Energy stocks were hot in 2022. Many believe that they will continue to be among leaders in 2023. We don’t think so, not because of our preference nor because of fundamental analysis. We simply look at the chart and see a very tired XLE ETF. At the same time, we look at the tech sector, particularly semis stocks with the semis phenomenal weekly chart, and see the exact opposite. In line with our 2023 forecasts we see semis to be among the sectors that will be bullish in 2023.

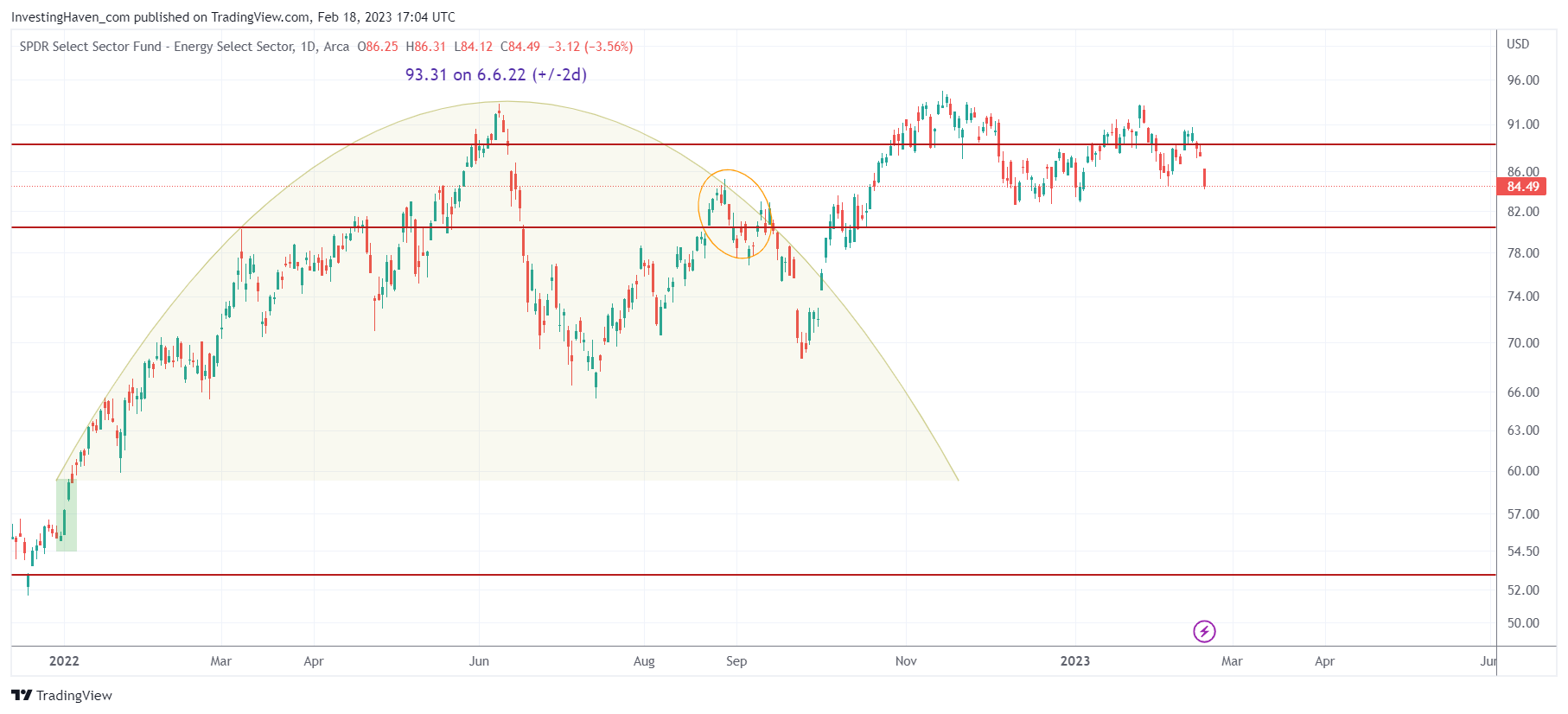

First, the XLE ETF chart.

Visibly, this chart is tired. It held up very well, right at the 2022 highs, but it is giving up. Unfortunately, there is not a lot of support below 82 points.

