[Ed. note on October 2nd 2018: we published today our silver price forecast for 2019 which builds upon the 2018 forecast, readers are adviced to read our 2019 forecast as it contains our latest and greatest insights for the silver price in 2019]

[Ed. note on August 15th 2018: we published today this silver price crash 2018 article which explains why we believe the silver price is near a major bottom]

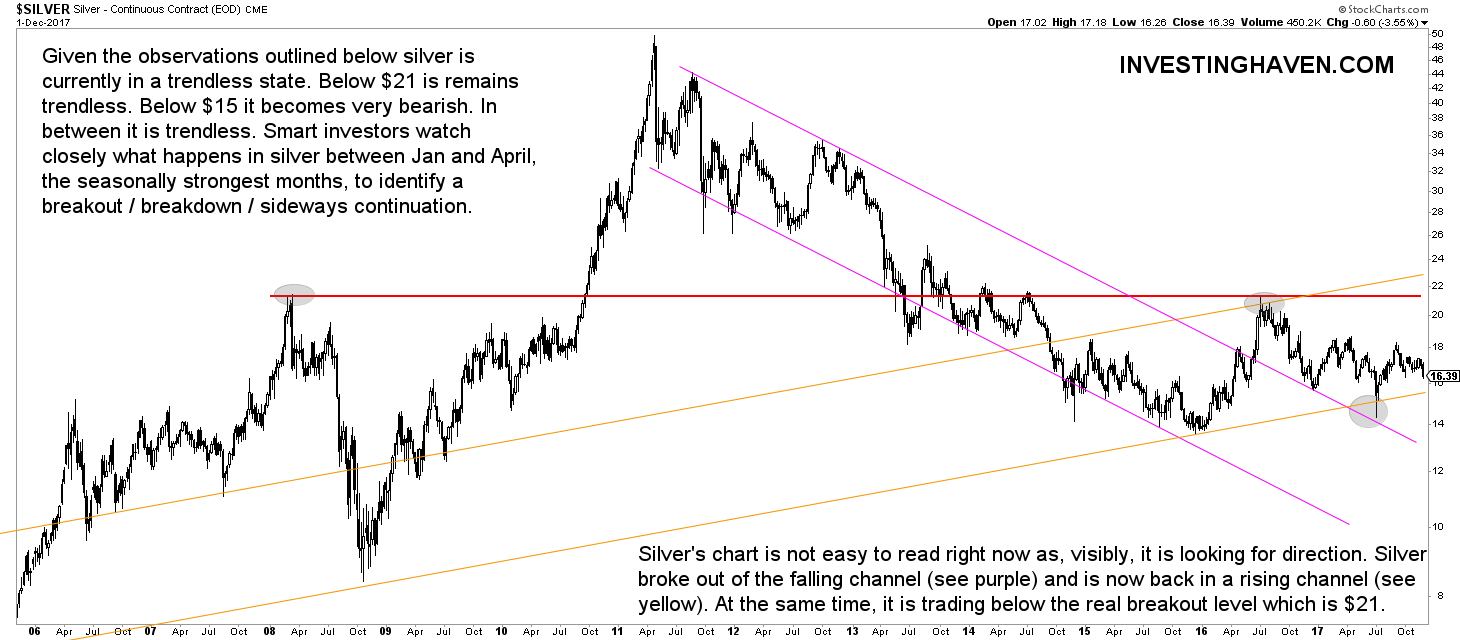

Silver is in a trendless state since it peaked in the summer of ’16. It retraced right after, and has been consolidating in a range between $14 and $18. That said, what is our silver price forecast for 2018?

Looking back to the ongoing year (’17) it is fair to say that our silver price forecast got achieved. Our primary price target for silver, in this article written more than a year ago by InvestingHaven’s research team, was $14. Our viewpoint was that, depending on the evolution of the silver price, silver (SILVER) could fall to the 10 to 12 range, though we clearly indicated it was a stretched scenario (not very likely in other words, but should not be excluded neither).

