What’s the narrative in markets since January? For 6 full months it’s all and only about falling growth stocks (tech stocks, Nasdaq). The way the human brain works is based on associations. If the brain is exposed to the same message, for 6 full months (for close to 200 days) it is going to create a narrative. The ‘growth stocks down’ narrative is ingrained in the mind of 99% of investors. That’s why they miss the turning point. We are on record saying that the Nasdaq has gone through a turning point as explained in great detail in recent Momentum Investing alerts. Commodities are not the place to be but growth stocks will be the place to be in the next 18 months.

We are certainly not using financial media to come the above mentioned conclusion. It might be true that even financial media reported on the Nasdaq’s longest win streak since November. While this may be true, we started noticing this 3 weeks ago.

We noticed two things and reported this in the research shared in our premium services.

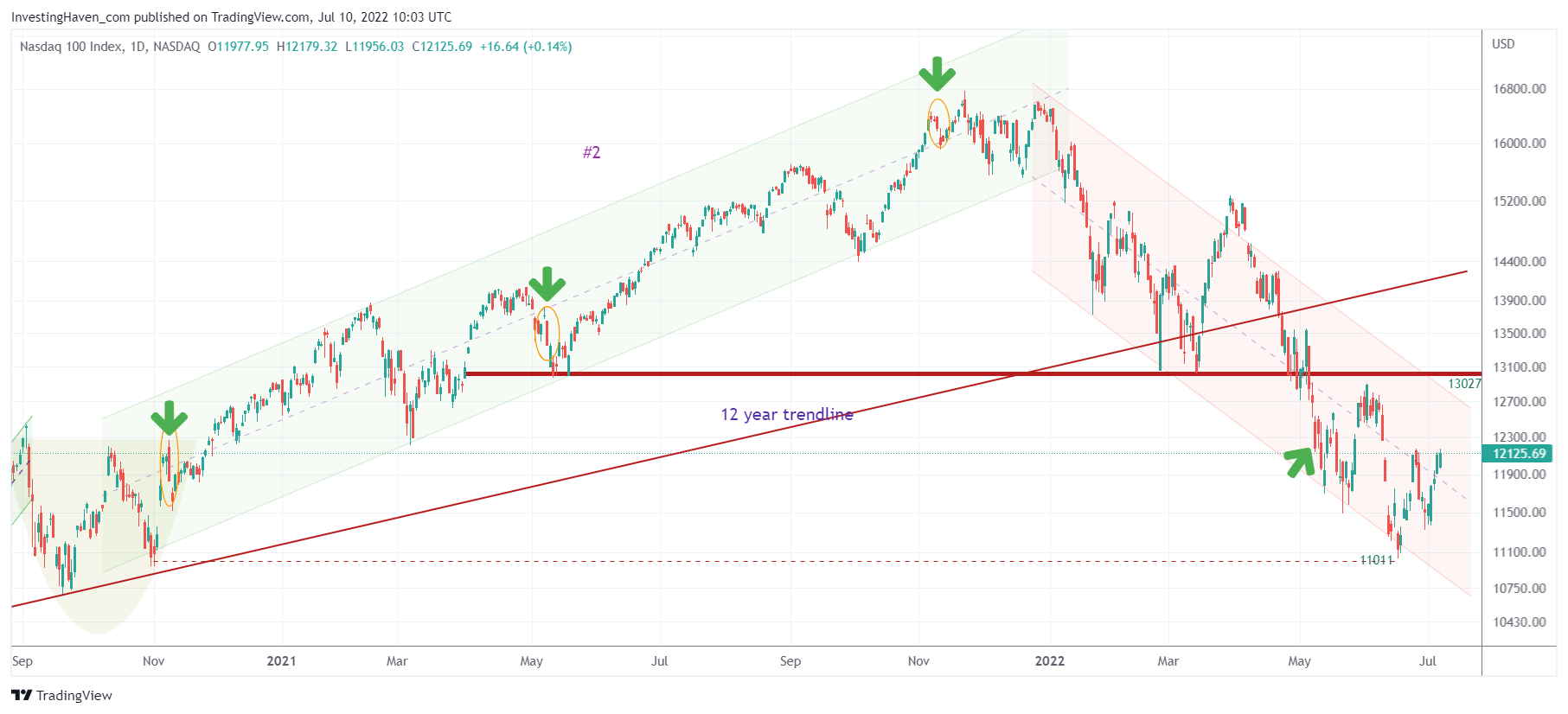

First of all, the chart of the Nasdaq came down to test 11,011 points a level that was tested a few days before November 9th, 2020, when the W reversal in the Nasdaq started resolving higher. It was a price point set on November 1st, 2020, to be price. For those that think in terms of time/price harmony, there is lots of price harmony and good reasons why the Nasdaq found support at exactly that same price level.