The odds favor a move lower, not necessarily a crash but just a pullback that might turn this chart too tired to break out to new highs in 2023.

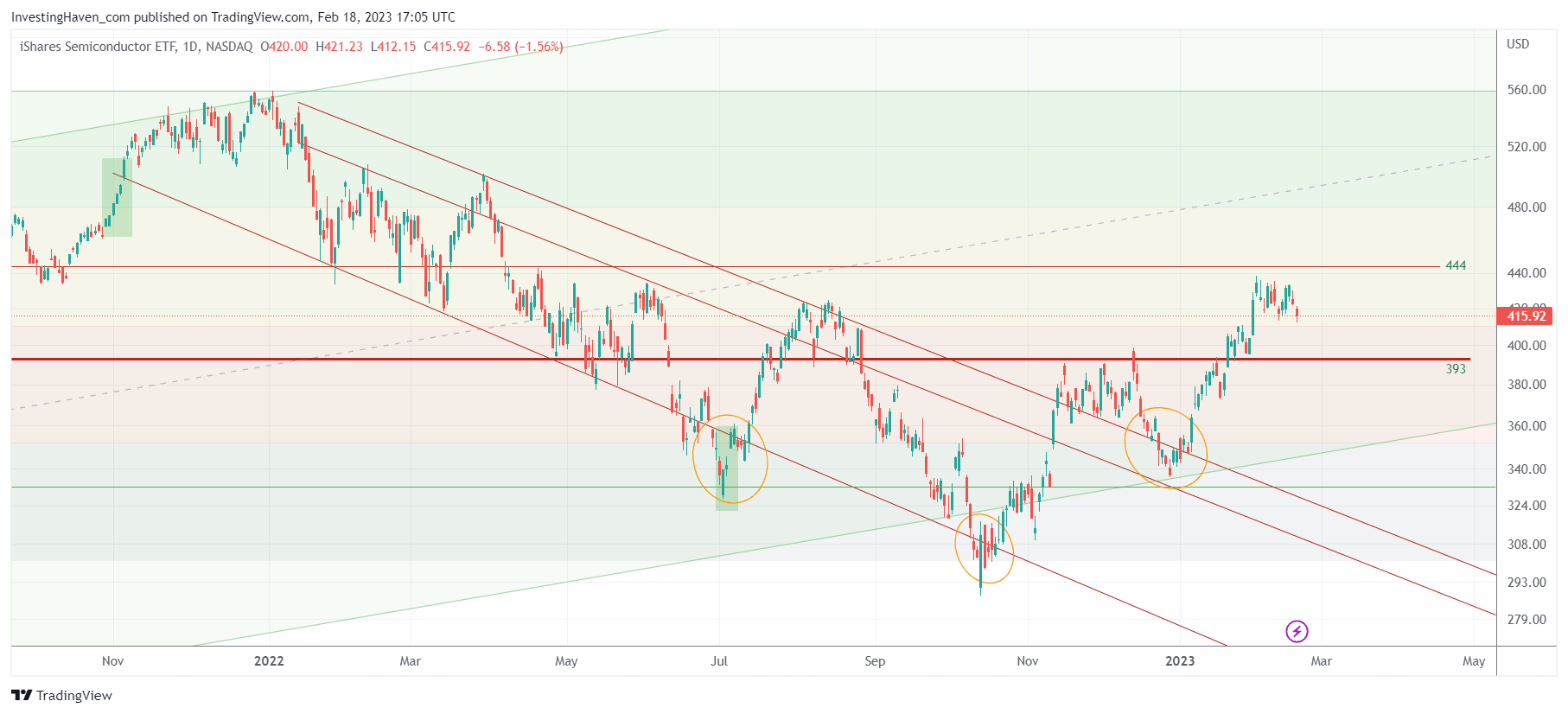

Next, the semis chart.

We see the exact opposite picture on the semis ETF chart. There is plenty of support in the 360 – 390 area. Moreover, we can clearly see an inverted head and shoulders setup in the making which is a bullish pattern.

We believe semis will have more upside potential in 2023 than energy stocks.

In our stock market investing service Momentum Investing we are preparing a special about artificial intelligence stocks. We will pick out 2 high potential tech stocks to buy in March, aiming for 50 to 100 pct upside potential.