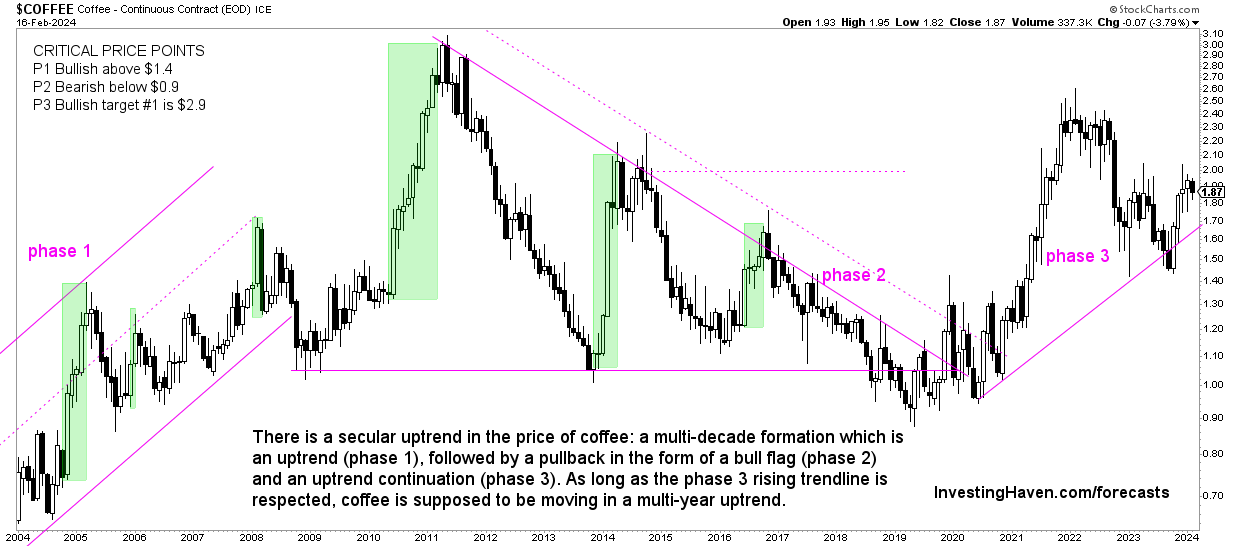

Interestingly, the long term coffee chart supports all the findings in our 3 leading indicators.

On the one hand, we see an enticing long term setup for the price of coffee. On the other hand, we also observe the probability of coffee to return to its previous ATH.

We believe that it might be a choppy road, certainly not a straight uptrend, between 2024 and 2026, for the price of coffee. We have seen violent moves to the upside of coffee in the past. The price of coffee tends to move aggressively higher every 2 to 3 years.

The odds favor an upside move, as a final outcome.

Now, if we look at how this relates to OUR coffee price chart, it gets very interesting. So it does not happen often but when coffee starts a breakout you want to be in that market.

The critical price points we have identified:

- P1 Bullish above $1.40

- P2 Bearish below $0.90

- P3 Bullish target at $2.90

Now, the really important insight that we can derive from our longest coffee price chart is the rising trendline that originates in 2020. We don’t want to see a violation of that trend, below this trendline the coffee chart requires to build up a new structure, presumably at 1.40.

