The gold market is suffering, and it doesn’t look like it will turn bullish in the short term. Probably medium to longer term, which is several months out. Can a sudden turnaround take place? While everything is possible, and we always (ALWAYS) have to stay open minded, it’s not the highest probability outcome. Consequently, gold stocks are not in a great shape currently. This timing is in line with our gold forecast for 2021, however we didn’t expect gold to fall below 1700 USD/oz. Our best gold market forecast is that gold will consolidate going into the summer. Depending on the structure of the consolidation as well as its leading indicators we will find out this summer whether the 2nd half of 2021 will be bullish.

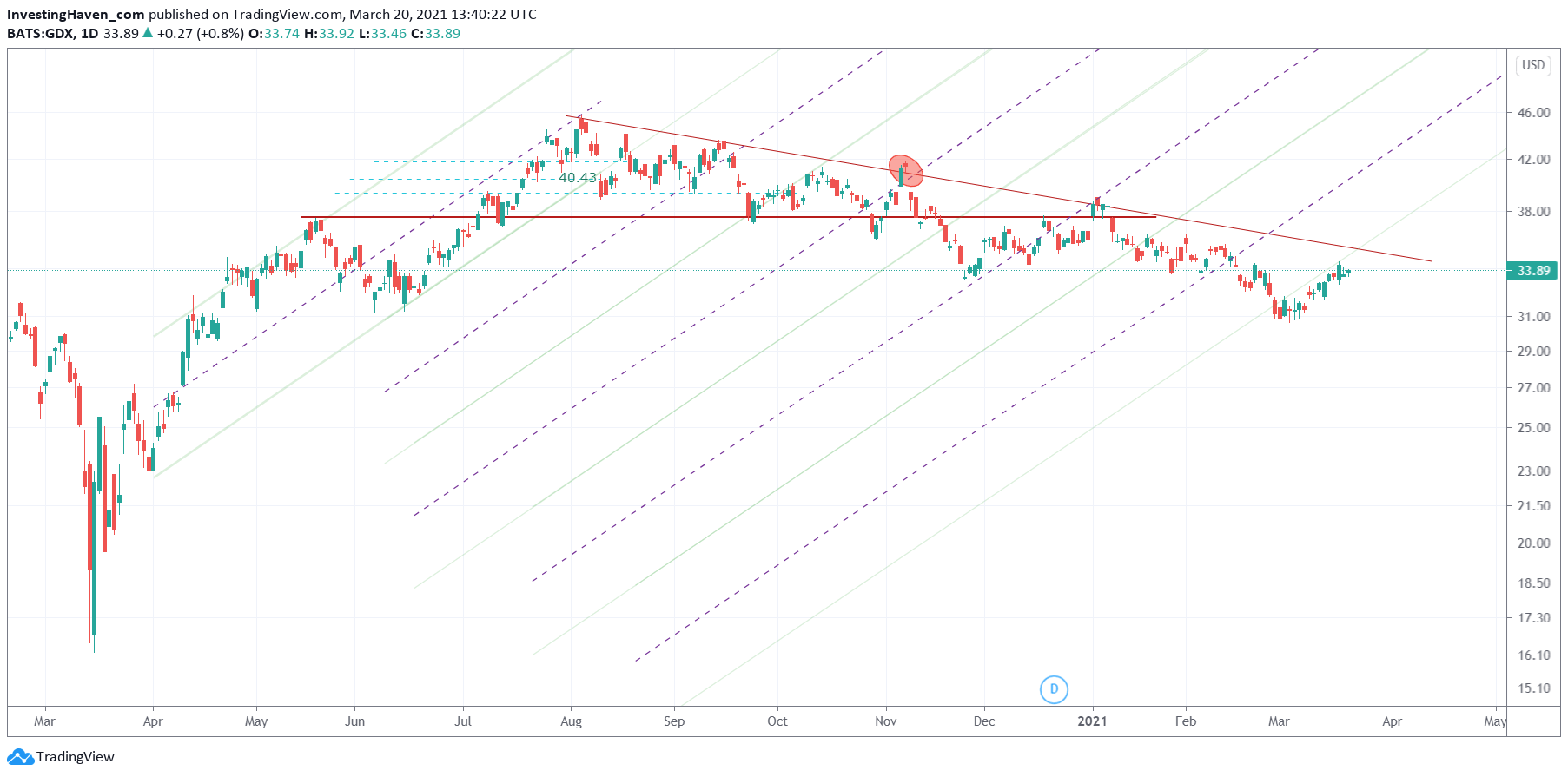

The chart of the leading gold stocks ETF GDX says it all: gold stocks are in la-la land. There is nothing particularly bullish on this chart at the time of writing. As long as this index trades below the red falling trendline it is in a downtrend or consolidation.

Or is there anything bullish? There *might* be, and we see one sign of a potentially constructive setup. It’s not confirmed at this point in time, but it is the one thing we are watching: the ‘double bottom’ scenario. The March 2021 lows are at similar levels as the June 2020 lows. It is, for now, a potentially promising setup, but it has to hold. It’s too early to get excited, it’s too early to take positions, but it’s the one thing we will be watching closely.

