The market is preparing for volatile month of June, likely to start next week already. Value stocks are signaling this. Are you ready for this?

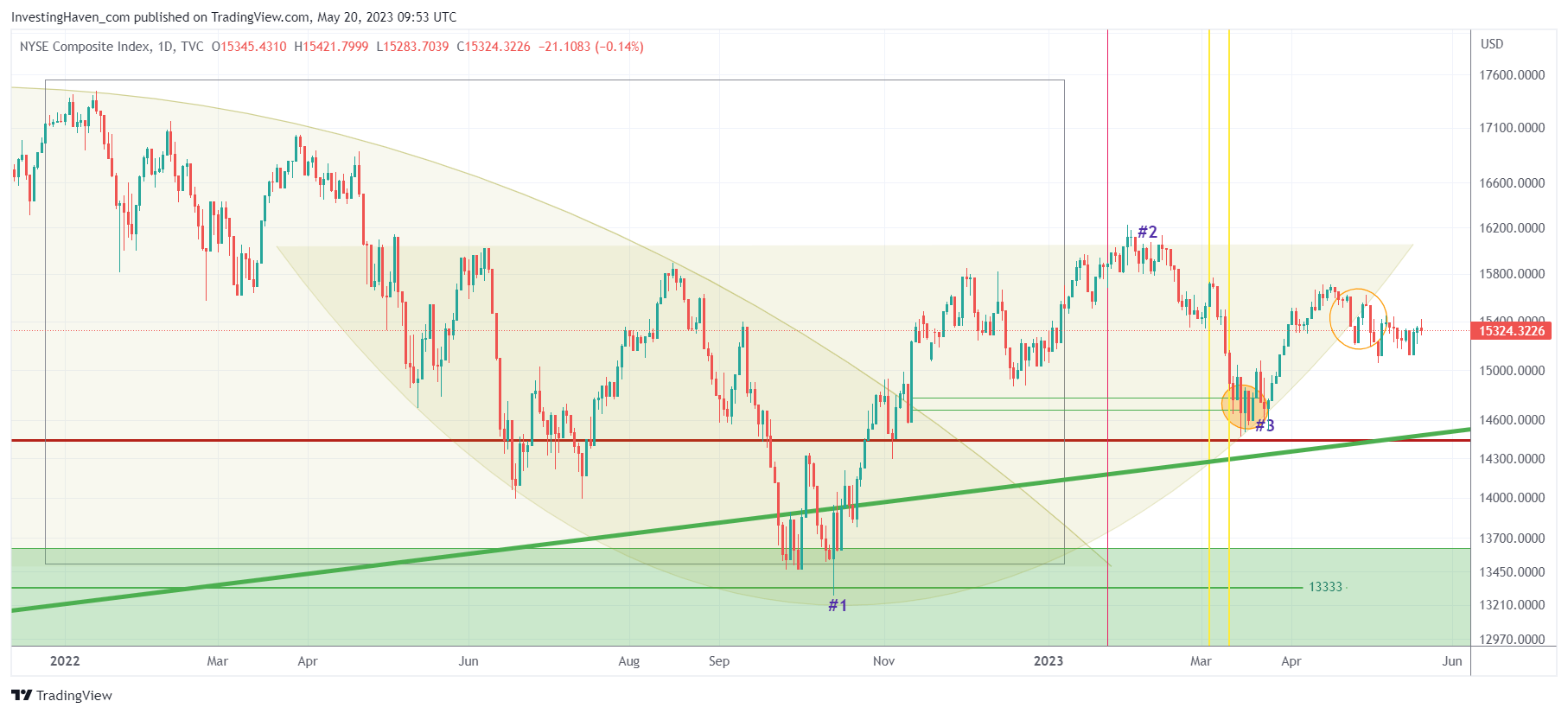

Here is how we used the NYSE Index, a crucial component of our methodology, since February of this year. Let’s play back what we forecasted, how it turned out (spot-on) and we believe is next!

On Feb 11th, 2023, we wrote A Reasonable NYSE Target For March of 2023 when the NYSE Index was trading at 15.8k points:

Our expectation is that a pullback to 14700-14900 is a real possibility, in the next 2 to 4 weeks from now.

Two weeks later, we wrote How Concerning Is The Recent Breakdown In The NYSE? when the NYSE Index was trading at 15.4k points:

It looks like our forecasted price target is now underway, it is going to take a little longer is what we start concluding. We need another 3 weeks to get there, the price target remains valid.

On March 12th, at the depth of the regional banking crisis, we wrote Markets Close To Touching First Downside Target when the NYSE Index was trading at 14.8k points:

We believe that the 14600 target will be reached next week. The market might overshoot this target, but selling should stop around 14400 in order qualify as an inverted head & shoulders pattern.

Three weeks later, on April 2nd, when the NYSE Index started a strong bounce after touching our target of 14400 points. The media was extremely bearish, we just enjoyed how the market did exactly what we predicted it would do: bounce at a specific price point in a specific week. We wrote The Financial Media is Not Your Friend – How to Avoid Getting Trapped.

Fast forward to today, we notice how they NYSE Index fell outside of its 12 month rounded pattern. In a way, as seen on the chart, it is in ‘la-la-land’ right now.

This setup implies that this chart (market) is vulnerable to a decline now. The higher probability is a move lower which is consistent with recent writings: This Leading Indicator Loses Bullish Structure, Now Very Vulnerable.

The NYSE Index is likely going to find a lot of support at the multi-year rising trendline, the one in green (rising, thick) on below chart. Interestingly, the level it will cross during the month of June will be the exact same level as during the March sell-off, at the depth of the regional banking crisis.

In other words, we believe that the NYSE will drop to 14.4k in June. It has the possibility to set a double bottom. As long as the thick green rising trendline is respected on a 3 to 5 day closing basis, the outcome will be bullish.

Did you reach your saturation point when it comes to the indecisiveness of this market? Are you fed up reading conflicting messages and doomsday predictions? You might want to consider our auto-trading service, you completely outsource the trades, we only trade the S&P 500. We introduced a new 6 month offer. More about our auto-trading service >>