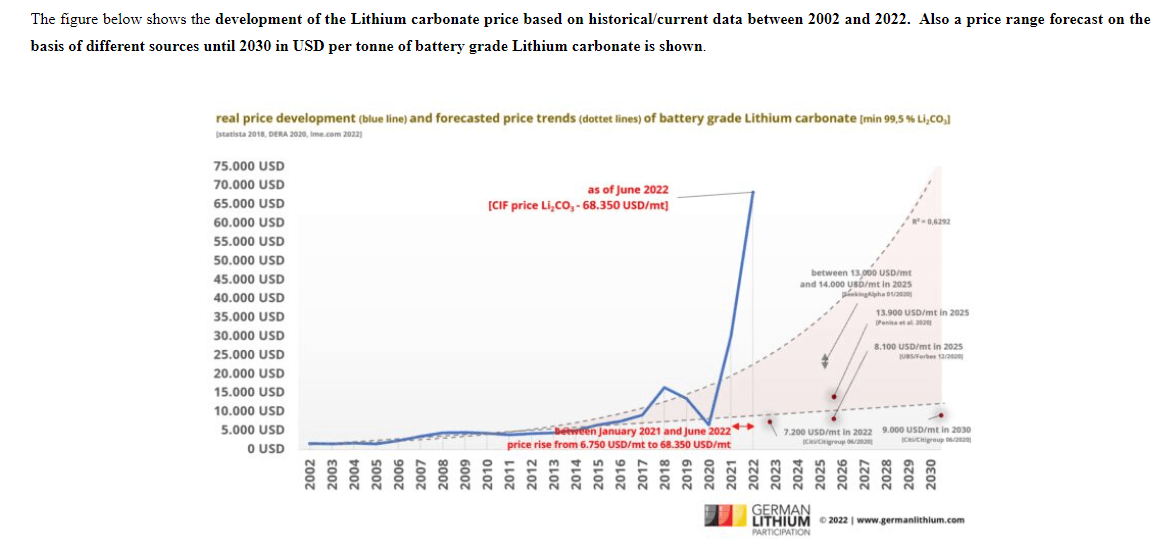

The price of lithium has been in uncharted territories in 2021 and 2022. Lithium has been constantly making new all-time highs. This simple fact makes it very hard to forecast the price of this sought after commodity. In this article, we discuss our Lithium outlook as a follow up on our Lithium market forecast for 2022. Are we still on track for a solid close of 2022 in Lithium stocks? Did the price of Lithium peak in 2022 and is the upwards move now done? How is Lithium America stock price, $LAC, holding so far?

Lithium Outlook 2022 – How Is Price Performing So Far?

Below is a quote from our Lithium forecast 2022, it illustrates Lithium’s price action so far:

We expect lithium stocks to outperform the market again in 2022 but they will move in a very cyclical way so buy the dip is the right approach

We also added:

But the mega secular bull market in lithium stocks is not over yet, far from it, as explained in our green battery metals forecast for 2022. It is even not halfway according to us. It is rather clear from the charts that some lithium stocks might be taking a breather to recharge themselves but they will continue to perform well in 2022.

Published in November 2021, the outlook was a spot on call and we are currently in the dip period. But why do we believe this is a dip and not a reversal? Let’s start by taking a look at the key factor driving the price for this commodity: Supply and Demand.

Outlook For Supply And Demand For Lithium

The outlook for the demand for Lithium remains Bullish. If we were to only consider the growing demand for Lithium batteries from mobile devices, electronic vehicles and storage devices, that’s more than enough to keep the price levels higher for a while. Rechargeable batteries use up more than half of the worlds Lithium supply.

As we want to remain objective and factual, we collected the following data points showing how demand for Lithium is set to keep growing till at least 2028 -2030.

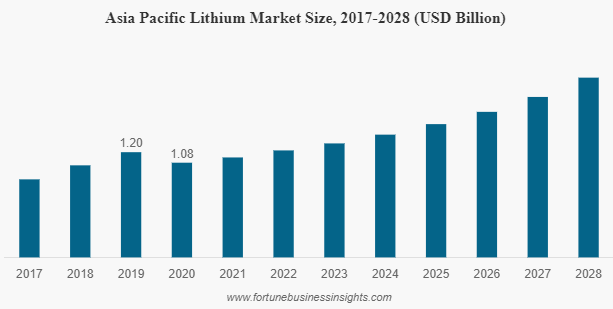

China, Japan and South Korea being the Top 3 Lithium importers, let’s see what the outlook for their Lithium market looks like for the next few years: Based on the chart below, they are set for years of continuous growth.

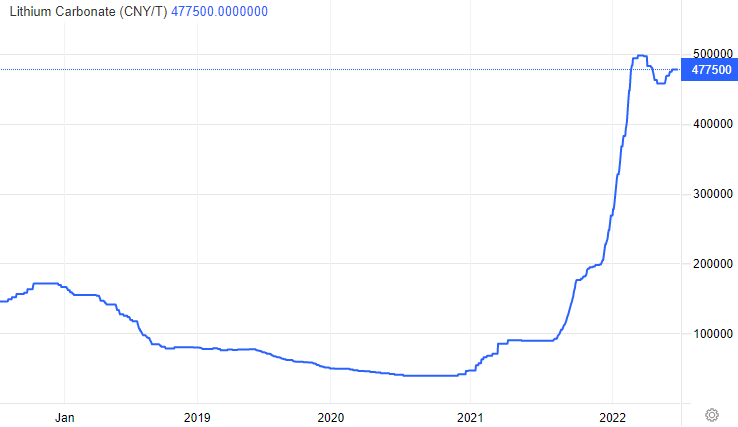

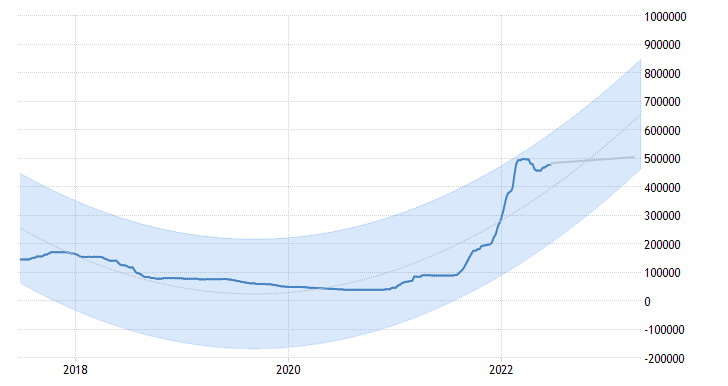

Trading Economics forecasts an increasing spot price as well following the current temporary dip. They also see the price back to previous ATH by end of the year.

Trading Economics provides Lithium pricing based on spot prices for Lithium Carbonate, 99.5% Li2CO3 min, battery grade, traded in China. Lithium is a silver-white light metal. Lithium hydroxide is used in batteries for electrical vehicles and mobile phones. The latter is produced from a chemical reaction between lithium carbonate and calcium hydroxide. The biggest lithium producers are Chile, China, Australia and Argentina. The largest lithium importers are China, Japan, South Korea and the United States.

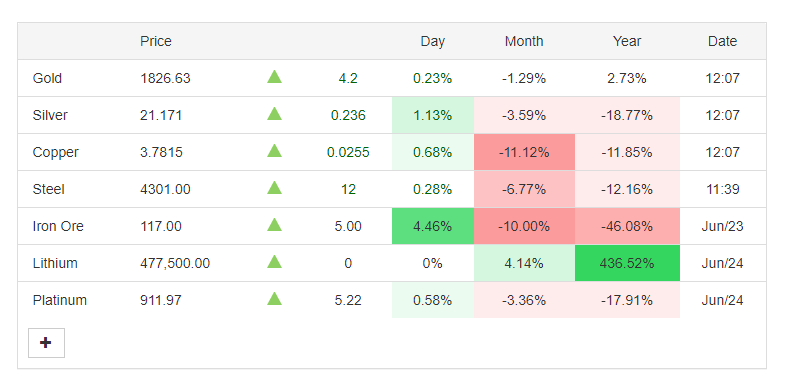

In terms of performance, Lithium clearly outperformed compared to other metals and is still green for the year.

