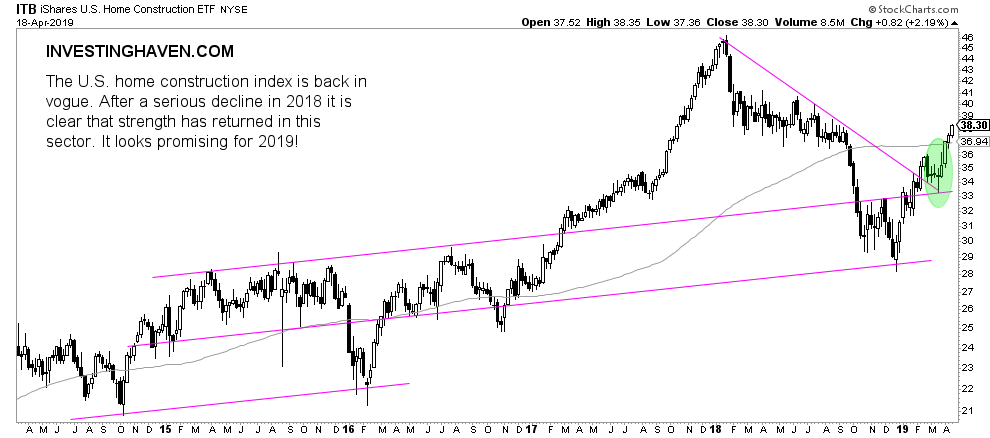

In going through our monthly ‘ceremonies’ and checking many hundreds of charts we noticed in the U.S. stock sectors section one very interesting setup. Particularly, the U.S. home construction stock market sector has a great chart setup. Interestingly, this move in U.S. home construction is the result of intermarket dynamics as per our 100 investing tips. Because of the fact that interest rates moved violently it created also violent moves in correlated markets, particularly U.S. home construction. Read on to understand what we mean by this.

Last year was a disaster for the home construction stock sector. The sector crashed some 40% in exactly 12 months.

Interestingly, as always, the sector came down to test its long term support. Is this coincidence that we so often see retracements find supporta at trendlines?

It isn’t of course. Markets work on a certain cadence, and more often than not there is a reason why prices rise or fall until a certain point.

The U.S. Home Construction index ITB ETF went from 28.50 points to 38.30 points in the first 4 months of 2019. More importantly, the ongoing rise looks like just the beginning. There is plenty more upside potential.

From an intermarket perspective this makes sense. A large part of last year was characterized by rising interest rates. Consequently, people take less loans to construct homes. Of course, veterans typically are privy to lower interest rates since they can use a VA construction loan for new home construction. As 2019 was all about falling rates, until a few weeks back, it makes sense that an overreaction in U.S. Home Construction on rising rates is now in the process of moving to a new balance.

U.S. Home Construction and interest rates are inversely correlated. Because of the fact that interest rates tend to rise and fall in a violent way it also implies that their correlated markets tend to move in a violent way. This is the type of opportunity that investors should benefit from.

Both the chart setup of ITB ETF as well as the interest rates direction do not really suggest that it’s time to sell as per Barron’s. We think otherwise.