The investor community has been spooked by high interest rates, a hawkish tone of voice of central bankers, a narrative about continuously rising rates. In doing so, many lost track of what we coined the “Productivity Mega Cycle.” Specifically in AI & Robotics, there are tremendous growth opportunities, offsetting the recent increase in rates. Based on the chart setups of AI & Robotics ETF’s, we predict that AI & Robotics stocks will outperform the market in 2024.

In our work, we focus on 4 mega cycles: AI & Robotics, silver, alternative energy, the broader lithium & EV space. In this article, we focus on AI & Robotics which is the opportunity that the investment opportunity associated with the Productivity Mega Cycle.

Productivity Mega Cycle

The Productivity Mega Cycle, a confluence of technological advancements and economic evolution, is reshaping industries. The core driver is the integration of AI and robotics, propelling businesses towards unprecedented efficiency. AI-driven automation optimizes processes, reduces costs, and enhances decision-making. For investors, understanding this cycle is not just about technology; it’s recognizing how businesses leveraging AI will outperform, making AI-centric investments a key component of their strategy and portfolio 2024.

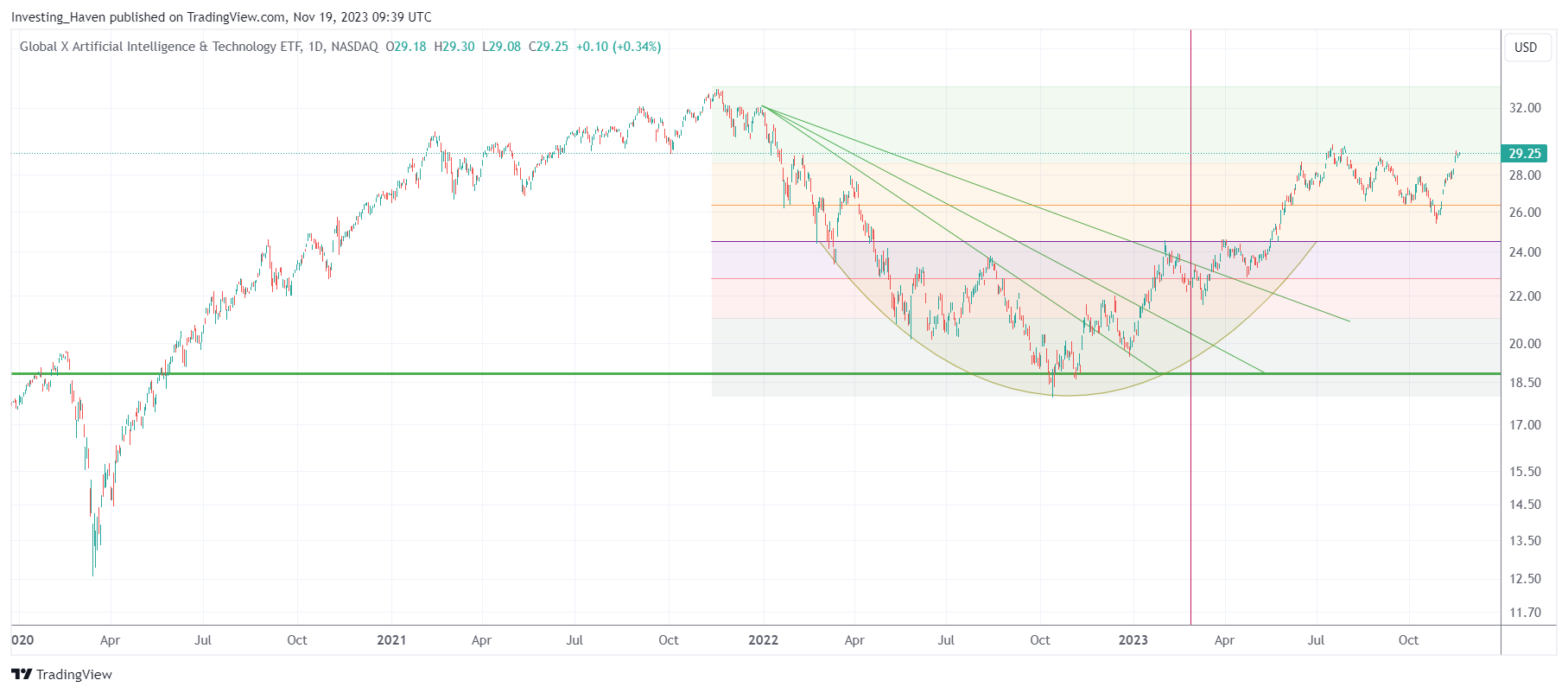

AI Technology ETF – bullish cup and handle (leading)

The AIQ AI Technology ETF’s formidable chart structure is more than a visual pattern; it’s a reflection of the market’s confidence in AI’s potential. This ETF, with a strategic focus on AI semiconductors like Nvidia and AMD, positions investors at the epicenter of AI innovation. The cup and handle reversal signify a brief consolidation before a potential surge, highlighting the need for investors to be part of this momentum. AIQ isn’t just an investment; it’s a stake in the companies driving the AI revolution.

