Several lithium stocks did really well in the latest bull run in markets. As the market is headed for a pullback (a pullback, not a stock market crash to be clear), the question is whether lithium stocks are worth buying the dip. We continue to hold our bullish lithium forecast 2023. However, it is clear in the meantime that not all lithium stocks will move concurrently in the same direction.

This is what we wrote in Lithium Price Breaking Out Aggressively, Lithium Miners Will Follow Suit:

At this very point in time we can only conclude, based on the ‘lithium spot’ chart, that the single biggest opportunity in the market is to be found in the lithium space. There is not any market that has a similarly strong setup, there is not any market that trades at ATH, above the highs of 2021 and 2022.

So, in essence, there are 3 elements to take into account when considering a lithium investment.

First, spot lithium. The price of lithium continues to rise, it gives green light until it starts declining. That’s not likely going to happen anytime soon.

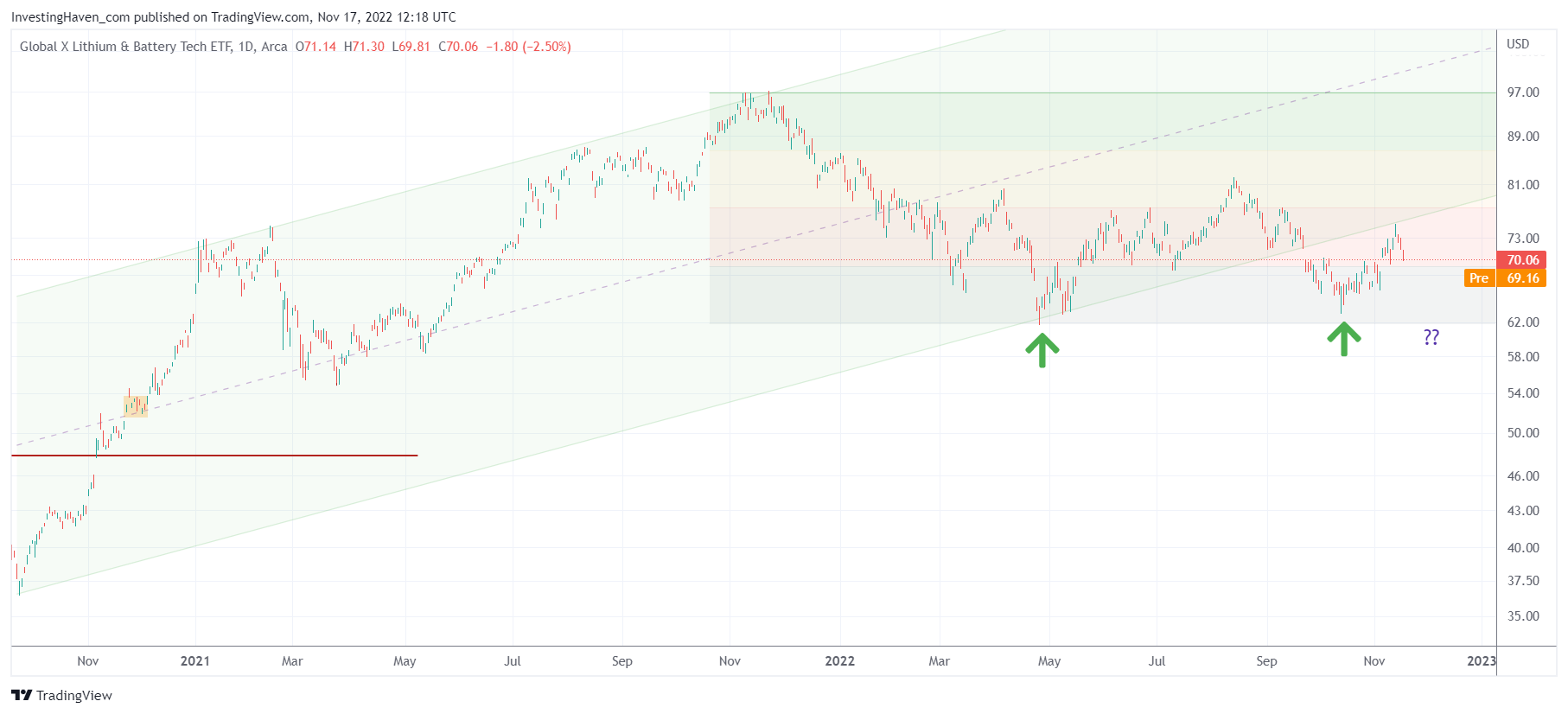

Second, sector momentum. The one chart that can help understand when the sector is dipping is LIT ETF, featured below. LIT made a double bottom and is likely starting a pullback now. The million dollar question is whether it will set a higher low. If so, we have green light to consider a lithium investment.

Third, specific stock selection. In our research note “Lithium & Graphite top stock selection” (available in the restricted area of our Momentum Investing service) we have outlined the structure that the market is following. There are multiple criteria that play a role when selecting a lithium stock:

- Size of the lithium deposit.

- Richness of the lithium deposit.

- Expected year of production.

- Production volume.

- Cost of production.

- Offtake agreements.

Picking lithium stocks is not easy, but the above mentioned criteria are a checklist for lithium investors. Combined with spot lithium and below chart this should provide sufficient support for investors to understand which stock(s) to choose and when to enter.

Investors interested in capitalizing on the long-term uptrend of lithium stocks should consider consulting our top lithium & graphite selection. In it, we share a very clear investing strategy based on risk/reward considerations. Out of hundreds of lithium & graphite stocks, we did make a selection of 15 top lithium & graphite stocks, based on fundamental analysis (including grades, deposit size, year of production, location) combined with charting analysis.

Top Lithium & Graphite Stocks Selection >>