Our latest gold price forecast: gold might come close to the $2,550 area in 2024 because of the bullish setup of gold’s chart and its leading indicators.

[OUR LATEST GOLD FORECAST] A Gold Price Prediction for 2024 2025 2026 – 2030

As a reference, this article was initially published in October of 2023. This is what we wrote back then about gold’s prospects in 2024:

- The price of gold will surpass $2,000 in 2024. Gold’s leading indicators are bullish, we predict $2,200 or slightly higher followed by a pullback in 2024.

- Our latest gold price forecast: gold will come close to to $2,200 in 2024 because of the bullish setup of its leading indicators. We predict that gold will move to $2,200 and pull back from there in 2024, it might slightly exceed $2,200. After a pullback, we see gold moving to $2,500 in 2025.

Nowadays, anyone can create and share a gold price forecast, particularly on social media. The quality of forecasting, the forecasting methodology, the analysis framework don’t matter any longer. It’s about the clicks and likes. Over here, at InvestingHaven.com, we are going through the hard work, the genuine analysis, in order to forecast future gold prices.

Gold forecast analysis – outline

We think of a gold price forecast as an art and a skill. If you are looking to understand the true dynamics driving the gold price, you will like our gold price prediction methodology.

- 1. Three leading indicators for our gold price predictions

- 2. Our gold price prediction for 2024

- 3. Gold predictions vs. gold news

- 4. Gold charts that support our 2024 forecast

- 5. Gold’s leading indicator #1: Euro (USD)

- 6. Gold’s leading indicator #2: Bond yields

- 7. Gold’s leading indicator #3: Inflation

- 8. Gold price forecast 2024: conclusion

- 9. Gold or silver in 2024? Our answer: silver!

- 10. Predicting the price of gold: our track record

We published a few must-read articles on gold, recently:

- First, we made the point that gold is expected to move higher and set new ATH. We used very different data points in that article, compared to the data points in this current gold price forecast.

- Second, we asked ourselves the question: ‘Will gold ever hit $3,000 an Ounce?‘ The short answer: “Yes, gold can and will hit $3,000. It will not happen in 2024, that’s nearly impossible. Fundamentals are right for gold to hit $3,000 an Ounce. A time window in which gold can hit $3,000 is February 2026 to August 2026.”

- Third, big picture, we looked at historical gold price trends and what it means for investors: : 100-year gold price trend.

The above mentioned articles combine short term viewpoints, forward looking thoughts with secular analysis.

1. Gold price leading indicators

We apply a limited number of leading indicators for our gold price predictions:

- The Euro (inversely correlated to the USD).

- Bond yields.

- Inflation indicators.

All three combined help us forecast the future path of the price of gold. Moreover, it is by using these 3 indicators that we were able to accurately forecast annual gold price targets some 9 months prior to the market hitting them.

2. Our gold price prediction 2024

Based on the long term charts which show gold’s dominant patterns we expect gold to consolidate in a wide range between 1,750 and 2,200 USD/oz. We expect a long term bullish reversal to push the gold price to new ATH with $2,200 as a first bullish target (give or take 5%), followed by $2,500 in 2025 and ultimately $3,000 to be hit in the period 2025-2026.

InvestingHaven’s research team strongly believes that gold’s dominant trend is long term bullish. However, with the end of restrictive monetary policies we see gold moving directionally higher, potentially in a soft uptrend, irrespective of (healthy) pullbacks along the way.