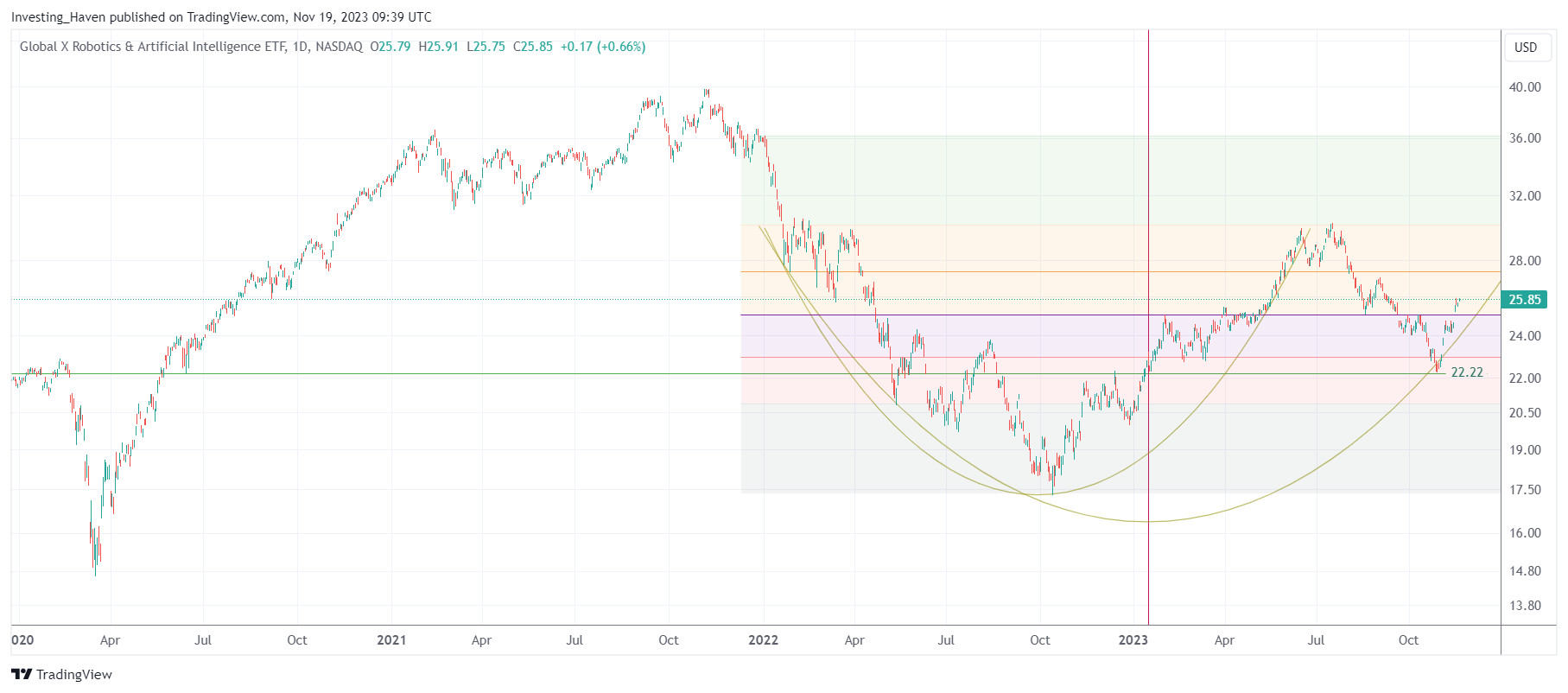

BOTZ AI & Robotics Sector ETF – bullish cup, handle underway (lagging)

BOTZ, while appearing to lag, presents a different angle for investors. The cup formation and the nascent handle suggest that opportunities might be ripe for exploration. Unlike AIQ, BOTZ has a diverse composition, potentially unlocking growth in untapped segments of the AI and robotics sector. Investors keen on getting ahead of the curve might find BOTZ an intriguing proposition, especially if it starts catching up, reflecting the broader potential of AI applications.

Implications for Investors

The Productivity Mega Cycle’s implications for investors are profound. Beyond the tech breakthrough and value offered by the technology, many (if not all) industries will be transformed. Recognizing the dual impact of technological growth and market dynamics is crucial.

AIQ, with its stability and emphasis on semiconductors, acts as a reliable anchor in an AI-centric portfolio. On the flip side, the lag in BOTZ hints at a different growth trajectory, offering a potential entry point for investors seeking diversity within the AI sector.

Conclusion: Productivity mega cycle & investment opportunities

The narrative for investors is one of portfolio positioning. The Productivity Mega Cycle is a secular trend, very powerful. It’s a force reshaping the world as well as the investment landscape.

In 2024, success lies not just in understanding technology but in anticipating how it will redefine businesses. A well-balanced portfolio, with enough exposure in AI & Robotics stocks, particularly representing companies with solid growth and healthy financial markets, is a crucial in any long term portfolio.

Do you prefer to let us do the hard work while you focus on other challenges in your life. Please consider our unique passive income service – create compound portfolio growth by outsourcing your trades.

Must-Read 2024 Predictions

We recommend you read our 2024 predictions as they are very well researched: