Is the bullish gold price breakout now confirmed? Yes, is the short answer. All indicators are on green for the gold market with the exception of the gold futures market as per the COT report which suggests the upside potential is getting limited. Technically, though, we see 3 consecutive weekly closes above $1400, arguably even 4 weekly closes, which confirms the bullish breakout in gold and validates our 2019 gold forecast. This has major implications for the whole precious metals market, in the first place the upward potential of the best gold stocks, our favorite silver miner First Majestic Silver’s upward potential and also our 2019 silver forecast.

Let’s take a top down chart approach in our attempt to answer the question whether the gold price breakout is now confirmed.

Again, we do not care about fundamental data like gold’s supply/demand, economic data like job growth or declines, imports into China or exports from any other country like Switzerland. All those data points are great inputs for story telling, but we are in this game to make our investable assets grow. Big difference!

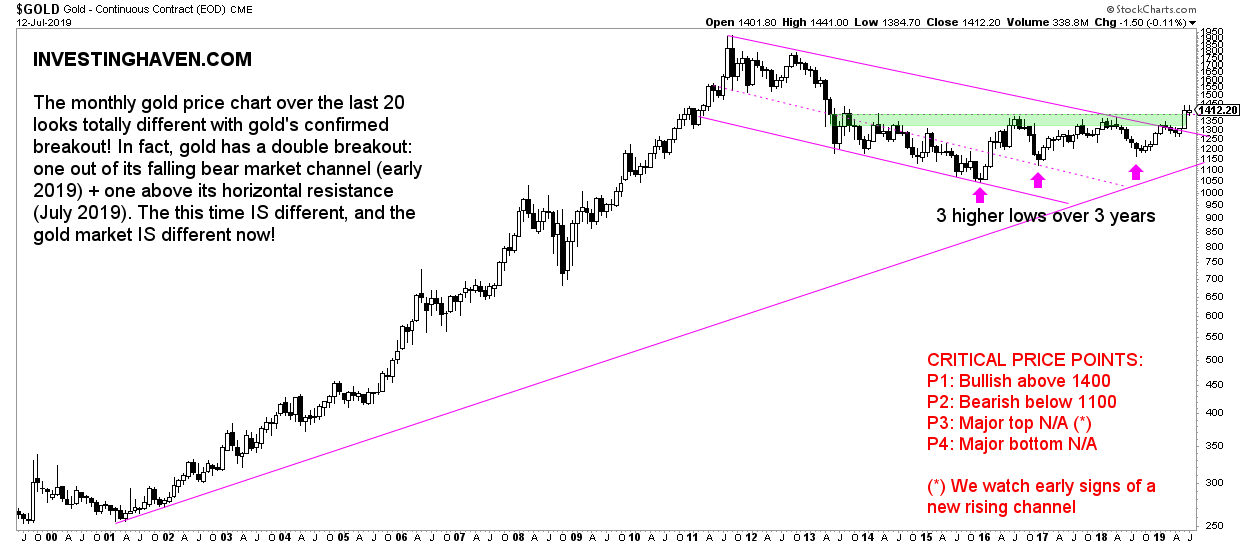

First, the monthly gold chart over the last 20 years.

It shows a double breakout!

First, it did break out of its falling bear market channel which lasted almost 8 years. Already a while back we noticed that Gold Entered New Bull Market Right Before Its 8th Bear Market Anniversary.

Second, it did confirm this week the breakout above its formidable horizontal resistance at $1375. This is something we labeled as ‘gold’s giant bear market wall‘ just to illustrate its significance.

A double breakout on a monthly chart is a big thing, a very big thing.

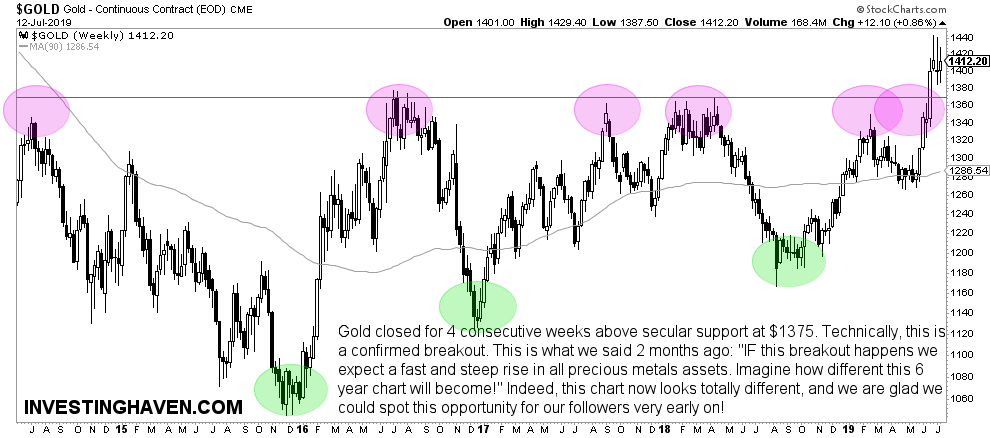

Moreover, on the weekly chart, we see how solid this ‘horizontal’ breakout looks.

As said 2 months ago the shape of this chart would change drastically if and when gold confirms its breakout. That’s what we see now, a totally different gold chart. Readers who want to compare this version with the previous one should take a look at the gold chart in this article What Happens If Gold’s Price Rises 2 Pct And Breaks Out (scroll down to the bottom of the article).

This is green light for the gold market and even the whole precious metals market! Only if gold would dip below $1400 again, structurally, would this be invalidated.

One thing we want to point out though is that gold will not ‘blast‘ into its new bull market. In other words do not expect a raging bull market, but a mildly bullish gold market. That’s because the set of circumstances support gold, but do not suggest that there is no other attractive investing opportunity. Watch out with the overly bullish gold articles out there, it’s confusing and only written by gold perma bulls. Be careful with this.

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific (gold and silver) investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 to 6 months. Subscribe to our free newsletter and get premium (gold and silver) investing insights in 2019 for free. Sign up >> ]