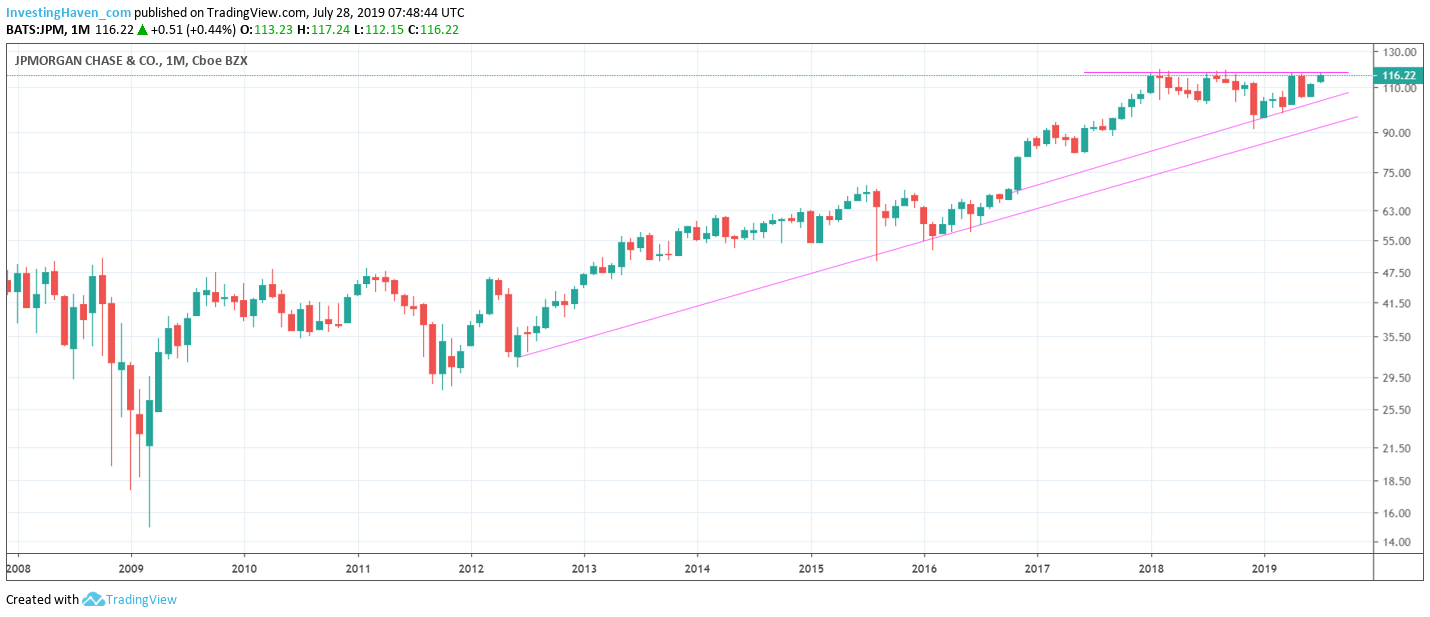

JP Morgan is a stock we do not cover often. In essence a banking stock with a $380B (!) market capitalization is not really the type of stock that will deliver great profits, right? Well, maybe this time may be different. There may be an evolution that is supportive of JP Morgan’s upside potential. We review both the monthly chart as well as the correlation with interest rates to understand if and when JP Morgan becomes an interesting target for investors.

This article is not meant to look at fundamentals, nor financials or JPM’s recent earnings beat.

We are interested in the message of the chart. As per our 100 investing tips:

The chart is crucial, and it is the most factual and data driven way to look at any market. That’s why we apply the ‘start with the chart’ principle. It means we first identify trends and opportunities in assets or markets based on chart patterns, only to consider this as green light to look into fundamentals and, when relevant, financials. So first the chart, then fundamentals.