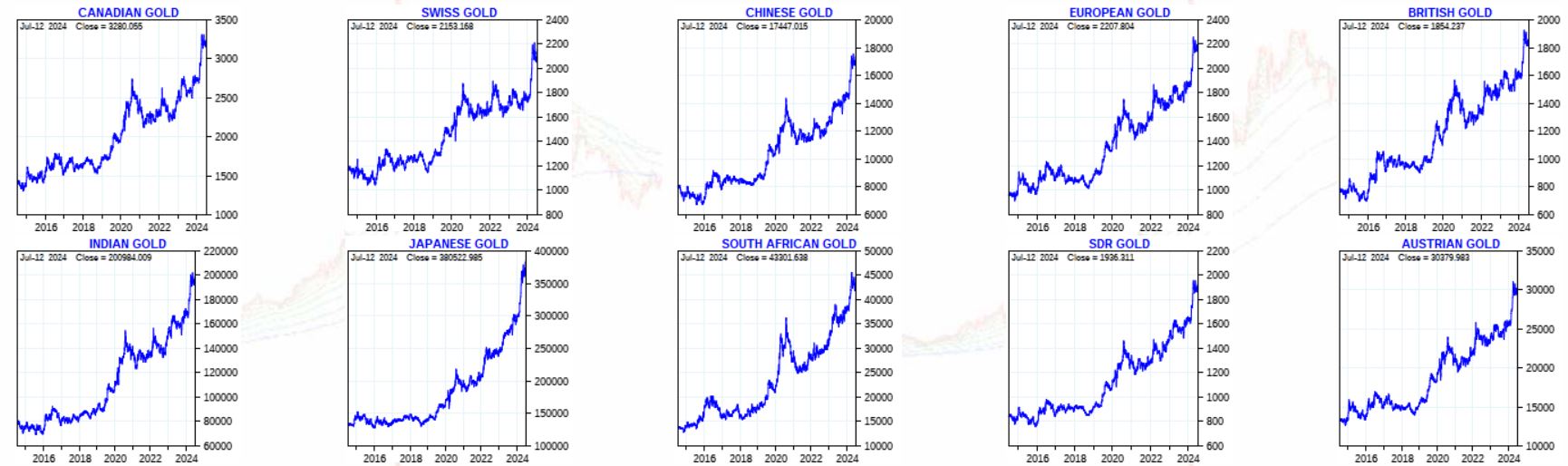

Note that most gold price predictions are U.S. centric (gold priced in USD). What many investors don’t realize is that gold is setting new all-time highs in each and every other currency as evidenced by this magnificent chart (by Goldchartsrus).

We see sufficient signs that the Fed will reverse its tightening policy in 2024. This does not imply they will lower the Fed Funds Rate immediately. It implies they will stop pushing and talking rates up. As the market is a forward looking mechanism, the market is already starting to factor in the fact that rates will eventually come in, as suggested by the 2-Year Treasury Yield divergence with the Fed Funds Rate.

3. Gold predictions vs. gold news

One common mistake is to look for clues about gold’s future price trend in the news.

It is tempting to read articles, but the point is that financial media’s economic model is primarily based on advertising revenue. In other words, headlines need to collect clicks in order for financial media to remain in existence. This does not mean that each and every gold article is bad or irrelevant, it implies that the essence of gold forecasting for gold investors is not to be found in financial media.

The point is this: gold news is lagging, often irrelevant.

4. Gold charts that support our 2024 forecast

The power of the pattern.

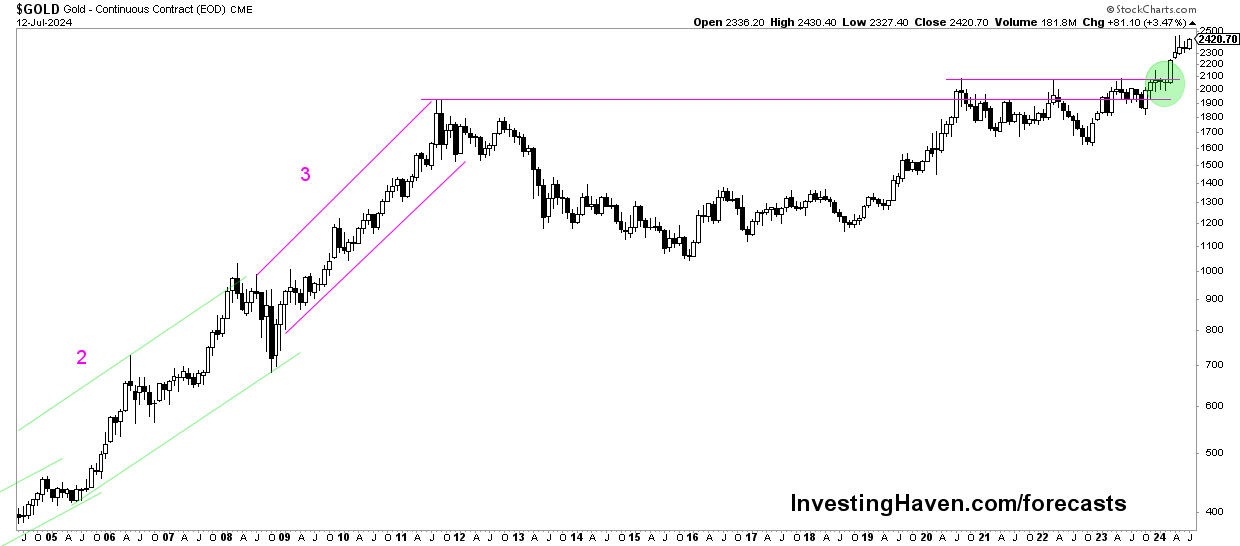

The long term gold price chart shows a long term bullish reversal between 2013 – 2019.

