It was very interesting when the world was ‘shocked’ in August of 2020 that Mr. Buffett took a significant position in Barrick Gold, a large cap gold miner. It was even more interesting that our Momentum Investing research showed that it was time to sell gold miners, not buy gold miners, in the first week of August. Yes, we still have a longer term bullish gold forecast, but this new bullish trend may take a while to materialize especially in the light of a bullish reversal in the USD. Whether Mr. Buffett his gold forecast is bullish or bearish is not clear, all we do know is that its position in Barrick Gold is now really testing the edges.

Investors are so easy to influence.

Barrick Gold surges 10% after Warren Buffett’s Berkshire Hathaway buys a stake

Warren Buffett’s Berkshire Hathaway bought a stake in Barrick Gold in the second quarter, a Friday SEC filing showed. Barrick Gold more than 10% in premarket trading Monday.

As per BI: The buy comes as a bit of a surprise, as Buffett has been a critic of gold in the past, saying that it isn’t as good of an investment as businesses, farms, and real estate. Still, the precious metal has been on a tear this year, as coronavirus pandemic panic has sent investors rushing into the so-called safe-haven asset.

That was August 17th, 2020.

Fast forward to November of 2020, and it appears that Mr. Buffett wasn’t that convinced about the prospects of the gold market … or there was simply a better opportunity elsewhere:

Berkshire increased its holdings of various pharmaceuticals, such as AbbVie, Bristol Myers Squibb, Merck, and Pfizer. That was quick – Buffett sold 9 million shares of ABX in the Qtr – trimming the position 44% from Q2. Whatever happened to “My favourite holding period is forever”!

And all those investors that were chasing prices higher, thinking that following Buffett’s positions is going to make them billionaires, were left behind with positions in Barrick Gold at the very top of 2020. Exactly the top.

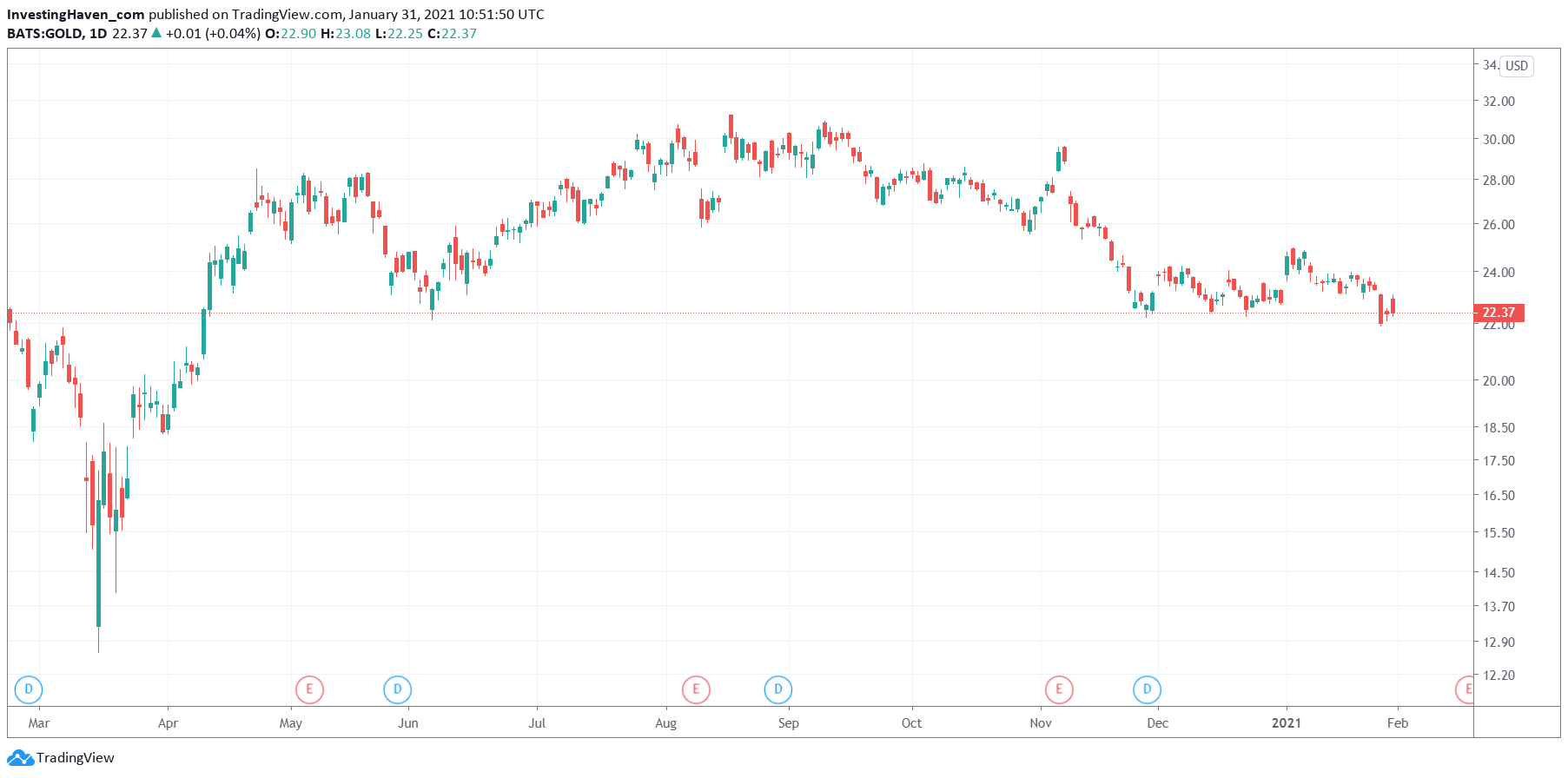

In the meantime Barrick Gold’s chart looks pretty cool, chart-wise, not if you are holding millions of shares of course. This stock may be setting a decisive bottom, but oh boy what happens if this stock moves a bit lower … a big breakdown.

In the light of a strengthening USD we would not be feeling very comfortable holding Barrick Gold at current levels. Doesn’t imply it will go up or down, just saying that we prefer to see a more solid consolidation before entering Barrick Gold.

In our Momentum Investing service we track gold and silver miners very closely. There are a few gold miners that look so much more promising than Barrick Gold. Yes, we might enter one of them, in the next 6 to 8 weeks, provided gold strengthens and the USD weakens (after what we expect to be a strong February).