Shopify’s stock price fell hard, very hard, in recent days. It lost 20 percent of its value in 3 trading days. Shopify’s stock price peaked at $232 on July 25th, and it closed Tuesday’s session at $181. Is this the start of a crash or a buy-the-dip opportunity? Let’s review InvestingHaven’s Shopify stock forecast for 2018.

Shopify’s drop is clearly linked to its quarterly earnings call. According to the company’s financial results published on Tuesday July 31st it appears that:

- Revenue: last quarter Shopify’s revenue came in at $245M, which compares to the quarter before (Q1) $214M and y-o-y $151M. An amazing growth if you ask us!

- Earnings: Shopify reported second-quarter adjusted earnings of 2 cents per share, a cent better than the same period a year ago and above analysts’ expectations of a loss of 3 cents per share, according to FactSet.

- Shares outstanding: What stood out in the CNBC report is the shareholder diluation: 10 pct new shares in the last 12 months, but, more importantly, is planning new offering of stock and other securities for up to $5 billion spread over the next 2 years which is significant compared to their $16B in market cap

Media of course were fast with their commentary. If we would believe their commentaries then Shopify’s stock forecast for 2018 would look bleak.

Bloomberg’s report with whom we only partially agree by the way says “The company itself has warned growth has its limits, and key metrics like gross merchant volume are beginning to show that. GMV was $9.1 billion in the second quarter, or 56 percent more than the same time last year. Still, that growth rate is significantly lower than the 64 percent the company reported in the first quarter of this year.”

The point about Bloomberg’s commentary is of course largely related to the nature of online retail which is very cyclical in nature: high selling season is November and December, simple as that. Shopify has a commission based revenue model (they charge a percentage commission of each sales of their merchants) on top of a fixed fee per store.

InvestingHaven is on record with a Shopify stock forecast for 2018

We do not trust commentary on financial sites too much. InvestingHaven applies a method which is based on the ‘start with the chart’ viewpoint combined with Tsaklanos his 1/99 Investing Principles.

What stands out, as part of the 1 pct of the news that matters, is that the new CFO of Shopify said “We’re confident in our overall business model to continue to produce growth,” she said “That’s what allowed us to increase our revenue forecast for the entire year.”

For tech companies the revenue increase is one of the most important indicators. Similarly, for Shopify’s stock forecast for 2018 and beyond, it is their revenue growth which is the catalyst.

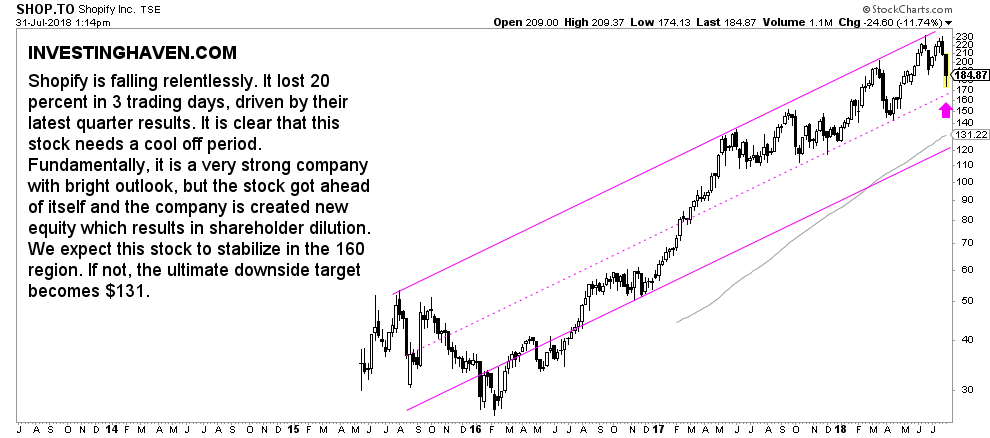

Moreover, and very important as a starting point, is the chart of Shopify. As seen below, we consciously choose to work with a monthly chart when doing forecasts.

Shopify’s monthly chart showed that the stock was inches away from its long term resistance right before earnings. That’s not a time to go long, on the contrary.

InvestingHaven’s reserch team interprets Shopify’s situation as follows. Fundamentally and financially, there is a strongly bullish aspect which is revenue increase which is offset against a bearish aspect which is the shareholder dilution. From a chart perspective, Shopify got ahead of itself, and is now retracing to the center of its long term rising channel.

Our Shopify stock forecast for 2018 is that $170 will provide strong support for the remainder of 2018. A consolidation might take place around that price level (primarily because of shareholder dilution) after which its stock price will continue its rise to the higher area of the channel (primarily driven by revenue growth and high selling season coming up). We believe that in 12 months from now Shopify will be trading at $250 (SHOP.TO which is the Toronto traded stock in CAD).