What Does The Supply Side Look Like for Lithium?

On the supply side, the pandemic’s lockdowns measure, global shipping and logistics issues definitely put pressure on Lithium’s supply. But this supply shortage is likely to continue for years if not decades for a multitude of reasons:

- Environmental regulations

- Lengthy qualification process

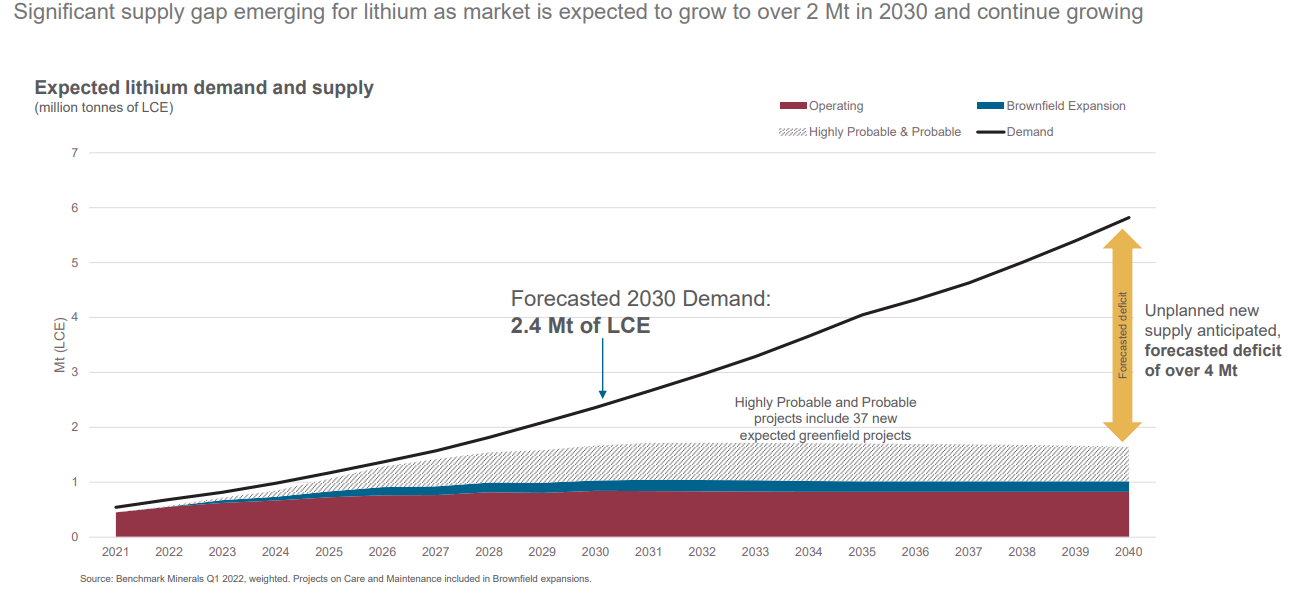

Therefore, miners such as Lithium Americas $LAC are forecasting a supply gap heading into 2040. As new miners start producing, they still forecast that the demand for Lithium is strong and that it will likely continue to increase.

Last but not least, Fortune business insights is expecting Lithium’s global market size to go from $3.64 billion in 2020 to $6.62 billion in 2028.

Based on the findings above, the demand for Lithium is here to stay and the supply is nothing close to covering that demand till possibly 2040. These findings corroborate our Lithium outlook: Higher Lithium stocks prices in 2022 and every dip is a buying opportunity.

Lithium Price: When to buy the dip?

Successfully buying the dip in Lithium stocks will have to be based on the following:

The charts. Whatever your investment choice is to play this sector, you want to tune out the noise and focus on charts and price action. We are putting together for our readers an article about when to buy the pullbacks that could be helpful. This will be particularly interesting if you are investing in stocks. Stay tuned.

Lithium contracts. These are usually negotiated in around September to end in December. That could also signal the end of the dip and the resumption of higher Lithium prices.

Interestingly, around mid-may this year, Goldman Sachs analysts published their Lithium outlook. They stated that the bull market for Lithium is over for at least a few years. Shortly after Credit Swiss published a similar outlook. But as the spot price is currently retracing the recent contracts are breaking records for Lithium price. A good example is the recent Pilbara minerals securing contracts around 6% higher than last month’s prices. Again strong demand low supply driving prices and most importantly, the contracts are closing way higher than the spot price. This leads us to think that most Lithium miners are currently undervalued.

This is a situation where the price of assets is clearly disconnected from the fundamental value. As investors, spotting this type of disconnect, pairing it with proper price action analysis and risk management is key to scoring strong returns. It takes lots of research, discipline and most important patience. This is at the core of our momentum investing strategy and Lithium is definitely part of our select sectors.

Case Study: Lithium Americas, A Major Play On Lithium & A Good Representation Of The Sector’s Performance

While we usually refer to ETFs for sectors, we believe that the ETF LIT doesn’t not necessarily reflect the performance of the sector. Definitely not the miners. Just look at the chart below and you can see how $LAC’s performance and $Lit are quite disconnected given the nature of the ETF’s holdings.

The one strong correlation was actually Lithium miners and $TSLA. This tight positive correlation broke recently and can also mean that Lithium miners are undervalued at current prices. Also note that these miners are a riskier vehicle to get exposure to the sector, which is also the reason why they yield higher returns when the tides turn. High risk high reward type of investment. Very volatile as well. Hence why for a more risk averse investor, the ETF might be a more sensible choice given the relative diversification.

Lithium Corporation of America or Lithium Americas

Lithium Americas is a lithium-bearing spodumene and pegmatite ores miner. They have a strong balance sheet with approximately $500M in cash as of March 2022. Geographically, they operate mainly in the USA (Nevada) and Argentina (Grandes Basin).

Cauchari-Olaroz in Argentina. AO is the largest lithium carbonate brine operation under consruction in over 20 years. Lithium Americas is currently in a joint venture with Gangfeng lithium to bring Cauchari-Olaroz into production. Gangfeng is China’s largest lithium compounds producer and the world’s 3rd largest lithium metals producer.

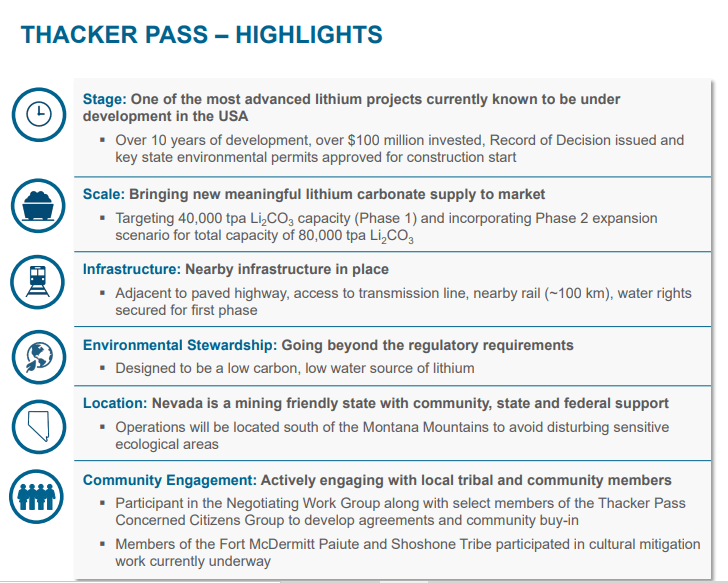

Thacker Pass, in Nevada. This is the largest known lithium resource in the USA and Lithium Americas is developing there with a goal to enable a US battery supply chain. See highlights below.