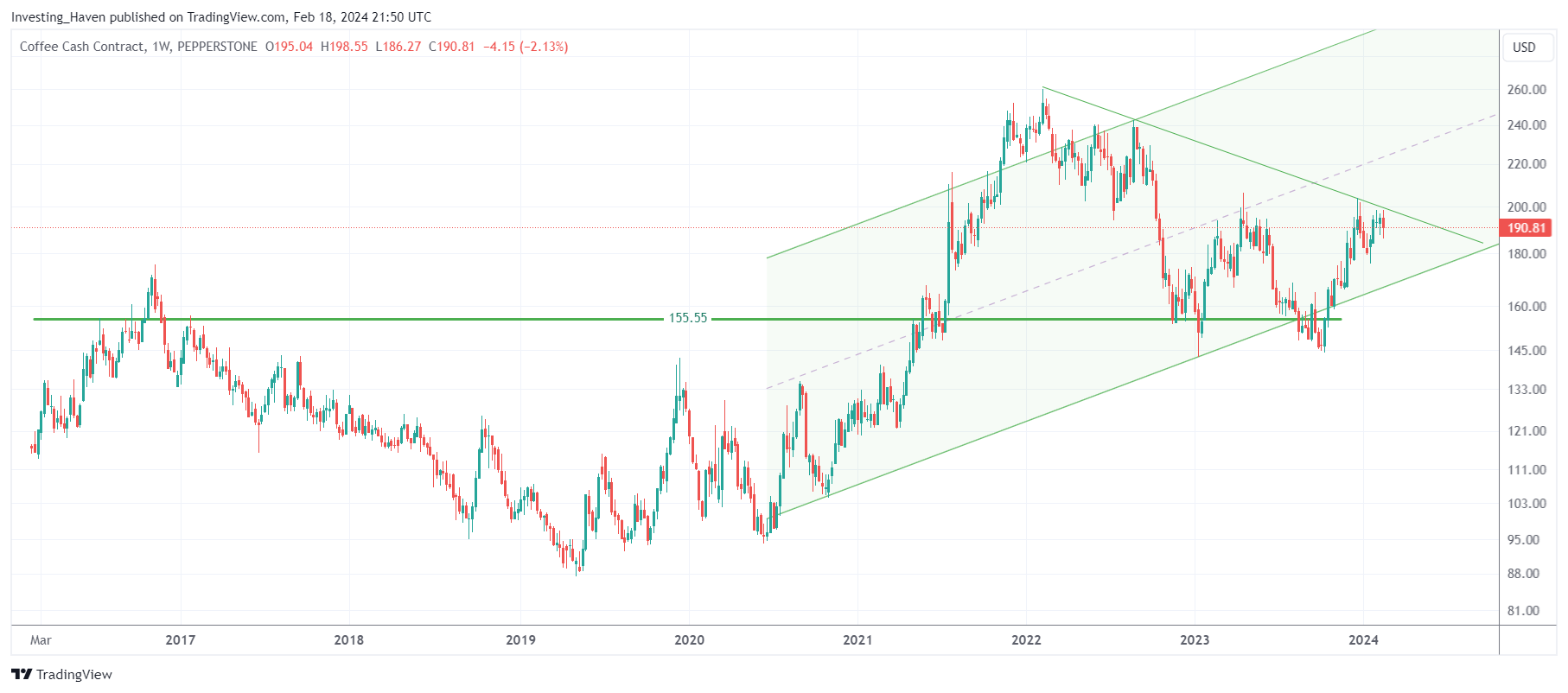

Coffee Price Chart – Rising Trend

Interestingly, the 1.40 price point (above) can be spotted, as a crucial level, on the daily futures price chart, below. It coincides with the 2023 lows.

Conclusion from the coffee price charts:

- We believe that coffee is a buy-and-hold investment in 2023, for 2024 and 2025.

- The pre-requisite: the 2023 lows will need to hold on a 3 to 5-week closing basis.

Our coffee price forecast is directionally bullish as long as the 2020 highs are respected (former resistance, now support).

Summary: Coffee Price Forecast 2024, 2025 and 2026

The coffee price leading indicators are somehow supportive for higher coffee prices going into 2024 and 2025:

- Global supply/demand factors are favorable, directionally.

- The USD against the Brazilian Real did hit resistance in 2023. It will become very supportive for coffee once it moves lower in 2024 or 2025.

- The coffee CoT is rather neutral, with a bullish bias.

The coffee price chart suggests that, ultimately, 1.40 might be tested in 2023.

