The price of uranium had a nice run since that V shaped recovery in April 2020. URA for instance went from $7 USD to $31 in less than 2 years. The increase in price was fueled by speculation, reduced supply and more countries reassessing their previous decisions to abandon this source of energy. Consequently, spot price went higher and so did most of Uranium miners. Back in April, we wrote that uranium’s bull market did not end. What are the expectations for the bull market in uranium as we head into the 2nd half of 2022?

We start our analysis with the uranium price chart exhibiting the uranium spot price.

The uranium spot price had some sort of bullish wedge in the period October of 2021 to March of 2022. The subsequent price action confirmed the bullish wedge: a bullish breakout. After almost touching 66 USD uranium spot came down. All we can observe, right now, is some sort of consolidation right above the bullish wedge breakout.

The question today is the following: Is the uptrend in Uranium miners exhausted at this point? What can investors expect in terms of price action?

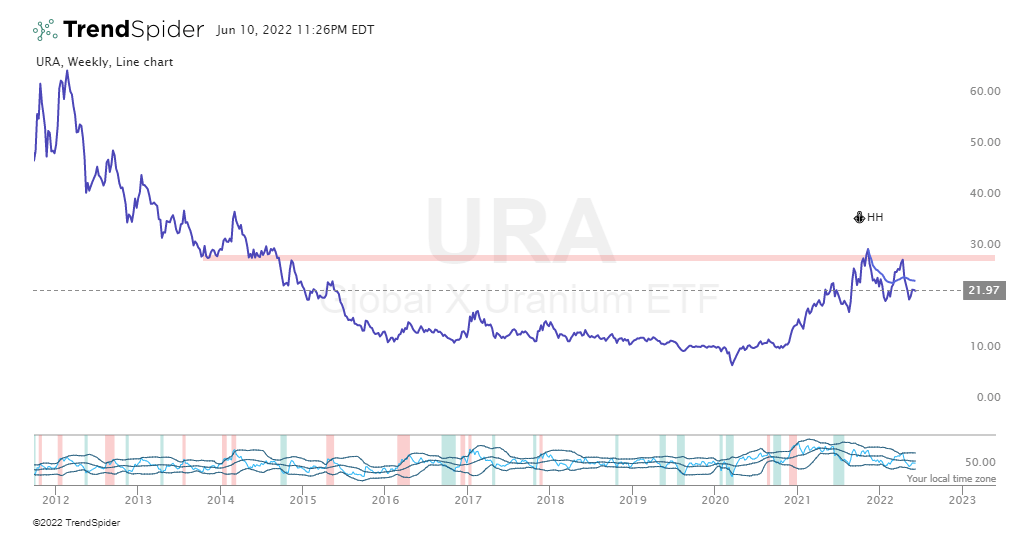

To answer these questions, we will take a look at $URA’s chart. The daily chart below shows that the price just hit a strong resistance area. It is currently pulling back and might probably that support in the $19 area.

To initiate new positions, investors want to either wait for a successful retest of the $19 support or a breakout above the dotted line. Ideally, $URA should cross above $30 for the next leg up.

We mention these levels but it is likely that the price would consolidate for a little while to digest the significant gains from the last 2 years. This last run that started in May 2022 seems like a relief rally and looks like it is about to get rejected.

The Uranium spot chart above shows a possible rejection happening as Uranium spot price hits $53.

The weekly chart is fascinating as it shows a multi years rounded bottom working towards a resolution.

It also shows the importance of the support in the $19 area as well as the strong resistance the price faces once it hits that $30 area. For now, it seems very likely that the price will consolidate in between those 2 important price levels. Given that multi-year rounded bottom, it will eventually breakout to the upside.

Written by hdcharting, reviewed by Taki Tsaklanos