The price of gold created either a topping pattern in 2020/2022 or is in the process of creating a cup and handle. We cannot rely solely on the gold price chart to make the call which of the 2 scenarios are most likely. We need leading indicators to help us understand which path gold might take.

The same findings that we get from the quarterly chart shown above are visible on the long timeframes of gold’s historic interactive chart.

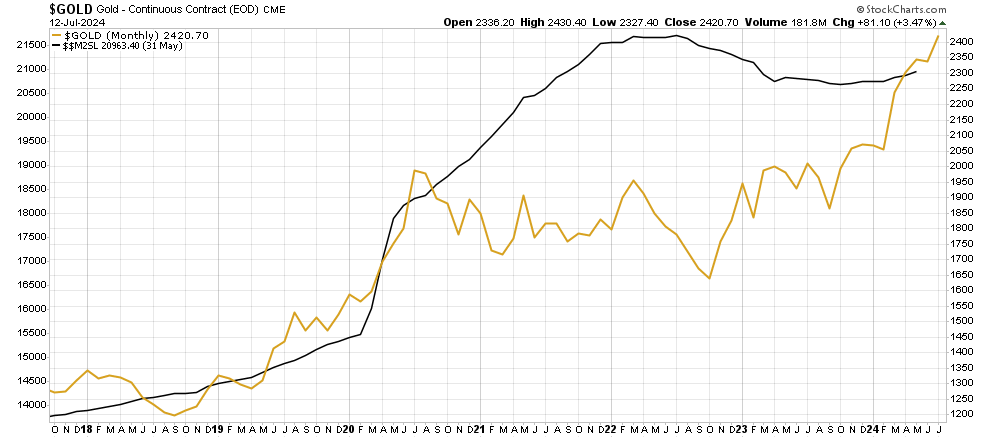

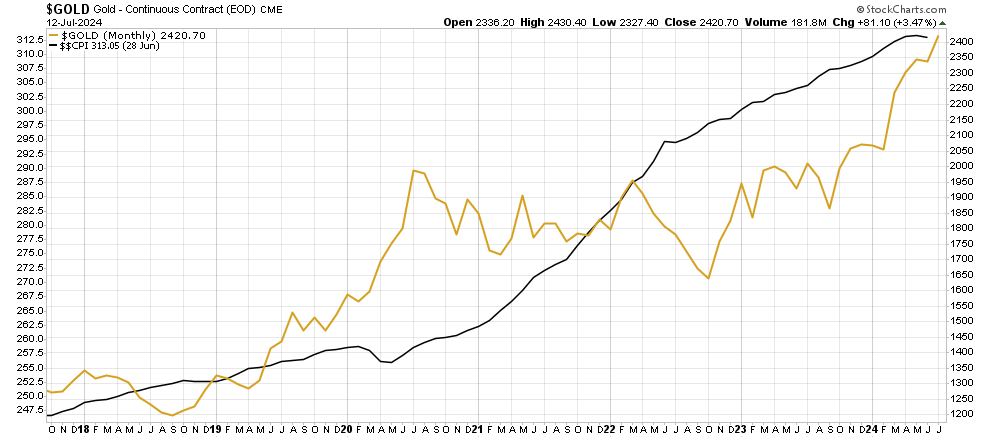

Very important: the correlation between the price of gold and the monetary base M2.

As seen on below chart, the monetary base M2 continued its steep rise in 2021. It started stagnating in 2022. Historically, we see that gold and the monetary base move in the same direction. Gold tend to overshoot the monetary base but mostly it tends to happen temporarily. Both are more in synch now. This suggests that gold in nicely in synch with the monetary base: markets that directly influence the gold price, think USD and Yields, will play a crucial role in determining the future gold price trend.

Several more data points will help us understand whether gold will consolidate with $2,200 as an upside projection for 2024. They are presented in the next sections.

