Three months ago we identified the Top 4 Agricultural Stocks Worth Considering To Buy In 2018. This selection was based on the observation that the agricultural commodities space was heating up. In recent weeks, agricultural commodities have weakened strongly, and it seems appropriate to revise our former thesis. What is our outlook for agricultural commodities going forward in 2018?

From a market perspective we believe that commodities are being influenced by strength in the USD in 2018. So one of the key indicators for the agricultural commodities outlook for the remainder of 2018 is how the USD will perform, and that is not sufficiently clear at this point. There are attempts of the USD to break out, but there is also rejection at breakout. It is wise to wait for a confirmation of the next trend in the dollar.

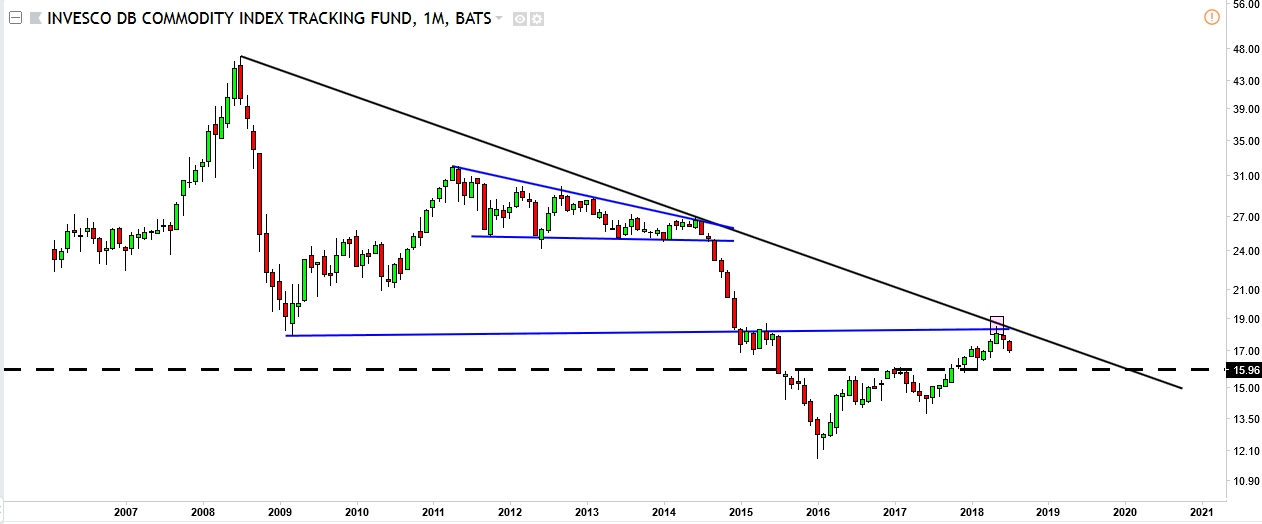

As seen on the first chart the commodities index got rejected last month right at a major breakout attempt.

Agricultural commodities outlook as the sector is breaking down in 2018

Within the agricultural commodities space we see a couple of important observations, and we focus first on the leading ETF in this space. This chart, and the patterns on there, largely determine the outlook for agricultural commodities in 2018 and beyond.

The PowerShares DB Agriculture Fund is an index fund that seeks to provide investment results corresponding to the DBIQ Diversified Agriculture Index Excess Return, its underlying index, in addition to any interest income generated from the fund’s holdings in U.S. Treasury securities. To achieve its investment objective, the fund primarily invests in futures contracts on agriculture commodities included in its underlying index. DBA uses a rules-based methodology to roll its futures contracts as they approach maturity, in an attempt to minimize the effects of contango.

As per the World Bank report last year, the outlook for agricultural commodities in the first part of 2018 was indeed bullish. Also Rabobank’s research team subscribed to the bullish thesis.

All agricultural commodities futures are getting hammered. Some are trading at major support, others are falling through support (breakdown).

Palm oil futures are trading at major multi-decade support:

Coffee futures are also trading at multi-decade support, and have even broken down from the series of higher lows which started in 2013:

This chart zooms in on the recent triangle pattern, and it shows how critical current price levels are!

Soybean futures are falling through multi-decade support:

Corn futures are near major support:

Agricultural commodities stocks: grim outlook for the 2nd half of 2018

As a result of the bearish energy in this market several agricultural stocks are getting hammered.

Look at MGP Ingredients which is flirting with breakdown:

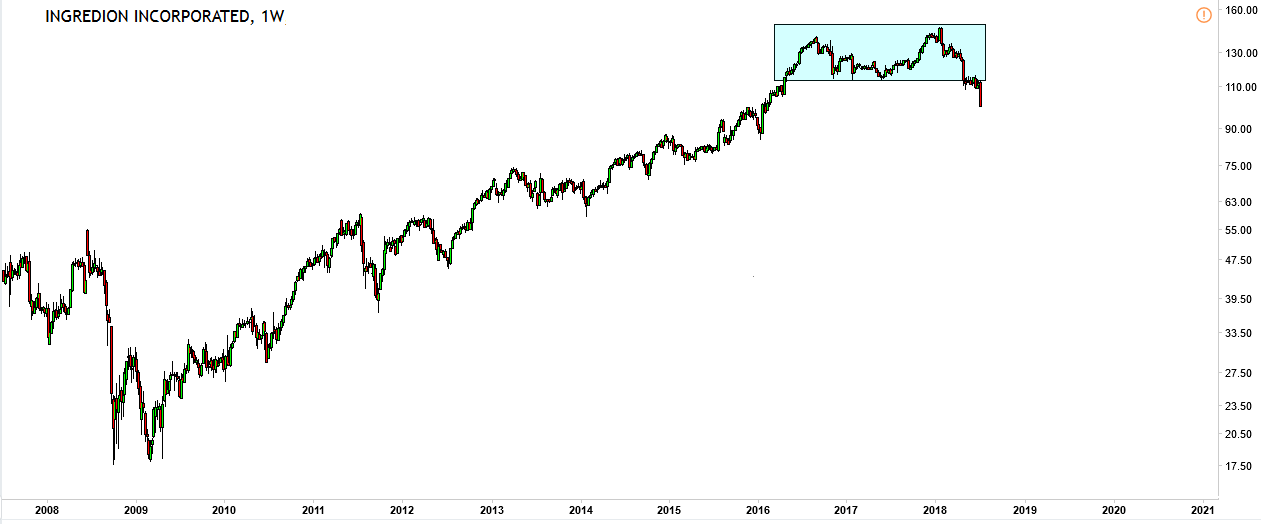

Ingredion has fallen through support, big time:

Green Plains is testing major support:

Conclusion on agricultural commodities outlook for 2018

The conclusion is simple: the USD must weaken at this point in order for agricultural commodities to come back in their bullish trend. It is not too late yet, but this should really be the end of the bearish wave in agriculture otherwise a serious breakdown will be following in the second part of 2018.