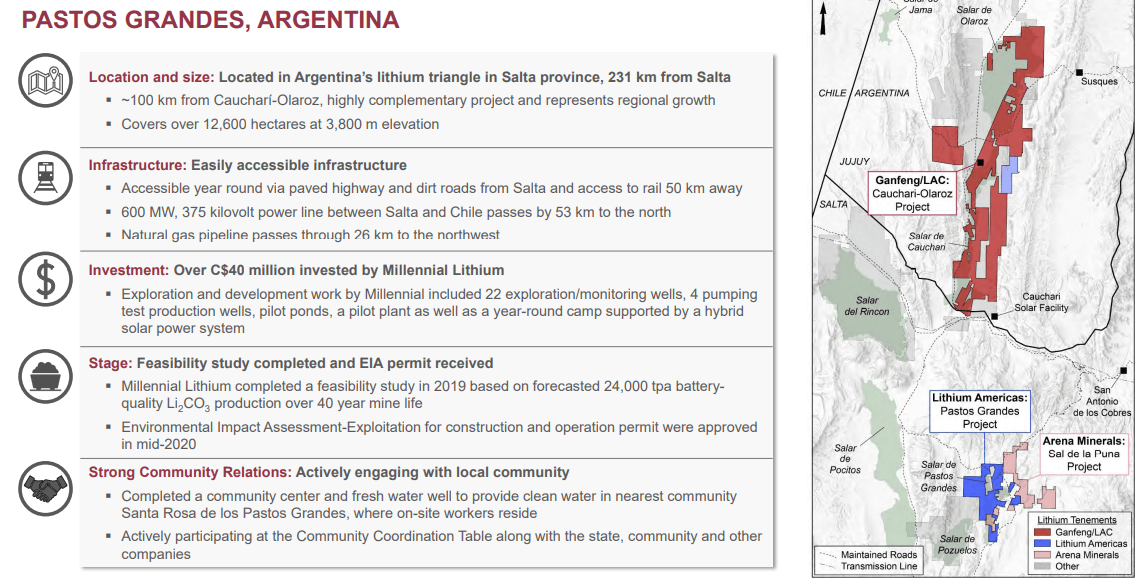

The company also acquired Millennial Lithium’s advanced-stage Pastos Grandes project. We will cover that acquisition in the upcoming catalysts section.

Lithium Americas has many catalysts lined up for the second half of 2022

Spot catching up with record contract prices ( A sector wide catalyst)

As mentioned earlier, Lithium contracts are breaking records but lithium miners are trading at undervalued levels and the spot price retracing. As more contracts are negotiated and closed at record prices in the second half of 2022, investors will eventually realise that contract prices have decoupled from the spot price (probably the second half of 2022). That’s when we will probably see the next leg up for Lithium’s spot price and many Lithium miners.

Cauchari-Olaroz mine

- Commissioning target date in the second half of 2022. Production’s initial target for stage 1 is 40,000 tpa lithium carbonate then 60,000 tpa lithium carbonate in stage 2. This is the joint venture with Ganfeng Lithium.

Thacker pass catalysts

- Feasibility Study results expected in the second half of 2022, target capacity at 40,000 tpa lithium carbonate for Phase 1 and a total capacity of 80,000 tpa for Phase 2.

- After the recent request by BLM to include additional documents, the ROD appeal process is expected to be complete in Q3 2022. The ROD was initially received in January 2021.

Regional growth perspectives (Long term catalysts)

- In Jan 2022 $LAC acquired Millennial Lithium and their 100% owned advanced stage Pastos Grandes project located 100 km away from Caucharí-Olaroz.