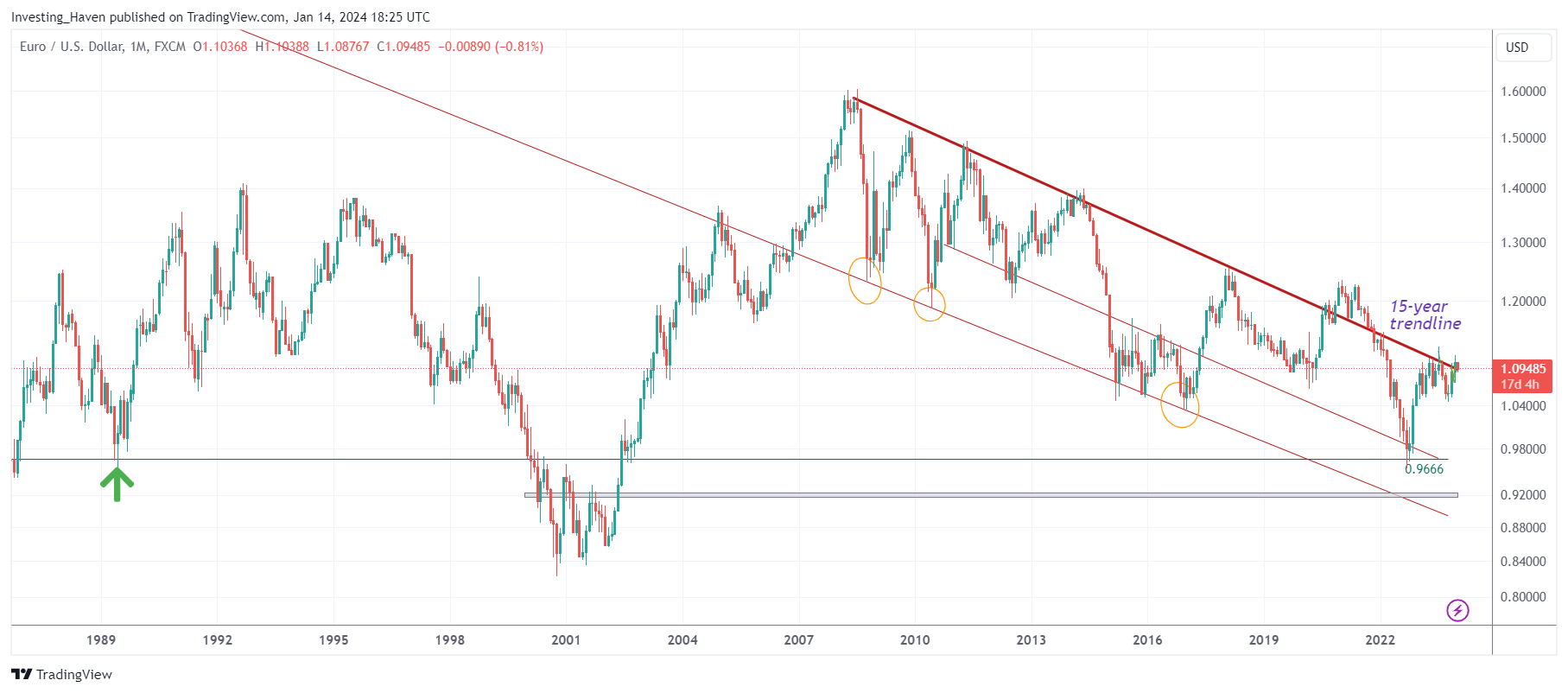

5. Gold’s leading indicator #1: Euro (USD)

Gold tends to go up when the Euro is in a bullish mindset. Consequently, when the USD is rising it puts pressure on gold.

We need to understand the secular patterns in order to get an understanding of gold’s projected path.

The longest term Euro chart has 2 targets: 0.9666 and 0.91 approx.

As seen, 0.9666 was achieved in September of 2022. This level coincides with the lows printed in 1989, a very important price point simply because it goes back so many years in time.

We don’t see the Euro falling below the 2001/2002 lows. This should prevent gold from starting a long term bear market.

The Euro’s longest term chart suggests that the Euro against the USD is hitting resistance around 1.10 points. At the same time, we notice that volatility is declining which is good news for gold. The one scenario in which gold cannot shine is when the USD is too strong, rising too fast.

6. Gold’s leading indicator #2: Bond yields

Bond yields are inversely correlated to gold.

