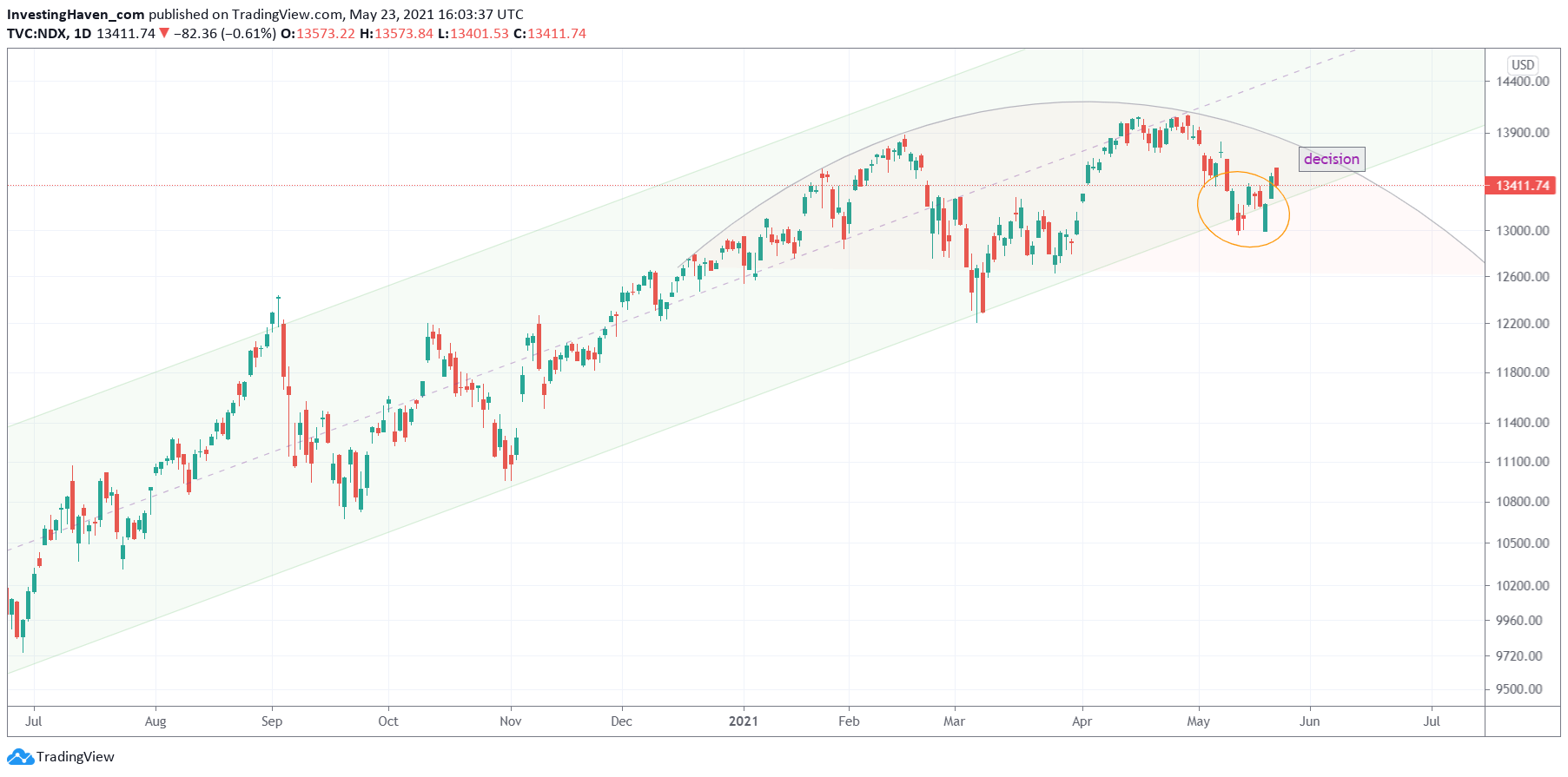

The Nasdaq is close to enter a decision window: a strongly bullish or strongly bearish outcome will be there in the first week of June. We have a hard time forecasting whether the Nasdaq will resolve higher or lower. All we can do, right now, is manage potential tech positions as we work towards our forecasted timing.

The reason we believe the first week of June will bring clarity for the Nasdaq that is consolidating for almost 4 full months now… is the chart.

As said the chart has lots of info, and the best leading indicator of price is… price!

The Nasdaq chart has a bearish topping reversal that started in January of this year. As per our calculations the decision window of this rounded pattern is the first week of June.

On the flipside, it also has a solid rising channel that started in April of last year.

So as we combine both insights we see that the first week of June coincides with a support area of the rising channel. This means that the bullish case will come with a higher low against March and May. But the bearish case will be a triple top scenario.

Whatever the outcome all we can see is that any outcome will come with heavy buying vs. selling. So better be prepared for any outcome because the trend will be strong.

In our Momentum Investing portfolio we may consider a tech position, because many tech stocks have declined considerably in recent months. There are real bargains in this sector. We will not decide too fast though. In our Trade Alerts portfolio we may have a ‘quick trade’ in semis or any other tech ETF, provided tech moves higher in June.