This is a monumental period in time for Bitcoin. The chart we first featured in Bitcoin Is Testing A Crucial Level is the one that is sending a really serious message to crypto investors, one that might be more complicated to decipher than it looks at first glance. Regardless, crypto investors better pay attention now and not just to the BTC chart but the entire crypto universe!

This is what we wrote last week:

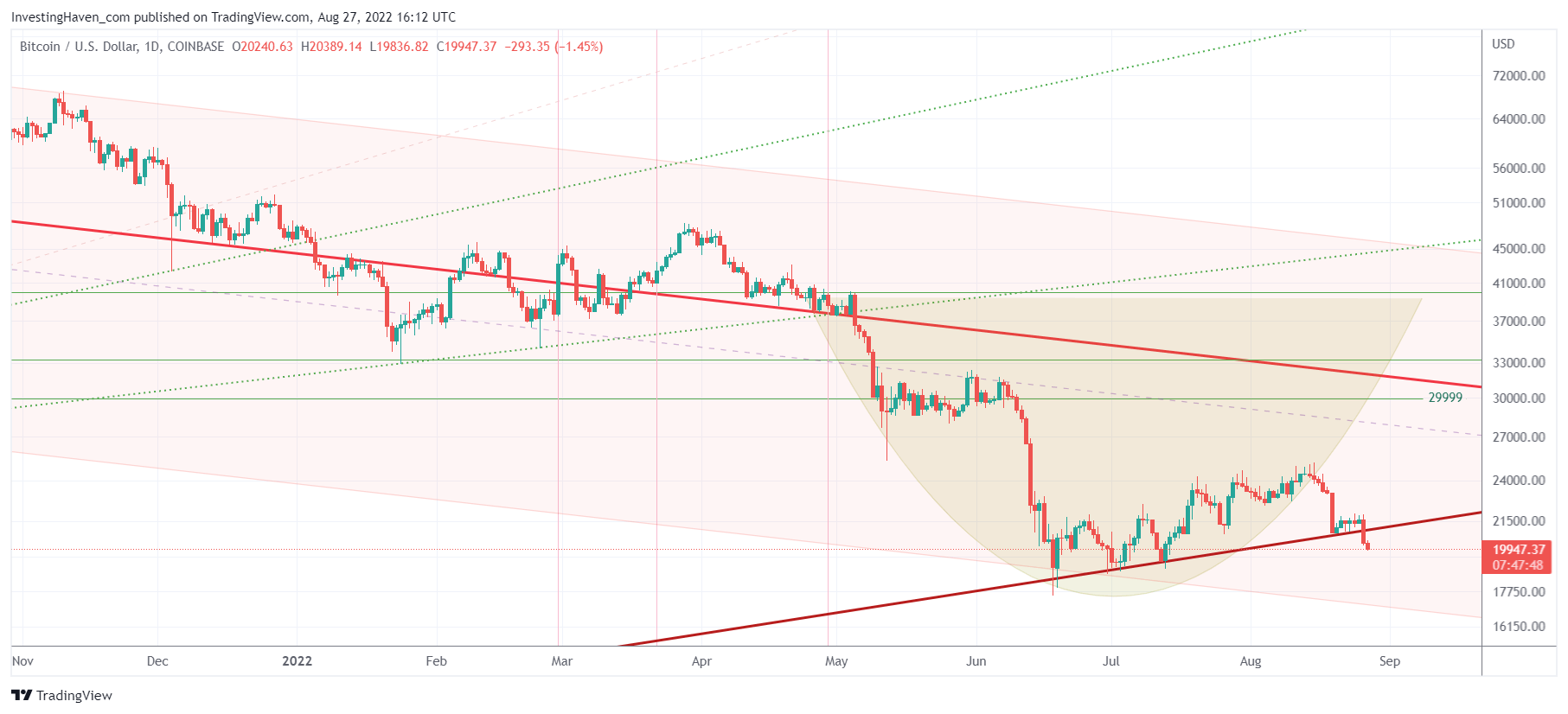

While there is no reason to be concerned looking at crypto from a long term investor perspective, there certainly is reason to be serious with the current level. As seen on below chart, there is medium to long term trendline that connects the June/July 2022 lows with the Corona crash lows. This level better holds, if not the June lows are the lowest acceptable support level.

The same chart, one week later, is looking pretty concerning.

First of all, the long term rising trendline is in the process of giving up. Make no mistake, this is the trendline that connects the Corona crash lows with the June and July 2022 lows.

Note that a failed breakdown is a possibility, it certainly might happen, we need BTC to re-claim this trendline the latest by the end of next week. A bullish micro-reversal is what should come with a failed breakdown.

What’s even more concerning is that the 10 year rising channel (chart shared yesterday in the restricted area of our crypto research service) is in the process of giving up. In a way, the rising trendline shown on below chart somehow coincides with 10 year channel support.

This is big, it’s huge, nobody is talking about it though.

This is a quote from the research note we shared yesterday in our research service:

One would intuitively expect that the entire crypto space will be following a path similar to the one BTC is following. Nothing is further from the truth. We look at ETH as the ultimate proof of this. While ETH is weak right now, it is still 40% above the June lows (daily closing prices).

While it is easy to conclude that ETH is stronger than BTC, which is true and might have long term consequences, there is a much more important conclusion that we potentially can draw from all this. The point is this: Layer1 divergences might be the new normal in crypto markets (Layer 1: think Cardano, Ethereum, and the likes). We discussed this in more detail in our research note.

This ‘new normal’ also comes with capped upside potential and specific dynamics on how to hit multi-baggers.

Now is a time to be paying attention, not necessarily to be too active in the crypto space. We do pay attention because we believe a structural shift in crypto markets is underway, and it will become the central topic of our crypto alerts in the next few months.