As seen, below, on the weekly chart of 10-year Yields, gold was able to rise after Yields peaked mid-2023.

With the prospects of rate cuts in the US (as explained here and here), it is expected that Yields will not move higher. This is supportive for gold.

7. Gold’s leading indicator #3: Inflation

Gold shines in an inflationary environment.

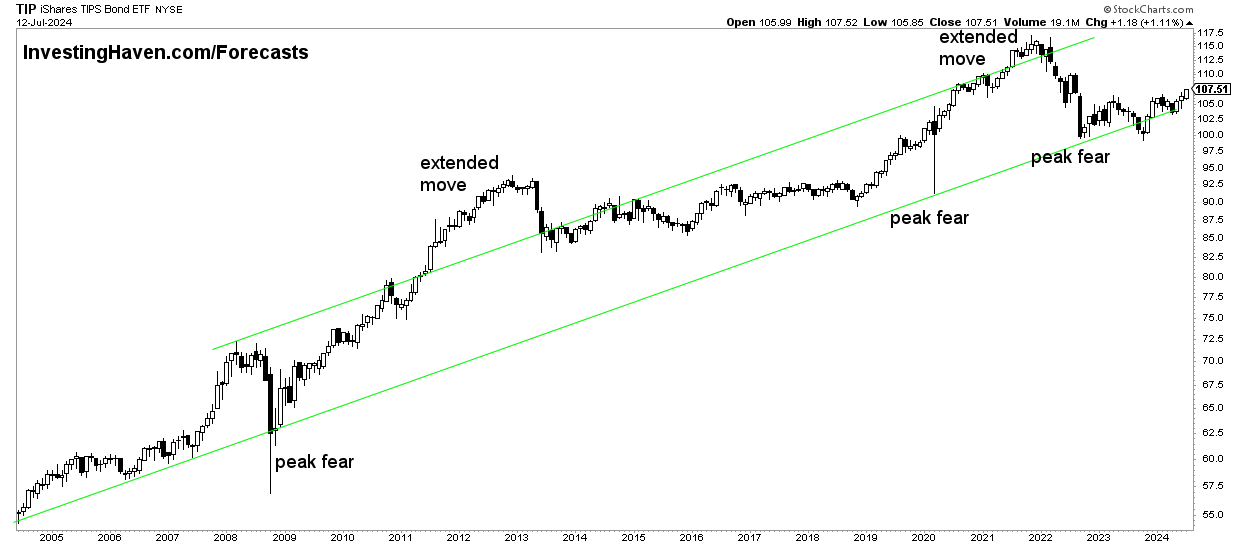

Inflation expectations expressed by TIP ETF came down in a dramatic fashion. We don’t expect this trend to continue in 2024 especially since monetary policies are close to being stretched in terms of rate hikes.

Moreover, TIP came down to a long term trendline (support) which connects the lows of the epic 2008/9 and 2020 market crashes.

We expect gold to be supported in 2024 by TIP which is now clearly stabilizing so it can start rising again over time. A rise in TIP (inflation expectations) is good for gold, as both assets are positively correlated.

Monetary inflation is easing but eventually it will move up again. The divergence between gold and the monetary base will moderate eventually.

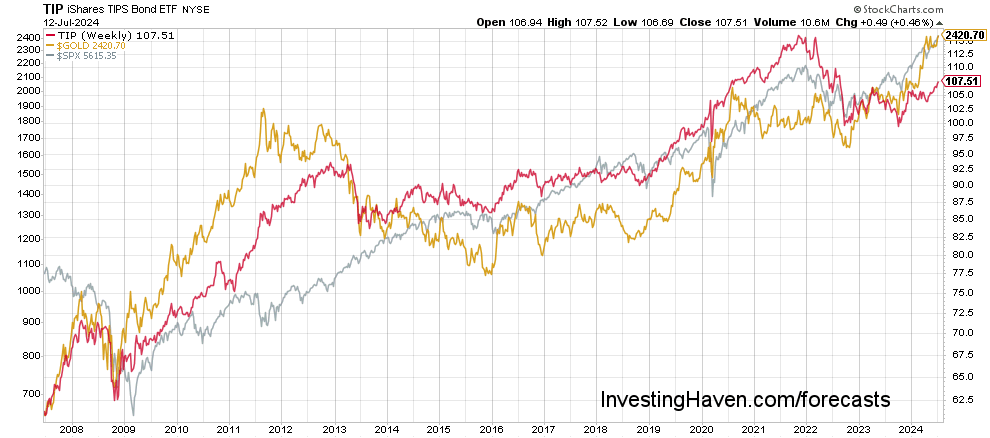

When we look at the historic relationship between TIP, gold and stocks, we can see how a decline in TIP has led to lower gold and stock prices. However, as TIP is hitting long term support, it should suggest that gold and stocks will move higher in 2024, although it might happen at different points in time.

8. Gold price forecast 2024: conclusion

It is clear that we have sufficient confirmation from the gold chart patterns on all timeframes as well as gold’s leading indicators that gold may stabilize and remain range bound in 2024.

The U.S. Dollar does have less upside potential than downside potential in 2024. The same accounts for Treasuries. Inflation expectations should resume their uptrend at a certain point in 2024.

Our gold price forecast of $2,200 at the higher side, published in October of 2023, was already met in the first half of 2024. We believe that gold will move in a range between $2,157 and $2,555 in 2024.

9. Gold or silver in 2024? Our answer: silver!

Should investors focus on gold or silver in 2024? Our answer is very clear: silver! We explained this in great detail in Which Precious Metal To Buy For 2024: Gold vs. Silver?

That’s because of the much stronger fundamentals of silver compared to the ones of gold.

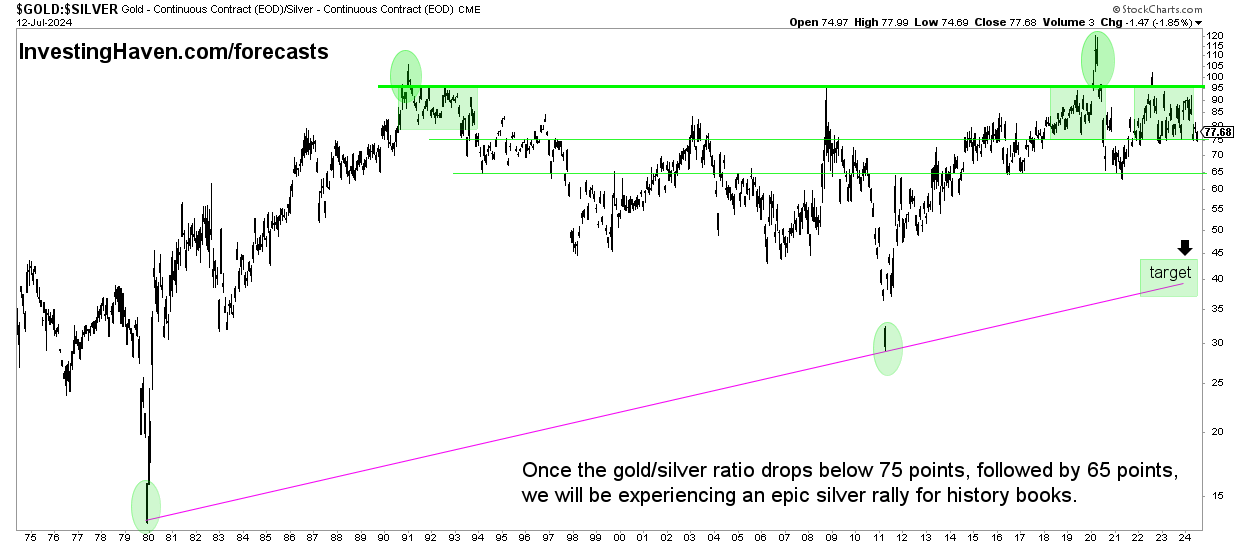

Also, one of our precious metals indicators, the gold to silver ratio, suggests that the downside in silver is limited and the upside huge. As explained in One Silver Chart Justifies ‘Buy The Dip’ For Long Term Positions:

In essence, any readings above or near 100 (gold price : silver price) are long term buy opportunities. It happened 2 times in history, a few weeks ago was the 3d time. We are confident that silver is a long term buy. Yes, buy the dip is justified (provided no leverage) regardless what happens to precious metals in the next few weeks and months.

The historic gold to silver ratio chart is featured below.

