What is the 2nd half of 2021 going to bring? We will try to forecast 2021 trends (August till December) in this article solely based on price action across markets, i.e. combine chart analysis and intermarket capital flows.

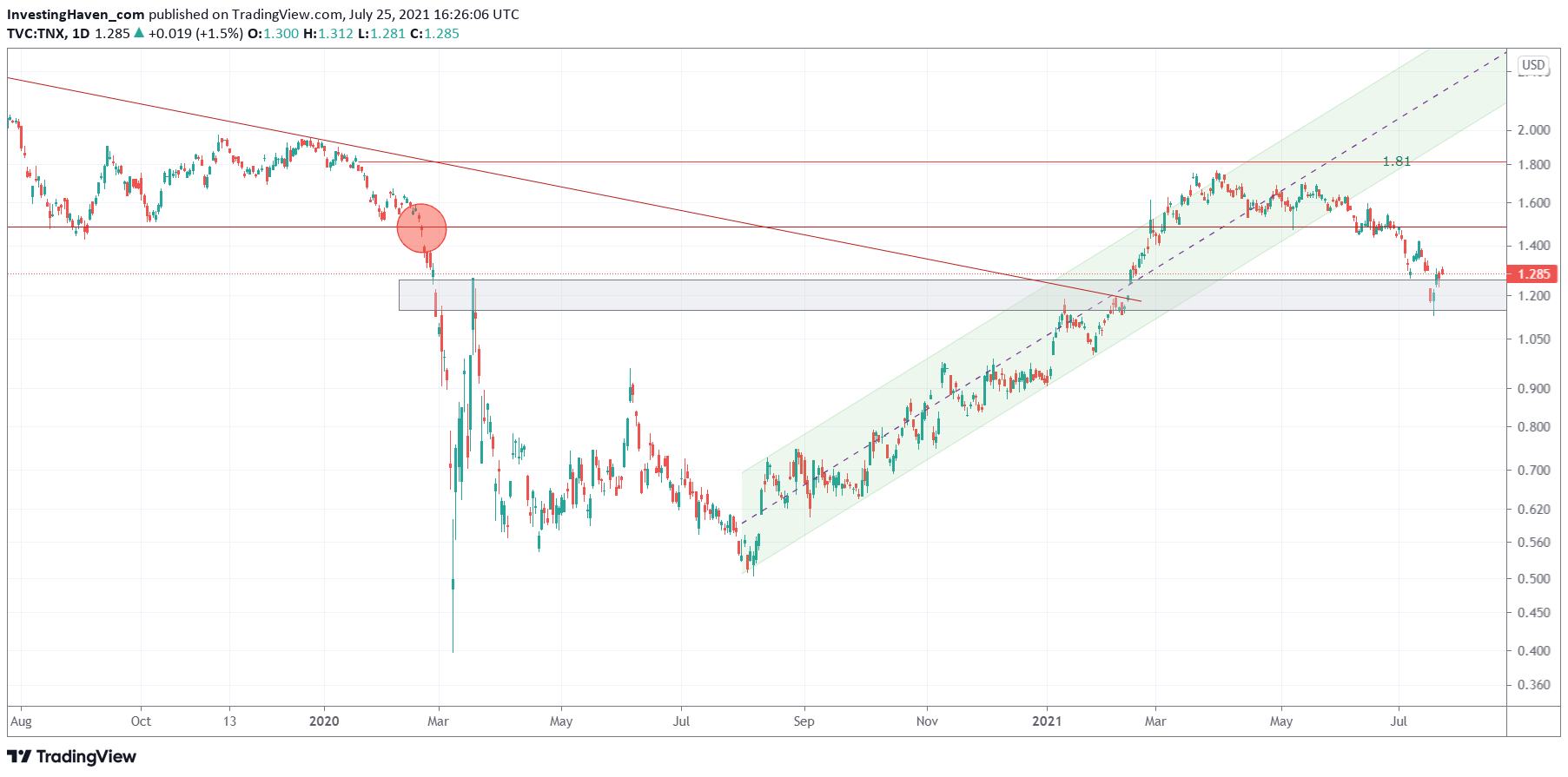

The leading indicator for risk assets is TNX, bond yields. It is positively correlated with risk sentiment.

Our 2021 forecast based on this chart: risk assets will create limited momentum, only a few very specific sectors will do really well. Ultimately we can expect one good sell off in the 2nd half of 2021, presumably after summer. It is not clear yet whether this will be a short term retracement or a bearish 3 month cycle. We need our crash indicators to weigh in as we approach the end of the summer.

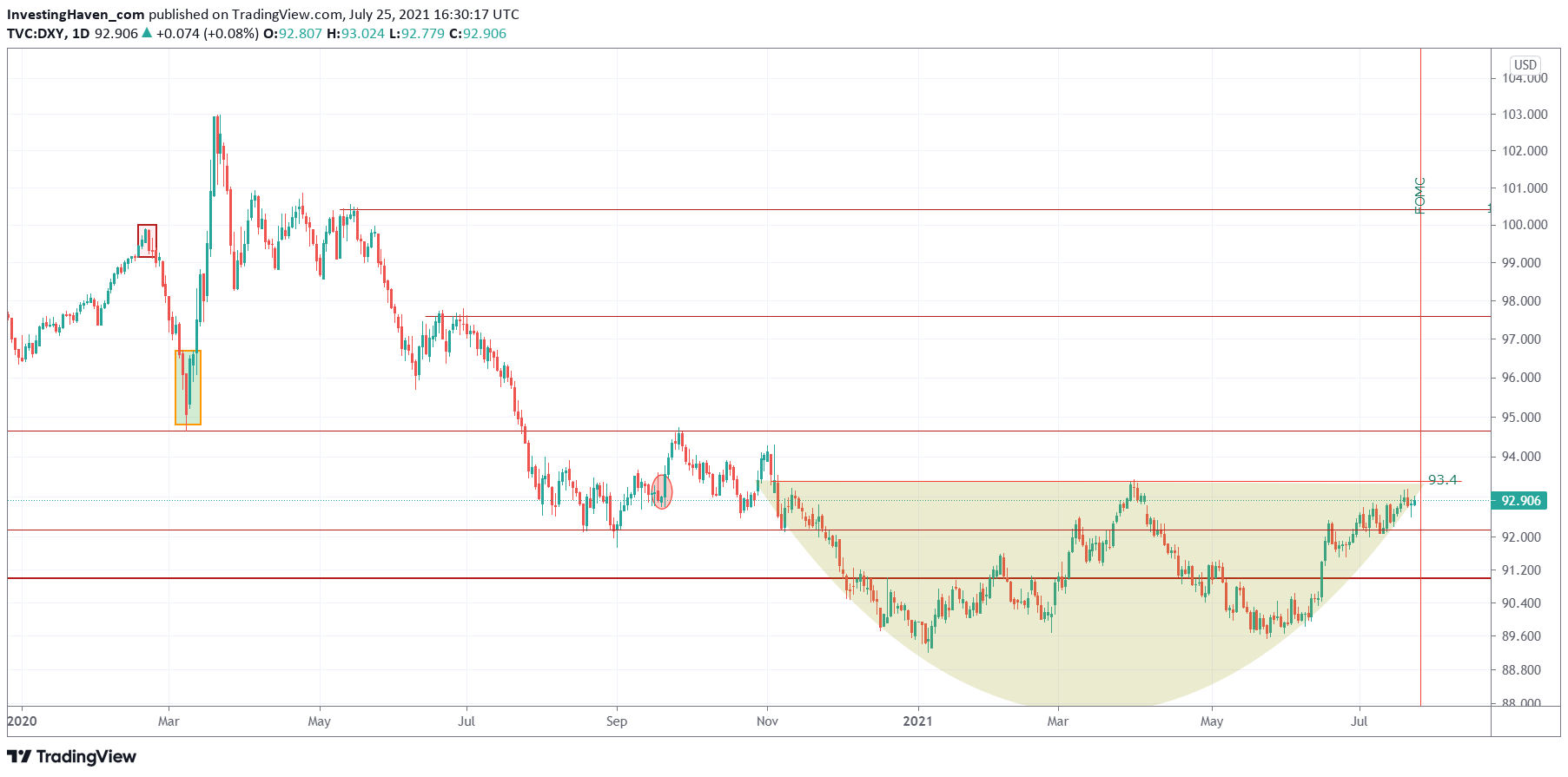

The USD has this powerful W reversal. It has the ability to create havoc in markets because a rising dollar suggests investors and traders are going into cash (out of risk assets like stocks).

Our 2021 forecast based on this chart: We believe 93 to 94 is going to be too much resistance for the USD. If that’s not the case the USD chart may create damage to global markets.

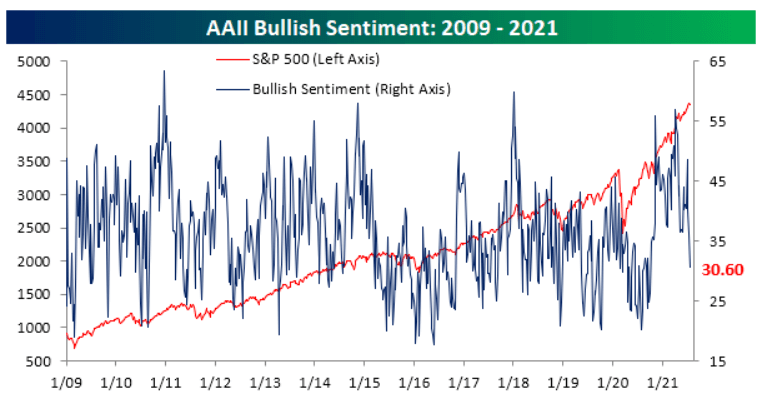

Sentiment is crashing amid falling bond yields and a rising USD. But look how low sentiment has fallen. We should be concerned if the above charts would have trended in the opposite direction with stock indexes rising and sentiment near all time highs. We get the opposite picture now.

Our 2021 forecast based on this chart: Stocks have not peaked yet, there is more upside potential in the short term. Ultimately after summer we have to re-assess sentiment with bond yields, the USD, stock indexes, and combine it with our crash indicators. That’s to understand the timing and nature of the retracement or sell off which we can expect after summer.

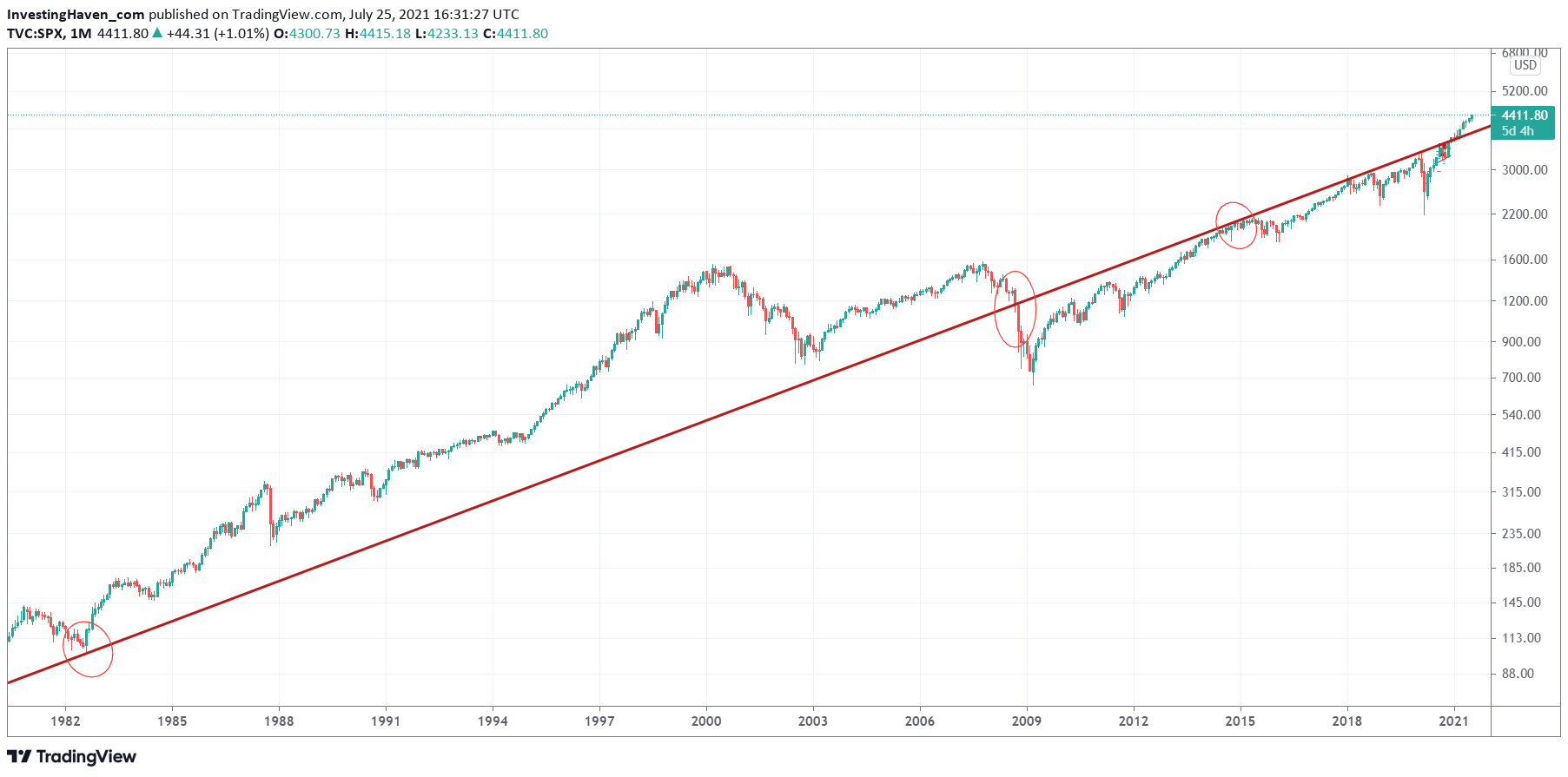

The longest term S&P 500 chart says that the rise in stocks is accelerating, especially since last December when the multi-decade rising trendline was broken to the upside.

Our 2021 forecast based on this chart: The stock bull market is far from over. Buy the dip will be the dominant theme, also in the second half of 2021.

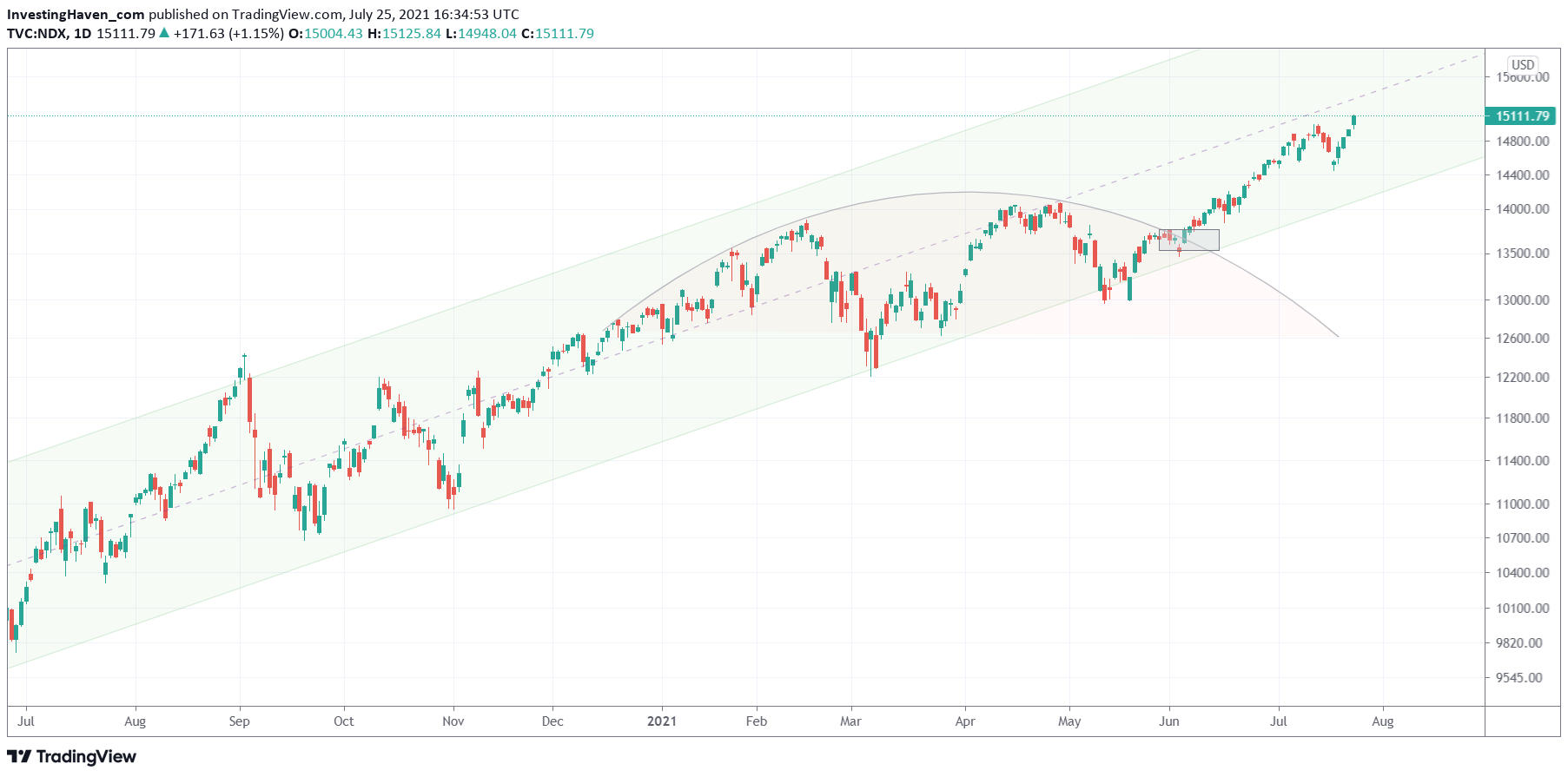

The Nasdaq chart respected its long term channel. Looks good here, and buy the dip near support is a must.

Our 2021 forecast based on this chart: The Nasdaq rise is not over yet. But be selective as there not a broad participation in the rise of tech stocks currently.

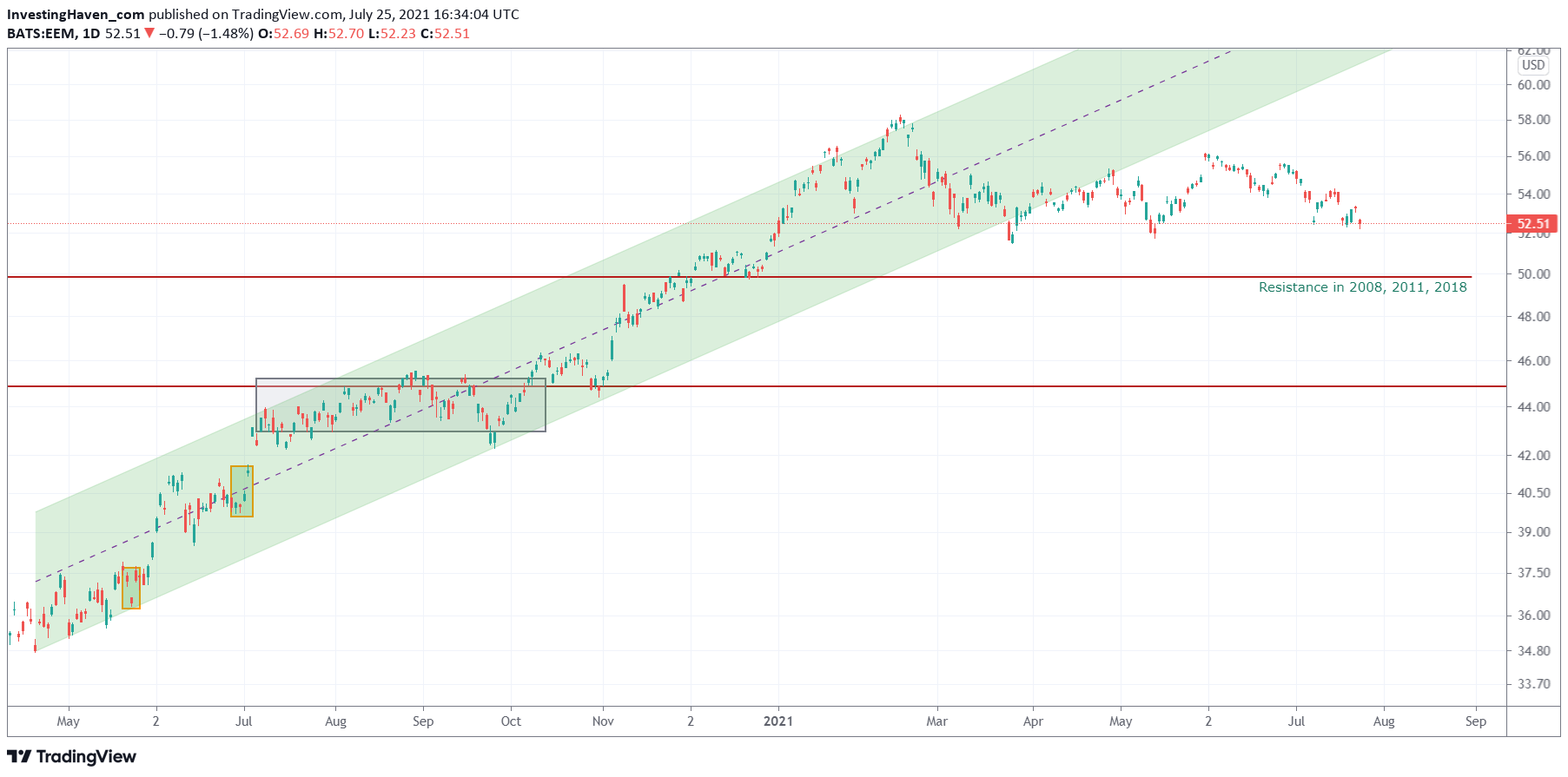

Emerging markets are a mess because of the de-listing of Chinese stocks.

Our 2021 forecast based on this chart: The recent breakout attempt failed. Some emerging markets might do well, but be selective and avoid Chinese stocks trading on U.S. stock exchanges. Overall, this chart below is turned into a mess.

