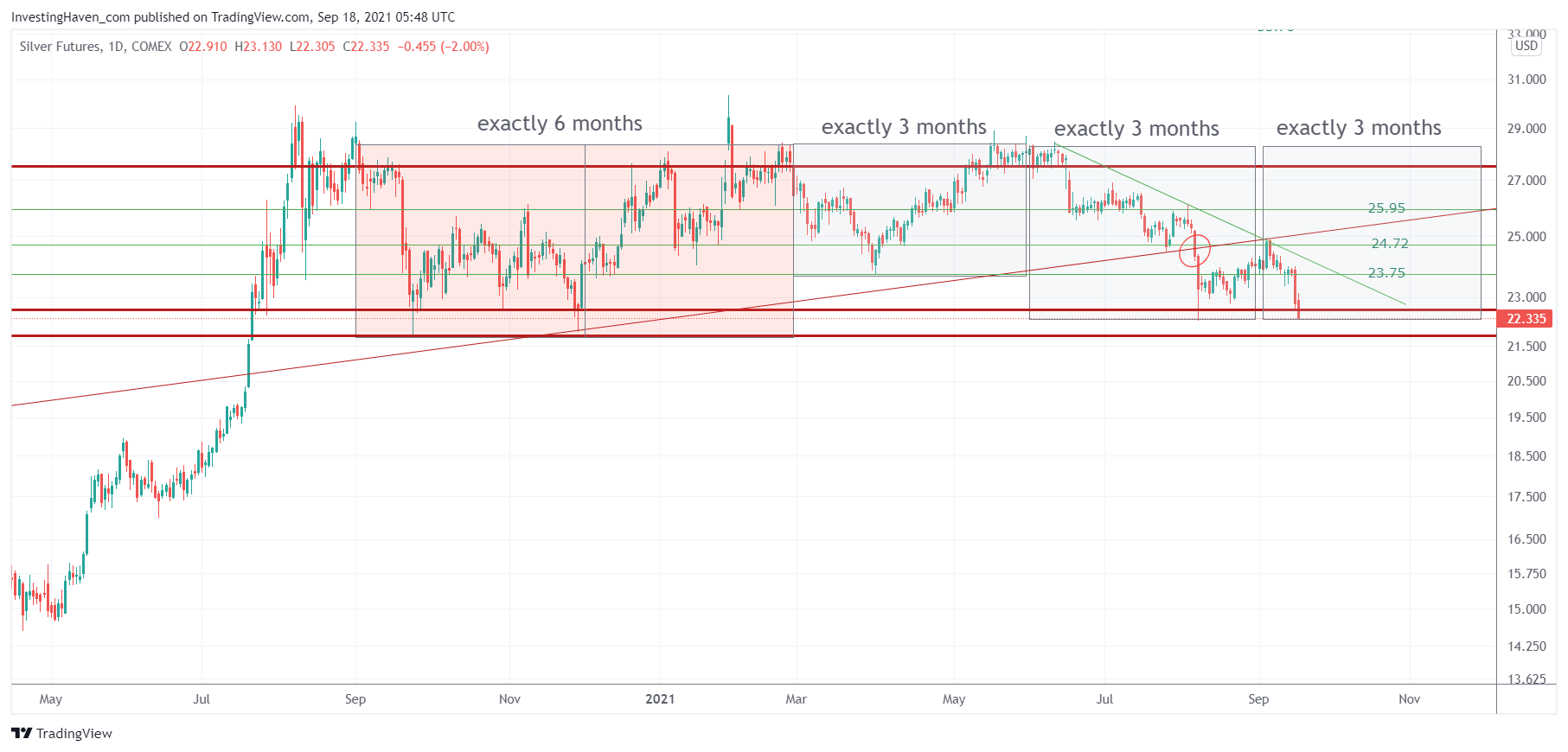

We expressed high expectations about silver since May of this year. So far, we have only seen failed attempts of silver to move higher. Friday’s close could be a great double bottom. But the USD is creating havoc in the precious metals market. What about our bullish silver forecast for 2021?

