We did not cover the uranium market for a while now. If we do so it typically means that particular market needs some time to figure out where it’s headed. We may have a pointer now based on the price of uranium futures which got triggered in June of 2019. It may well be that the uranium market has started a new bull market though in an invisible way. As per our 100 investing tips for successful investors this is awesome primarily because by far the biggest profits for investors come from positions that are taken in the early stages of a new bull market. Buy low sell high, right? That’s what it is! However, we will outline why most investors will not benefit from this with the key reason being Tsaklanos his 1/99 Investing Principles.

Note that our uranium stocks forecast for 2019 may not be achieved this year, it likely will not, but don’t forget this one characteristic of the uranium stock market (URA): once it starts rising it goes up ultra-fast. You don’t want to miss an uptrend in the uranium market so it is one of those markets that should continuously be on your watchlist.

Last time we covered uranium is when we wrote in April of 2019 Is The Uranium Stock Sector Ready For A Giant Breakout?

We thought we got the answer in the meantime, and the answer as “no” simply because of the failed breakout on the uranium futures chart.

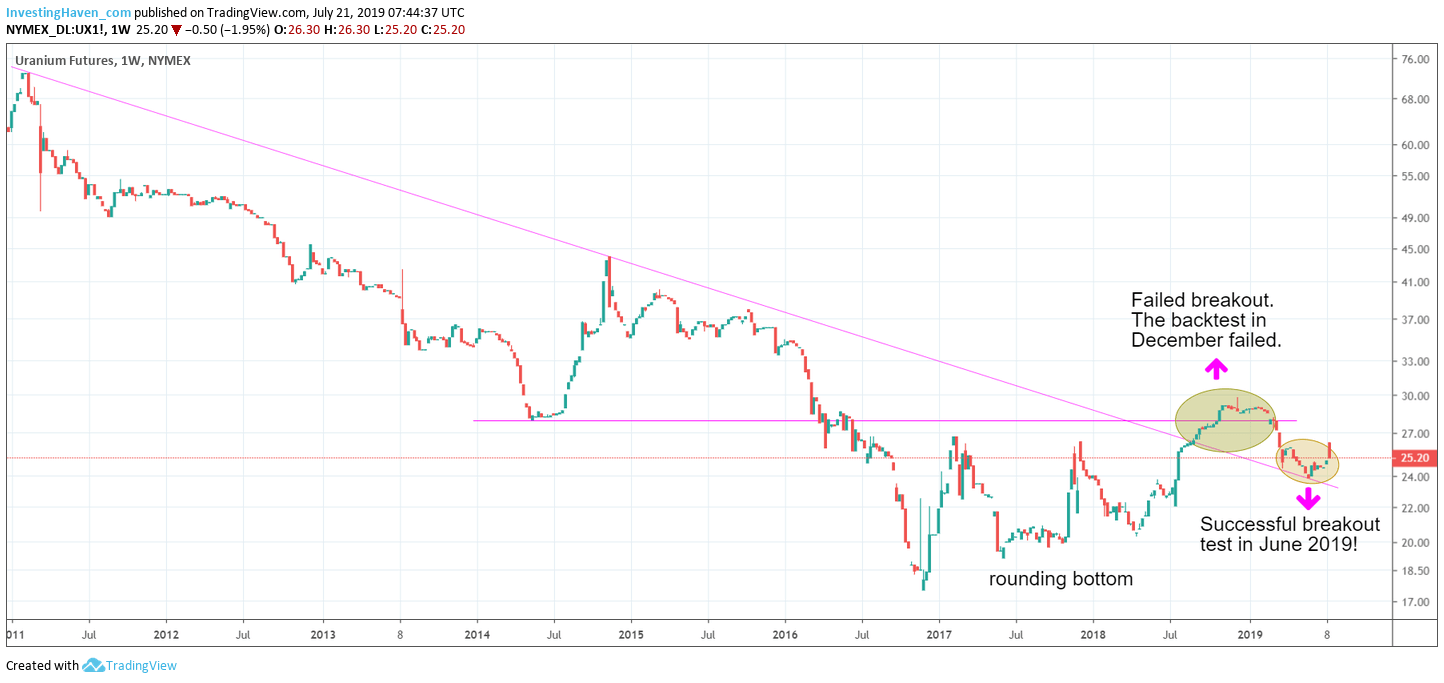

Below is the uranium futures chart since its major peak in 2011. What does this chart learn?

One conclusion was indeed that the April 2019 breakout attempt failed. Former support of 2014 became resistance in 2019. It appeared to be too strong of resistance.

However, as it always goes with strong resistance, eventually it may break after multiple attempts. That’s why chartists tend to call them ‘tests’: there are tests to check what happens with supply/demand volumes in that market when price gets to that particular strong resistance point.

What we saw in the subsequent period is really worth noting, and may be a game changer for the uranium market. Uranium futures fell to the bear market trend line, tested it, and bounced higher.

This successful test of falling resistance has the potential to confirm a new bull market provided horizontal resistance will be broken at one of the next attempts.

Here it becomes interesting because the process that will follow is where 99% of investors will give up. It is one of the real life applications of Tsaklanos his 1/99 Investing Principles.

99% of investors will give up in the continuous attempts of the uranium spot price to overcome the 28.50 USD.

In the meantime it may well be that the new bull market started.

Remember, the more invisible a bull market, especially its start, the better!

That’s why we believe it is worth accumulating slowly but surely the good names in the uranium market. Think of UEC (UEC) or Cameco (CCJ).

Obviously, by far the best strategy long term is to rotate profits from one successful investment into the slowly but surely improving uranium stock market.

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]