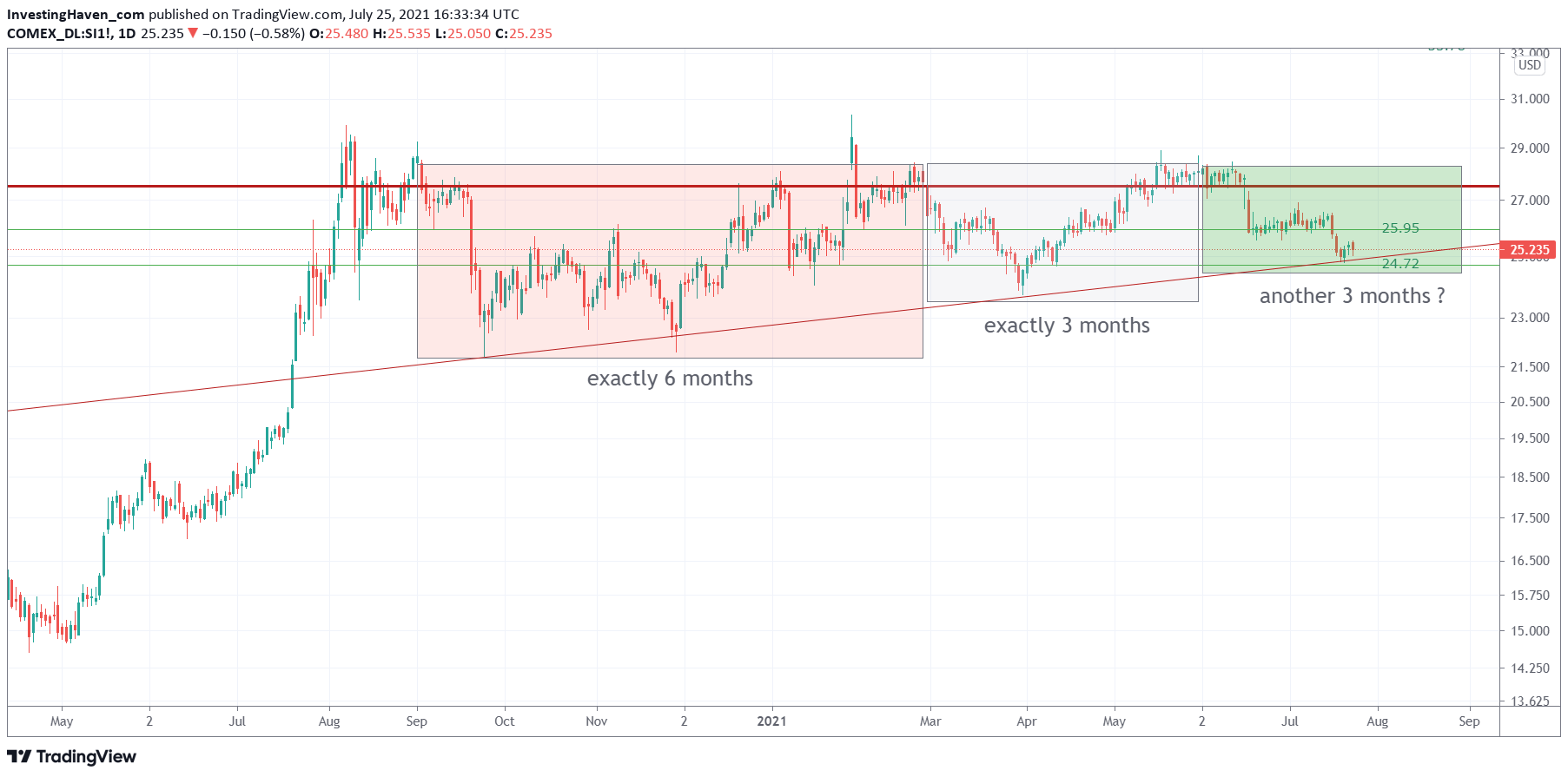

Silver is close to completing a 12 month bullish reversal, right below its secular level 28 USD.

Our 2021 forecast based on this chart: If silver goes back to 28 USD in the 2nd half of August, and ultimately decides to break above 28 USD in 3 to 6 weeks from now, it will be ‘hallelujah’ time for silver and silver mining stocks. Bond yields have weakened, great for silver; in case the USD rally would stall we would expect silver to have the ideal conditions to break out. This would confirm our silver price forecast 2021 which we published 9 months ago.

But the most important charts come from green battery metals.

