Rising rates is the big topic, top of mind of investors. While rates have been very strong lately, we continue to believe that rates have peaked. We think so despite the narrative and consensus view is that they will continue to rise. Rate-sensitive parts of the markets are in a strong buy area, simply because rates have set a multi-year high.

We recently wrote a few really important articles about the two topics that relate to this article: rising rates (influenced by rate hike expectations) and fragile markets.

Will interest rates move much higher, and, in doing so, will they break markets?

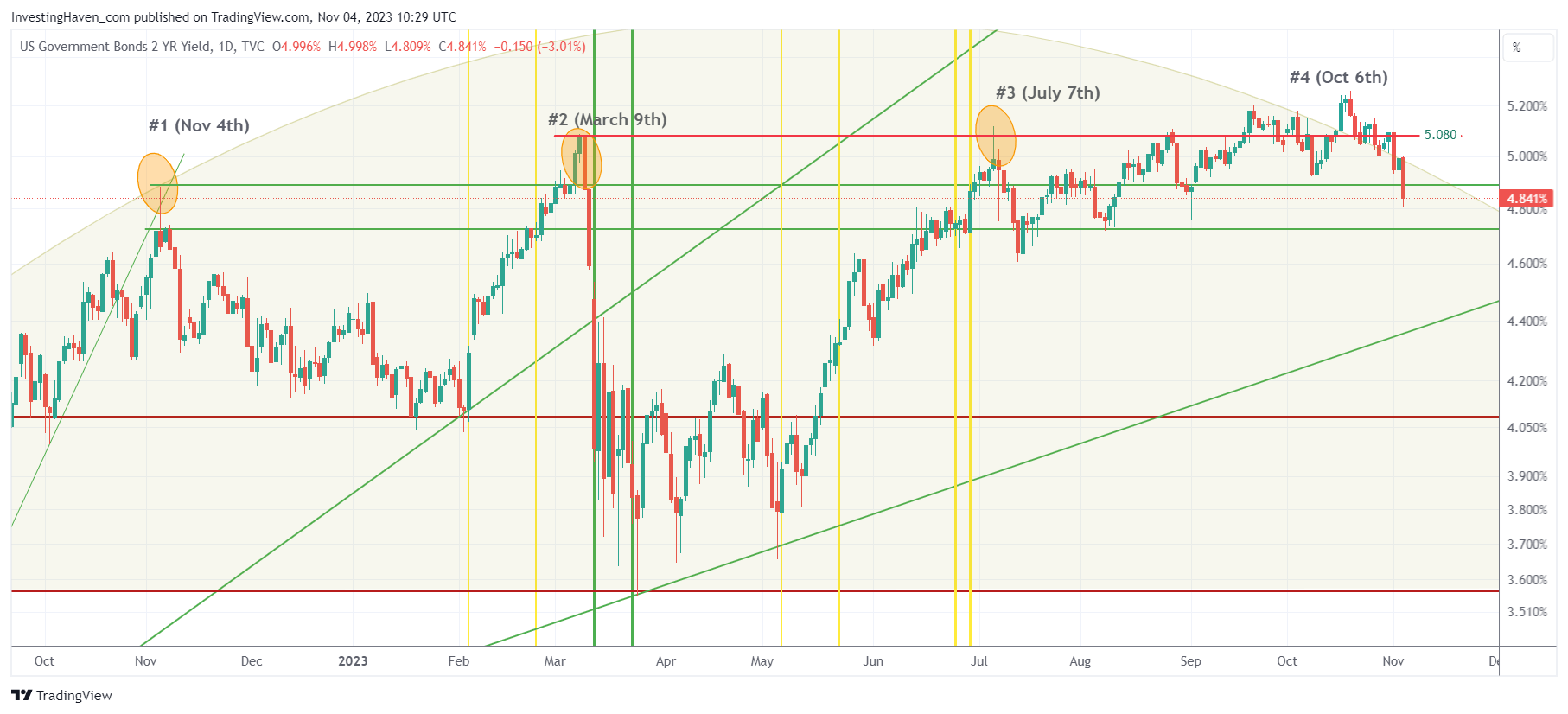

Our answer: In our humble view, rates have limited upside from here, especially 2-Year Yields which is the important one in our view. They will not break markets in the foreseeable future.

Will inflation continue to push markets lower in November 2023?

The short answer: No, inflation will moderate, with a significant decline expected in October’s headline inflation data, providing support to markets in November of 2023.

Can the stock market be bullish in November of 2023?

Our answer: We believe November of 2023 will be a bullish month for stocks, this is why: if the S&P 500 respects its rising channel, in the first week of November, it will imply that the probability of a bullish month of November will have risen exponentially. In that scenario we expect readings around 4666 in the S&P 500 around year-end.

How to know if stocks will (not) tank in 2024?

Our answer: The answer to the question “will stocks tank or even crash in the first half of 2024” can be answered by (a) leading indicator TIP ETF should not print more than 3 monthly candles below 105 points (b) volatility index VIXY should not print more than 5 daily candles above 27.2 points.

Rising Rates – A Consensus View

The ‘higher for longer’ mantra, originated by the Fed’s hawkish speeches, created a consensus view among investors.

