Silver is gaining strength … again. We have seen many ups and downs in silver after the Corona crash. We remain firm on our silver price forecast for 2020, and interestingly MarketWatch featured this silver forecast from InvestingHaven a few days ago.

This article published on Friday June 26th on Marketwatch features InvestingHaven’s silver price forecast, as well as our copper forecast:

Silver, copper prices mark an impressive recovery from March lows (MarketWatch)

This is the quote that covers our forecast, both on silver as well as copper:

Gold has benefited from that, as has silver, which is both a precious and industrial metal. “Silver’s solid price action is driven by its precious metal side much more than its base metal characteristic,” and the low interest rate environment is great for precious metals, says Taki Tsaklanos, founder of InvestingHaven.com. A second wave of virus infection probably would put “even more fuel under silver’s price rally” because of the prospects of a long-lived low interest rate environment, and inflationary measures of policy makers to stimulate economies, says Tsaklanos, who expects silver to test $21 before year-end.

Interestingly, we published our silver forecast initially in October of last year, which is exactly 9 months ago. And the silver market is perfectly on track to get to our projected price target.

We did not expect this sell off to around 12 USD when we wrote our silver forecast 9 months ago. But the market is clearly considering it some sort of ‘anomaly’, and precious metals are continuing their regular course as if the March/April ‘cataclysmic crash’ never occurred.

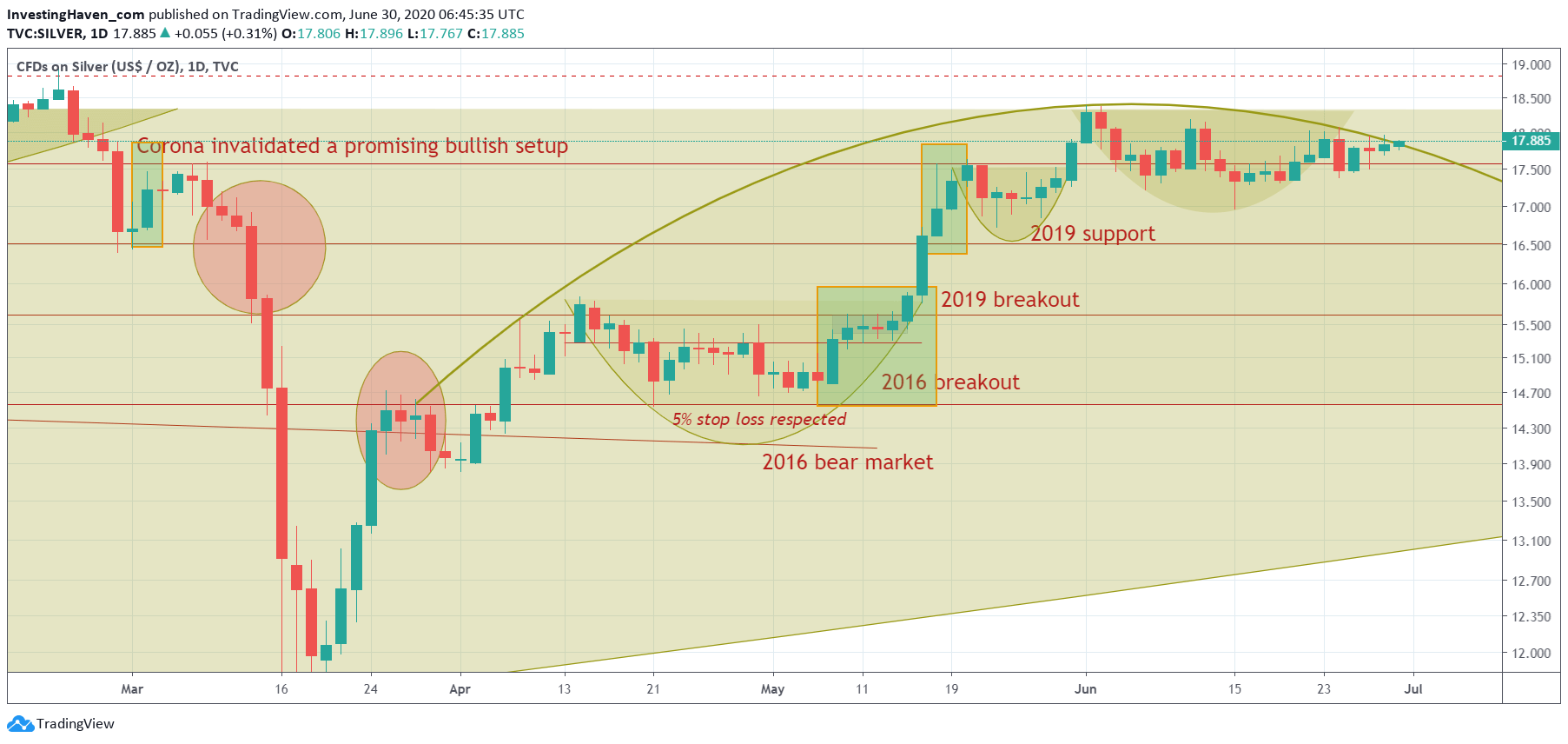

The daily silver price chart shows another attempt of silver to ‘break up’ which means that it wants to move above its potential bearish reversal.

Silver has to overcome huge resistance at 18.50 USD. The first time it tested it a month ago was too hard to overcome this resistance because it was double resistance (resistance of 2 distinct patterns as we shows in below chart). However, with the ‘break up’ which is occurring at current levels we can expect a lower level of resistance once silver gets back to 18.50 USD.

Yes a final breakout above 18.50 USD is in the cards!

Our Momentum Investing members are enjoying a great precious metals stock tip which we flashed 2 weeks ago. It was, by far, the strongest precious metals miner among mid and large cap miners. So far, in 2 weeks time, our members and our Momentum Investing portfolio has an unrealized profit of 30%. You too can follow our premium investing research and get (precious metals) stock tips by signing up here.