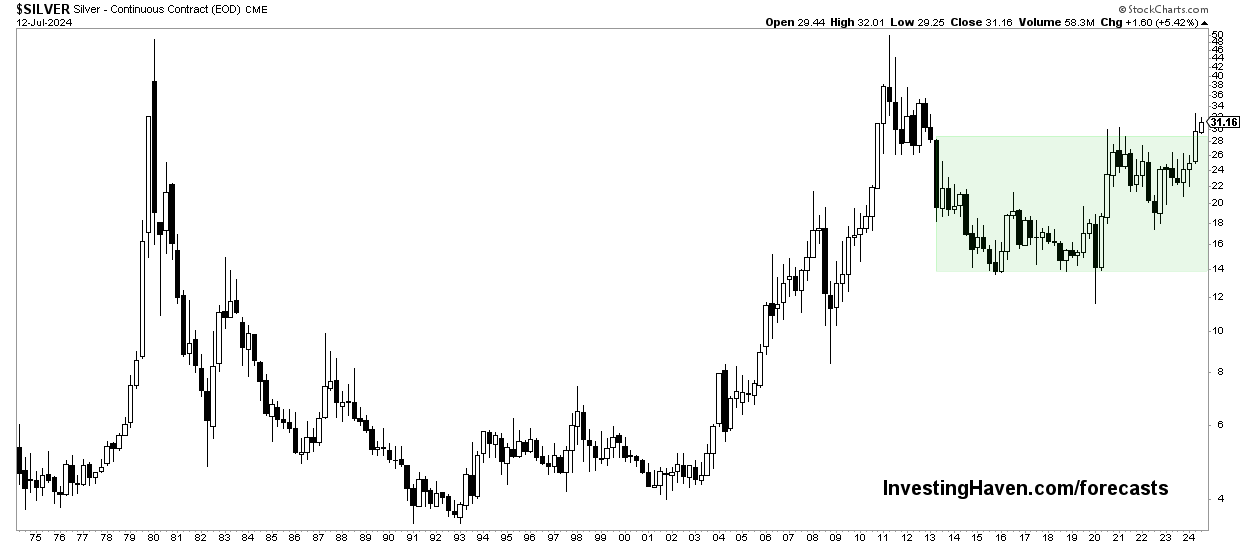

The silver price chart over 50 years says it all: a wildly bullish cup and handle formation that may get aggressive in 2024 in favor of silver.

10. Predicting the price of gold: our track record

For 5 years in a row our gold forecasts were phenomenally accurate. They are all still available in the public domain on our blog, and the table below depicts the summary of each year’s gold forecast with the highs/ lows per year.

Interestingly, InvestingHaven’s research team has been spot-on with its gold price forecasts for 5 consecutive years. However, our gold forecast 2021 of 2200-2400 USD did not materialize. After 5 consecutive years of spot-on gold forecasts we did miss in 2021.

How comes?

In 2021 the intermarket readings were absolutely accurate; they justified a gold bull run. Bond yields did fall close to 40% at a certain point while the USD was rather flat. There was no gold bull run while any other point in time in the past gold would have been rallying in those circumstances.

This suggests that either our method stopped working OR our forecast is postponed. Eventually, it appeared that the market conditions which were created post Corona were so unique and extreme that all markets got messed up.

We remain convinced that our longstanding forecasted gold price targets will be hit, they may materialize with some delay.

This is an overview of our historical gold forecasts.| Forecasts from the past | Lows - highs in the past | Our accuracy |

|---|---|---|

| 2016 | bearish | $1,000 | $1,049 - $1,386 | Accurate |

| 2017 | bearish | $1,000 | $1,123 - $1,358 | Accurate |

| 2018 | bearish | $ 1,100 | $1,160 - $1,365 | Spot-on |

| 2019 | bullish | $1,550 | $1,265 - $1,556 | Spot-on |

| 2020 | bullish | $1,750 | $1,498 - $2,075 | Highly accurate |

| 2021 | bullish | $2,200 | $1,675 - $1,921 | Missed |

| 2022 | bullish | $2,000 | $1,626 - $1,801 | Missed |

| 2023 | bullish | $2,200 | $1,811 - $1,943 | Accurate |

Weekly Gold & Silver Price Analysis

Our public blog posts typically share high level insights that are not actionable. For actionable insights, we recommend considering our detailed gold & silver price analysis. It is a premium service, covering leading indicators of the gold price and silver price. Premium service: Gold & silver price analysis >>

Must-Read 2024 Predictions

We recommend you read our 2024 predictions as they are very well researched: