The stock market in India has been one of our key themes in 2016. We already observed this huge opportunity in the making in the fall of last year when we wrote that out of the emerging markets with the highest GDP growth India had (by far) the most interesting setup (read this article).

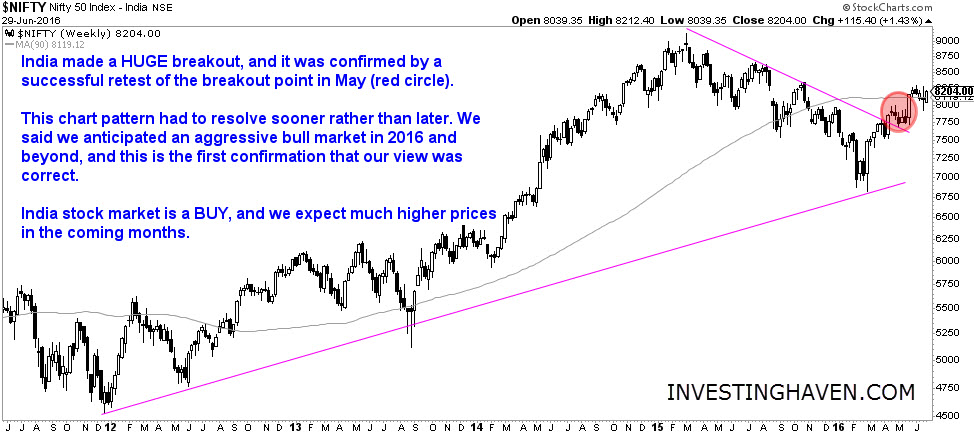

As we revisit the stock market chart of India, represented by the Nifty 50 Index, we see an incredibly interesting setup. The breakout took place in March of 2016, and was confirmed in May. Now the Indian stock market is off to the races, and is heading towards all-time highs.

Meantime, we found the first quarter GDP growth for India. According to Economist.com, GDP grew with an astonishing 9.6% in Q1. That is the highest growth of all 50 countries that The Economist is tracking. That’s another factor which justifies a BUY signal for Indian stocks.

InvestingHaven is focused on profitable opportunities as markets are becoming harder to trade and to invest in, as explained in our May webinar Slow Death Of Markets. The stock market in India is one of those low risk high reward opportunities in 2016 which smart investors are looking for in these volatile times.

Look at the chart of the Nifty 50 Index. It really is a beauty, and a textbook example of a breakout.

The question is how exactly to play this opportunity. We believe the INDA ETF is a reliable ETF as there is a high trading volume, and perfectly tracks the NIFTY 50 Index. We believe you should create your own basket of stocks only if you are sufficiently familiar with Indian companies.