Our leading risk indicator, as per our 100 Investing Tips For Long Term Investors peaked a week ago. Surprise surprise, stocks have been struggling since then (not all stocks, some stocks, because the stock pick in our Momentum Investing portfolio is doing great so far). The question top of mind of investors: how much more downside is there in our leading risk indicator (EUR)?

If we follow up on our previous articles on this topic we want to highlight the most recent piece we wrote:

Leading Indicator Euro About To Make A Hugely Important Decision

The conclusion from this recent article:

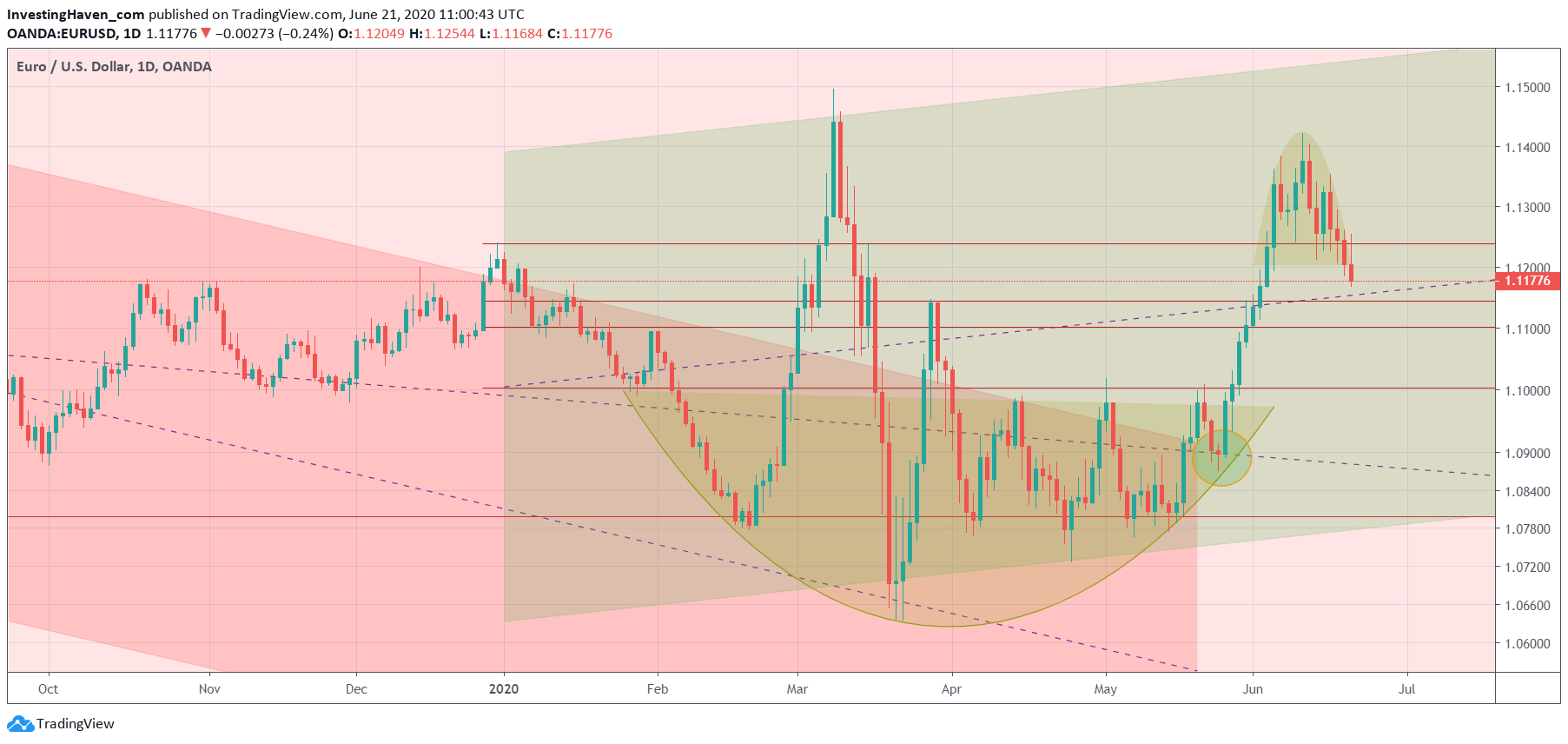

The most likely path of global markets is that the Euro is going to introduce a new RISK on wave, once the Corona crash aftermath effects start fading. The daily chart confirms this. We need Euro readings above 1.09 to know for sure.

So the 1.09 level in the Euro is an important level to watch because above this level we can consider markets to be in a ‘risk on’ wave. This underpins the ‘long’ thesis for quality stocks.

As seen on the daily chart, enriched with our own annotations, the Euro set a medium term top in the form of a reversal. This means that the Euro is headed lower now, which implies that risk sentiment is gradually becoming less ‘risk on’.

How far can the Euro fall, is the million dollar question?

As per our charting work believe there is solid support around 1.10, very solid support. The downside is limited, and consequently the ‘risk on’ wave should not suffer too much.

More importantly, when it comes to the longer term Euro trend, we believe the above is happening in the context of a longer term uptrend.

More importantly, when it comes to the longer term Euro trend, we believe the above is happening in the context of a longer term uptrend.

As said The Euro Could Trigger Strong Momentum Into Commodities in 2020.

This bullish Euro trend is happening in the context of a secular downtrend. As long as the Euro remains below 1.20 it remains in a (very) long term downtrend. This means that RISK ON cycles don’t last very long (not more than 1.5 years).

We will focus on the best performing commodities in our investing portfolio, particularly the precious metals market.

Do you like our analysis? You can follow our work with our look-over-the-shoulder investing method and strategy as per our Momentum Investing service. We tend to take one commodities position next to a technology position. Moreover, on the short term timeframe, we apply a proprietary method with short term trading signals in the S&P 500 which delivered +80% so far in 2020.