Why would anyone be concerned about the stock market in Brazil? It is not a leading stock market, it is not a leading economy in the world … so why bother? Very simple, says InvestingHaven’s research team, Brazil is part of the emerging stock markets that will outperform global stock markets, and Brazil has a great setup. So the Brazil stock market can be very profitable to investors in 2018.

How simple can market analysis be, right?

Wrong, because we explicitly started with one of the many misconceptions. Many investors do not care about a country like Brazil for all the wrong reasons in the world. The Brazilian economy is not able, their political situation is not reliable, they did not participate in the G20 summit last summer. Oh, and here is the latest and greatest reason to avoid Brazil: Standard & Poors did downgrade the country because “its long-term credit rating because of “slower-than-expected” changes by President Michel Temer’s government” says BusinessTimes.com.

Imagine this, the well respected Standard & Poors downgrades Brazil, and InvestingHaven’s research team says the Brazil stock market is wildly bullish in 2018, so investors better add this to their portfolio. How can this sound reliable or even real?

It is very simple. In fact, it is much simpler than anyone can imagine. There is a very small number of data points that are relevant for investors, and only those ones do matter. In the case of Brazil:

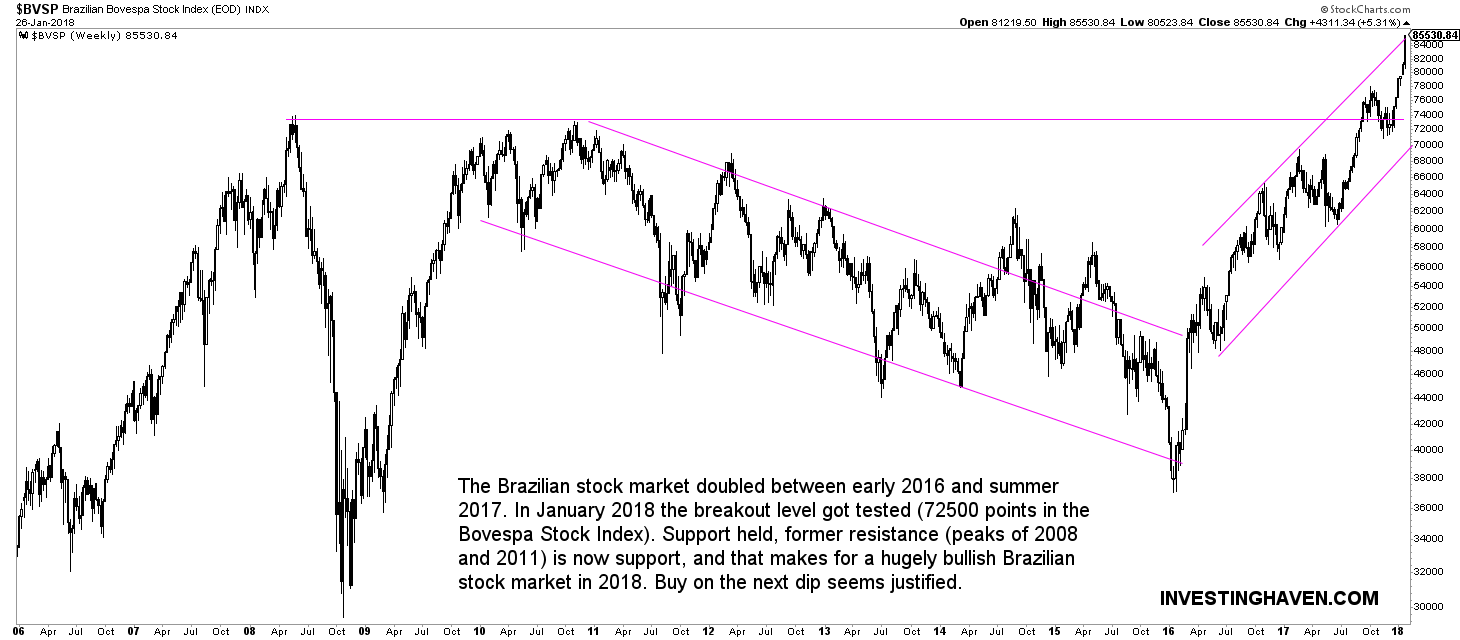

- The chart of the Brazilian stock market looks amazingly strong!

- It is part of a larger trend which is a raging bull market which started only last year as explained already a year ago in Emerging Markets Will Be Strongly Bullish In 2018 and confirmed very recently in It’s Official Emerging Markets New Major Bull Market In 2018 Is Now Confirmed

- The underlying fundamentals of the economy of Brazil are improving drastically based on top line growth, as explained in this CNBC article as well as reported by Reuters (consider this the 1% of news articles that have some value for investors).

As explained in our article 5 months ago, the Brazil Stock Market Impressive Breakout did already take place. Moreover, as important, we wrote this back then:

This is a great example of how the economy follows the market, and that is reflected in recent news items about the Brazilian economy. People sometimes tell us that we are too focused on charts which may be true but not a problem. The market is the leading indicator for the economy, at least most often. So staying focused on the charts is not only good for neutralizing your personal emotions it also has a fair chance of giving you leading data.

Investors focus on the wrong things. They read as much as they can, they look at so many data points that, in the end, they get so confused that they do not know what to make out of it.

The chart is the primary indicator for any market. The higher level trends (e.g., industry-wide or country-wide or regional level trends) should be in synch. A couple of fundamental data points need to be in synch. All the rest is noise. Even a lot of fuzz about Brazilian Stock Market Crash last year does not matter (the Brazil stock market fell 17% in one week and it created a lot of anxiety which may or may not be relevant depending on the setup and context).

InvestingHaven is on record saying that the Brazil stock market will be bullish in 2018 based on 3, and only 3, data points (one of which being the chart of the Bovespa embedded below). The current setup looks overextended, so a pullback is likely to take place anytime soon. Any dip is worht buying. An easy way to ride this bull market are high volume ETFs like EWZ and BRF.