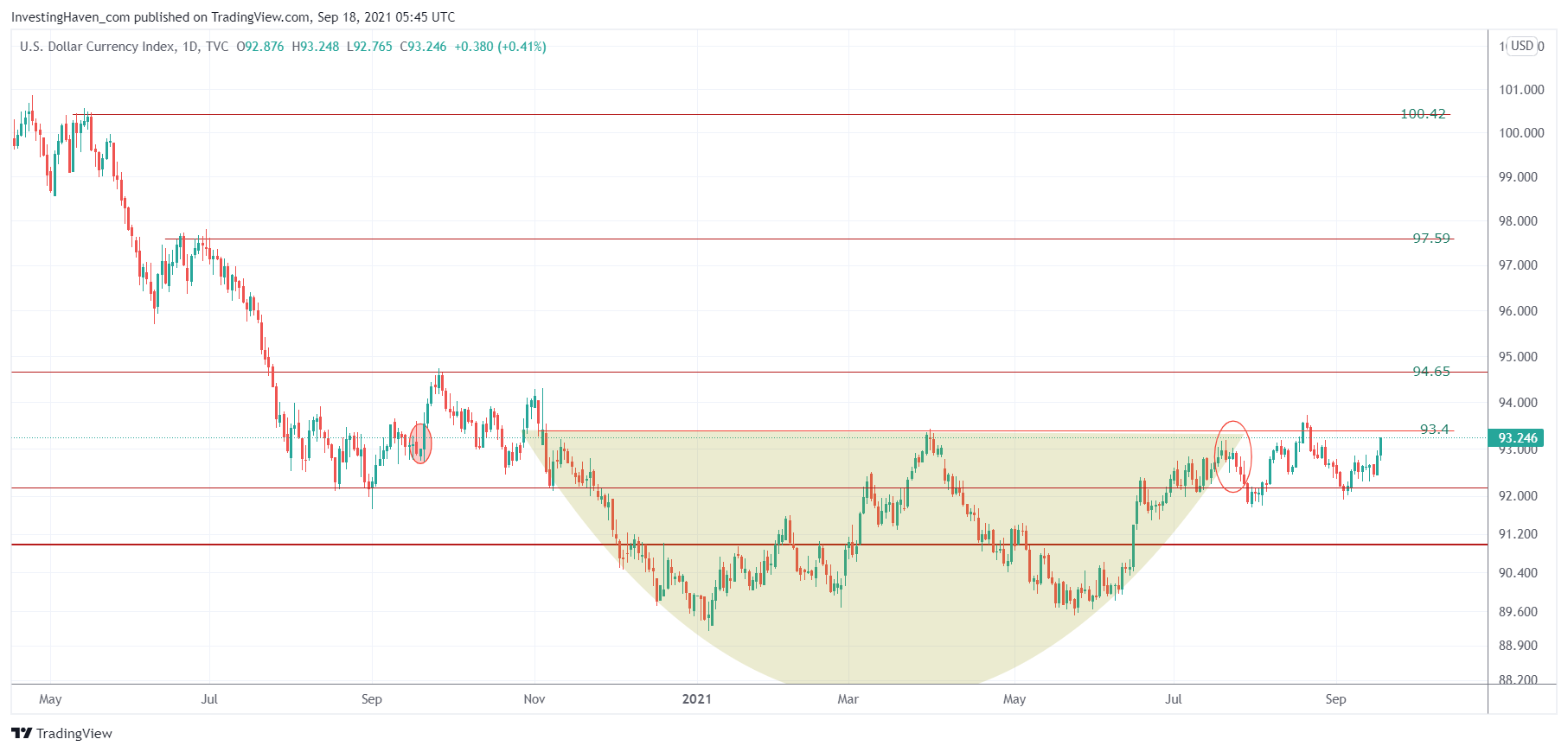

Strength in the USD on Thursday and Friday pushed precious metals lower. The nice setup in silver on Wednesday turned into a move lower.

At this very point in time it is only clear that silver is about to start testing a really important support area. The 22.50 to 21.50 area better holds (on a 3 day closing basis).

What do leading indicators suggest for the price of silver?

First, the USD chart is testing 2021 resistance at a time when silver is testing 2021 support. No coincidence. A lot will depend on how the USD will react as it approaches two very important levels: 93.40 and 94.65.

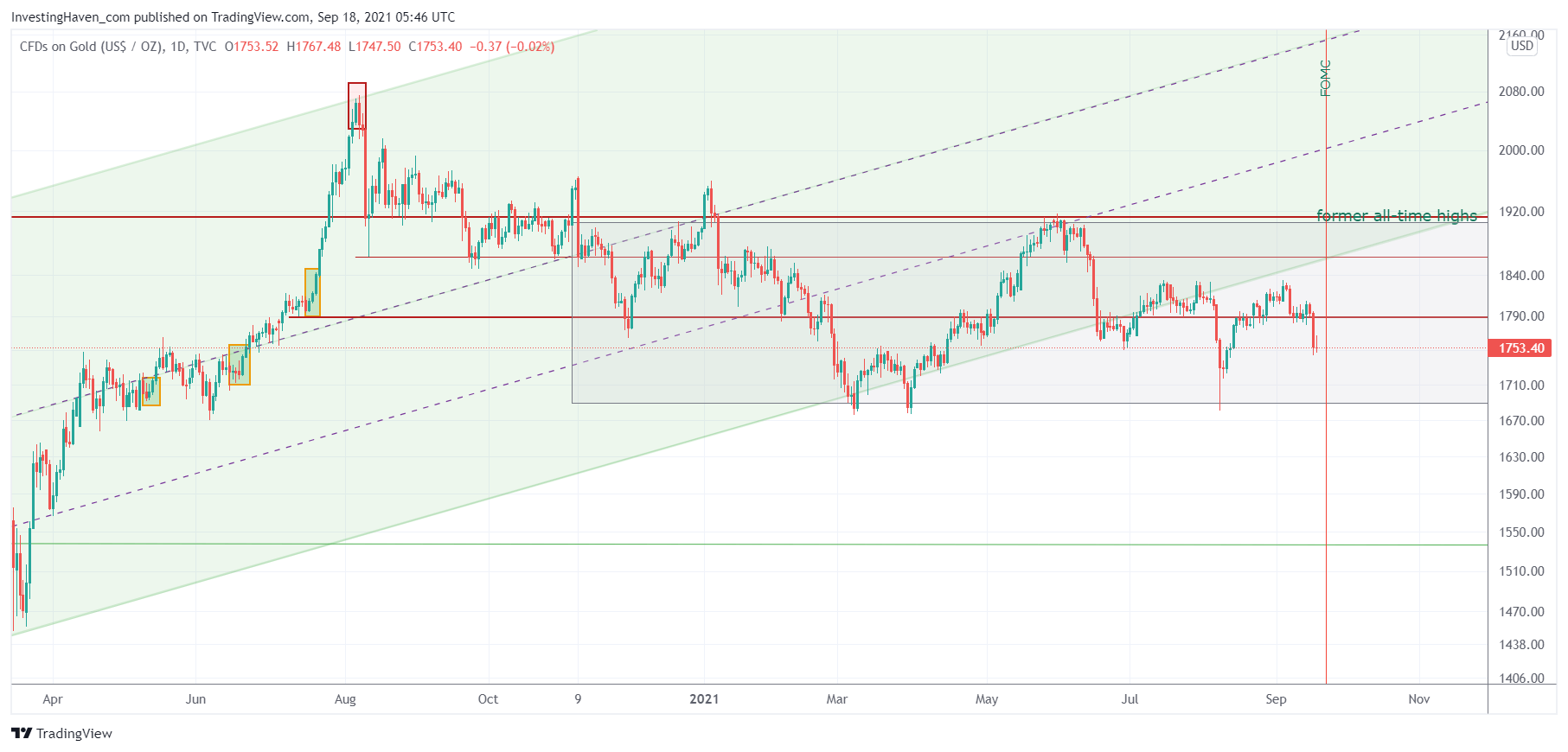

Gold, if anything, is printing a higher low, for now. The lower 1700s turned into solid support. The fact that gold fell outside of its 3 year rising channel made it vulnerable which is presumably which we got the flash crash on August 8th.

We featured several more leading indicators of silver in the weekend edition of Trade Alerts. It is clear though that the USD is the dominant force at play right now, not only for precious metals but for all markets. In a way, we concluded in our premium membership updates, metals and markets are depending on the USD particularly as it approaches 93.40 and 94.65 points.