Some readers got upset with this forecast. That is not a problem per se. We are not investigating nor writing to make people happy. If anything, InvestingHaven’s team analyzes in an as neutral and unbiased way as possible to identify the best investment opportunities in the market.

Gold and silver are assets that evoke strong emotions with their investors. So we want to make the point to readers that they should not get upset if they read a bearish scenario in our articles. We always indicate when a bearish scenario is in play but also when it gets invalidated. So readers have to watch our price points or triggers rather than become upset because of us writing about a potentially bearish scenario.

The challenge with forecasting silver in 2018

We feel that 2018 will become very challenging to forecast silver’s price. We do not have a clear view at this point. There are opposing forces at play right now, and silver could go either direction, but, even importantly, remain trendless.

Before looking into the details suffice it to say that we want to present readers with a clear analysis that makes sense even if market conditions are unclear. We don’t want to write simply to write, and, in doing so, tell something meaningless, as this BI article does in telling something but also nothing about the silver price.

Let’s revise the market forces at play.

On the one hand we see silver-friendly market forces in 2018:

- We anticipate some sort of a stock market crash in 2018, not necessarily the same as in 2008 but something sudden and strong. Stock markets will likely recover, but we anticipate that capital will flow out of the U.S. markets into emerging markets. If (that’s a big IF) such an event will take place in 2018 then we can reasonably expect a flight to fear assets, first and foremost gold / silver as well as the Japanese Yen.

- There are some early signs of inflation picking up again. This not strong yet, and certainly not confirmed. But with rising inflation we can reasonably expect gold and silver to perform strongly.

On the other hand we see the following headwinds for precious metals, in particular silver:

- Western central banks are committed to continue their rising interest rates policies. This really is in line with what this writer observes. That is certainly not silver-friendly. Note that gold and silver were rising between 2001 and 2011 in a strongly declining interest rate environment.

- The U.S. dollar seems to be bottoming, as the 91 level is respected so far.

- Money is flowing into bitcoin and other cryptocurrencies. We believe that, in line with what CNBC says over here, this comes ‘at the expense’ over capital flowing into precious metals.

Our silver price forecast for 2018

The only reliable way to do a silver price forecast for 2018 seems to be by sticking to the silver price chart.

More so than forecasting any other market we feel that silver price forecasting this year will be based on our ultimate compass: silver’s chart. So what do we read in silver’s chart?

The long term chart (12 years) shows a very interesting pattern. In fact, it is a set of patterns that nicely come together.

There is this falling channel (purple lines) that seems to be broken now. Silver moved out of that with the 2016 rally, and it is back in the rising channel (yellow lines).

However, there is another force at play, i.e. the strong secular resistance which kicks in at $21 (red line).

Let’s get things straight:

- As long as silver does not rise above $21 it has not broken out in which case it is trendless or bearish.

- If silver falls below $16 (and stays below 16 for at least 3 consecutive weeks) it is bearish.

- Between $16 and $21 silver is neutral.

- Moreover, $14 is a major price level as it marks the lows of the last 9 years. If silver sets a major double bottom between 14 and 15 in 2018 then (only then) will we become very bullish for the long term.

Are we able to forecast a precise silver price target for 2018? We have a hard time doing so, and we promise readers to continuously follow up, and update this article each time we get a new signal on silver’s chart or in the silver market which could lead to a price target.

For now, though, we stick to a neutral trend forecast in silver, with a bearish bias.

However, we are very closely watching what happens near the $14 price level for reasons outlined above. That is to get an idea on the secular support levels. Similarly, once silver starts rising in the first months of 2018 (seasonal strength) we are closely watching the $21 area as secular resistance.

To be continued once we have new insights.

Update on January 20th 2018

The silver market looks increasingly more constructive. We can make the point that the price of silver could break out in 2018 based on this 40-year silver chart.