Rising 2-Year Treasury (negatively correlated to Yields) seems to be an overcrowded trade as evidenced by the following statistic (courtesy of Bespoke Invest):

Traders are Short the Two-Year. Speculator positioning on the 2-Year Treasury as measured by the weekly Commitments of Traders Report (COT) hit its most net short level in the history of the series dating back to 1990 in the release as of 9/8/23. That means that futures traders are betting the yield on the 2-year will continue to go higher even after it has risen from 0.22% up to just under 5% in the last two years. (Source: CFTC)

What we do know, from history, is that the consensus trade mostly does not work out.

As said in one of previously mentioned articles, inflation is moderating. We wrote:

No, inflation will moderate, with a significant decline expected in October’s headline inflation data, providing support to markets in November of 2023.

In the meantime, we noticed the inability of 2-Year Yields to truly break out, and reported it back many times in recent weeks. The market now confirmed our expectations:

Should Investors Be Concerned for 2024?

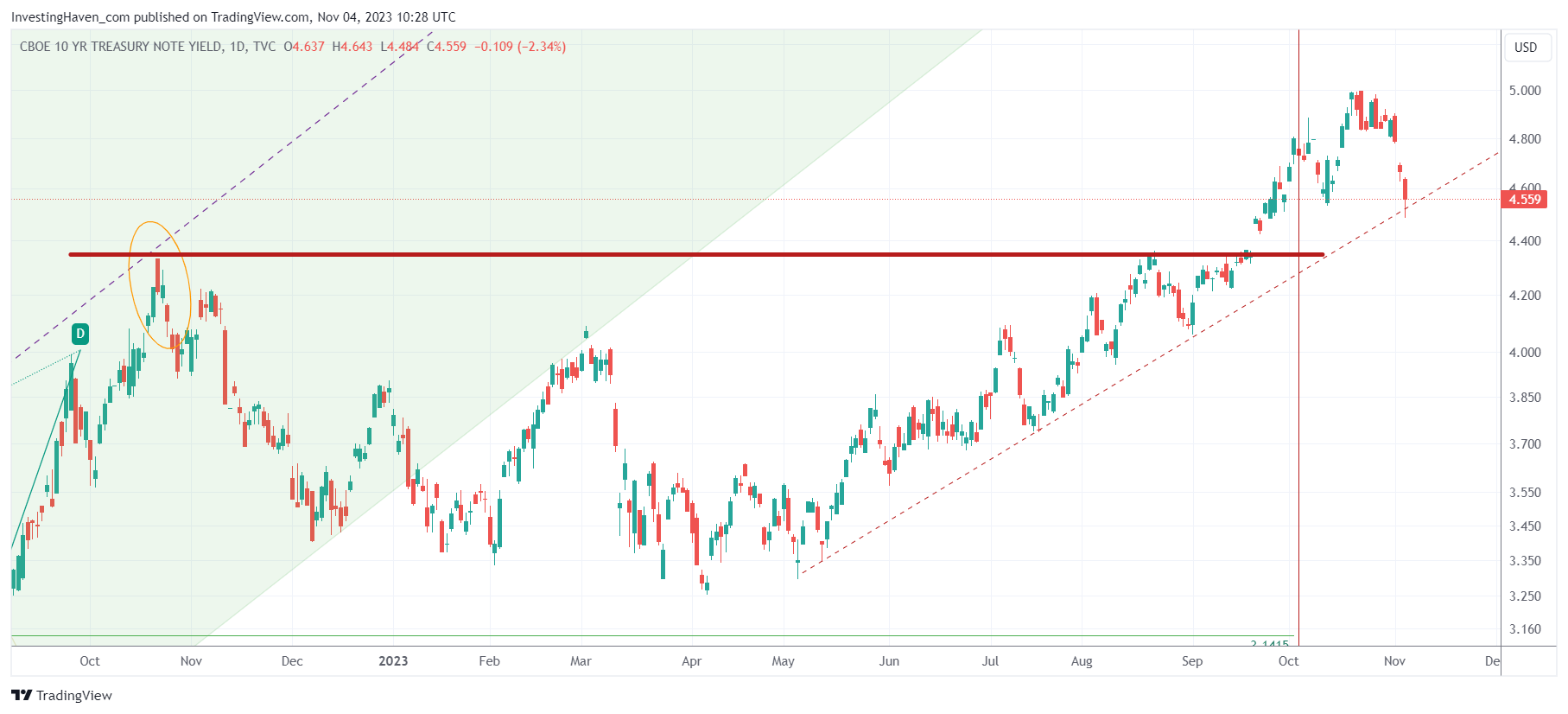

Moreover, and equally important, is the inability of 10-Year Yields to move above 4.99%. As seen on the next chart, 10-Year Yields touched their 6-month rising trendline. A break below 4.55% will confirm that (a) inflation has peaked (b) rates have peaked (c) stocks will do well throughout 2024 & 2025.

Enjoying our work? We provide weekly, detailed market analysis to members of our Momentum Investing premium service. As part of the service, we provide detailed sector coverage in AI & Robotics stocks, silver, lithium & graphite, alternative energy.