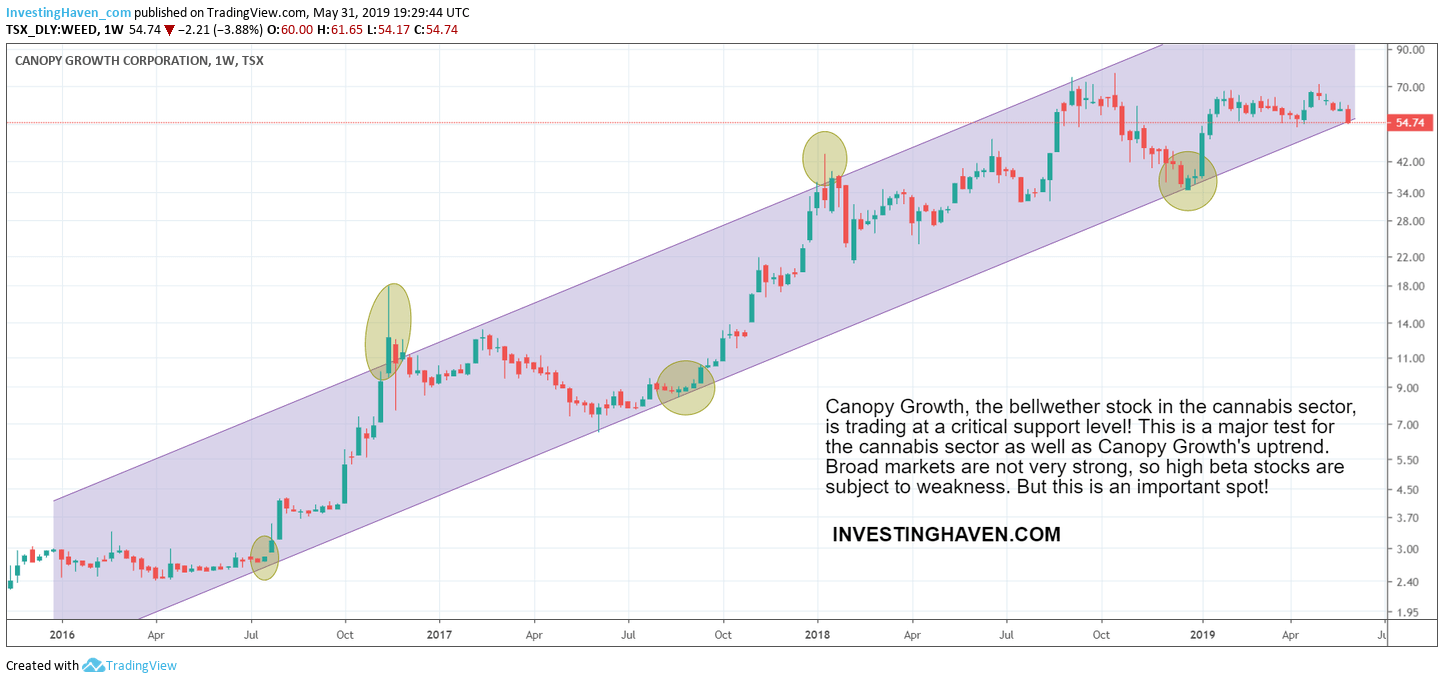

The cannabis sector is undergoing a crucial test. The 3.5 year rising channel of sector leader Canopy Growth (WEED.TO) is being tested right now. As long as there is no confirmed breakdown we continue to believe that our cannabis stock forecast is valid. A confirmed breakdown will change this picture. The point though with cannabis stocks is that they qualify as a potential candidate for a TOP investing opportunity in 2019 but they will rise if broad market conditions favor high beta stocks. Between now and then, with rising Treasury notes and falling rates, conditions are not good enough for volatile stocks like cannabis stocks. A breakdown is a possibility, but we believe rates have fallen sufficiently to justify a stabilization around current prices.

Let’s first build up the cannabis stocks story of the last 6 months. This is the sequence as per our writings and observations:

Cannabis Sector Near Make-or-Break Level, Either Ultra Bullish Or Bearish (April 2019)

Cannabis Investing: The 10-Baggers Of 2019 Are Underway (January 2019)

Cannabis Stock Sector: Go vs. No-Go For A 2019 Bull Market (late December 2018)

Cannabis Sector Setting Triple Bottom After 50 Pct Decline (early December 2018)

Visibly, it has been a tough 6 months for this sector. No coincidence it’s not only cannabis but broad markets yo-yo-ing from bearish to bullish and back to bearish.

Remember, as one of the important investing tips: high flying stocks only perform well during favorable broad market conditions. In other words bullish momentum in broad stock indexes create the right environment for high flyers like cannabis stocks to do their magic.

Consequently, it might take months, maybe even a year or so, until these conditions develop.

June 2019, especially the end of month closing price at June 28th 2019, will be of extremely high importance. Similarly, the subsequent monthly closing prices will be equally important.

Even more important are the weekly closes during the month of June. Below chart is the weekly chart, and it can close once or twice below the 54 CAD level, but certainly not more than 3 times in order to respect its 3.5 year uptrend.

Small detail: peak fear tend to coincide with major bottoms. At the end of December last year it was also the bottom of high beta stocks right at a time when it was news that was all over the place.