Last week we mentioned the Epic Breakout Attempt In The Baltic Dry Index. This week we observed the start of this epic breakout. The last day of this month will be crucial for a high level of confidence forecast about this breakout. We’ll emphasize, again, that this is one of the very few real bull markets in 2021. Investors should conclude that ATH indexes necessarily comes with many segment specific bull markets, it’s certainly not the case in 2021 which makes it a very challenging year (especially mentally for a large group of investors).

On that last point about the mental state of investors: we believe some investors tend to feel left behind. We introduced an acronym for this: FLB which stands for ‘Feeling Left Behind’.

Some, not all, indexes are setting new ATH. But not all segments are supporting this, in fact most stocks and sectors are really left behind (divergence between breadth and the best performing stock indexes). Moreover, many have a fear that the market is setting a top similar to the ones in 2000 and 2007 (they conclude that big crash is imminent).

Nothing is further from the truth: it’s only a handful of stocks that drive the performance of the S&P 500, Dow Jones, Nasdaq. Consequently, most portfolios do not reflect ATH performance.

The FLB feeling is clearly creating stress, both emotional and mental, among a group of investors.

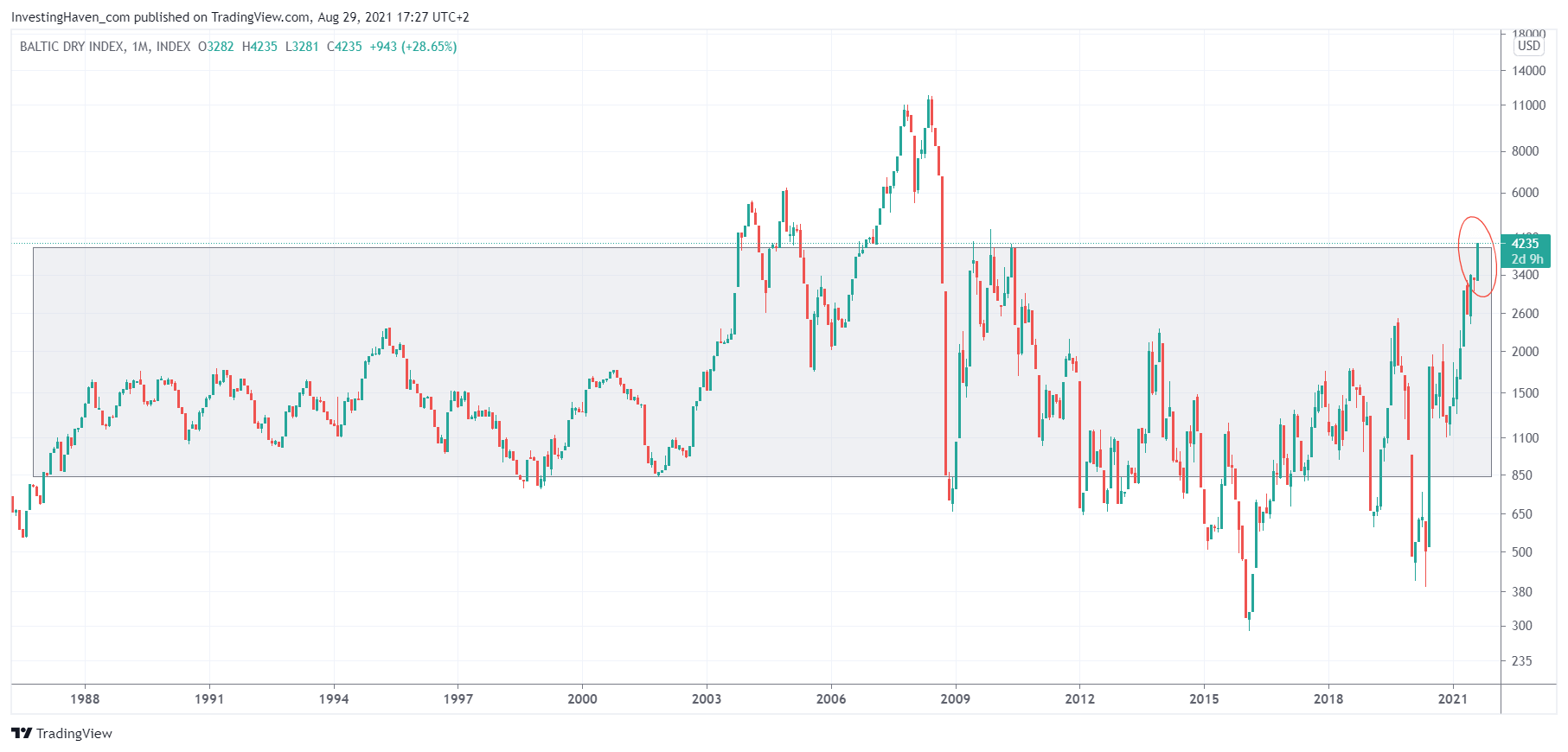

Here we have one of the few real bull markets this year: dry bulk shipping. Last week we wrote this about the Dry Bulk Index, the leading indicator for dry bulk shipping stocks:

The entire world is facing supply chain challenges. Products that need to be transported by ship are suffering post-Covid issues primarily congestion issues in ports. This pushes the prices of carriers higher, much higher, as evidenced by the Baltic Dry Index trend.

