Markets feel uncertain and unpredictable, absolutely horrible for the vast majority of market participants. The one thing that keeps on coming up, across the board, is the idea that a really big market crash is underway. Over here, at InvestingHaven, we are not speculating nor selling banner ads by creating fear. Likewise, no conspiracy stuff over here. We are here, telling you, all our indicators suggest that NO big stock market crash is underway. Eventually, this market will crash, but not in 2022 and presumably not yet in 2023 (although our expectation is that by October of 2023 we need to be out of the market).

We look around us, what is that we observe:

- Consumer price inflation hits highs not seen since the 70ies.

- Horror scenes of mass human destruction in the form of a war that is completely useless.

- Central bankers attracting the attention of the global investor community that are able to dominate the direction of markets through their monetary policy decisions.

- Financial markets accelerating their trends: from 3 year trends to 3 week trends.

- Volatility that is not able to get back to ‘normal’ levels.

- The average stock that got decimated in the light of indexes hitting ATH.

Admittedly, these are not amusing times. At least 90% of market participants have portfolios that got beaten down in the last 4 to 12 months, especially in the last 4 months.

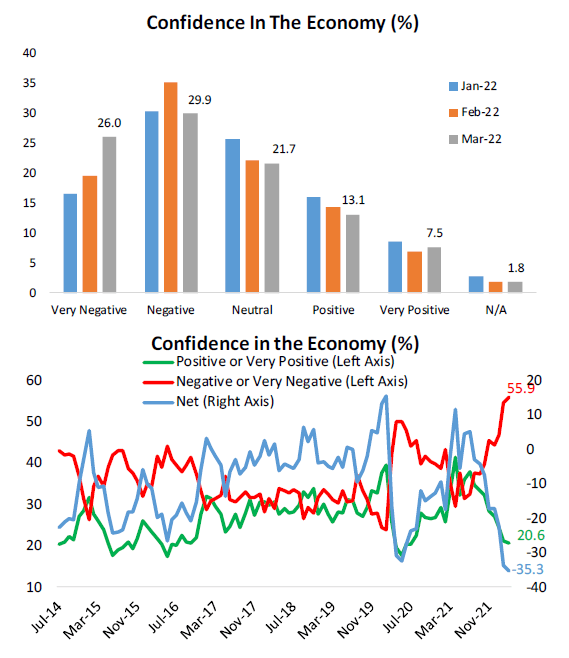

The Bespoke Investment research service published this ‘not so interesting’ charts showing the extreme level of negativity of consumers. The lower pane of the chart points out that fait in the economy by consumers is hitting multi-decade lows (the red line represents negativity which is why it’s hitting ATH).

What happens when all these trends are ongoing and accelerate over the course of 4 full months?

Indeed, total loss of confidence, which is what the chart above represents.

In times like these, it is important to get a few things right as an investor:

- Do not over-trade. Do not over-react.

- Stay focused on the bigger picture trends.

- Understand that good things start when it feels ugly. Likewise, bad things tend to start when it feels good.

- Be smart.

There is always a bull market somewhere. The question is where and when.

We are going to make the point that markets are not going to crash any time soon. Eventually they will, and as pointed out we expect a bad cycle to start in the last quarter of 2023 which is when a 3 year bullish cycle will be complete (it started on November 9th, 2020).