From our article the Biggest Investing Opportunity Of This Decade

Green batteries for cars, planes, but also homes. Will this be the next big thing. Will this offer once-in-a-lifetime type of opportunities? It could be. Probably it will. But specifically the commodities that are inputs into this secular renewable energy wave. Why? Simply because of the big rotation that comes with market crashes. We saw this in 2000 and 2010 so we should see it again in 2020 and beyond. It is commodities that came out of a major bear market, so some segments in the commodities space should create a secular trend in 2020 and beyond.

Also, we wrote in Super Cycle In Green Battery Metals Starts In 2021:

History shows that bull runs in these metals don’t happen concurrently. They rise one by one. As an investor the trick is to be go overweight, per strategic metal, as each bull run unfolds. It’s ok to keep a one or two smaller allocations for the long term, but we want to have a larger allocation in each bull run. That’s exactly the strategy we will apply in this strategic metals super cycle, particularly in our Momentum Investing strategy and portfolio.

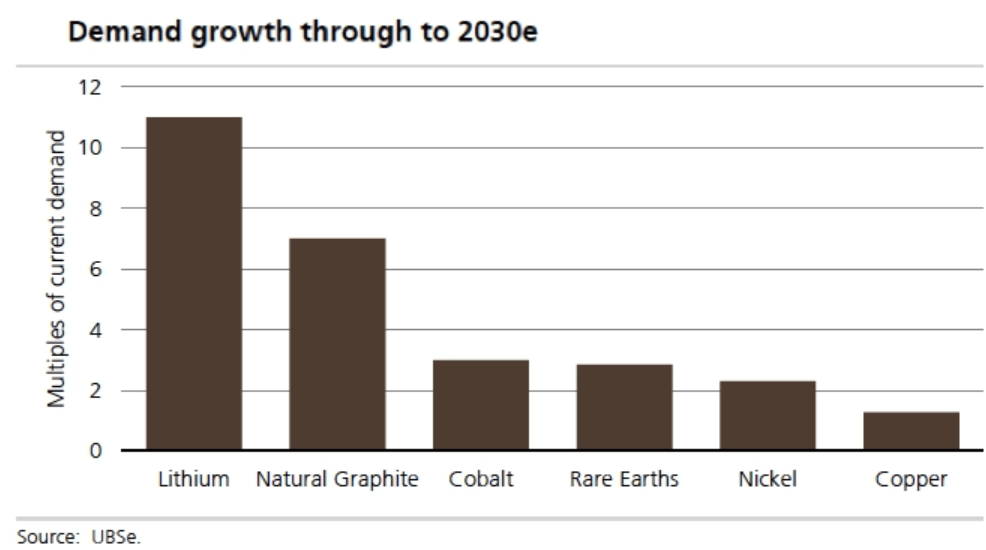

Among many other researches we see that also UBS is ultra bullish on green battery metals. Below is their projection of green battery metal demand, and how many multiples it will grow this decade. Note that lithium and graphite demand are set to grow in a phenomenal way, followed by cobalt and rare earths. This one of the many projections of the coming supply deficit in green battery metals, and even if this the real supply deficit hits in 2025 we will start seeing early signs of the mega boom in these miners starting in 2021.

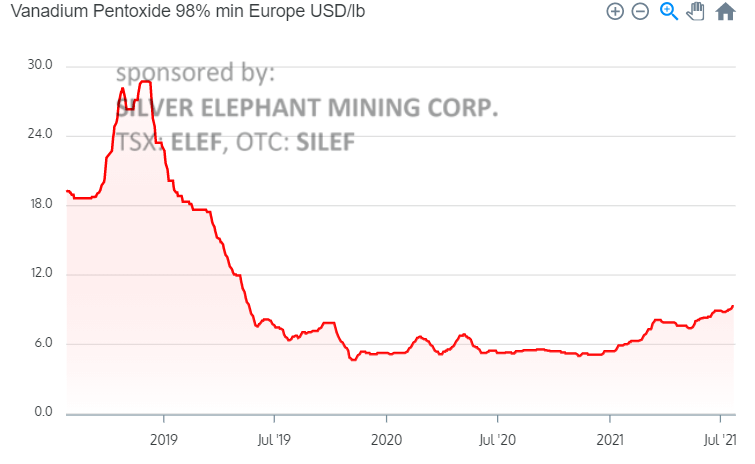

One of the green battery metals is vanadium. Below is the 3 year chart.

Our 2021 forecast based on this chart: This major breakout is set to continue, vanadium miners will be explosive if this breakout continues.