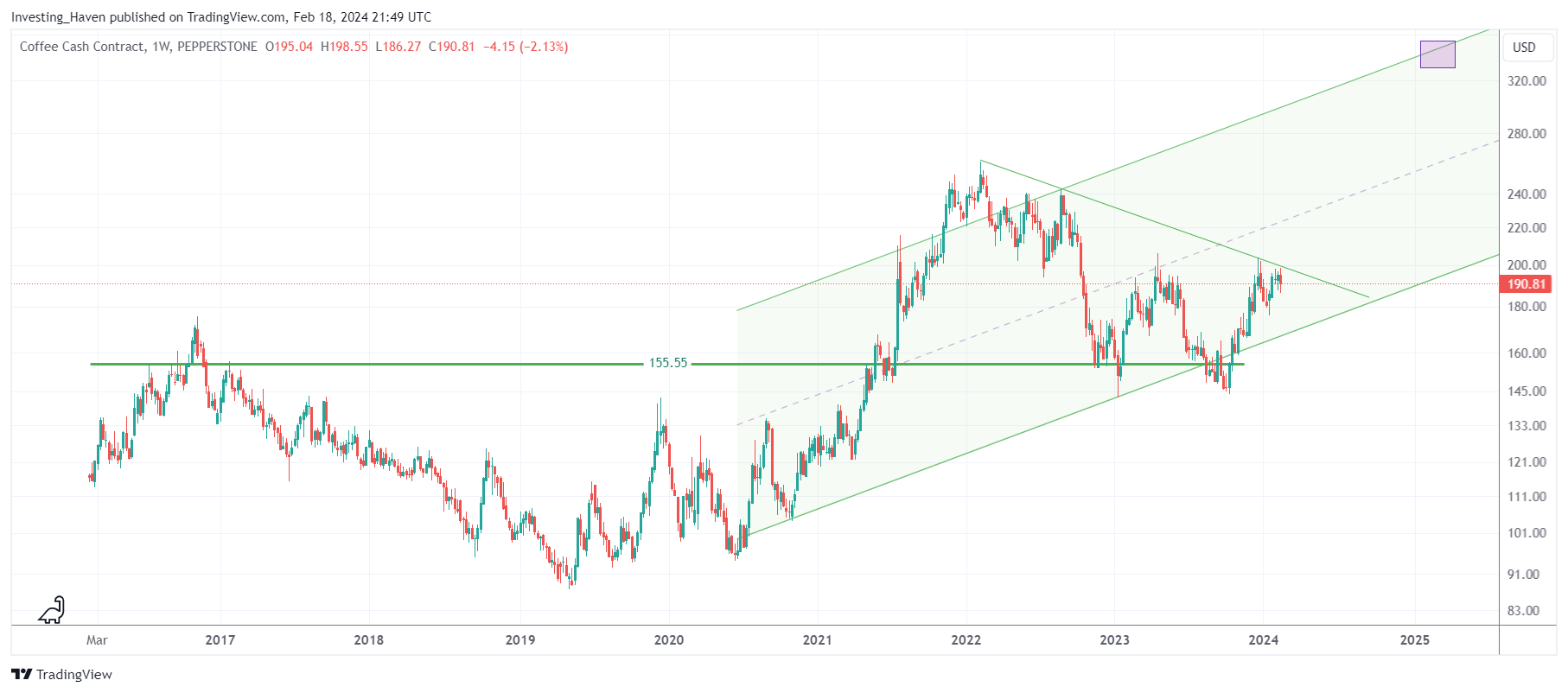

Ultimately, in order to answer the question about our coffee price forecast 2024 & 2025, with a reasonable price target for 2025, we feel we have to project the current trend into the future, add an invalidation scenario to it.

That’s why we strongly feel that the next chart is decisive. Ultimately, it will reflect changes in the trends of leading indicators, some of which are neutral right now.

Our coffee price forecast 2024, 2025 and 2026 is 3.3 points provided 1.4 is respected. The green rising channel on the multi-year chart should be respected in order for coffee to get to the projected bullish target in 2025 (purple box).

A Coffee Price Forecast for 2024, 2025 and 2026 Click To Tweet

Must-Read 2024 Predictions

We recommend to read the following predictions as they are highly informative and very well researched.