The monthly chart, as per our top down approach, looks ready for an important breakout. No coincidence, JP Morgan was stuck in a sideways range since Jan 2018. This perfectly aligns with the ‘risk off’ cycle we identified as explained in great detail in Green Light For Global Stock Markets Going Into 2020 as well as Investing Opportunities: What The 2nd Part Of 2019 May Bring.

Because of this we fundamentally disagree with JP Morgan’s stock market crash call which they forecast for the next 18 months, even next quarter (see here).

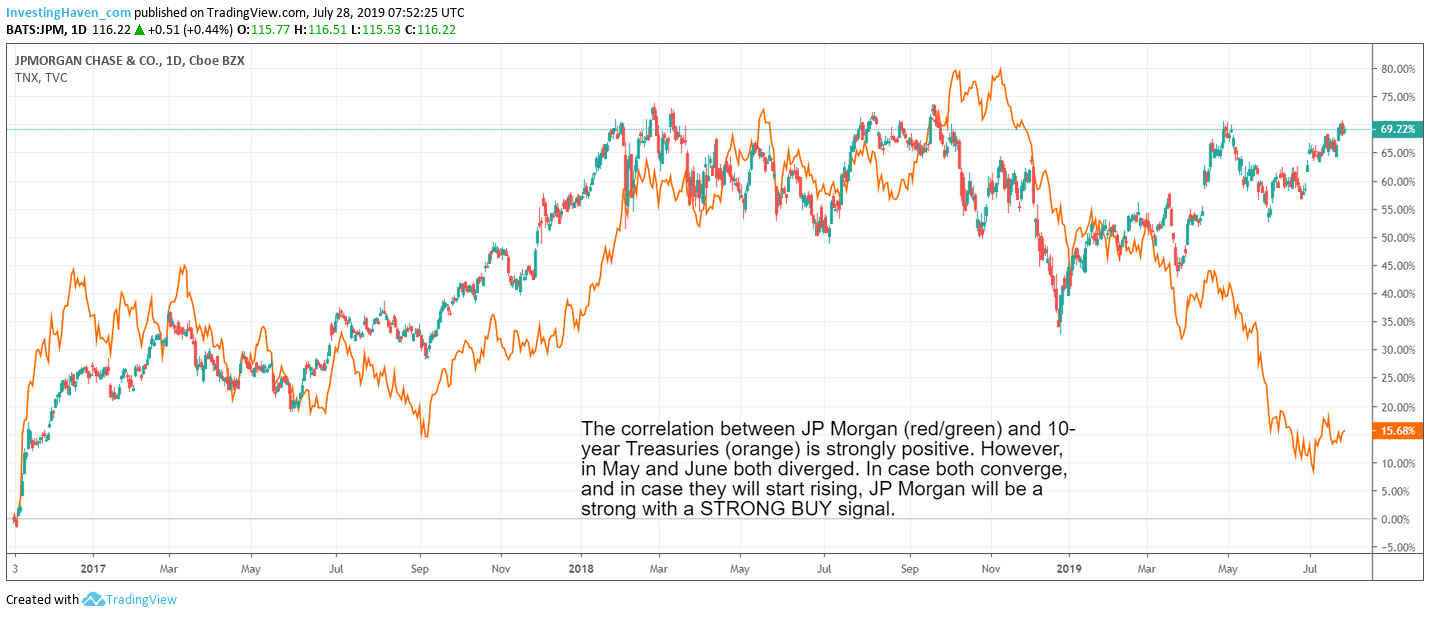

Where it becomes really interesting is when we review the correlation between JP Morgan (red/green) and 10-year Treasuries (orange) on below chart.

The correlation is strongly positive, obviously.

However, in May and June both diverged. This is rather exceptional, and suggests either the decline in 10-Year Treasuries was overdone, or JP Morgan has been rising for the ‘wrong’ reasons.

In case both converge, and in case they will start rising, JP Morgan will be a strong with a STRONG BUY signal. We closely monitor below chart before taking positions!