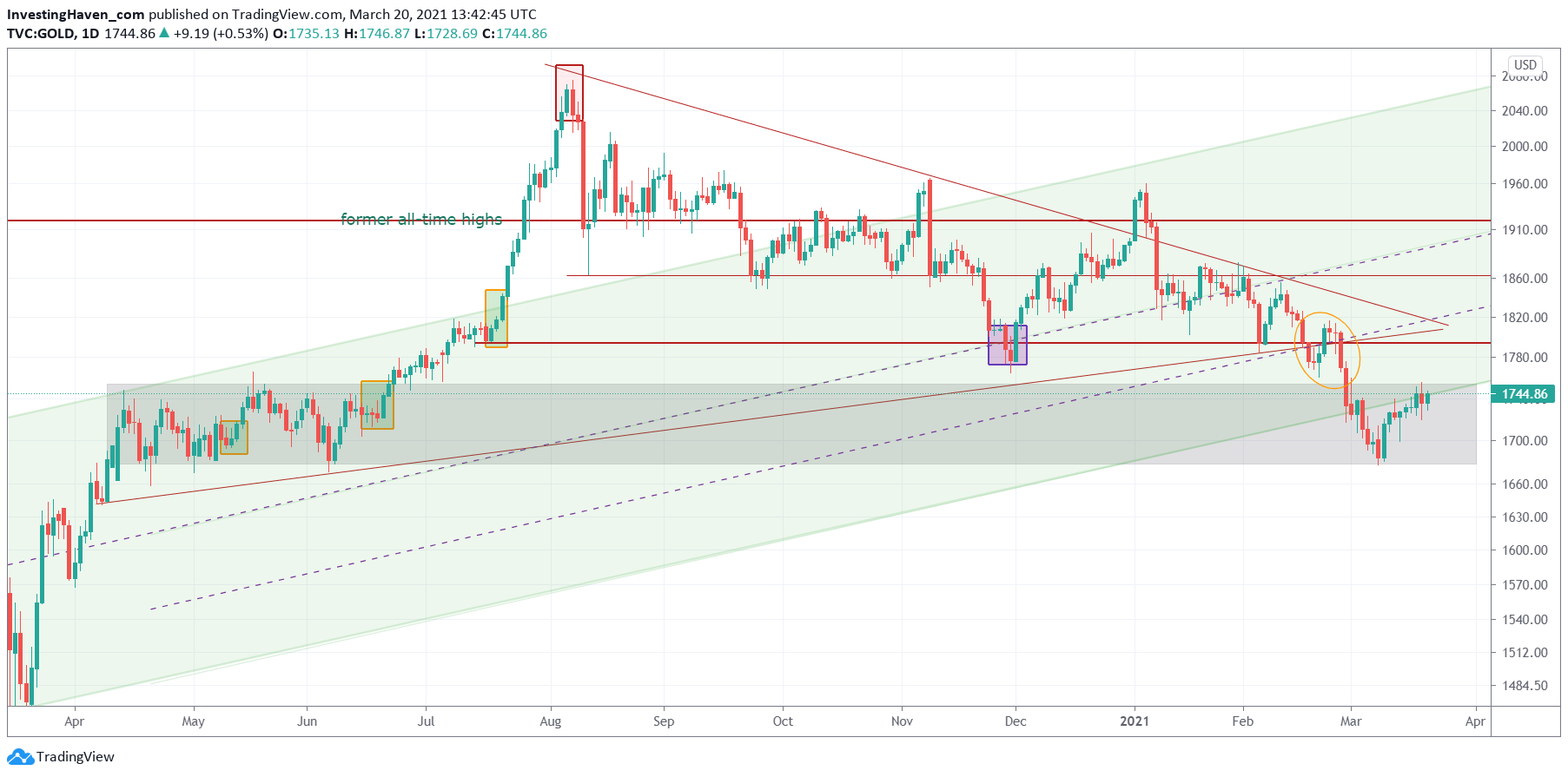

The gold price chart tells a similar story, and we did indicate this ‘for simplicity’ by adding the grey box on below chart (daily gold price chart).

In terms of leading indicators we know that Yields and the Euro are the primary drivers of the gold market. Yields are too bullish right now, so there is no way they will let gold rise at this point in time. The Euro is too flat right now, so there is no way they will let gold rise at this point in time.

For gold to become bullish we need a trend change in Yields (flat to bearish) combined with strength in the Euro

Both charts suggest that the gold market needs more time. And they also suggest that in case gold and gold stocks refuse to fall lower it might be that they are setting up a bullish reversal. If that’s the case (and it’s a big IF) we will see a flat structure going into the summer, with one bullish attempt to breakout which is likely going to fail. In case both gold and gold stocks set a higher low, right after that failed breakout attempt, it will be the ultimate signal that the bullish reversal will resolve to the upside … Now THAT will be the moment we will be very interested to get exposure to the gold market.

Enjoying our work? We feature more detailed analysis in our weekend updates of our Momentum Investing service. We also share which stocks we invest in, obviously in line with our higher level market readings. Whenever we feel the gold market is (getting) bullish we take gold/silver stock positions. In our Trade Alerts premium service we focus on SPX trading with short term trades, and take a gold or silver position from time to time, only when there is short term bullish momentum.