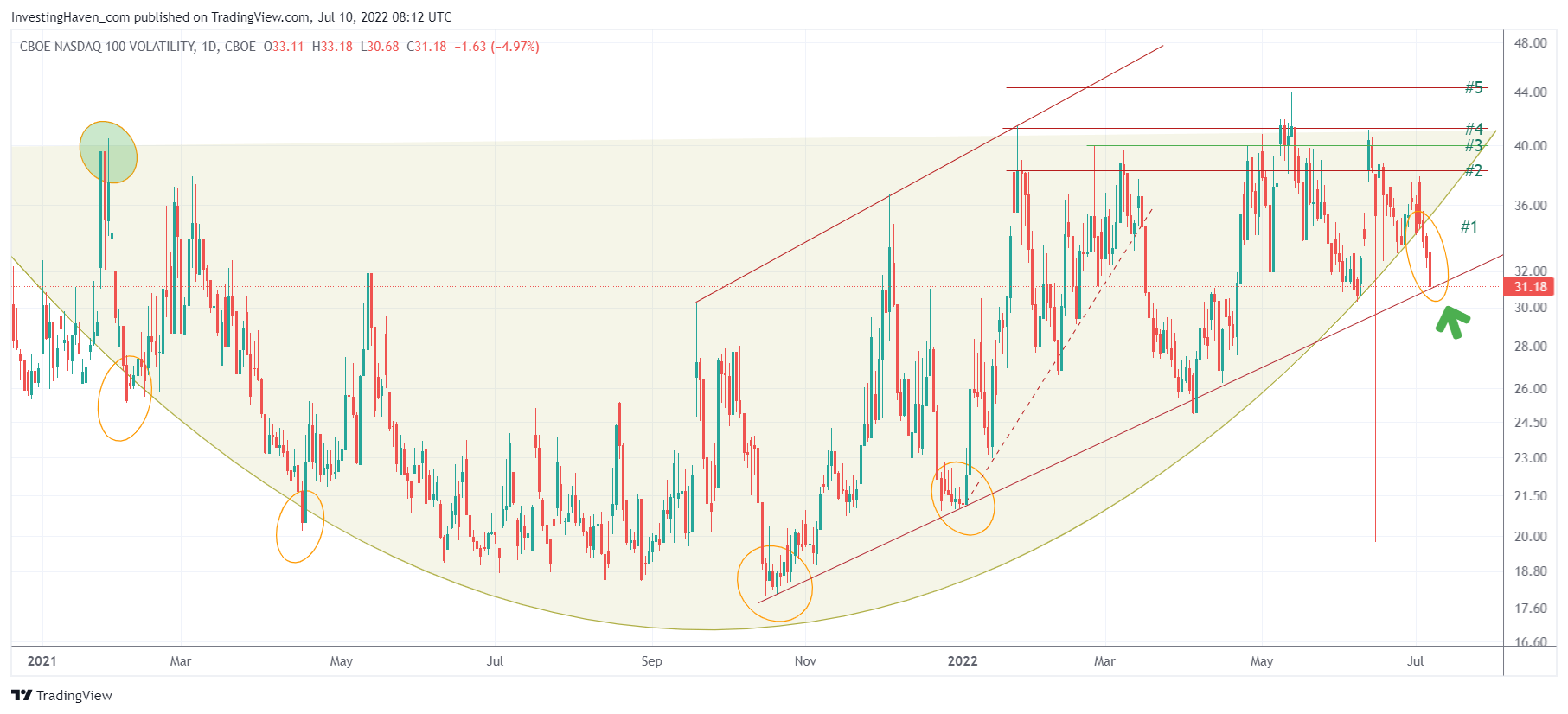

Second, in terms of leading indicators, as explained in great detail in How To Forecast The Nasdaq, the Nasdaq volatility index starting showing a topping pattern, already 2 to 3 weeks ago.

Look what happened last week: a breakdown of epic proportions.

Note that we feature 6 distinct volatility indexes in the research shared in our Trade Alerts service. The Nasdaq volatility index is just one of them. What we have found, over time, is that each of those 6 volatility indexes is dominant. It is a matter of finding the dominant volatility index and understanding its intention.

All this suggests that a bottom is set in the Nasdaq. Best case, this is not just a local bottom but a turning point.

In our Momentum Investing service we featured 3 stocks in one of the most promising sectors (please read the in-depth portfolio and stock insights published on Monday July 4th). All of them went up strongly last week, they are almost leveraged plays when compared to the Nasdaq index.