The Dry Bulk Index is now ‘breaking out’. Below is the up to date monthly chart, and the monthly closing price above the grey area may be the trigger for a parabolic rise in this index. Subsequently, dry bulk shipping stocks might go through the roof.

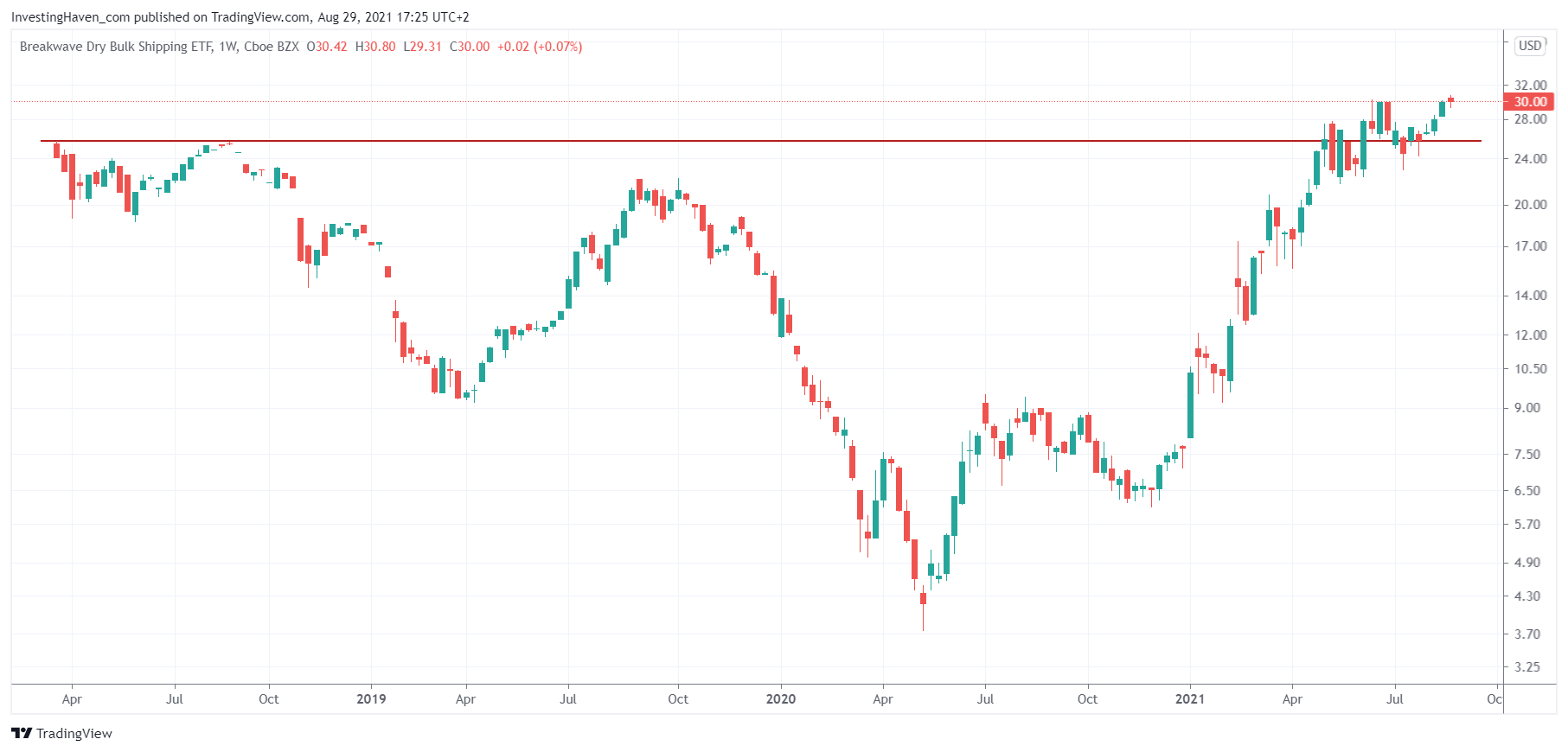

The breakwave dry bulk shipping ETF featuring dry bulk freight rates is confirming its breakout (3 daily candles above support).

In Baltic index logs sixth straight weekly gain on capesize strength we read “The overall index, which factors in rates for capesize, panamax, supramax and handysize vessels, gained 40 points, or 1%, to 4,235, rising for a sixth straight week, up 3.5%.”

In our Momentum Investing portfolio we noticed this trend and opened a 25% allocation in one dry bulk shipping stock. The chart, both daily and longer timeframes (weekly, even monthly) look spectacular. Our position is close to hitting 20% unrealized profits. Note though that unrealized results are just that: unrealized. Too many investors look at their daily P/L status, and they do themselves a disservice considering unrealized profits as a success and unrealized losses as a failure. We will be excited once we realize 50 to 70 pct profits on our dry bulk shipping stock, not sooner.