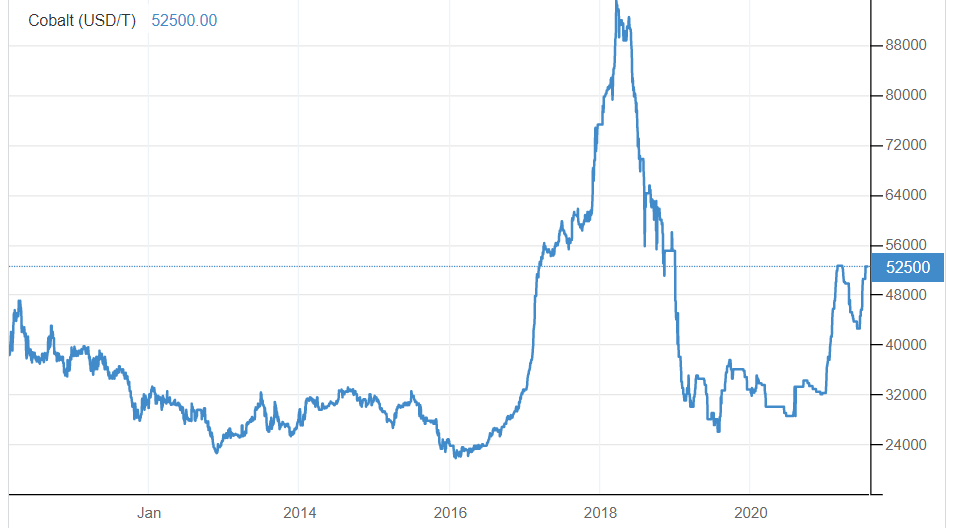

Another crucial green battery metal is cobalt. Below is the 9 year price chart.

Our 2021 forecast based on this chart: The powerful bull market that started in January of 2021 is set to continue and accelerate. Cobalt miners will go ballistic.

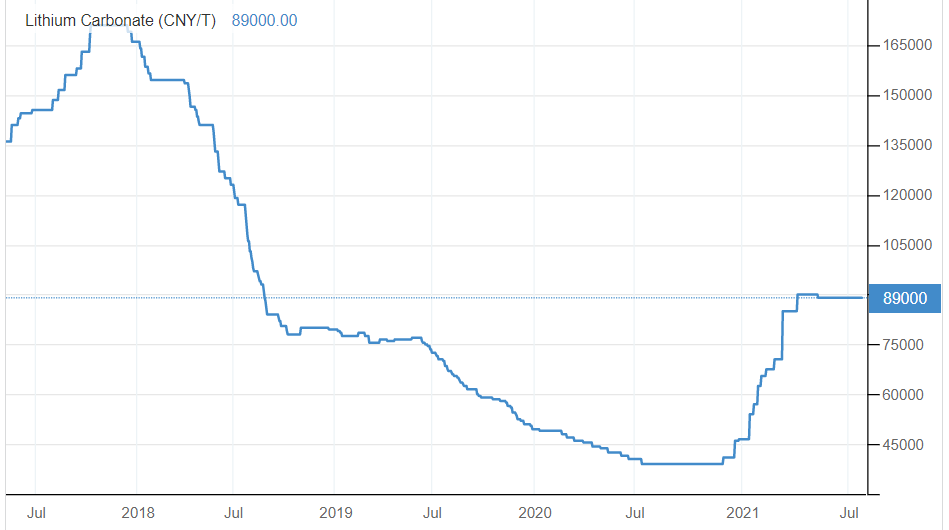

Here is lithium, another green battery metal and presumably the most well known.

Our 2021 forecast based on this chart: The temporary pause in the context of a major reversal is set to resume soon.

All these charts suggest a few things for the remainder of 2021:

- Momentum will be capped, overall.

- Stocks will do well, but there will not be an equal distribution.

- Only a few sectors will do really well, especially green battery metals and presumably some specific tech sectors.

- Silver is the big outlier: if it decides to break above 28 USD in 3 to 6 weeks from now it will have set a perfect 12 month bullish reversal which will push silver miners many multi-folds higher by 2022.

Want to be more engaged with our work?

We run a premium membership service for investors: Momentum Investing. In there we focus on the super cycle in metals, especially green battery metals and silver. Moreover, in our Trade Alerts we are about to offer an auto-trading service so members can achieve the ‘passive income dream’. This service will run automatically SPXL/SPXS orders. VIP members will have access to our SPY options service, also in auto-trading mode, with stellar profits.

Last but not least, we donate every year to charity. Today, we communicated to all our premium members that we will donate +10% of our profits to 4 charity organizations active in child protection / cancer research / local support of those in need.

Not only do VIP members benefit discounted rates, but they also will have access (free of charge) to auto-trading and will contribute with their membership fees to charity. Want to know more about our VIP membership offer, please send a request to investinghaven at gmail.com.