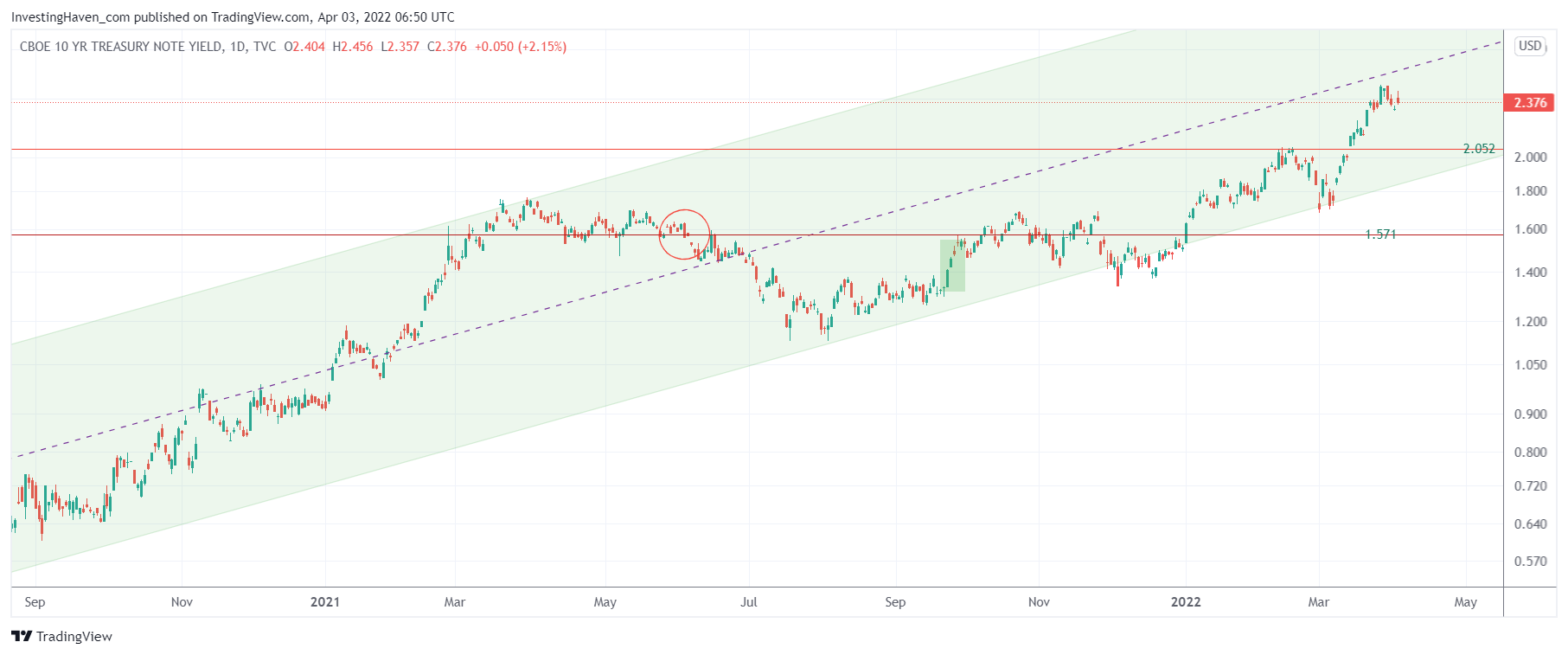

One leading indicator, which is bond yields, is rising strongly. This is not a condition for a crash, it’s a condition for risk assets to outperform defensive assets in the medium term (9 months out).

