Gold is having a really rough time. It may not break down but it certainly is struggling creating momentum. Which signals are we looking for to increase exposure to the gold (and silver) market? Also, what about our gold forecast and silver forecast for 2021?

The story of 2021 in markets has 2 components: one is the USD story and the other one is the major divergence between indexes and the majority of stocks (breadth).

The USD story is really simple: tiny USD moves higher created damage in some USD sensitive sectors in a highly asymmetric way.

Case in point: base metals and precious metals.

While it is clear that the USD should be watched closely as a leading indicator for gold (and silver) we want to take it one step further. We want to include a few additional indicators that help us understand when gold may create momentum again.

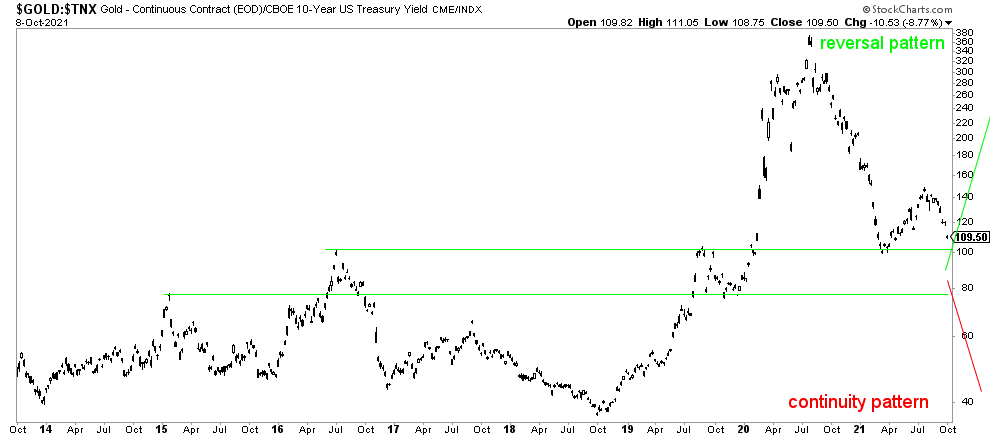

The gold to bond yields ratio is one of them. The ratio chart helps us understand key levels and turning points.

Essentially, this intermarket chart says that gold is entering a decision area. This may need many months before any sign of resolution but it is clear that the area between those green lines will be either a turning point (W reversal pattern which will result in a strong move higher in gold) or an acceleration of the ratio lower (continuity pattern).

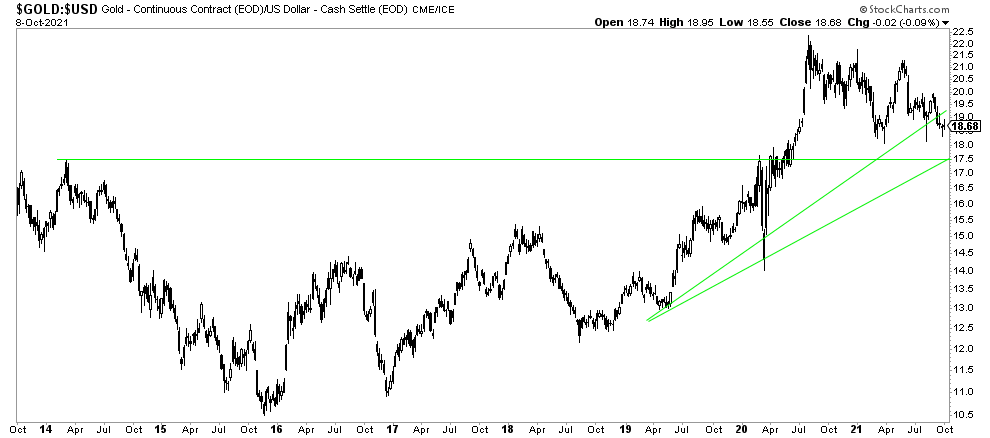

Similarly, the gold to USD ratio chart is not so far from a decisive area. Again, it might take months before a decision is taken (by the market) but at this point in time there is only key levels to watch. No momentum in precious metals until these intermarket directions create a new upward trend in favor of gold.

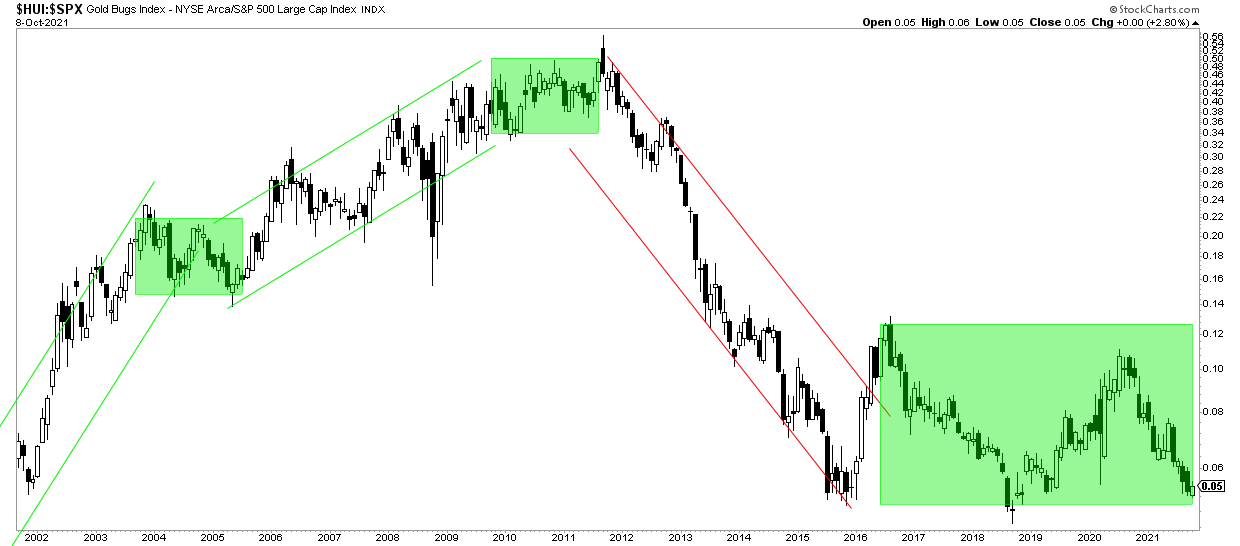

If anything gold and silver miners are now getting in oversold area. They might stay there for a while, consolidating, waiting for direction.

Our 2021 gold and silver forecasts will not be achieved (gold +2200 and silver higher 30ies). That’s the first time in 7 years that our precious metals forecasts don’t get hit. So far, all of them were extraordinarily accurate. However, our 2021 targets will be valid in 2022, and we will be releasing our 2022 forecasts in the not too distant future.

We would be very interested to pick up oversold quality gold and silver miners around current levels or even a bit lower assuming the downside potential is limited as per the last chart. Both Momentum Investing (stock investing) and Trade Alerts (short term trades) have an above average interest in gold and silver.