Gold continues to struggle. One would expect gold to do well with bond yields starting to struggle, but it’s not happening… yet. As per our gold forecast we expect the 2nd half of 2021 to be favorable for the gold market. If anything, gold miners continue to try but fail to succeed… at this point in time.

The gold miner chart GDX ETF is the one we feature to understand opportunities in the gold mining space, or lack thereof.

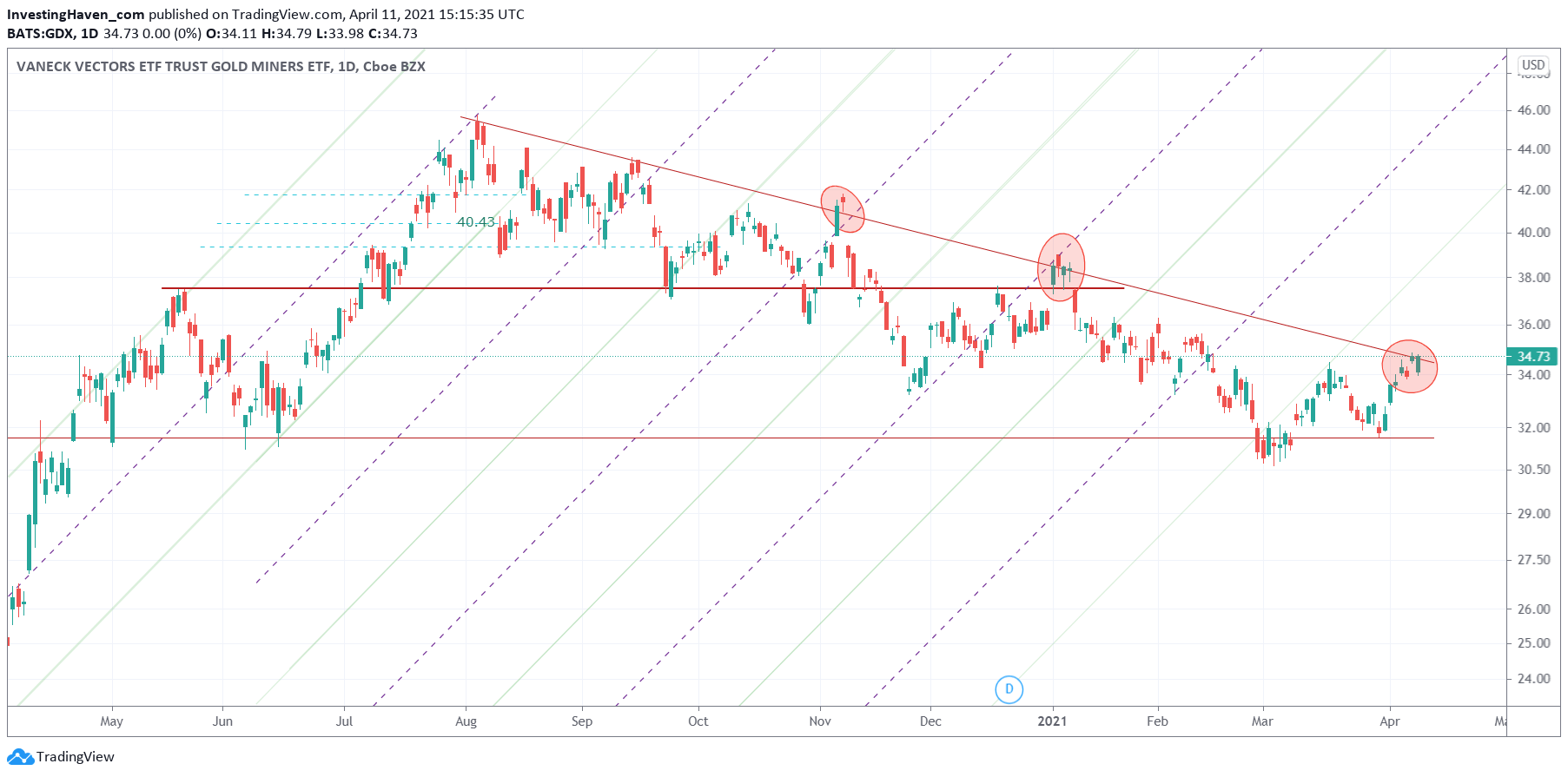

As seen on below chart, the daily GDX chart, miners tried to break above a falling trendline (the one that was created with last year’s August highs) but failed, again. This is failed attempt #2 in the last 6 months.

However, on the flipside, we start seeing a few bullish signs. These are early signs, but there are some bullish data points on this chart:

- Support around 31 points was respected.

- A W-reversal over the last 3 months is printed on this chart.

- Selling pressure is fading.

Now it is very simple: IF GDX succeeds in respecting 31 points, and break above its falling trendline, it will set the stage for a bullish 2nd half of 2021.

Enjoying our work? In our Momentum Investing portfolio we take gold mining positions but only whenever the gold market is bullish. In our Trade Alerts portfolio we take short term gold or silver trades, but only whenever the gold market is bullish.