Crude oil did write history in May of this year when its futures price (nearest month) went below zero. Never happened before in history. May marked a spectacular come back in the price of crude oil. Since June crude oil stabilized, and given the current setup we would forecast more downside price action in the coming weeks and months.

It is pretty simple with crude oil.

Forget supply / demand, forget the weekly inventory updates, forget experts forecasts and Aramco’s announcements.

Just look at price, and the chart (once you got the chart right).

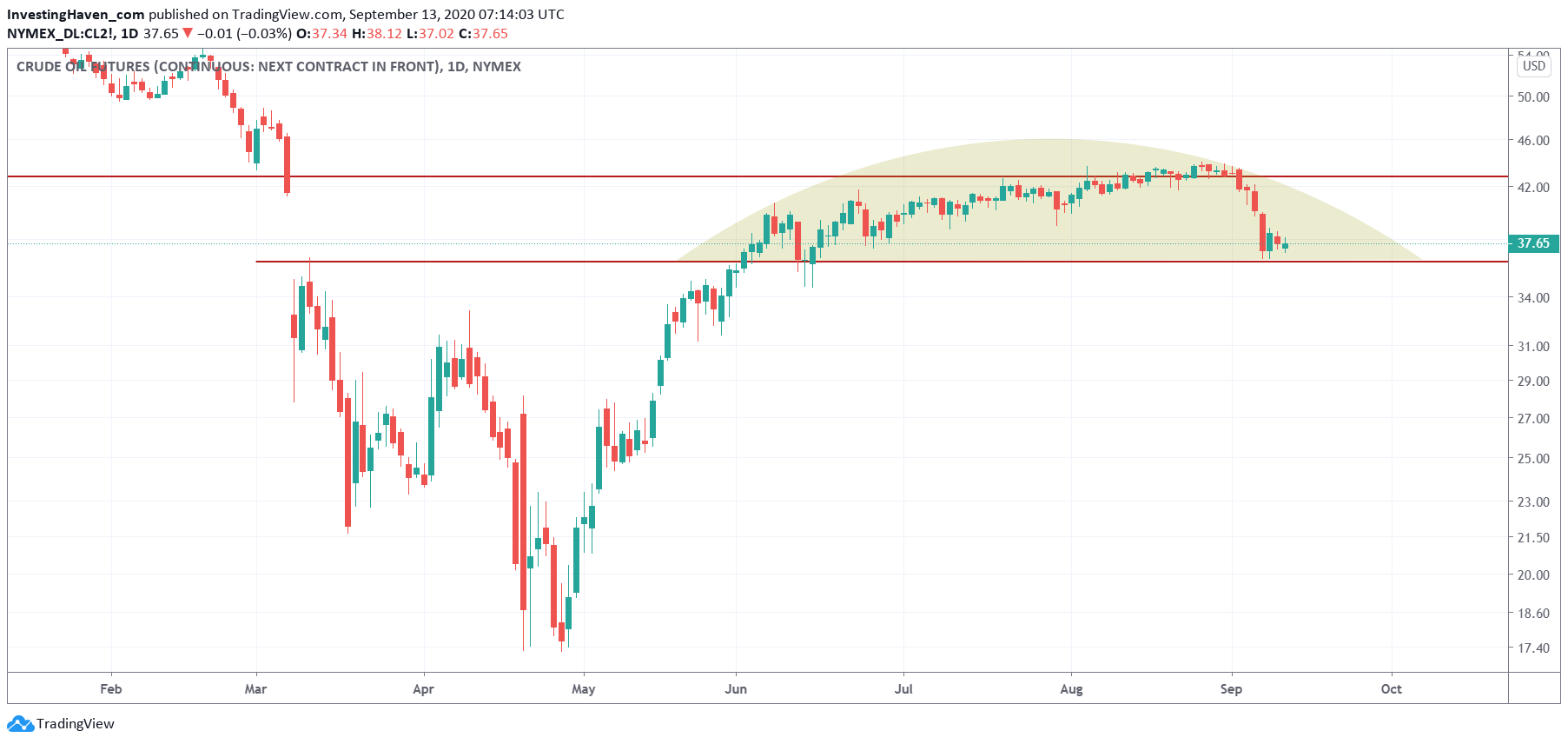

Below is the daily crude oil chart, with a very clear setup:

- The crash in March.

- A reversal which took 2 months to complete, pretty chaotic reversal with a higher left and right wing and sharp V at the center.

- A magic recovery in May.

- A rounded top in June/July/August.

Crude oil’s spectacular rally has run its course. It is now neutral at best, and bearish at worst.

There are a few ways to ‘play’ crude oil weakness. One of them is buying stocks sector that are sensitive to crude oil prices because crude is their (most) important input. We are closely tracking a few stocks that may do very well if crude’s weakness continues. Want to see which stocks we are talking about? Watch the weekend update (scheduled for later today) of our Momentum Investing premium service.