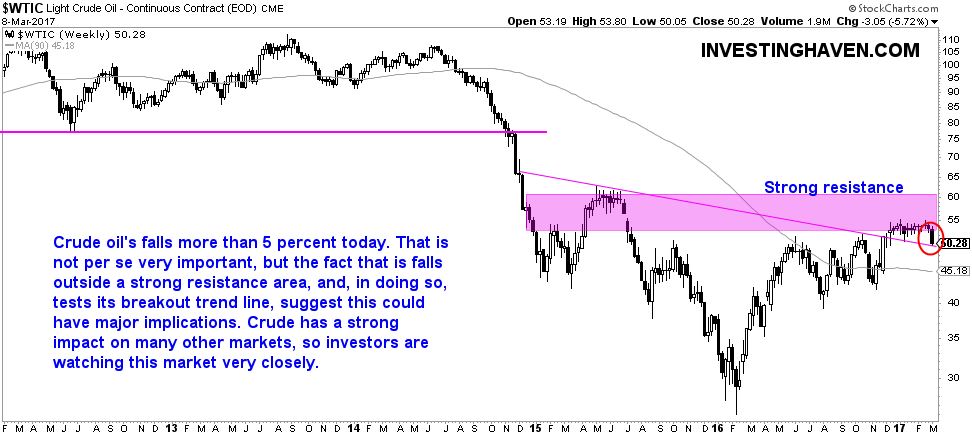

Crude oil fell more than 5 percent today. It closed the trading session right above $50 per barrel.

InvestingHaven’s crude oil forecast for 2017 was rather neutral, certainly not very bullish nor very bearish. “Our expectation is that crude oil prices in 2017 will not move up to area 1 (above $90) and will not collapse into area 3 (below $30). By exclusion, we predict that crude will trade mostly within area 2 (between $40 and $60- throughout 2017.”

The fact that crude oil fell 5 percent today is not the major news. By far the most important piece of information for investors is (1) what happened on crude oil’s chart (2) what happened in other markets.

First, crude oil’s collapse is a sign that it cannot break through resistance. THAT is important news, also because it is now testing a breakout trend line. If $50 does not hold, crude’s short to medium term outlook will be very bearish.

Second, intermarket dynamics are a very important pillar of InvestingHaven’s methodology. The fact that crude oil falls right at a time when yields are rising along with the U.S. dollar is a second very important piece of information. The point here is that we see a first sign of rates which are rising too high too fast. As explained in 4 Amazing Safe Haven Charts for March 2017, this flight to the dollar could result in turmoil in markets.

Rising yields suggest ‘risk on’, and that is confirmed by falling prices in gold and the Yen. But if yields would rise too high too fast, it would be counter-productive as the dollar would be rising too fast as well (and that is always a tricky thing). We already get a first sign today from the crude oil market, a risk and inflationary asset, which fell sharply.

Our point is that sharply rising yields along with a strongly rising dollar could bring turmoil in markets. Investors are seemingly not fleeing to safe havens like gold and the Yen. They could also quite stocks and other leading commodities. In other words, this trend could be setting up for a very unusual trend in markets, one that most investors would not expect and certainly not understand.

Most investors are focused on mainstream financial media which is focused on a classic storytelling format to bring ‘interesting’ stories. For instance, this article ‘explains’ crude oil’s plunge based on production data similar to this crude oil price article on CNBC. Business Insider took the same path in this crude oil article. While we are not challenging the data in those articles, we make the point that investors should focus on other data points for decision making. Story telling is good for marketing, but not for investment decisions.

Today’s market setup could be a first warning sign. In order to get more clues on new market trends, we closely watch what stock indexes combined with crude oil will do in the coming days and weeks.