- A strategic investment of 17.4% in Arena Minerals, an exploration-stage company. Arena’s primary exploration asset is adjacent to LAC’s Pastos Grandes project.

- Acquisition of 5% of GT1, a North American focused lithium exploration and development company

with hard rock spodumene assets in north-west Ontario, Canada

Whereas these points are not necessarily catalysts for the price right now, they will probably have a positive impact on $LAC’s production capacity and future market share.

- The company is clearly building strong collaborations to be a key developer in Argentina. Argentina’s Lithium is easier and less expensive to mine. Bolivia’s Lithium is harder to process and Chile doesn’t have as many salt lake options compared to Argentina.

- According to the company, they are also looking to cover most aspects of the lithium processing and production value chain, from the processing of spodumene to the production of battery-grade lithium chemical.

- They are also going after enabling a North-American Battery supply chain.

If executed successfully, these 3 points will represent a huge edge for $LAC, it’s shareholders, Argentina and the North American EV industry.

Lithium Americas The Chart

Lithium America’s long term chart shows a beautiful consolidation following an uptrend. We have All-time highs followed by retraces and continuation patterns (Cup) leading to further upside. This chart below is the TSX ticker so it’s in Canadian dollars and it clearly shows a double bottom right at the bottom of the horizontal channel.

That means there is no structural damage to the bullish price action. That double bottom was actually a great buy the dip opportunity.

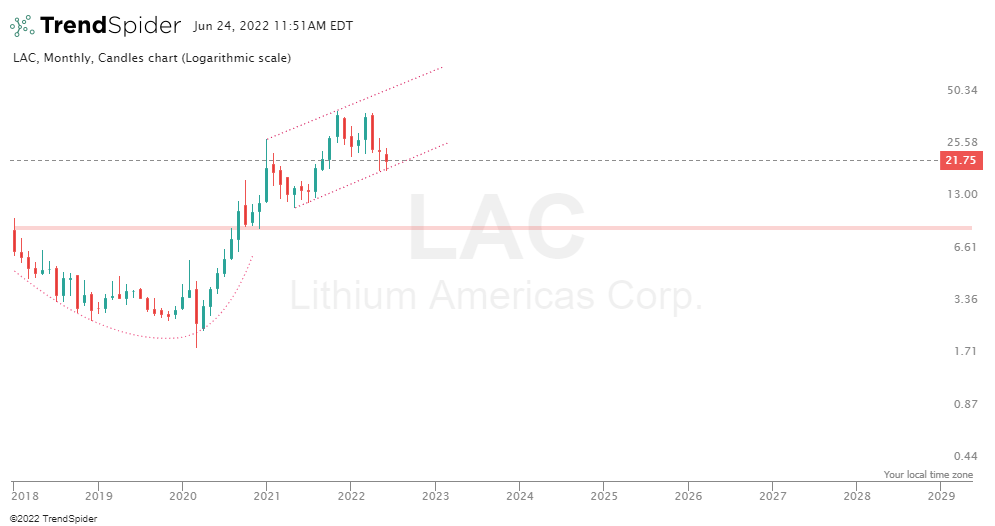

The US ticker is showing a similar structure and we can clearly see a second cup forming of the log chart. That usually means more upside coming of the structure holds. The levels are pretty clear.

$LAC’s monthly chart is impeccable. A nice cup and a well defined ascending channel. If current levels hold, we might see a new ATH by 2023.

In closing, Lithium related stocks remain Bullish on the long term and therefore our Lithium price forecast for 2022 is still on track. The main risk we see for the sector is the social and environmental impact (Pollution, water depletion, chemicals used in the process.). On the other hand, we believe that the extraction and treatment processes will hopefully become more environmentally friendly as the sector matures.

However, one thing is clear, as lithium prices picks up again, many miners will benefit and our Momentum Team will remain on task to identify the ones that would yield the highest returns.

Written by hdcharting, reviewed by Taki Tsaklanos