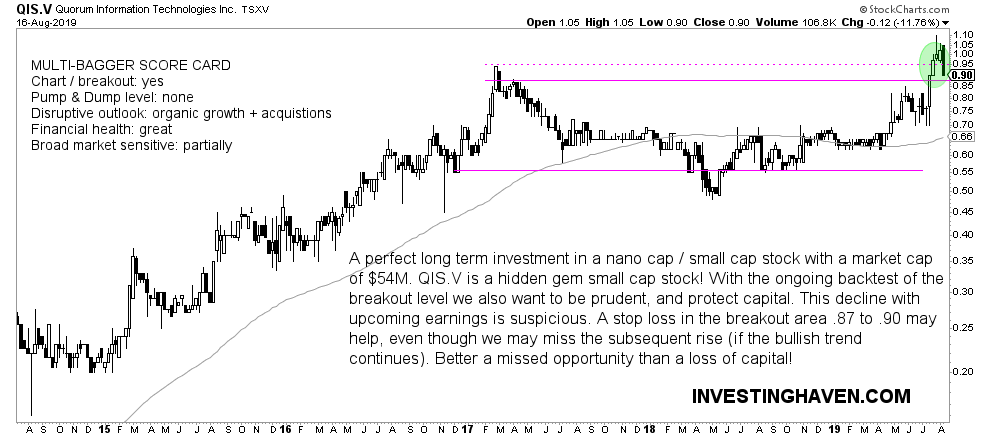

In our piece Investing Opportunities #2: Another Hidden Gem Microcap Stock we featured QIS.V after analyzing all relevant data points in their earnings, on their chart and their company news releases. We signaled a BUY alert on the breakout. Today we see a stiff correction, and provide some guidance on how to handle this. There are multiple options to consider, but which ones?

As part of our 16 episodes of Investing Opportunities (until November of 2019) we guide our followers with our method to identify and play the best investing opportunity of the second half of 2019.

This is a process, and we would like to illustrate this by looking into the details of the hidden gem micro cap stock we identified after looking through hundreds of potential candidates.

This is what we are trying to accomplish by continuously scanning the market:

In essence what we are looking for is hidden gems in the small to mid cap range of the stock market with lots of upside potential, just because broad markets are favorable in the next 12 months.

However, there are multiple levels to assess an opportunity, it’s not simply one chart or some financials of a stock.

The levels we have to assess:

- Broad markets > if there is a strong ‘risk off’ sentiment you can be sure that the majority of stocks are not worth buying! Right now, we see a trendless state in broad markets even though the root cause of this (crashing yields) are about to stop falling most likely as explained in great detail in Investing Opportunities #4: Volatility Is Tough, How To Handle It.

- Financials and outlook of the particular stock > this looks great in the situation of QIS.V. However there are earnings coming up in a week and the recent sell-off is suspicious. Unclear what the answer is to this point for the very short term.

- Chart momentum > this looked awesome, but has changed in recent days.

- Sector momentum > neutral.

- All of the ‘multi-bagger score card’ items listed on our charts (see below chart in the left top corner) > so far all looks good in the case of QIS.V.

So where does this leave us with an assessment?

The short answer: risk is increasing, may require some action.

The long answer, and different options? This will appear in the newsletter.

Because of the high value of this we reserve this for subscribers to our ‘free newsletter’. This is premium content that we give away for free, but only after signing up to our free newsletter. Subscribe to our free newsletter and get premium investing insights in 2019 for free. Sign up >>