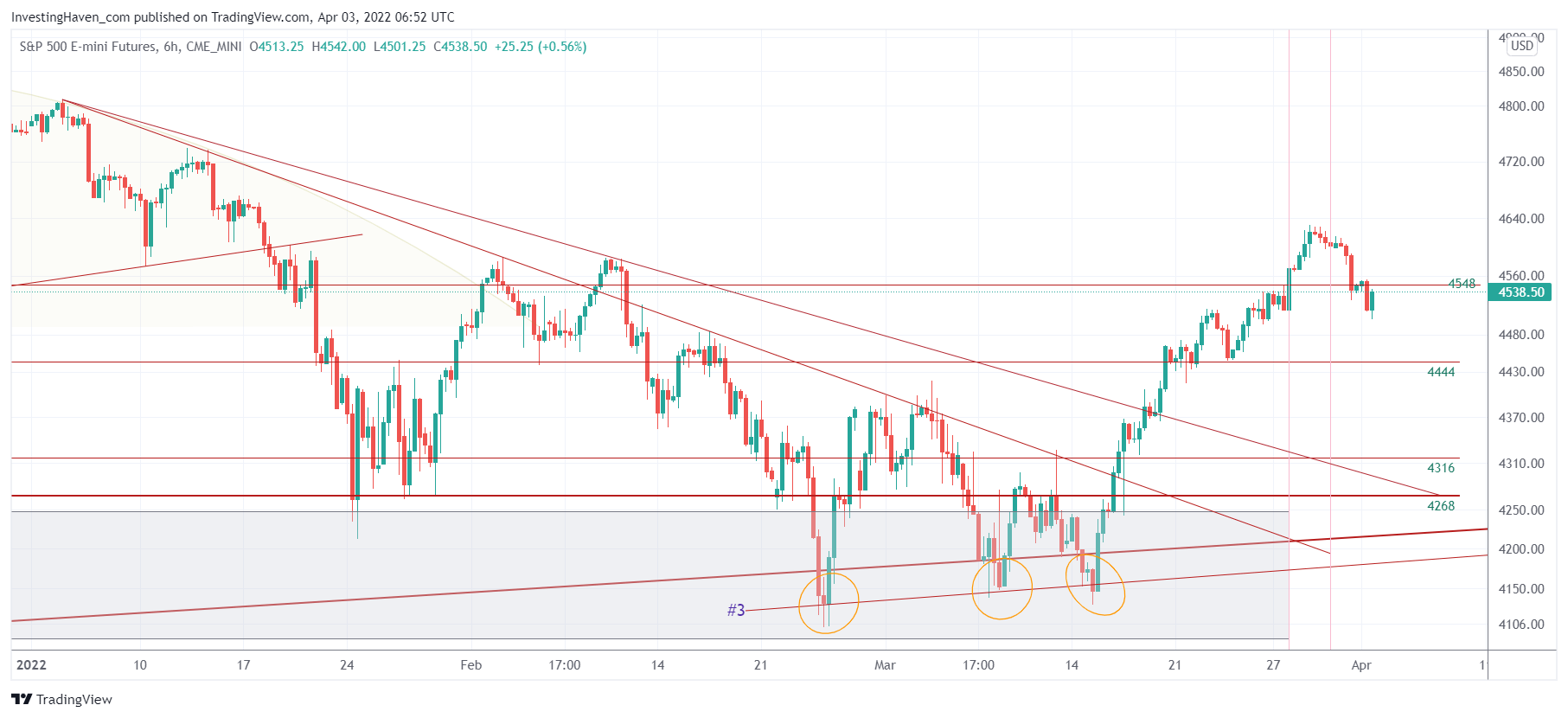

Another leading indicator, which is the S&P 500 chart structure, shows that a bullish reversal is in the making. Admittedly, the 3 week rise since March 15th needs a ‘cool down’ period of another few weeks. But, ultimately, the bearish period seems to be complete.

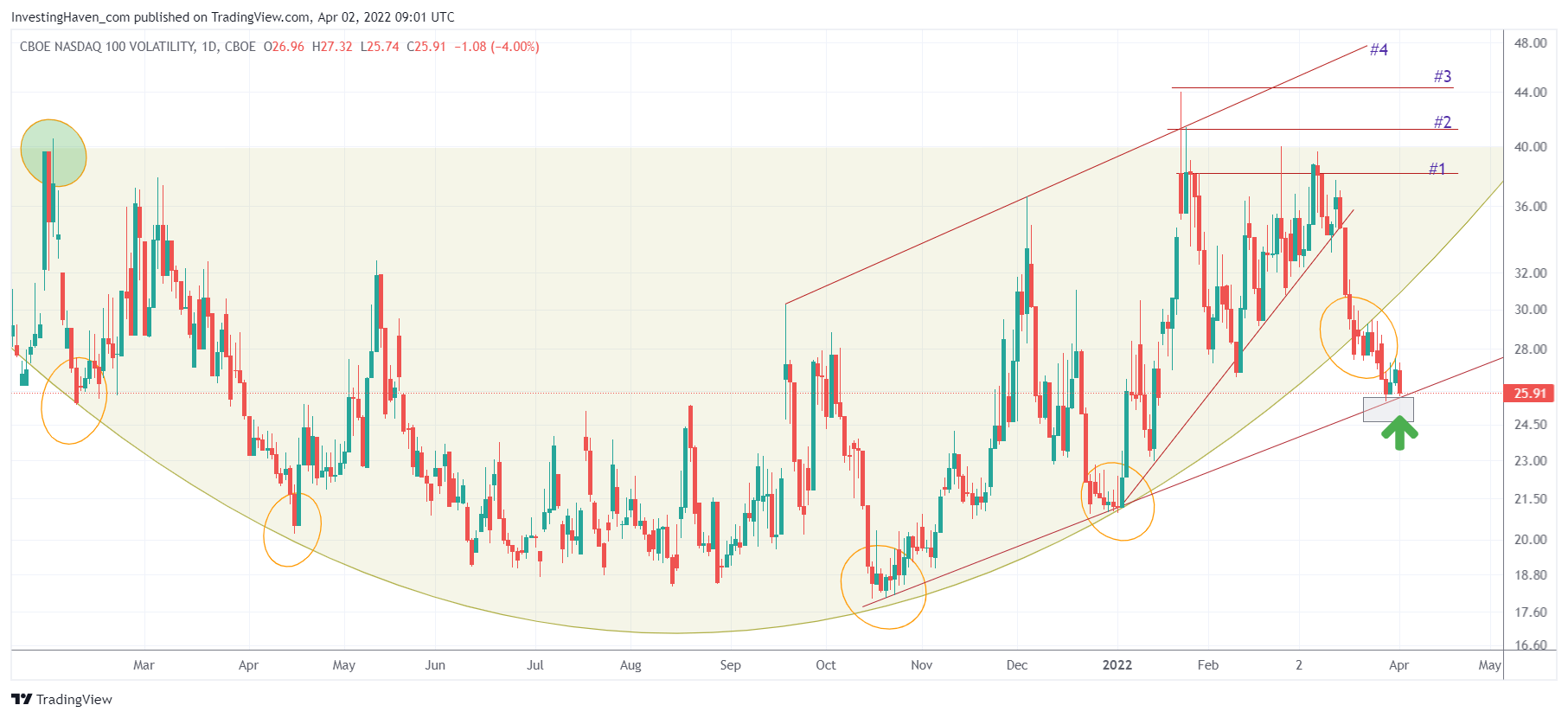

One more leading indicator, which is the volatility index of the Nasdaq, completed its bearish intent. From our Trade Alerts weekend alert: “The Nasdaq volatility index which was the driver of the recent sell-off (in fact, the driver of selling since mid-November) came down exactly to the point we indicated a while ago: the green arrow. There is only a real trend change in the Nasdaq (confirmed bullish trend) once its volatility index falls below this rising trendline indicated on below chart. Whenever this happens, we know for sure that markets resume their uptrend.”

All-in-all, our leading indicators suggest that the worst part of selling is over.

However, while this may sound like good news, we continue to see highly bi-furcated markets. Not all sectors will do equally well. Finding the right balance between patience, being able to spot the big trends and acting from time to time (for instance, having the guts to liquidate a position in a portfolio in order to hit a big trend) is what is required nowadays.

Moreover, some trends tend to last only 3 week trends, think the commodities boom in February. On the other hand, some over trends like green battery metals are multi-year booming trends with some heavy retracements.

In the end, considering all data points provided in this article, we could argue that this market is going to climb the wall of worry. Patience is required, a decent methodology to ‘read markets’ and spot mega trends that make you sleep well at night.

No big crash is imminent, on the contrary. A few volatile weeks are likely, but profitable trends are underway. Eventually, in some 18 months from now, we believe a really big crash will hit markets. That’s not now though!

Don’t be fooled by financial media and the endless stream of noise on Twitter.

Our premium services help you stay grounded. In our Momentum Investing service we have top notch analysis that helps stock market investors stay calm and focused on the trends. In our Trade Alerts service we are focused on trading the S&P 500 (we were profitable in Q1/2022) but also in silver. We offer fully automated trading on the S&P 500 in 2 distinct ways (if you send us a message we’ll offer you a 3 month trial period at a discounted rate).

PS/ We want to let our followers know that we sent a donation to charity, our first 2022 donation. Last year, we supported 4 distinct organizations focused on children. The organization we selected for our first 2022 donation was founded by one of our premium members: www.housetogrow.org.